$LOAC - SPAC for 4D Pharma (#DDDD) due diligence thread including:

✅Company overview

✅Product overview

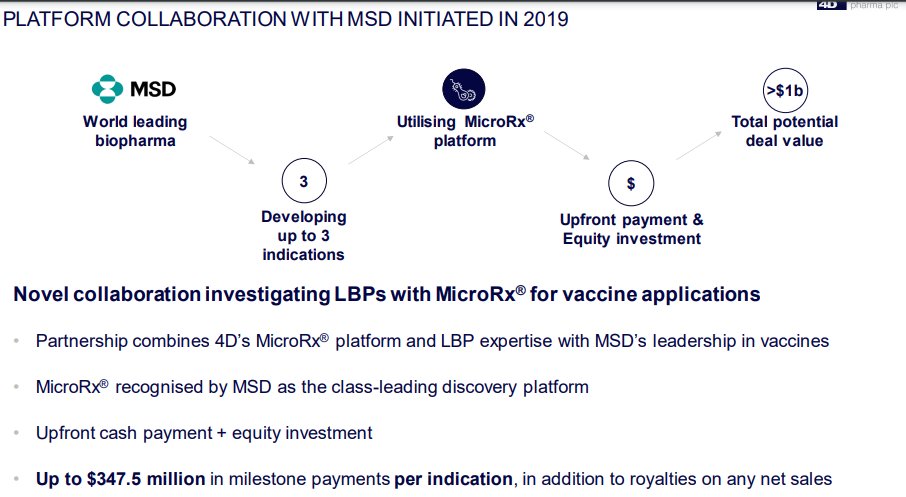

✅Collaborations with major #pharma companies ( $MRK, $PFE, and Merck KGaA)

✅Key competitors

✅Pipeline and upcoming catalysts

✅Company overview

✅Product overview

✅Collaborations with major #pharma companies ( $MRK, $PFE, and Merck KGaA)

✅Key competitors

✅Pipeline and upcoming catalysts

𝘾𝙤𝙢𝙥𝙖𝙣𝙮 𝙤𝙫𝙚𝙧𝙫𝙞𝙚𝙬

4D Pharma (#DDDD) is a pharmaceutical company leading the development of a novel class of drugs derived from the microbiome (LBPs).🦠

Here is a quick overview of how 4D utilizes the microbiome for unique solutions. vimeo.com/249654919

4D Pharma (#DDDD) is a pharmaceutical company leading the development of a novel class of drugs derived from the microbiome (LBPs).🦠

Here is a quick overview of how 4D utilizes the microbiome for unique solutions. vimeo.com/249654919

#DDDD / $LOAC is leading the microbiome sector with:

✅More than 1,000 granted patents

✅Partnerships with several large biopharma companies (Merck, Pfizer, Merck KGaA) and in talks with others

✅Unique discovery platform of live biotherapeutic products (LBPs)

✅More than 1,000 granted patents

✅Partnerships with several large biopharma companies (Merck, Pfizer, Merck KGaA) and in talks with others

✅Unique discovery platform of live biotherapeutic products (LBPs)

4D has an estimated market cap around $200-250 million. This is way undervalued compared competitors (more on competition further down the thread)

🚀 $LOAC has a small float: ~1.2 mil, and can move very quick.

📈 Current share price for $LOAC is $12.85, and $LOACW is $1.95.

🚀 $LOAC has a small float: ~1.2 mil, and can move very quick.

📈 Current share price for $LOAC is $12.85, and $LOACW is $1.95.

🔜 The merger between 4D Pharma (#DDDD) and Longevity Acquisition Corporation $LOAC is expected within the next 4-6 weeks. Expecting final DA and merger date soon.

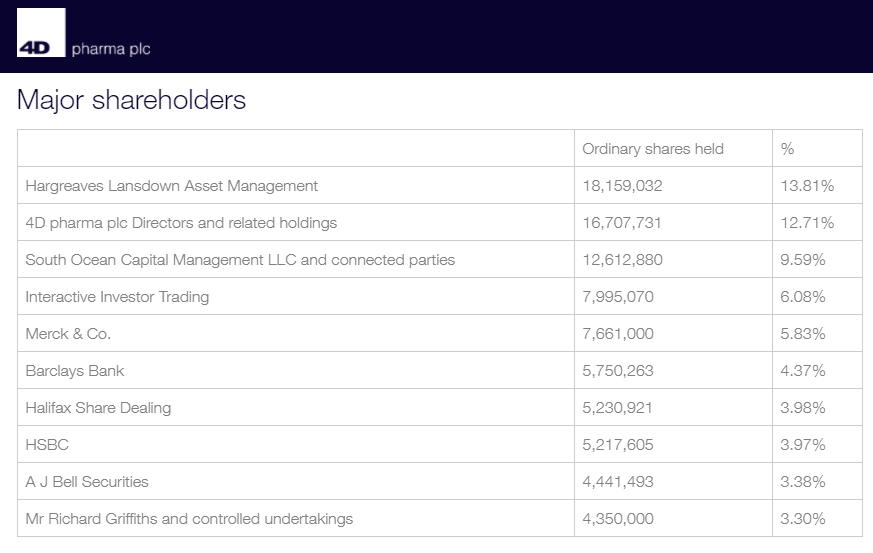

Major shareholders of 4D Pharma include Merck & Co., who holds 5.83%.

Partnerships with Merck and other major pharma companies is a theme you will see throughout this dd thread.

$LOAC #DDDD 🔬🦠💊🧪

Partnerships with Merck and other major pharma companies is a theme you will see throughout this dd thread.

$LOAC #DDDD 🔬🦠💊🧪

𝙈𝙖𝙣𝙖𝙜𝙚𝙢𝙚𝙣𝙩 𝙩𝙚𝙖𝙢

4D Pharma's mgmt team has wide range of experience in working at large pharma and bio companies, including $BMY, $SGMO, $GSK, $TAK, Roche, Celgene, among others. Also, several have experience in partnering and investing in bio-science companies.

4D Pharma's mgmt team has wide range of experience in working at large pharma and bio companies, including $BMY, $SGMO, $GSK, $TAK, Roche, Celgene, among others. Also, several have experience in partnering and investing in bio-science companies.

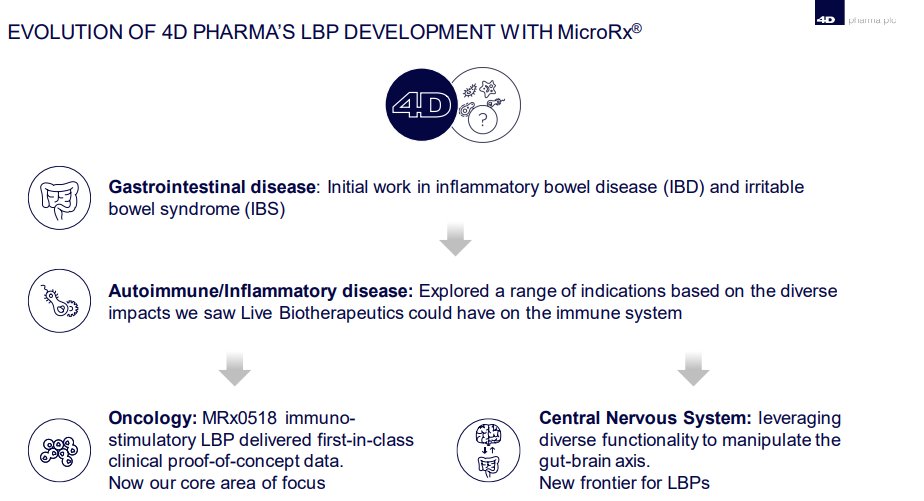

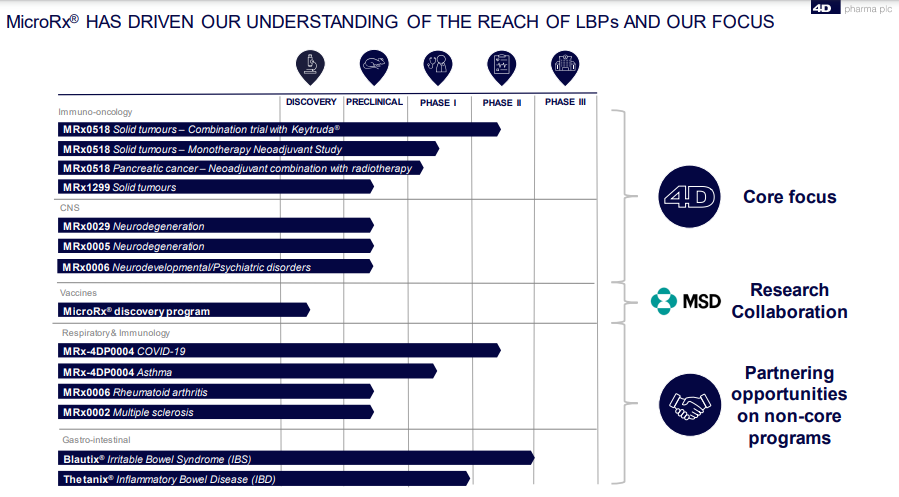

#DDDD is harnessing their research and knowledge of the microbiome to progress treatments for a slew of cancers and diseases.

The company's core area of focus is oncology. But they also have advanced work in central nervous system, IBS, and autoimmune/inflammatory diseases.

The company's core area of focus is oncology. But they also have advanced work in central nervous system, IBS, and autoimmune/inflammatory diseases.

𝙋𝙧𝙤𝙙𝙪𝙘𝙩 𝙤𝙫𝙚𝙧𝙫𝙞𝙚𝙬

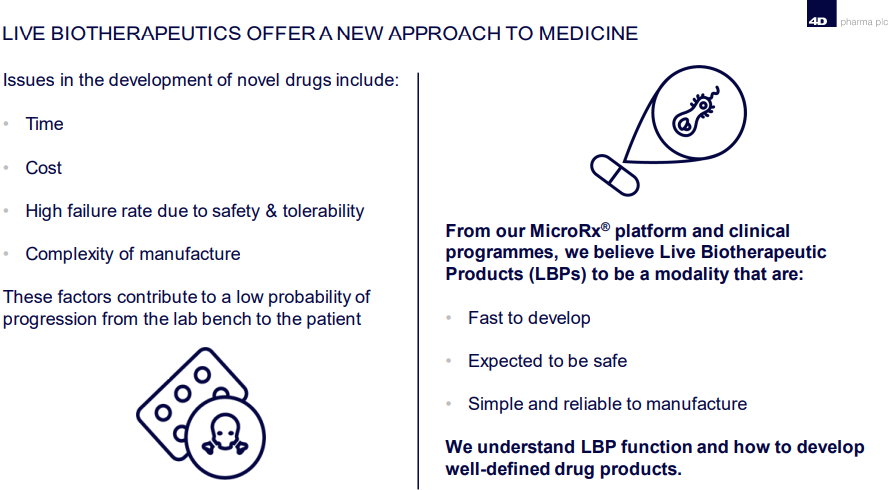

#DDDD ( $LOAC) has a proprietary platform called MicroRx for discovery of LBPs for treatment of a wide range of diseases. In <2 yrs, it has produced a pipeline of 12 potential therapies, & is expected to deliver many more candidates.

#DDDD ( $LOAC) has a proprietary platform called MicroRx for discovery of LBPs for treatment of a wide range of diseases. In <2 yrs, it has produced a pipeline of 12 potential therapies, & is expected to deliver many more candidates.

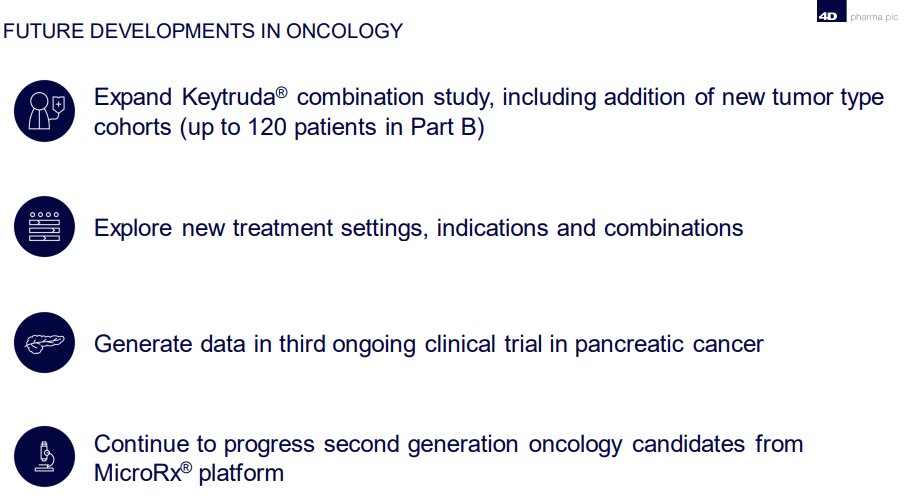

4D Pharma is focused on immune-oncology and is in the process of developing an "oncology franchise."

Their leading oncology microbiome drug is MRx5018.

What sets MRx5018 apart from all others is its applicability to numerous cancers and treatments. $LOAC #DDDD

Their leading oncology microbiome drug is MRx5018.

What sets MRx5018 apart from all others is its applicability to numerous cancers and treatments. $LOAC #DDDD

MRx5018 is a single strain LBP in development for the treatment of cancer.

It's an oral capsule that stimulates the body’s immune system, directing it to produce cytokines and immune cells that are known to attack tumors.💊

It's an oral capsule that stimulates the body’s immune system, directing it to produce cytokines and immune cells that are known to attack tumors.💊

MRx0518 is being evaluated in 4 different clinical trials in cancer patients.

💊MRx0518 clinical trials:

▪️ Combination w/ #Keytruda® ( $MRK) on solid tumors

▪️ Combination w/ #Bavencio® ( $PFE) to begin in '21 on bladder cancer

▪️ Solid tumors - monotherapy

▪️ Pancreatic cancer

💊MRx0518 clinical trials:

▪️ Combination w/ #Keytruda® ( $MRK) on solid tumors

▪️ Combination w/ #Bavencio® ( $PFE) to begin in '21 on bladder cancer

▪️ Solid tumors - monotherapy

▪️ Pancreatic cancer

𝘾𝙤𝙡𝙡𝙖𝙗𝙤𝙧𝙖𝙩𝙞𝙤𝙣𝙨 𝙬𝙞𝙩𝙝 𝙢𝙖𝙟𝙤𝙧 #𝙥𝙝𝙖𝙧𝙢𝙖 𝙘𝙤𝙢𝙥𝙖𝙣𝙞𝙚𝙨

MRx0518 partnership with Keytruda ( $MRK)

🧪Keytruda is a drug by Merck that is currently used alone or in combination to treat +15 forms of cancer.

More on Keytruda: bit.ly/3cUOZ07

MRx0518 partnership with Keytruda ( $MRK)

🧪Keytruda is a drug by Merck that is currently used alone or in combination to treat +15 forms of cancer.

More on Keytruda: bit.ly/3cUOZ07

Currently, MRx0518 is in an ongoing Phase I/II clinical trial in combination Keytruda in patients with advanced tumors/cancer growth who have previously progressed on ICI therapy. Initial data seems promising.

Enrollment for the trial is expected to by complete in Q4 of 2021.

Enrollment for the trial is expected to by complete in Q4 of 2021.

In addition to partnership on MRx0518, Merck (MSD) has also invested in 4D's MicroRx platform which has resulted in additional $$$ and investment into #DDDD $LOAC

MRx0518 partnership with Bavencio (product of $PFE)

📃#DDDD announced this week a clinical trial collaboration and supply agreement with Merck KGaA and Pfizer to evaluate 4D’s MRx0518 in combination with Bavencio for the treatment of bladder cancer.

📃#DDDD announced this week a clinical trial collaboration and supply agreement with Merck KGaA and Pfizer to evaluate 4D’s MRx0518 in combination with Bavencio for the treatment of bladder cancer.

This announced partnership between $PFE, Merck KGaA, and #DDDD is to evaluate the combination of Bavencio and MRx0518 as a first-line maintenance therapy for patients with bladder cancer where chemotherapy hasn’t been effective. More on the announcement: bit.ly/3rInn2x

Outside of the collaborations with Merck, Pfizer, and Merck KGaA, 4D Pharma's clinical studies with MRx0518 on solid tumors as a monotherapy and on pancreatic cancer are both in Phase I and showing promise.

Initial data from the pancreatic cancer trial is due in 2021.

Initial data from the pancreatic cancer trial is due in 2021.

𝘼𝙙𝙙𝙞𝙩𝙞𝙤𝙣𝙖𝙡 𝙥𝙧𝙤𝙙𝙪𝙘𝙩 𝙤𝙫𝙚𝙧𝙫𝙞𝙚𝙬

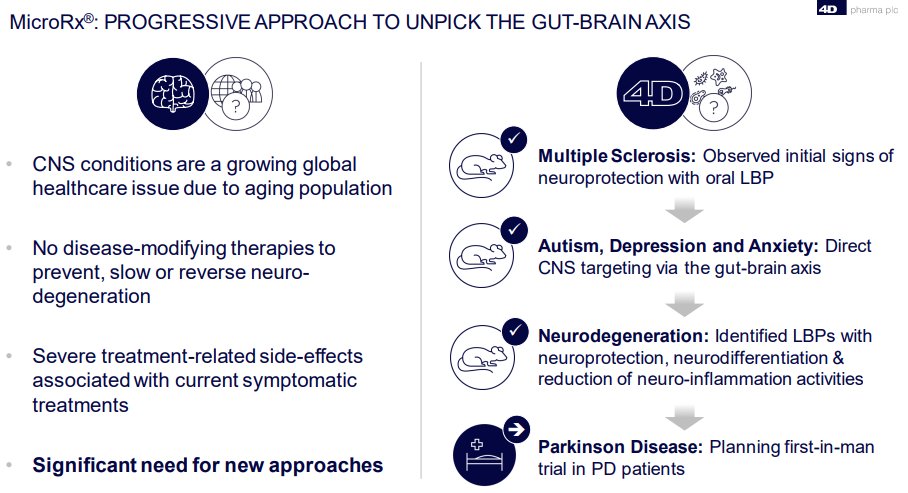

In addition to their blockbuster MRx0518, #DDDD has potential game-changing solutions to other common diseases. 4D is delivering new approaches to diseases impacted through the central nervous system and/or the gut-brain axis.

In addition to their blockbuster MRx0518, #DDDD has potential game-changing solutions to other common diseases. 4D is delivering new approaches to diseases impacted through the central nervous system and/or the gut-brain axis.

As #DDDD progresses their work to find novel approaches to diseases impacted by the gut-brain axis, they open themselves up to potential breakthroughs in areas such as: #autism, #Parkinsons, multiple sclerosis, depression, anxiety, and more.

4D's work has led them to be an industry partner on the Parkinson’s Progression Markers Initiative (PPMI). PPMI is a landmark study sponsored by The Michael J. Fox Foundation to better understand Parkinson’s disease and accelerate the development of new treatments. $LOAC

4D already has breakthroughs in IBS. In 2020, they completed Phase 2 study on their IBS product Blautix.

Blautix is the 1st therapy to show signs of efficacy in both IBS-C and IBS-D, and it has the potential to be the 1st therapy ever developed for the treatment of IBS-M.

$LOAC

Blautix is the 1st therapy to show signs of efficacy in both IBS-C and IBS-D, and it has the potential to be the 1st therapy ever developed for the treatment of IBS-M.

$LOAC

Phase 3 trail news of Blautix is expected in 2021. #DDDD management has stated that they have been talking to several potential partners, including all major players in IBS space.

The IBS market in the U.S. is anticipated to be 2.4 billion by 2024 – which is likely understated.

The IBS market in the U.S. is anticipated to be 2.4 billion by 2024 – which is likely understated.

Not to go unnoticed, #DDDD has been researching and testing the benefits of immunomodulatory therapy for COVID-19. The company is leveraging their experience with research on asthma and treating lung inflammation by conducting clinical trials with their MRx-4DP0004 product. $LOAC

𝙆𝙚𝙮 𝙘𝙤𝙢𝙥𝙚𝙩𝙞𝙩𝙤𝙧𝙨

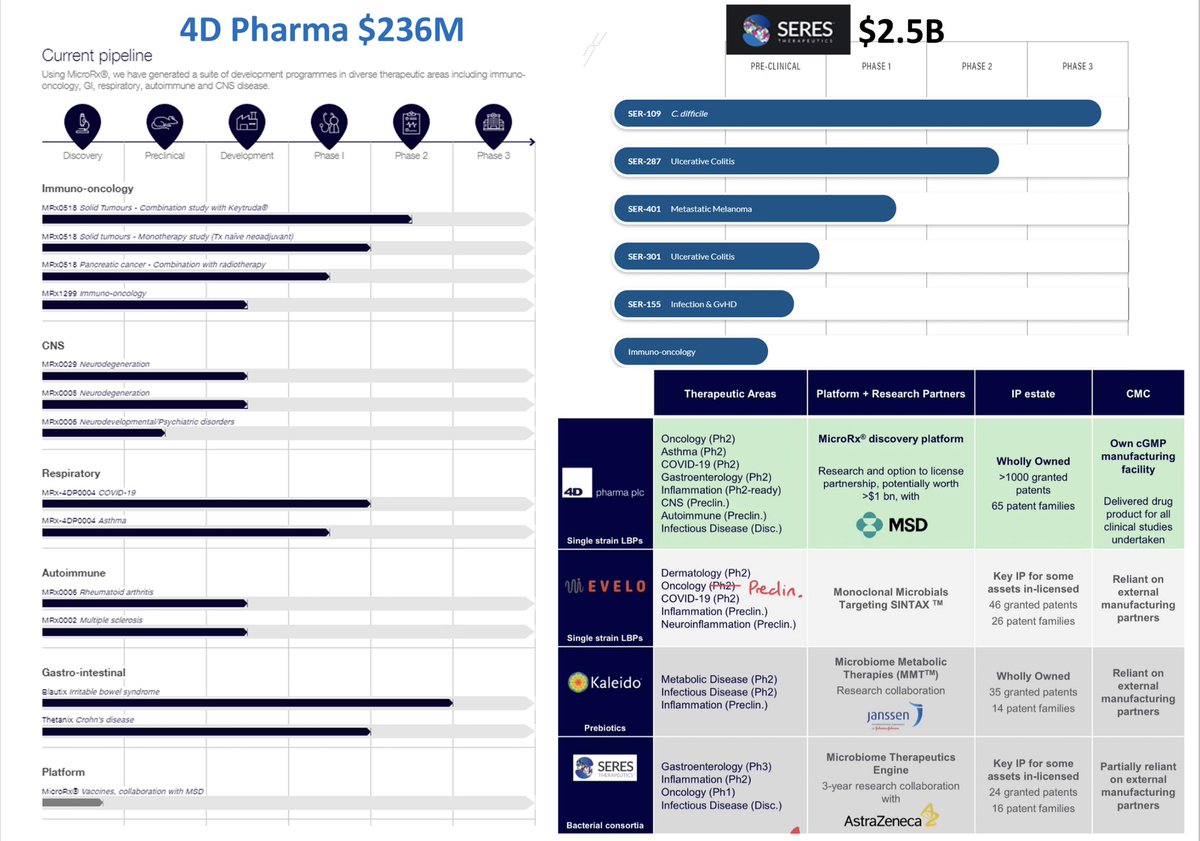

4D Pharma (#DDDD - $LOAC) has several competitors in the microbiome sector to consider:

▪️ Seres Therapeautics $MCRB - $29.00

▪️ Kaleido Biosciences $KLDO - $11.75

▪️ Evelo Biosciences $EVLO - $18.50

s/o to @LRamseu for the visual

4D Pharma (#DDDD - $LOAC) has several competitors in the microbiome sector to consider:

▪️ Seres Therapeautics $MCRB - $29.00

▪️ Kaleido Biosciences $KLDO - $11.75

▪️ Evelo Biosciences $EVLO - $18.50

s/o to @LRamseu for the visual

It's clear from the competitor analysis:

✅4D Pharma has a much broader portfolio

✅4D's big biopharma partnerships are more robust than most the competition

✅4D is severely undervalued with current market cap

$LOAC #DDDD

✅4D Pharma has a much broader portfolio

✅4D's big biopharma partnerships are more robust than most the competition

✅4D is severely undervalued with current market cap

$LOAC #DDDD

𝙒𝙝𝙮 𝙖𝙧𝙚 𝙩𝙝𝙚 𝙥𝙖𝙧𝙩𝙣𝙚𝙧𝙨𝙝𝙞𝙥𝙨 𝙞𝙢𝙥𝙤𝙧𝙩𝙖𝙣𝙩?

