You get a text from a friend saying there's a hot stock or crypto you NEED to buy now! Everyone is making racks!

Before you hit buy, check this out [Thread]

Before you hit buy, check this out [Thread]

NEVER trade money you can't afford to lose

If you're willing to stake $100 - stick to it. As fun as it it to YOLO, it's considerably less fun to end up living under a bridge.

Impulse decisions to take a stock to the moon take seconds, recovering losses take MUCH longer🚀🚀🚀

If you're willing to stake $100 - stick to it. As fun as it it to YOLO, it's considerably less fun to end up living under a bridge.

Impulse decisions to take a stock to the moon take seconds, recovering losses take MUCH longer🚀🚀🚀

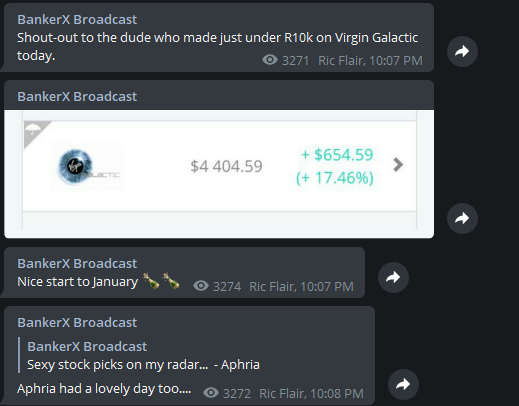

By the time you hear about the hottest stock, it's usually too late

The most valuable commodity is information. A pump is most lucrative at inception. The profitability of information erodes as the stock runs.

Most retail investors are late to the party and late to leave.

The most valuable commodity is information. A pump is most lucrative at inception. The profitability of information erodes as the stock runs.

Most retail investors are late to the party and late to leave.

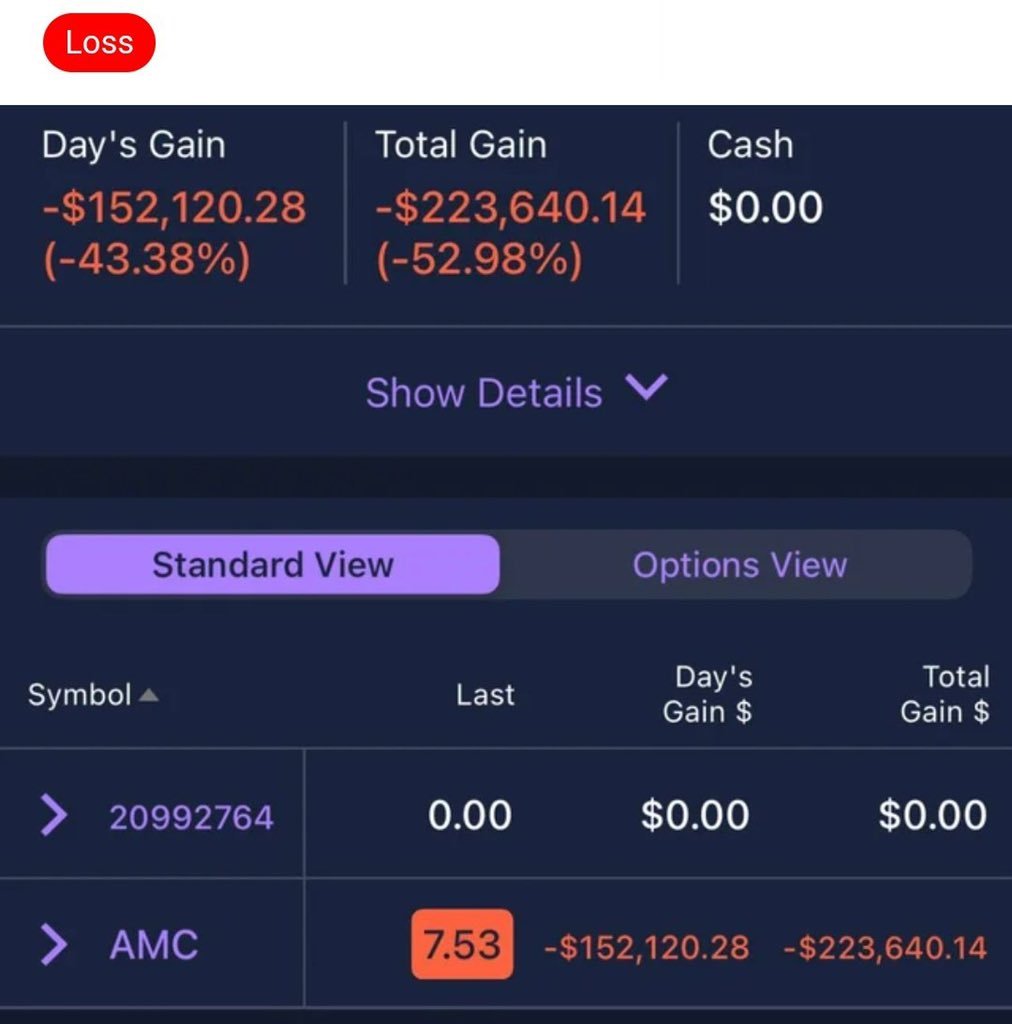

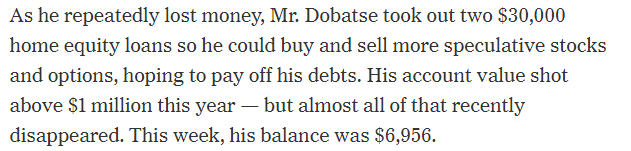

Leverage is a time bomb

Many traders who blow up their accounts first make money before the apocalypse. On a long enough timeline, trading with heavy leverage will devour your portfolio.

When you overlay massive volatility, you can be wiped out in seconds without managing risk.

Many traders who blow up their accounts first make money before the apocalypse. On a long enough timeline, trading with heavy leverage will devour your portfolio.

When you overlay massive volatility, you can be wiped out in seconds without managing risk.

Trading conditions are unstable

Retail trading platforms & stock exchanges have risk measures for when the market is going at breakneck speed

Your smartphone trading app WILL fuck you over. You will face trading halts, stock buy limits, ridiculously wide spreads & even outages

Retail trading platforms & stock exchanges have risk measures for when the market is going at breakneck speed

Your smartphone trading app WILL fuck you over. You will face trading halts, stock buy limits, ridiculously wide spreads & even outages

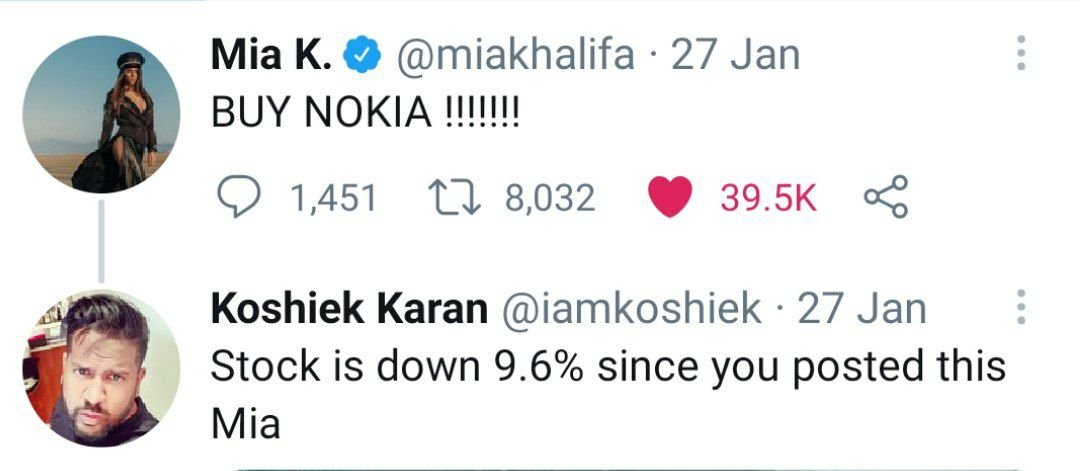

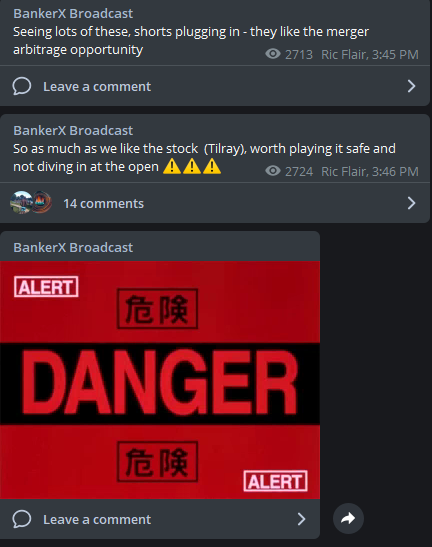

Be careful trusting the crowd

Anonymity comes without accountability

Online forums, messages boards and Discord channels are FILLED with "suits" - hedge funds & investment bankers

Also, that dude posting "diamond hands baby!💎💎", he sold his cannabis stock a long time ago...

Anonymity comes without accountability

Online forums, messages boards and Discord channels are FILLED with "suits" - hedge funds & investment bankers

Also, that dude posting "diamond hands baby!💎💎", he sold his cannabis stock a long time ago...

Ask yourself - does this trade make sense?

Seriously

If you're buying a stock that ran 500% in a couple of days looking to squeeze more juice, why?

If you're buying a massively inflated stock PURELY so someone else can quickly buy it off you - you're playing Russian Roulette.

