If it were to have a title, it would be sth along the lines of "and now we wait..."

Let's do this 👇

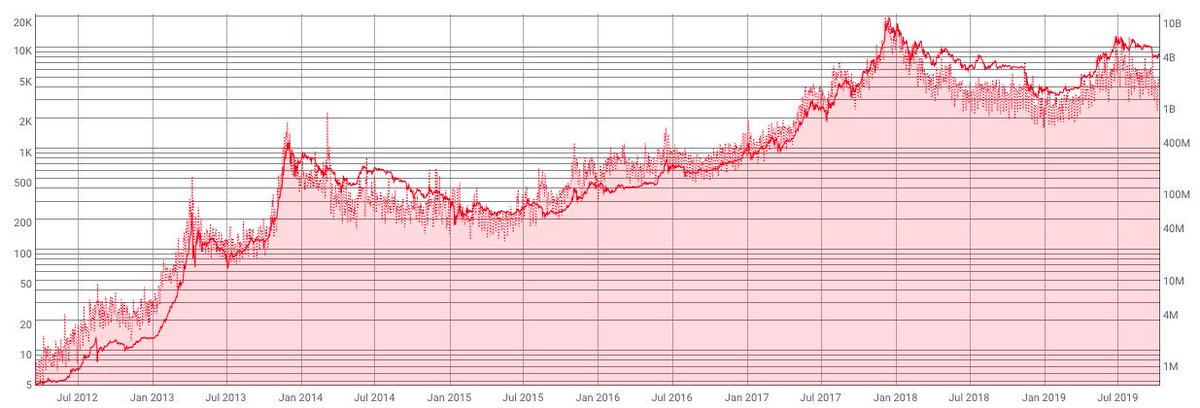

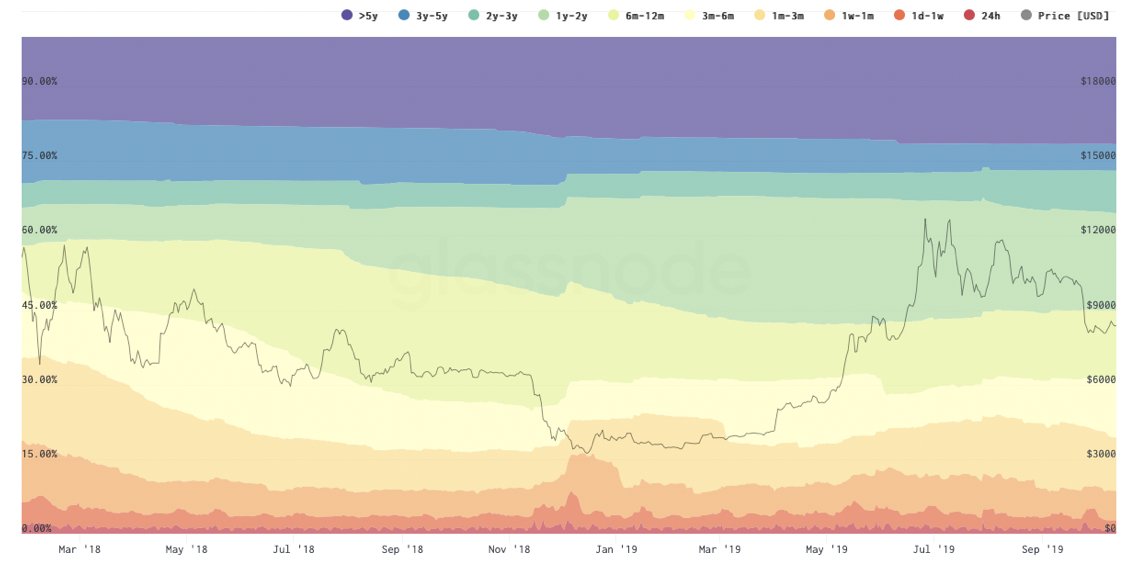

An increasing median, can reflect increasing belief in the fundamentals of the network and increasing confidence in the potential for higher price levels.

