I'd been peripherally aware of @abt_company last year working on couple of M&A DD engagements....an OTC shell slipstreaming into the in vouge sector of the time....reeked of the standard P&D playbook.

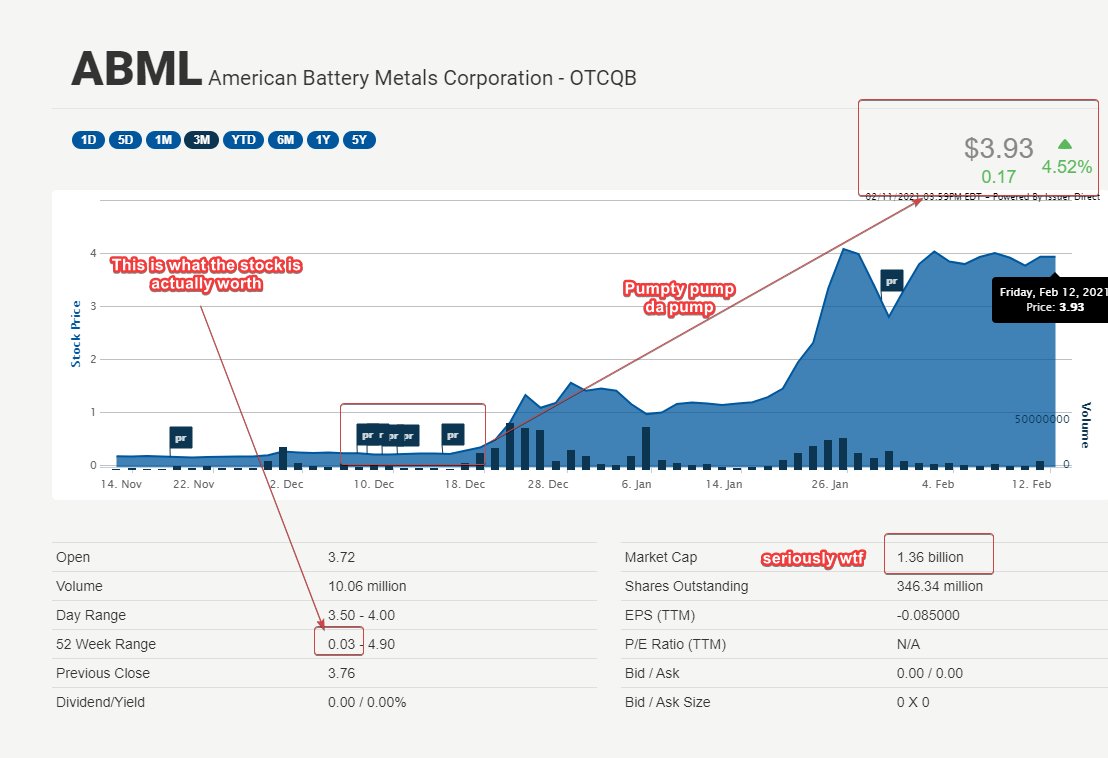

By chance I stumbled across them today and had a flick through their business and numbers....I have to admit I was way off the mark; the recycling business far more underwhelming and the pump exponentially higher than than I could have imaged.

Hows this for snake oil salesman. The global market was worth $1B last year...we are building a plant 20% of the global market .....topline number is $200m pa ....and its gonna run for the next 50 years.

Awesome dipshit. Currently the US share of the global market is low single digits. Apart from that you have nothing but a piece of dirt in Nevada...no permits..no customers...no feed...lots of hot air.

