Let's talk $CYDY. As an M.D. and a human, I _hope_ their imminent phase 2B/3 trial result for severe covid-19 is a success. However, as an investor, I'm short the stock, because it's trading like it's 1999, with a $4 bil mkt cap, even though its only clinical asset is from 1999.

the company's sole asset: leronlimab. It's a monoclonal antibody developed in the late 1990s that was selected because of its ability to occupy the CCR5 receptor (and thus prevent HIV binding), while having little to no effect on the normal functioning of CCR5

When I first met the CEO, long before Covid-19, he was already telling a story that was too good to be true. Essentially, "We have this HIV drug (leronlimab, formerly PRO 140), that we paid $3.5 million for, and it came with $200 million of drug supply."

Note, they bought the asset in 2012. It's now 2021. Is it on the market? No. Are much better HIV therapies already on the market? Yes. Has it stopped the company from claiming they are going to be commercially successful for HIV? Of course not.

Anyhow, the same 22-year-old asset that is neither FDA approved nor commercially viable for HIV is also being pitched for breast cancer, NASH, Covid, you name it. An army of stock promoters goes wherever $CYDY goes. A majority of American dentists have probably been pitched.

The nugget of truth at the heart of the company's promotion is this: all of those disease processes do, in fact, have some vague relationship to CCR5. It's a receptor on many immune cells, & the immune system does play a role in infectious disease, inflammation, & cancer.

BUT, just because a compound affects some cells that are somehow involved somewhere in a particular disease doesn't make it a good therapy. There's even a historical term for a man who comes to town promising to cure everything with one medicine: "snake oil salesman."

When Covid-19 struck and $CYDY started pitching leronlimab, I was suspicious, but also knew there was a chance that even a very promotional, blind squirrel might find a nut. Especially when there were a few early anecdotes of patients recovering while on the drug in April.

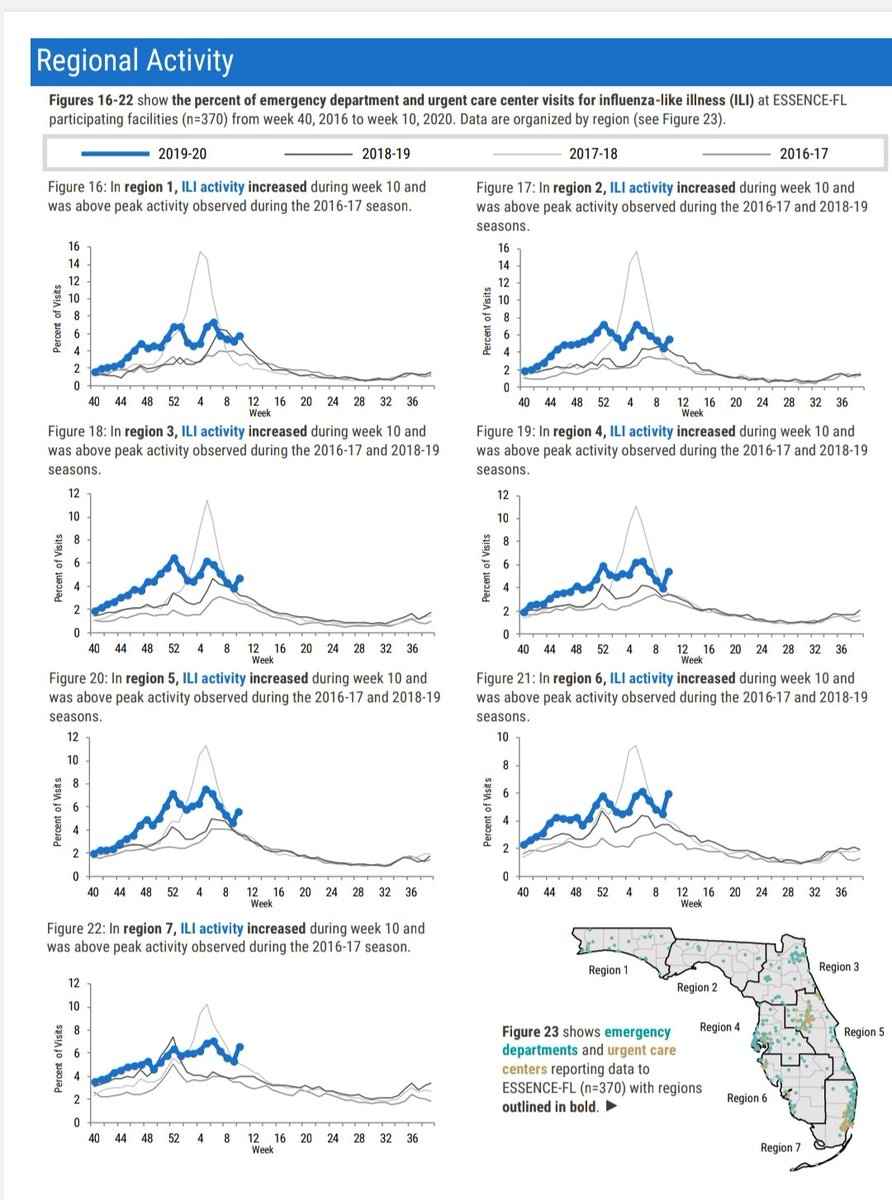

It became clear early in the pandemic that some patients have excess mortality from Covid-19 due to parts of the immune system being overactive. And the company provided open label (non-randomized) data to suggest leronlimab might indeed help to quell some of those parts.

This paper from Bruce Patterson, first released as a preprint in May, shows that CD8 T-cell counts went up, and viral loads went down, after critically ill patients received leronlimab. sciencedirect.com/science/articl…

An analysis of gene expression in two of the patients who got better showed that inflammatory markers downstream of IL-6, and interferon-related markers also improved. It's entirely theoretically possible that leronlimab is a useful drug for covid-19.

But, the catch is that the company actually needs to DEMONSTRATE this efficacy in a clinical trial. Instead, $CYDY demonstrates a consistent pattern of many press releases, much promotion, wild conference calls, and much hype, but no compelling clinical data.

When the company's trial in mild-to-moderate covid failed earlier this year, they labelled the results as a success, in spite of failing the primary endpoint and presumably, given the failure to report them, nearly all of the secondary endpoints. cytodyn.com/newsroom/press…

$CYDY made a big deal about one secondary endpoint, NEWS2 score, having improved in the treatment group, but fever is a component of NEWS2, and any drug that reduces IL-6 is likely to reduce fever. It's simply not a meaningful endpoint as far as the FDA is concerned.

$CYDY stock rallied yesterday as some investors were cheered by the British data that showed Roche’s anti-IL-6 drug tocilizumab improves mortality in hospitalized covid-19 patients.

https://twitter.com/MartinLandray/status/1359880492892454917

The key difference between the tocilizumab study and the $CYDY covid p2b/3 study about to read out at any moment is that the former had adequate statistical power, and the latter does not. If the same effect size is observed in Cytodyn's trial, it will have a p-value of 0.45.

Whereas tocilizumab reduced the relative risk of mortality by 11%, in order for the trial to be a success, leronlimab will need to show a 28% relative risk reduction; it has to work 2.5 times as well.

This will be a a huge hurdle to overcome, given that most of the patients in $CYDY's phase 2b/3 study will have been on dexamethasone, which we know has many of the same effects on the immune system (less interferons, less IL-6) that potentially make leronlimab work.

This severe covid-19 indication is the very best chance for $CYDY, the promotional blind squirrel, to find a nut. It's a massive public health crisis, time is of the essence, so maybe some 23-year-old drug works well enough to be effective.

But that is NOT how drug development generally works for nearly any other indication, and $CYDY is doing no real drug development. In 2021, almost all new drugs are targeted to a specific molecule in a way that makes them highly selective and effective.

If/when this phase 2b/3 trial fails, the blind squirrel's chances are over. To do a new covid trial would require thousands of patients vs. a comparator group that now includes both dexamethasone and tocilizumab.

$CYDY will likely cherry-pick some subgroup analysis or a secondary endpoint and try to claim success, but it won't matter; the drug can't get approved without a truly successful clinical trial.

$CYDY will continue to pump leronlimab for a broad array of indications HIV (not effective enough), breast cancer & NASH (shots in the dark), covid long haulers (no reason for it to work), and who knows what else, but the sad reality is…

one 22-year-old drug is not the cure for everything. And anyone who tells you otherwise is a snake oil salesman. Expect $CYDY to trade below $1.50 after the severe covid trial fails, and lower as time goes by. Sorry, I don’t make the rules.

p.s. Why hasn't the phase 2b/3 data already been released yet? After the last patient was enrolled, $CYDY said the trial result was coming in "mid-January." On Jan. 26, the CEO said "we are hoping [for] next week." The primary outcome is simple (mortality). Let us see it.

I have deleted an earlier comment about the original leronlimab study (jvi.asm.org/content/73/5/4…) which was in error.

Upon reviewing this study, it seems that leronlimab (PA14 in the paper) is being under-dosed in all of $CYDY's Covid trials. The IC50 for RANTES-mediated actions in this study is 45 ng/dL. One 700 mg dose would be expected to only generate serum concentrations of roughly 28 ng/dL

IL-6 drugs like tocilizumab block 98%+ of IL-6 receptors. At these leronlimab doses, $CYDY's drug is blocking less than 30 or 40% of CCL5-induced activation. They almost certainly should have used a larger dose; but that's what happens when your CEO is best as a promoter.

• • •

Missing some Tweet in this thread? You can try to

force a refresh