And vice versa.

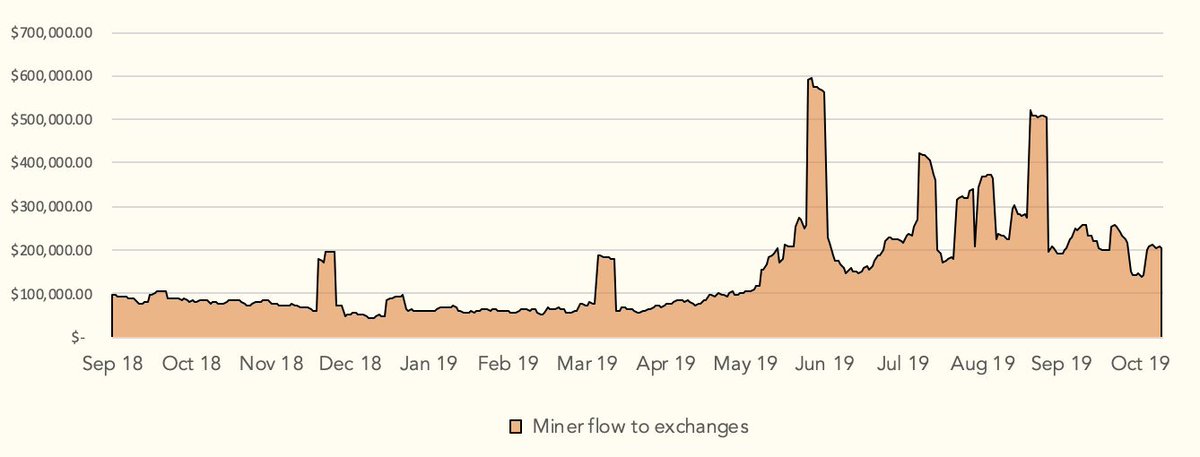

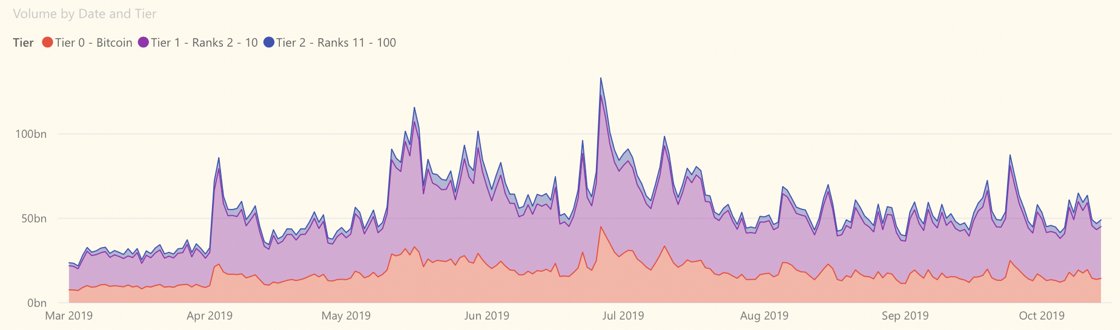

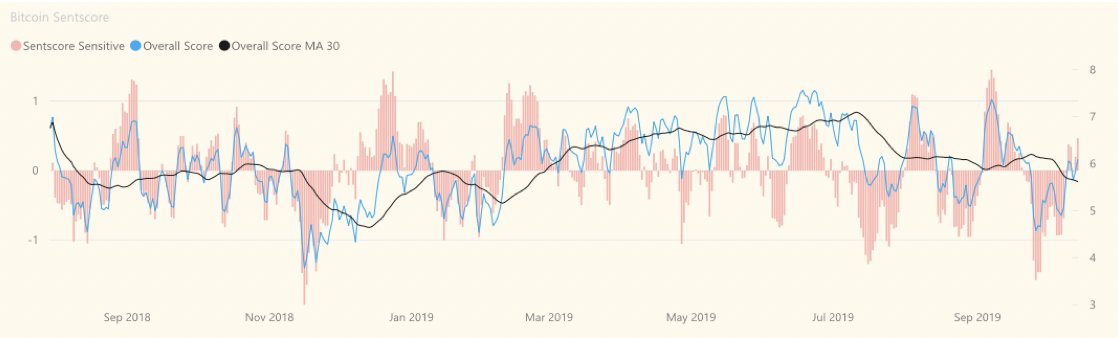

Off the different parties, traders appear to be the less optimistic.

The @cryptomenics sentiment indicator is back into the indecision zone. Historically, better buying opportunities appeared when the sentiment was grim for longer.

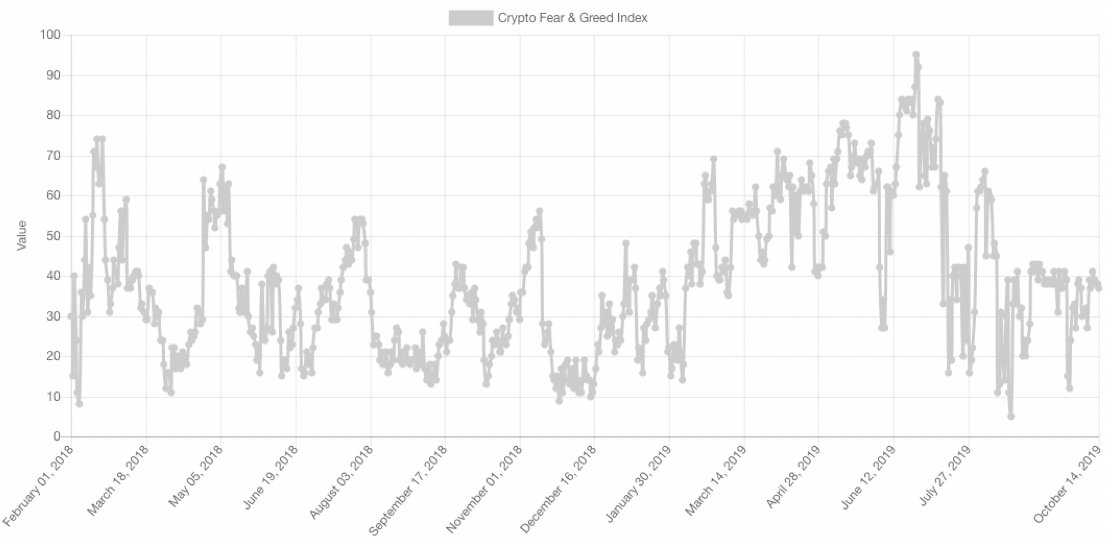

The Fear & Greed index agrees.

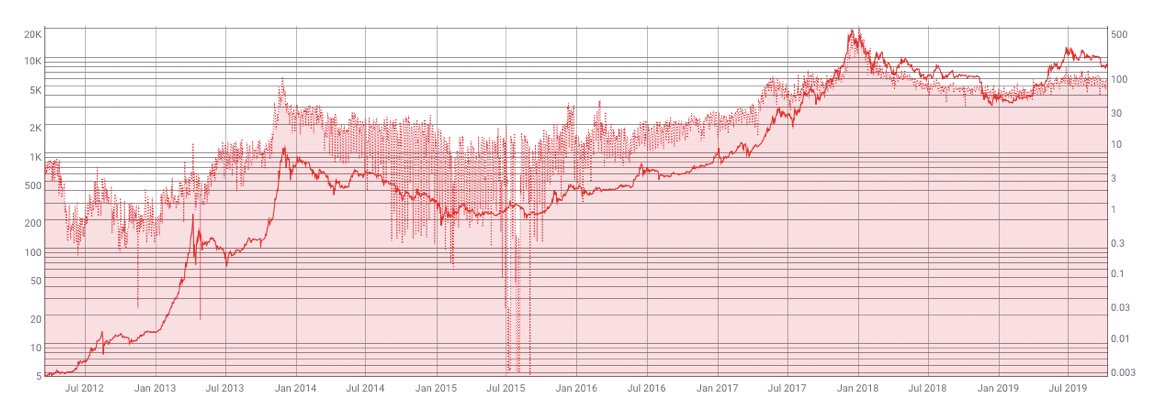

The high correl of the median tx USD value with BTC's USD price, is a pretty good indication this is still a speculative asset.