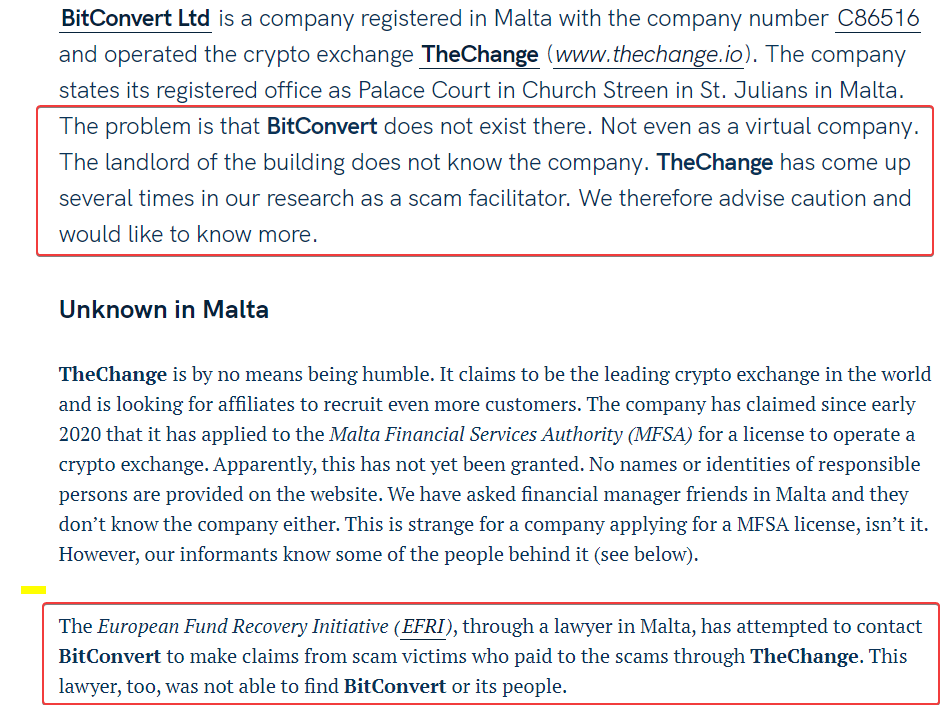

So what is American Battery Metals worth right now? Well its probably worth what it was at its 52w low which would have been sub $10m.....currently pumped to $1.35Billion.

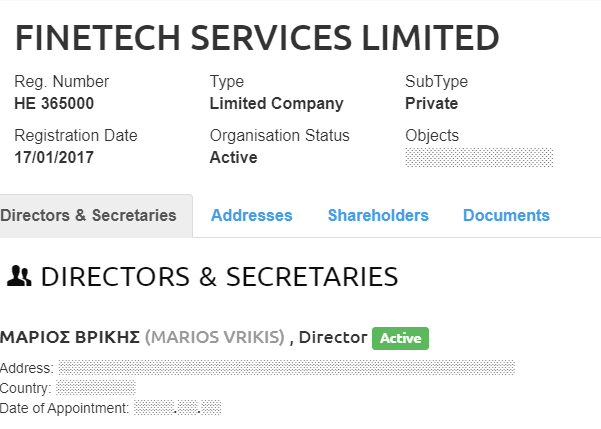

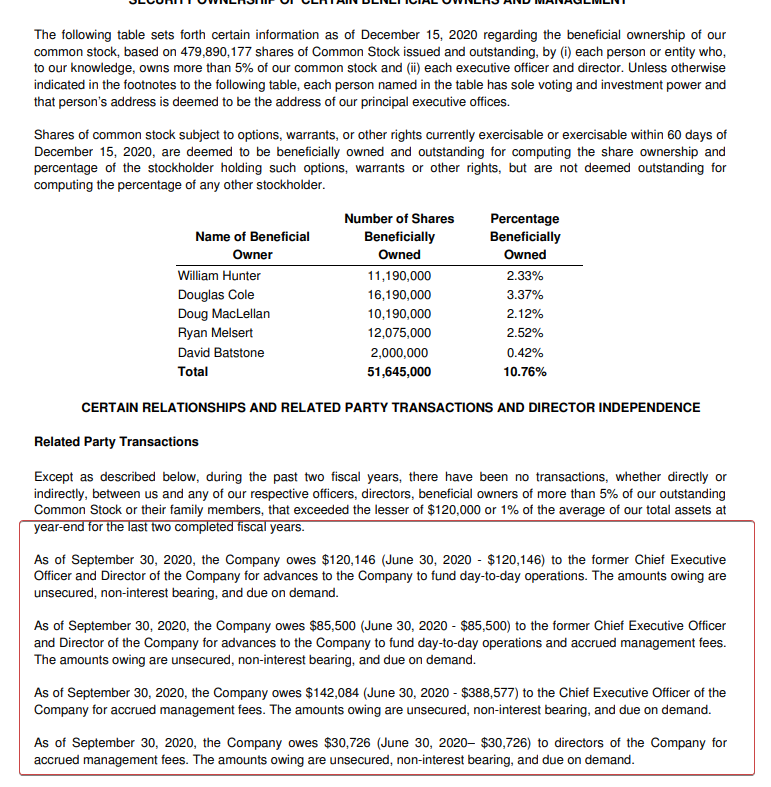

So who's behind this massive pump.....which is amazing since last year they were so flyblown that they couldn't even pay their own strawmen.. and were issuing IOU's as fast as they would write them up.

A quick once over the terms of the IOU's and its pretty clear that some holders have far more favourable terms than others.

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh