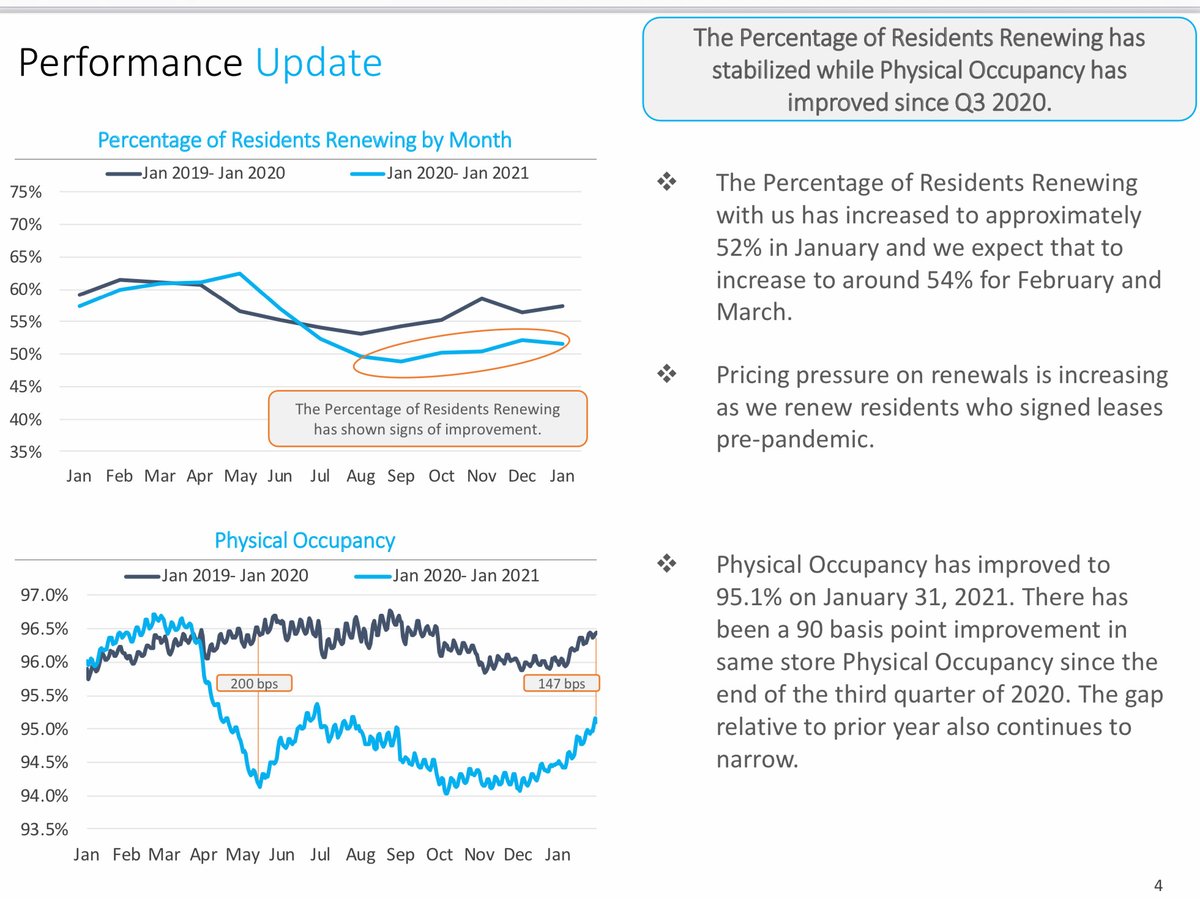

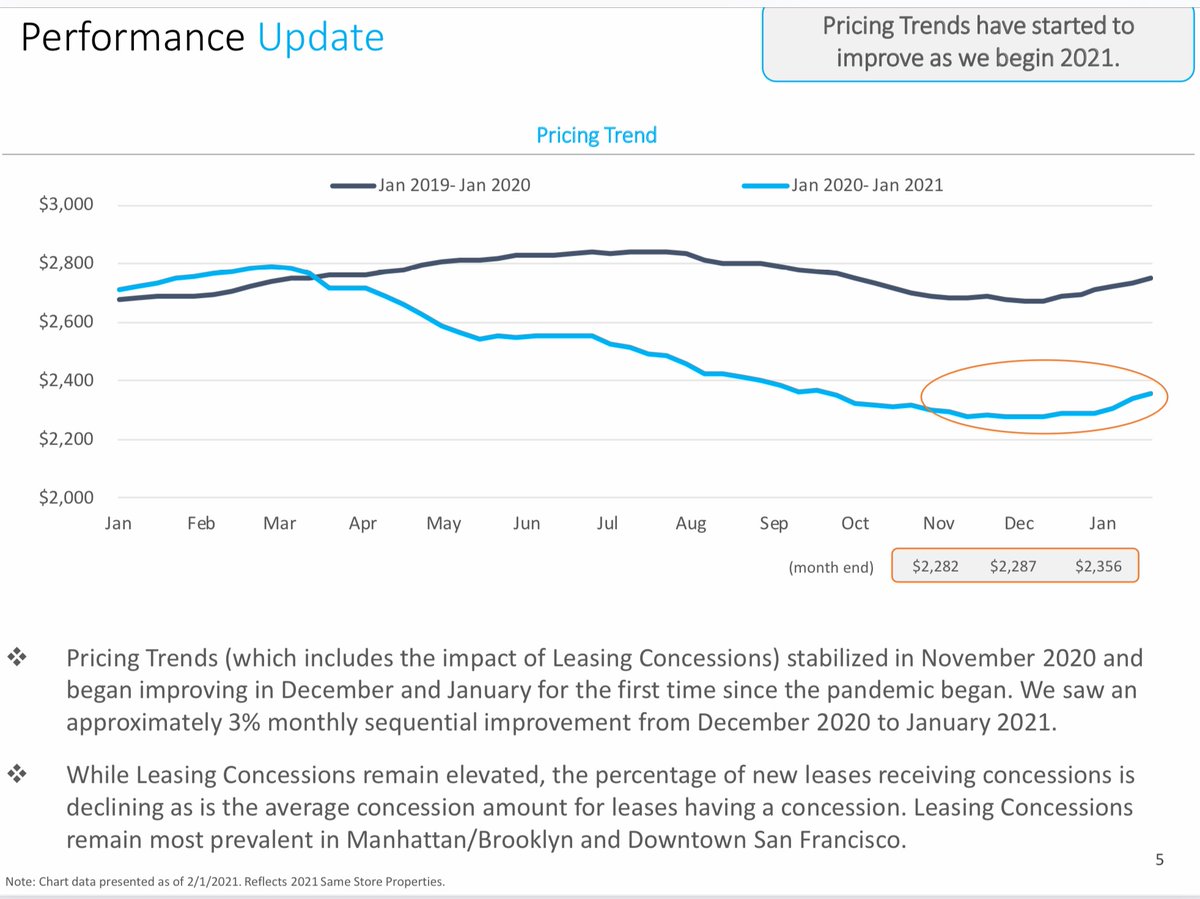

$EQR results as expected. 2021 NOI guide -12-15% so peak (2019) to trough (2021) decline in NOI expected to be -17-20%. I'd been thinking -20% after 3Q#s. Like at $AVB, $ESS, $UDR rents stabilizing/occupancy increasing. #reits $VNQ #dividend #cre #investing $TLT

No longer crazy cheap but reasonably attractive vs. private market/alternatives $SPY $IWM $MDY $TLT $GLD $BTC. I assume NOI recovers to 2019 levels by ~2024 and stock has fair value of $80-85 at that time. Coupled w/ divvies received this produces a 4 year IRR of ~8-9%.

Commentary post 3Q: privateeyecapital.com/3q20-updates-f…

• • •

Missing some Tweet in this thread? You can try to

force a refresh