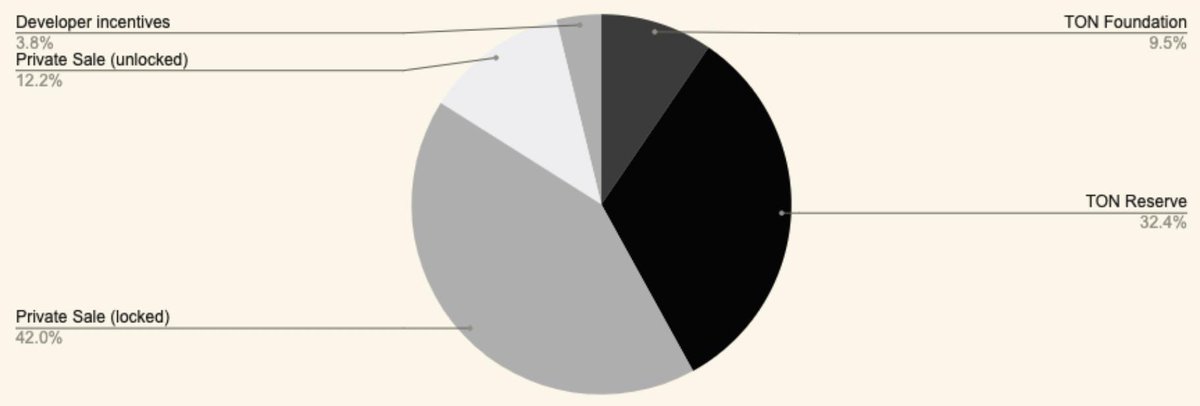

SAFT 1 sold for ~$0.38 per Gram.

SAFT 2 sold for ~$1.3 per Gram.

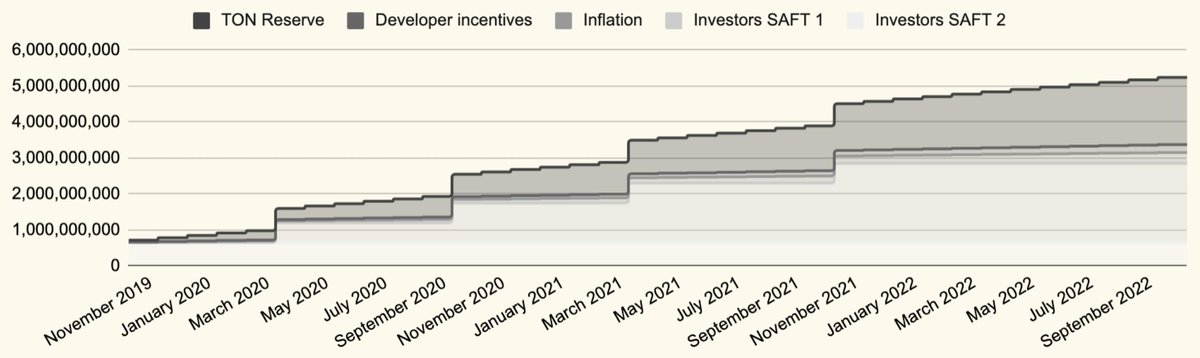

~55% of the total supply of $Grams was distributed to investors; ~12% will be unlocked on Day 1, with the rest to follow in 6 month intervals.

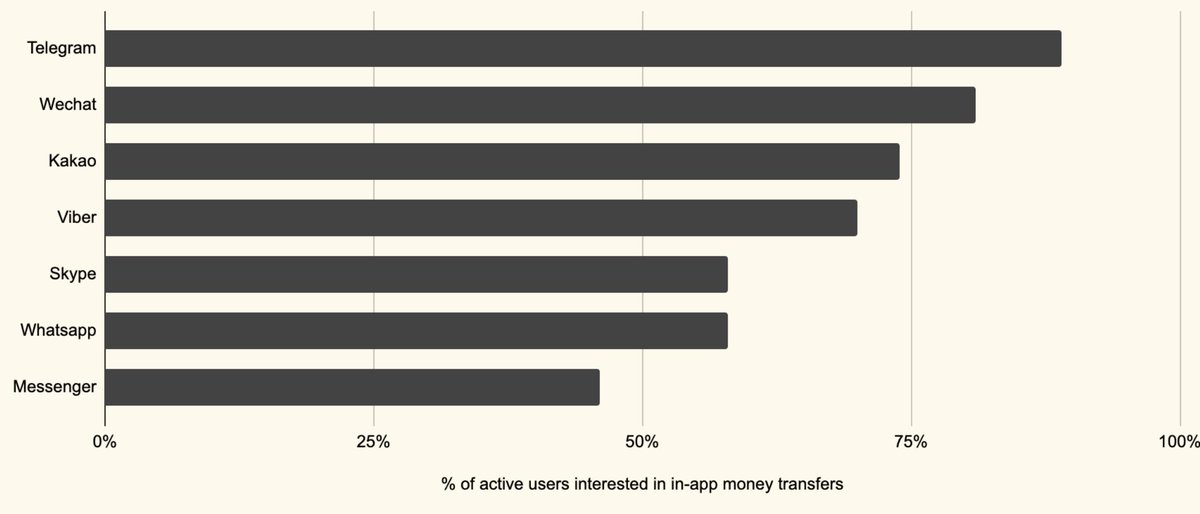

Also, its user base seems to be the most interested in money transfers as a feature.

That should come in handy!

