So you have probably noticed @terra_money’s exponential rise in 2021. And you’re probably wondering “where did this all come from?”

Well not from nowhere—in fact it’s been a relatively long and super interesting journey, well worth a review.

A thread👇🏻

Well not from nowhere—in fact it’s been a relatively long and super interesting journey, well worth a review.

A thread👇🏻

For some context, Terra is a Tendermint based Layer 1, optimized for financial services. The lifeblood of the system is an expanding set of stablecoins. Stability is achieved via seigniorage enabled by the native protocol asset, LUNA—burn $LUNA, mint stablecoins and so on.

Validators stake LUNA to secure consensus, and are also responsible for casting oracle votes that feed the system with information on the various exchange rates of assets on the platform.

Terra launched in 2019. The first stablecoins introduced to the system were the KRW and the SDR. These stables powered the back-end of Chai—a mobile payments and e-comm app with a large footprint in Korea.

Volumes and users on the KRW pair increased steadily over time. At the same time though, $LUNA was not looking like it was capturing a lot of that value. “Why is that?” you will naturally wonder.

When I first looked at Terra back in 2019, I immediately thought “if anything will disrupt Stripe, it will look like this on the back-end.”

But there was one issue—how do you get from 0 to 1?

Let me explain what I mean by that.

But there was one issue—how do you get from 0 to 1?

Let me explain what I mean by that.

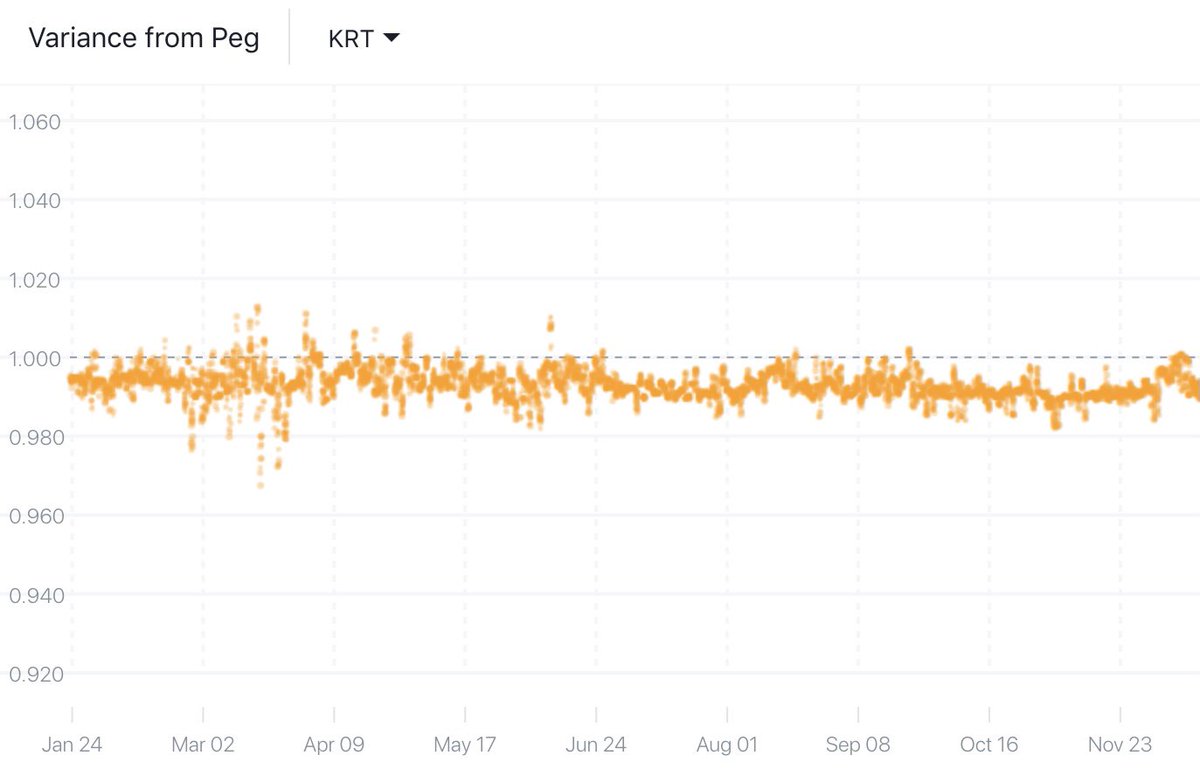

Say you are a merchant in the ecosystem and you receive synthetic KRW (KRT) as payment because lower fees and it’s convenient. If KRT is interchangeable with KRW, a rational agent would opt for always swapping into legal tender post payment, because KRW bears less risk than KRT.