🕯️@sqcrypto's output can't come soon enough🕯️

(am I doing this right?)

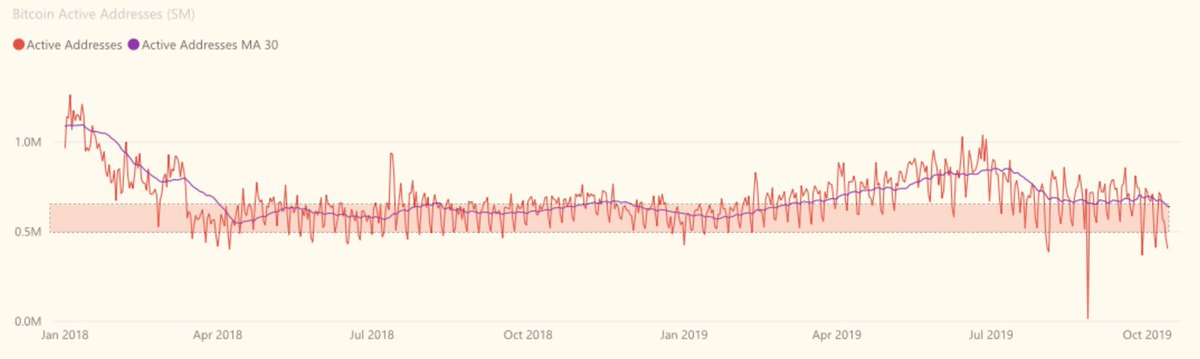

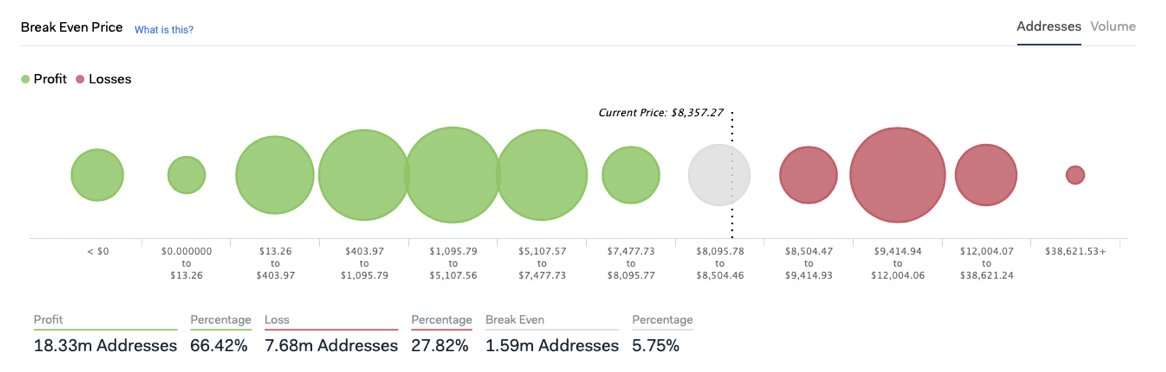

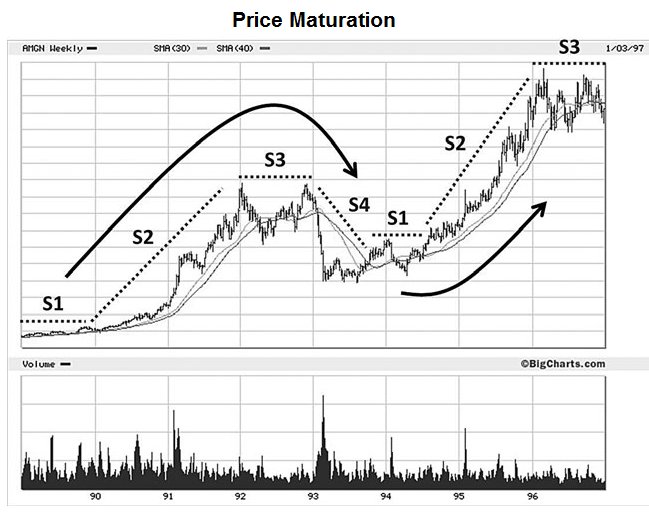

For demand to be activated, we will likely have to visit lower