Not only do 4D’s partnerships with Merck, Pfizer and Merck KGaA speak to the positive results #DDDD has experienced with MRx0518, it opens the door for much larger financial opportunities for both companies.

Not only do 4D’s partnerships with Merck, Pfizer and Merck KGaA speak to the positive results #DDDD has experienced with MRx0518, it opens the door for much larger financial opportunities for both companies.

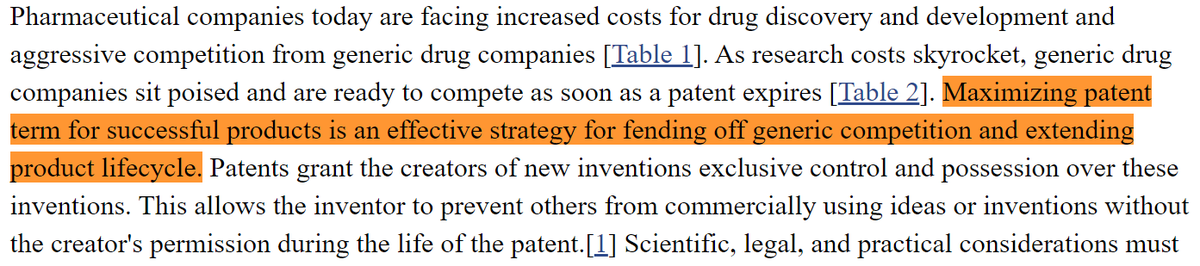

It is no secret that Merck has been searching for a complimentary drug to pair with Keytruda to boost its success. This can be seen with the failed phase 3 trial with ipilimumab and Keytruda.

Keytruda is expected to come off patent in 2026. One of the best strategies for companies to preserve product value is through post-patent defense and life-cycle management.

Source for this post and the following: ncbi.nlm.nih.gov/pmc/articles/P…

Source for this post and the following: ncbi.nlm.nih.gov/pmc/articles/P…

Several ways companies can protect their patent by post-patent defense or life-cycle management is through exploring new treatment options to extend the patent or by creating a combination of two products to sell as a new solution. A few examples for context in the attached.

𝙋𝙞𝙥𝙚𝙡𝙞𝙣𝙚 𝙖𝙣𝙙 𝙪𝙥𝙘𝙤𝙢𝙞𝙣𝙜 𝙘𝙖𝙩𝙖𝙡𝙮𝙨𝙩𝙨

4D Pharma is loaded with catalysts this year:

✅Several March presentations

✅ Completion of merger with $LOAC in the next 4-6 weeks

✅Expansion of numerous trials

✅New potential partnerships for trials

🚀🚀🚀 $LOAC

4D Pharma is loaded with catalysts this year:

✅Several March presentations

✅ Completion of merger with $LOAC in the next 4-6 weeks

✅Expansion of numerous trials

✅New potential partnerships for trials

🚀🚀🚀 $LOAC

In regards to the upcoming SPAC merger. Getting listed on the NASDAQ will open up a huge opportunity for investments that #DDDD has not had access to.

$LOAC

$LOAC

Take for example @CathieDWood and @ARKInvest - they have been vocal about foreseeing breakthrough therapies in cancer, and have also been keeping an eye on #DDDD. Listing on the NASDAQ opens up 4D to potential investments from ARK and others.

https://twitter.com/i/status/1348625151743635458

With most SPACs, evaluating value and potential can be difficult. In my opinion, #DDDD sits outside of the "most SPACs" category:

🔬Extensive research & experience

💊Broadest portfolio in sector

💰Significant assets (patents, partnerships, etc.)

LT potential is tremendous $LOAC

🔬Extensive research & experience

💊Broadest portfolio in sector

💰Significant assets (patents, partnerships, etc.)

LT potential is tremendous $LOAC

I'll add more dd as I come across it, but special shout out to some others that have been on top of #DDDD for a while:

@Brabo83

@BlogShrey

@LRamseu

@Brabo83

@BlogShrey

@LRamseu

• • •

Missing some Tweet in this thread? You can try to

force a refresh