If you extrapolate that behaviour to the ecosystem level, it means that the market is always net short KRT (or other stable) and the system is always in a state of excess supply!

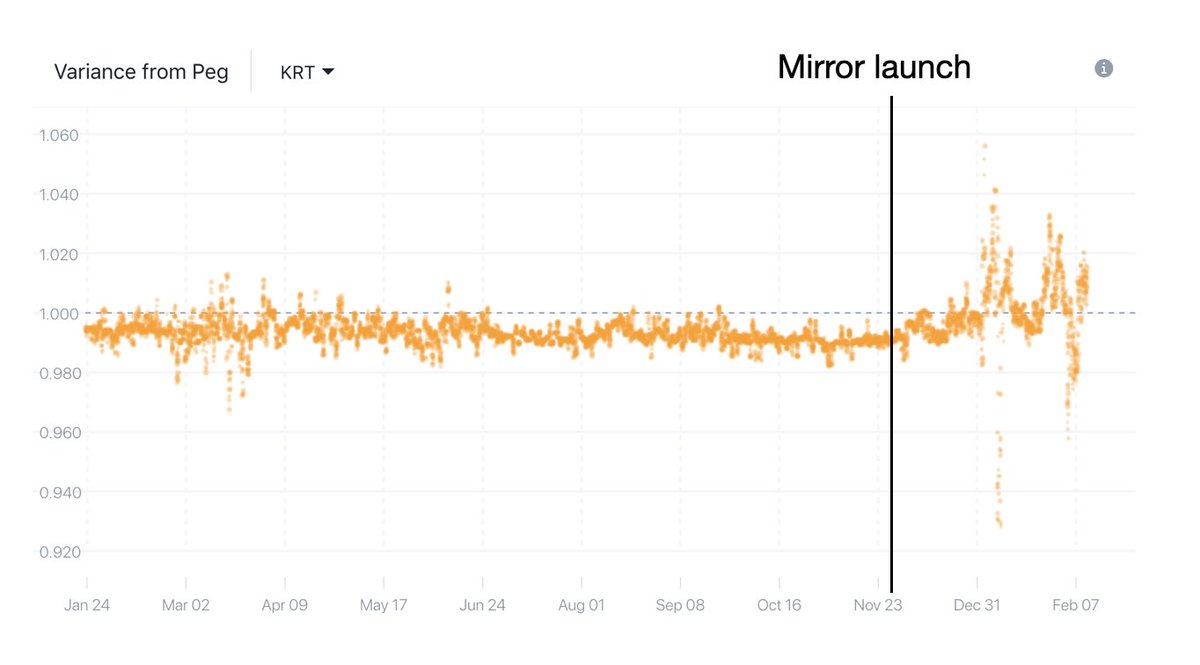

And excess supply means that KRT would always trade under the peg—and so it did.

And excess supply means that KRT would always trade under the peg—and so it did.

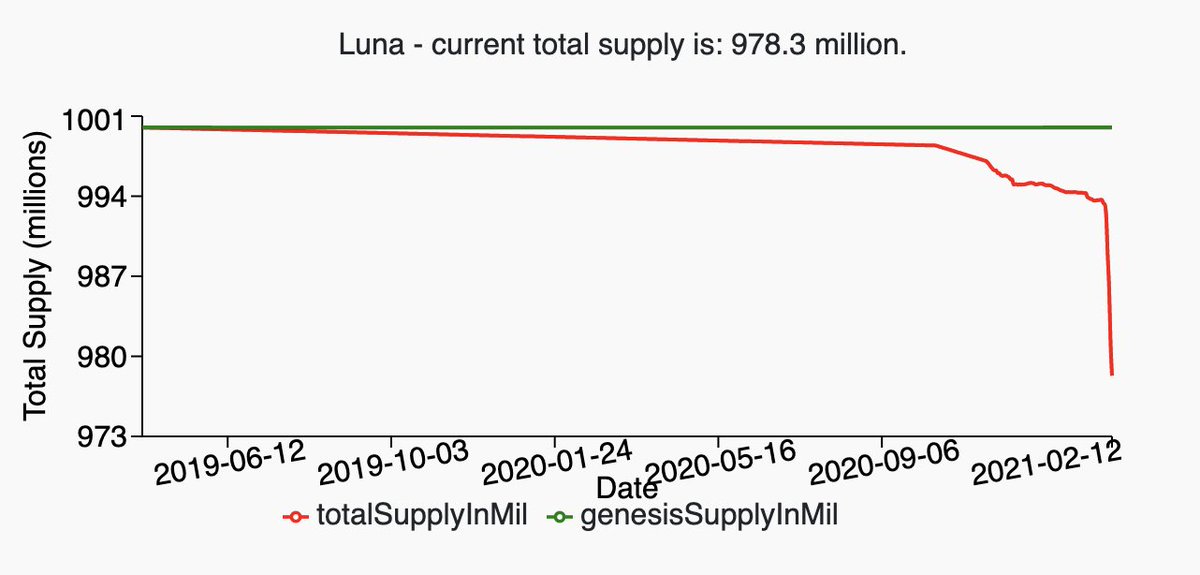

Given how seigniorage works in Terra, in order to bring KRT back to the peg, LUNA is minted in order to buy back the KRT overhang. All good—back to stability. But there’s one problem.

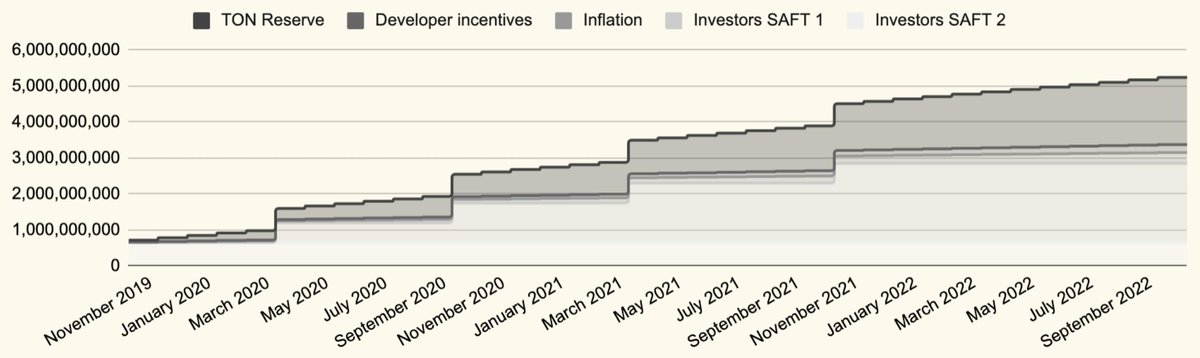

Inflation!

Inflation!

This meant that over time validators would be getting diluted much more than they are compensated for.

So when does this stop? Well, when “network effect”—ie when the rational play for merchants and other users of stables is to hold them—not swap them for the legal tender.

So when does this stop? Well, when “network effect”—ie when the rational play for merchants and other users of stables is to hold them—not swap them for the legal tender.

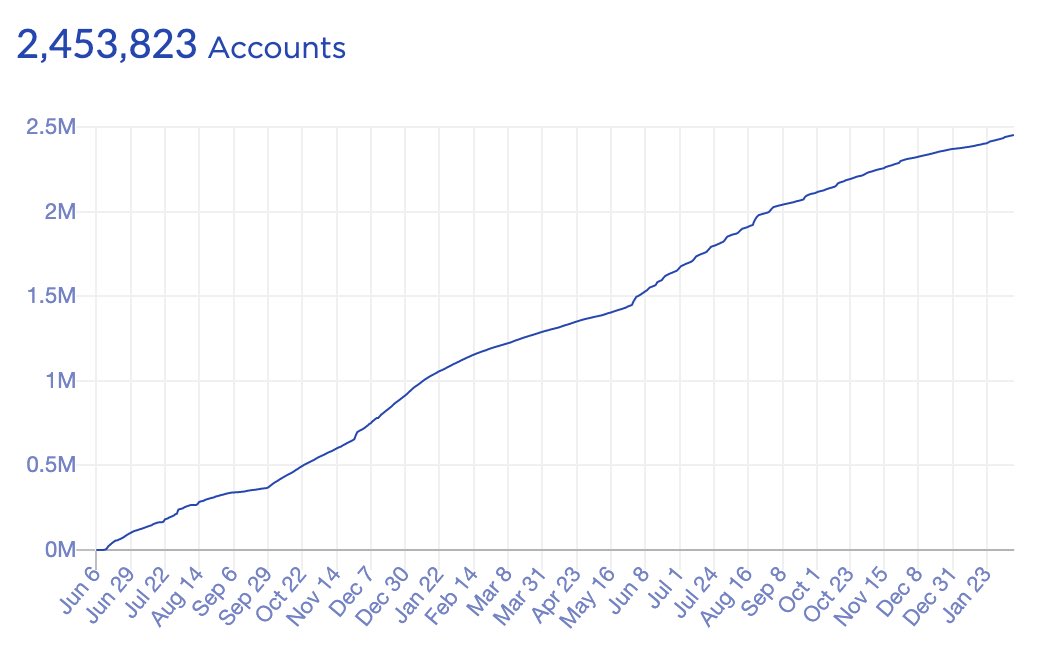

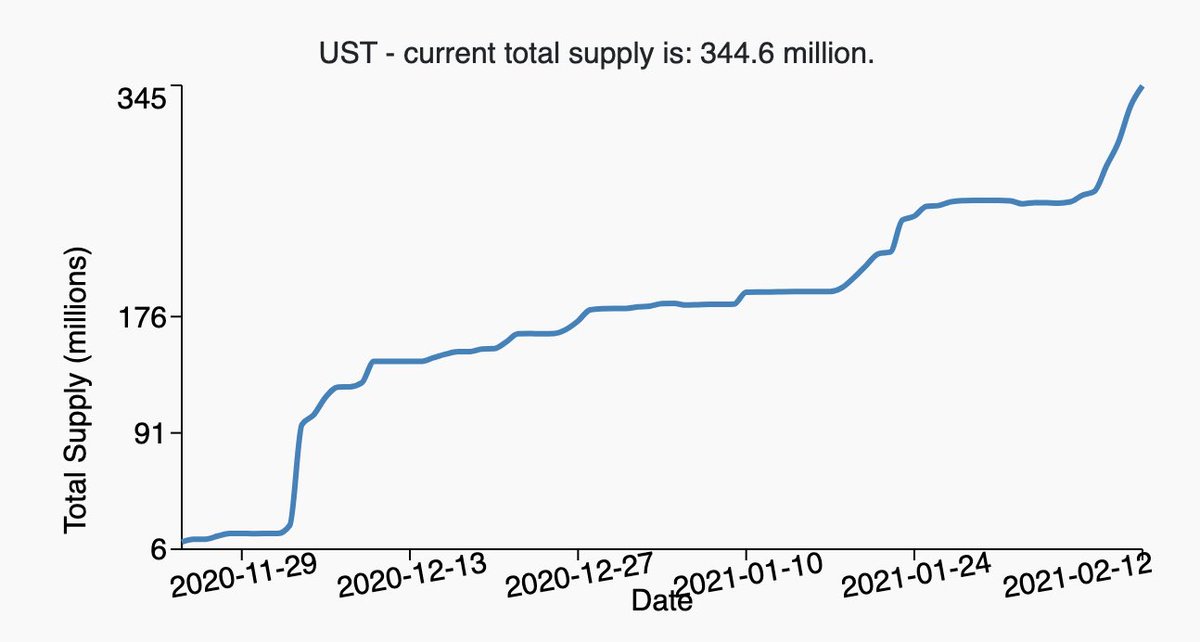

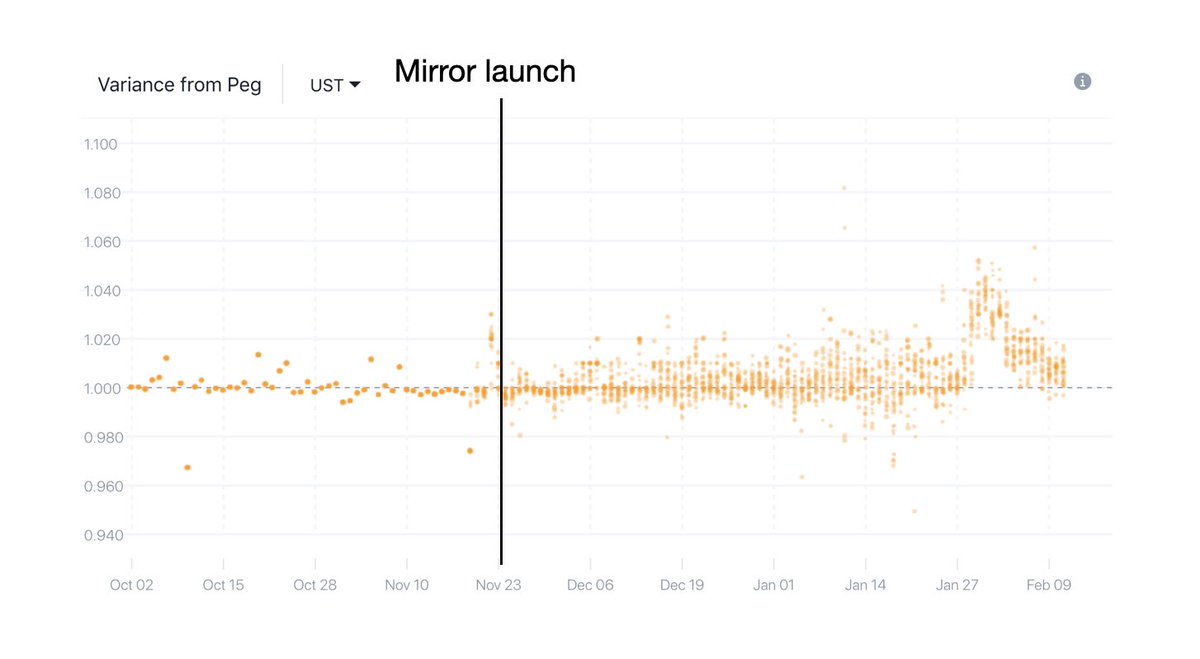

Enter @mirrorfinance and subsequently @alice_finance and @anchor_protocol—now the ecosystem has gone from a state of no clear incentive to hold the stables, to up to 400%+ APY on UST.

Incentive enough? Definitely looks like it!

Incentive enough? Definitely looks like it!

UST is in such demand that now the opposite is happening—the pair is consistently trading above the peg (as is KRT) and to temper this, LUNA must burned in order to mint more UST. That makes LUNA ever scarcer over time, as demand for UST and other stables increases.

Is this likely to continue? My bet is yes—subsidised yield is great to acquire users, but if utility in the Terra ecosystem keeps increasing (new facilities etc), it will very likely end up being Hotel California; you come for yield, but stay for the good times!

If we don’t take stock of what works in this ecosystem, we will never scale it.

There are important lessons in bootstrapping money eco’s in what @d0h0k1 and co have delivered. Hopefully this thread helps put it all in perspective—and may the odds be ever in your favour!

There are important lessons in bootstrapping money eco’s in what @d0h0k1 and co have delivered. Hopefully this thread helps put it all in perspective—and may the odds be ever in your favour!

As always—this is NOT investment advice.

If you are interested in learning more about

@terra_money and how you can get involved—if you’re so inclined—my colleagues at @BisonTrails have put together a really great guide 👇

bisontrails.co/terra-guide/

If you are interested in learning more about

@terra_money and how you can get involved—if you’re so inclined—my colleagues at @BisonTrails have put together a really great guide 👇

bisontrails.co/terra-guide/

• • •

Missing some Tweet in this thread? You can try to

force a refresh