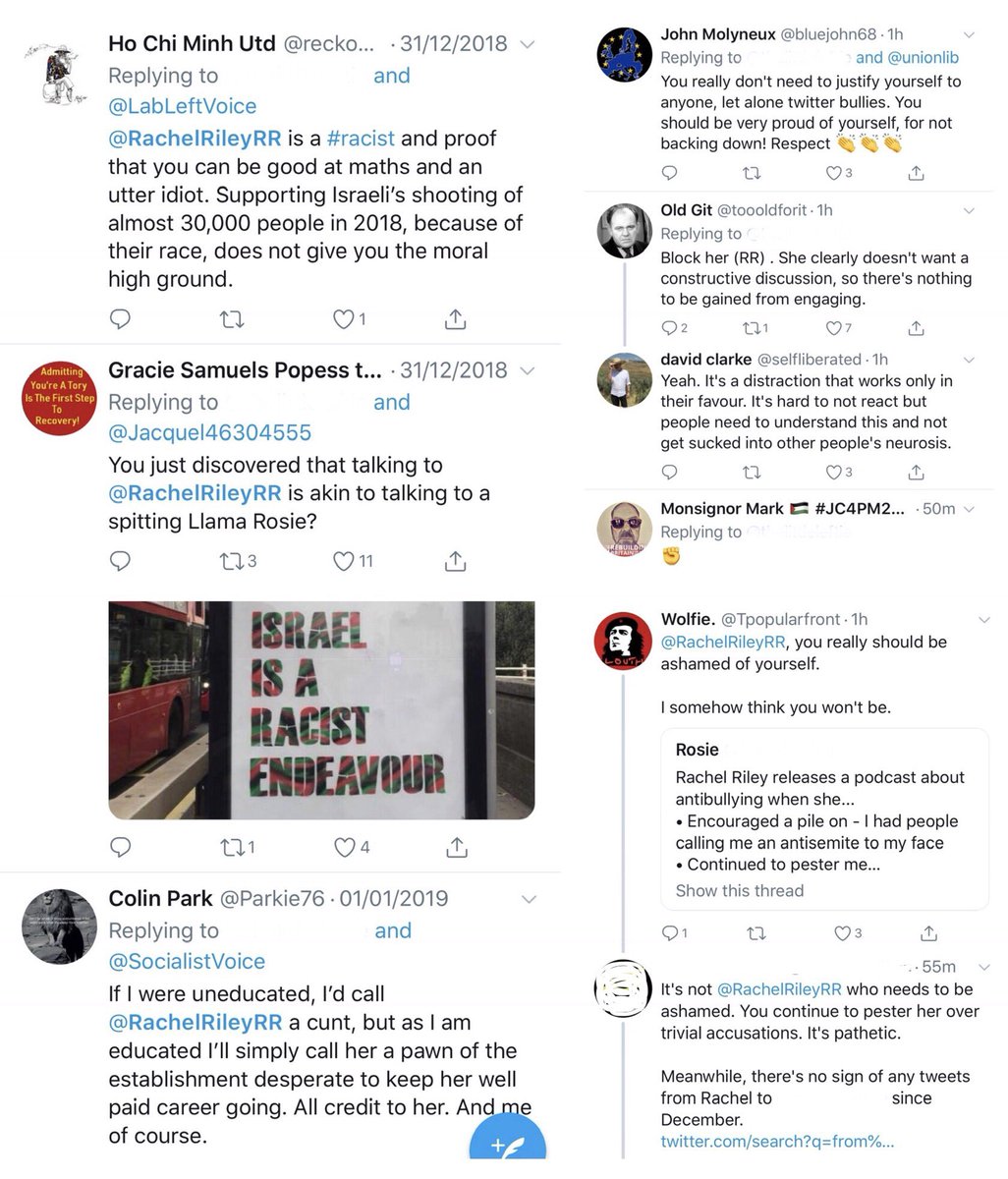

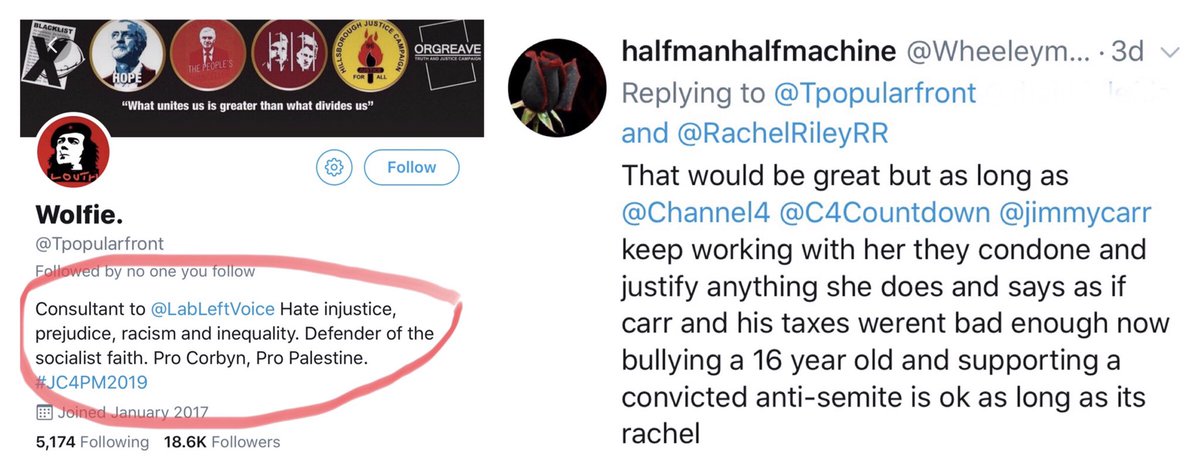

And they’re not exactly friendly with .@telegram...

To maintain that level, the - new - demand would need to match supply. For ref, $2.3B is $TRX and $XLM mcap combined.

Whether TON will be able to execute direct sales of Grams without risking it with the SEC though, is another story...

Two things I read here: $Gram safe, network launch - not so much.

Validators need to stake at least 100k Grams in order to become candidates. In order to become active, they will likely require more.

In SAFT 2 prices that’s $133k. Rich!

HLO: short-term turbulence. long-term, if #TON pulls through, this will be mega!

decentralpark.io/telegram-open-…