The backstory of RobinHood’s insane week & emergency fund raise:

As I’ve been writing, RH had a full blown liquidity crisis. RH could NOT meet DTCC’s initial call amount.

It cured the issue on the strength of its franchise, raising $3.5b of equity. 1/n

wsj.com/articles/robin…

As I’ve been writing, RH had a full blown liquidity crisis. RH could NOT meet DTCC’s initial call amount.

It cured the issue on the strength of its franchise, raising $3.5b of equity. 1/n

wsj.com/articles/robin…

Those emergency investors will get a quick win, as RH likely IPOs later this year.

“[RH] told investors they still plan to take the company public sometime in the first half of the year...To do so, he will have to clear the high growth bar set by Wall St. investors.”

2/n

“[RH] told investors they still plan to take the company public sometime in the first half of the year...To do so, he will have to clear the high growth bar set by Wall St. investors.”

2/n

https://twitter.com/compound248/status/1356354169683238914

RH’s business is going gangbusters.

Bizarrely, this whole event is likely to turn into a giant W for RobinHood.

I know that is frustrating and confusing for many people, but it’s true.

RH is well capitalized and is experiencing massive new customer onboarding.

3/n

Bizarrely, this whole event is likely to turn into a giant W for RobinHood.

I know that is frustrating and confusing for many people, but it’s true.

RH is well capitalized and is experiencing massive new customer onboarding.

3/n

https://twitter.com/compound248/status/1356619491619319813

Its current risks are Reputational & Regulatory.

Re: Reputational - it’s signing up tons of new users. The fallout is a non-event.

Re: Regulatory - RH didn’t do anything illegal & I don’t see Biden lethally attacking a company serving 20mm retail customers (aka “voters”).

4/n

Re: Reputational - it’s signing up tons of new users. The fallout is a non-event.

Re: Regulatory - RH didn’t do anything illegal & I don’t see Biden lethally attacking a company serving 20mm retail customers (aka “voters”).

4/n

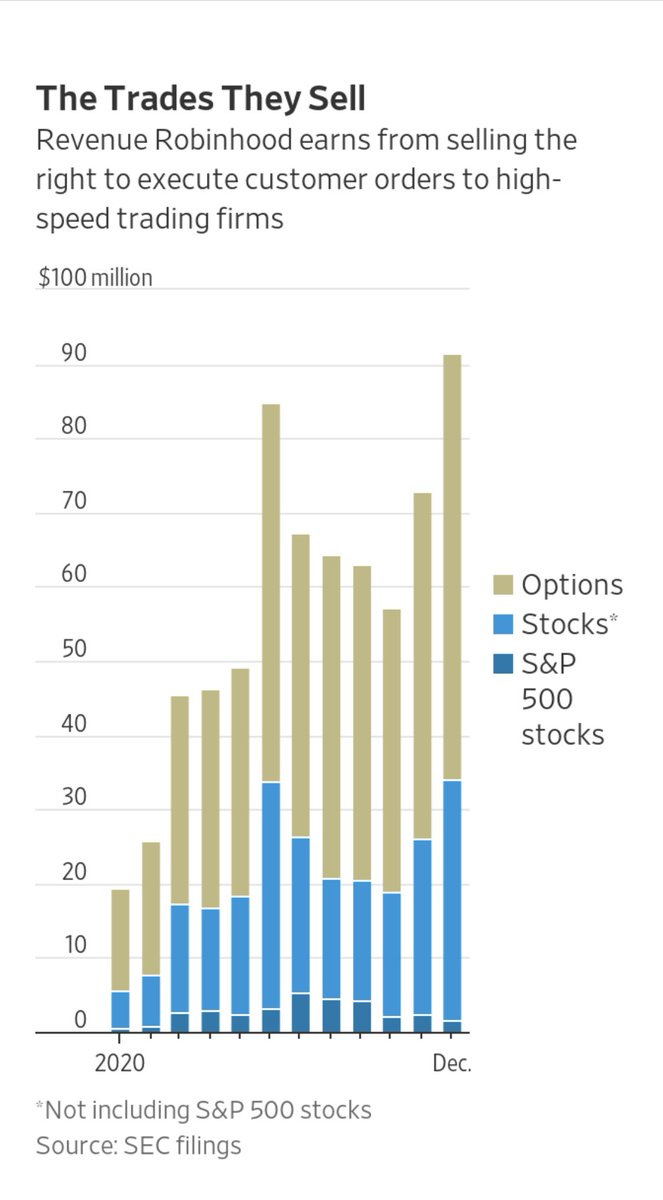

RobinHood’s customers are “less sophisticated” retail customers who traffic disproportionately in small caps and options. This is a goldmine for order flow buyers.

RH gets paid for order flow (PFOF) by Citadel Securities, et al, selling them a sneak peak at your trades.

5/n

RH gets paid for order flow (PFOF) by Citadel Securities, et al, selling them a sneak peak at your trades.

5/n

In exchange, Citadel Securities “provide liquidity” (scalp you).

As you can see, RH’s revenue is disproportionately NOT from S&P 500 stocks.

Less liquid small caps & options are the biggest scalping, which makes sense. Likewise on sec lending.

Vig begs to be collected.

6/n

As you can see, RH’s revenue is disproportionately NOT from S&P 500 stocks.

Less liquid small caps & options are the biggest scalping, which makes sense. Likewise on sec lending.

Vig begs to be collected.

6/n

...and the WSJ discusses plumbing:

“The simplicity of [its] user interface masked the complexity of the different parties that touch each trade...clearinghouses [like DTCC] that collect and distribute payments for customers’ orders & officially transfer ownership.”

7/n

“The simplicity of [its] user interface masked the complexity of the different parties that touch each trade...clearinghouses [like DTCC] that collect and distribute payments for customers’ orders & officially transfer ownership.”

7/n

“Clearinghouses can take days to finalize a transaction. To account for the risk that a trade—or a brokerage —could fail before the process is complete, clearinghouses require brokerage firms to post collateral each day to guard against potential losses.”

8/n

8/n

“Collateral requirements can be unpredictable. The formulas clearinghouses use to arrive at their requests aren’t ...public. The amounts are known to go up in volatile times and when a broker’s customers concentrate trading in a small number of stocks.”

9/n

9/n

https://twitter.com/compound248/status/1355276777858457602

The WSJ article discloses RH COULD NOT MEET the DTCC’s initial $3B collateral request.

RH negotiated it lower by halting buying in $GME etc

“DTCC agreed. [It] was reduced to $1.4B. RH already had $700 MM on deposit...meaning it only had to post an additional $700 MM” 10/n

RH negotiated it lower by halting buying in $GME etc

“DTCC agreed. [It] was reduced to $1.4B. RH already had $700 MM on deposit...meaning it only had to post an additional $700 MM” 10/n

Props to @vladtenev & RH - crafty.

They nearly stole defeat from the jaws of victory, but instead turned it into giant, strange victory.

RH is in great shape now. I expect it to be a force for years to come, expanding offerings, growing users, & building a huge business.

END

They nearly stole defeat from the jaws of victory, but instead turned it into giant, strange victory.

RH is in great shape now. I expect it to be a force for years to come, expanding offerings, growing users, & building a huge business.

END

• • •

Missing some Tweet in this thread? You can try to

force a refresh