price levels - even momentarily, or consolidate here for a while.

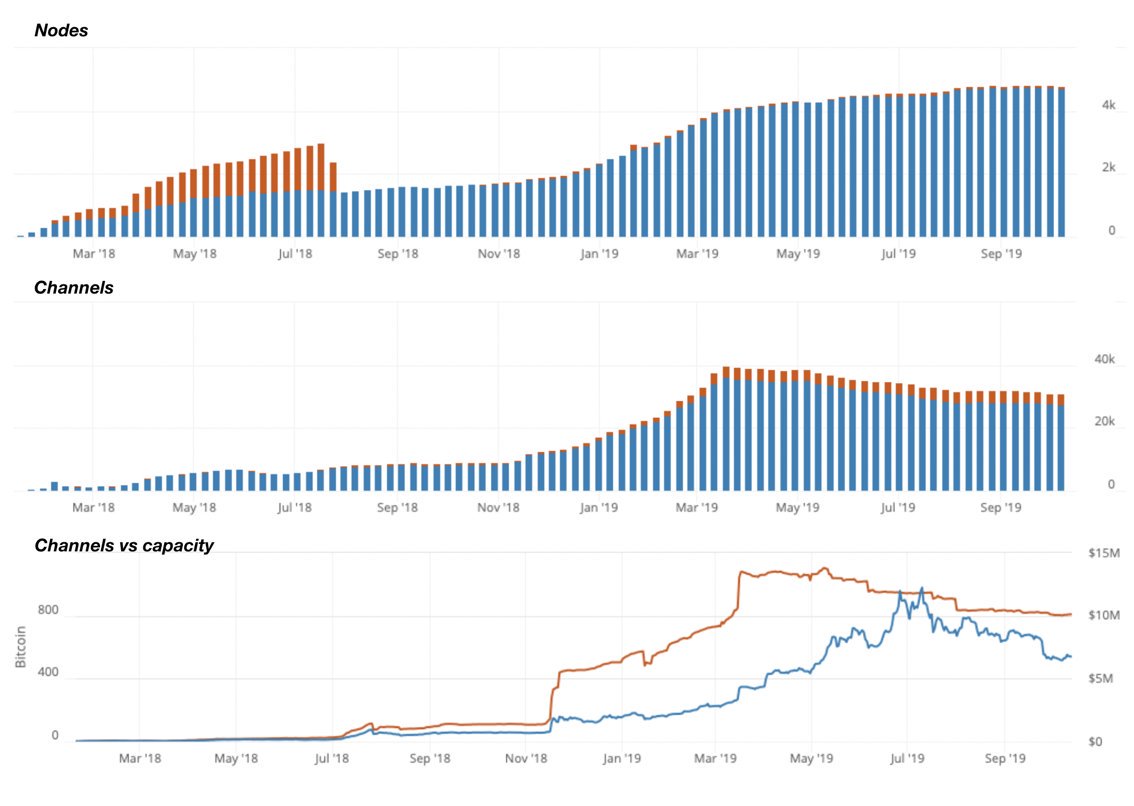

First time I did this was in March 2019, and since then there's easily 3 times as many data points avail, 3 times more accessible.

Kudos to all!

{end}