Seriously

If you're buying a stock that ran 500% in a couple of days looking to squeeze more juice, why?

If you're buying a massively inflated stock PURELY so someone else can quickly buy it off you - you're playing Russian Roulette.

Don't fuel bad positions by throwing more money in

You're down $5k but you want to "buy the dip" baby!! So you add $10k. In a few hours you're down $15k. If you wanted money to evaporate, just have kids.

You're down $5k but you want to "buy the dip" baby!! So you add $10k. In a few hours you're down $15k. If you wanted money to evaporate, just have kids.

"I'm doing this to stick it to the big guys!!"

No. you have too much time, internet access, money to burn and you like chicken tendies.

Does the system needs to change? Unequivocally, yes.

Should you be a martyr by donating money to hedge funds? Probably not

No. you have too much time, internet access, money to burn and you like chicken tendies.

Does the system needs to change? Unequivocally, yes.

Should you be a martyr by donating money to hedge funds? Probably not

Hedge funds are playing the game on easy difficulty

You lose rent money. Hedge funds lose the funds money

Hedge funds aren't facing stock limits, you're only allowed to buy one stock at a time

PornHub is soaking up your bandwidth, hedge funds are making money off miliseconds

You lose rent money. Hedge funds lose the funds money

Hedge funds aren't facing stock limits, you're only allowed to buy one stock at a time

PornHub is soaking up your bandwidth, hedge funds are making money off miliseconds

Wait, is the system broken?

The system is fucked. The disconnect between valuations and the real economy is massive. You have high unemployment, slow growth & mass restructuring yet the stock market is at an all time high.

This market is kept afloat by relentless Fed stimulus.

The system is fucked. The disconnect between valuations and the real economy is massive. You have high unemployment, slow growth & mass restructuring yet the stock market is at an all time high.

This market is kept afloat by relentless Fed stimulus.

Protect capital fiercely.

"What's the most I can lose here?"

It's really not a sexy question and nobody wants to be sensible when there's hype. Should you risk losing 90% of your capital for a 35% gain?

Meek Mill just tweeted about your stock? It's over for you.

"What's the most I can lose here?"

It's really not a sexy question and nobody wants to be sensible when there's hype. Should you risk losing 90% of your capital for a 35% gain?

Meek Mill just tweeted about your stock? It's over for you.

Resist FOMO

If you thought GameStop was a great business and liked it at $350, you will LOVE it at $50.

Think of it like playing in traffic, it's fun when there's no cars. When you're playing in peak rush hour... it's suicide. The more people get involved, the more traffic.

If you thought GameStop was a great business and liked it at $350, you will LOVE it at $50.

Think of it like playing in traffic, it's fun when there's no cars. When you're playing in peak rush hour... it's suicide. The more people get involved, the more traffic.

Consider long term alternatives

Is this $1000 better off in one of Cathy Wood's ARK ETFs? The dip in $TSLA looking more attractive? Should you have gone in on the Bumble IPO? Add a bit more to your Bitcoin wallet?

Recent market moves & greed has skewed our perception of normal.

Is this $1000 better off in one of Cathy Wood's ARK ETFs? The dip in $TSLA looking more attractive? Should you have gone in on the Bumble IPO? Add a bit more to your Bitcoin wallet?

Recent market moves & greed has skewed our perception of normal.

Time in the market beats timing the market

The era of democratizing finance is here. You don't need to be an investment banker or CFA to make bank. Access is long overdue

There's always juicy distractions en route the journey, keep your head down & avoid getting slaughtered!

The era of democratizing finance is here. You don't need to be an investment banker or CFA to make bank. Access is long overdue

There's always juicy distractions en route the journey, keep your head down & avoid getting slaughtered!

Shout-out for making it to end! 🚀💎💰

Feel free to join our Telegram community for daily market updates, hot stocks and really great jokes (can't confirm this).

Link: t.me/BankerX

Feel free to join our Telegram community for daily market updates, hot stocks and really great jokes (can't confirm this).

Link: t.me/BankerX

Articles & content referenced in thread:

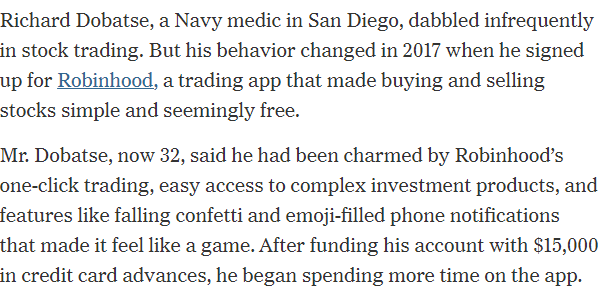

1. Robinhood Has Lured Young Traders, Sometimes With Devastating Results

nytimes.com/2020/07/08/tec…

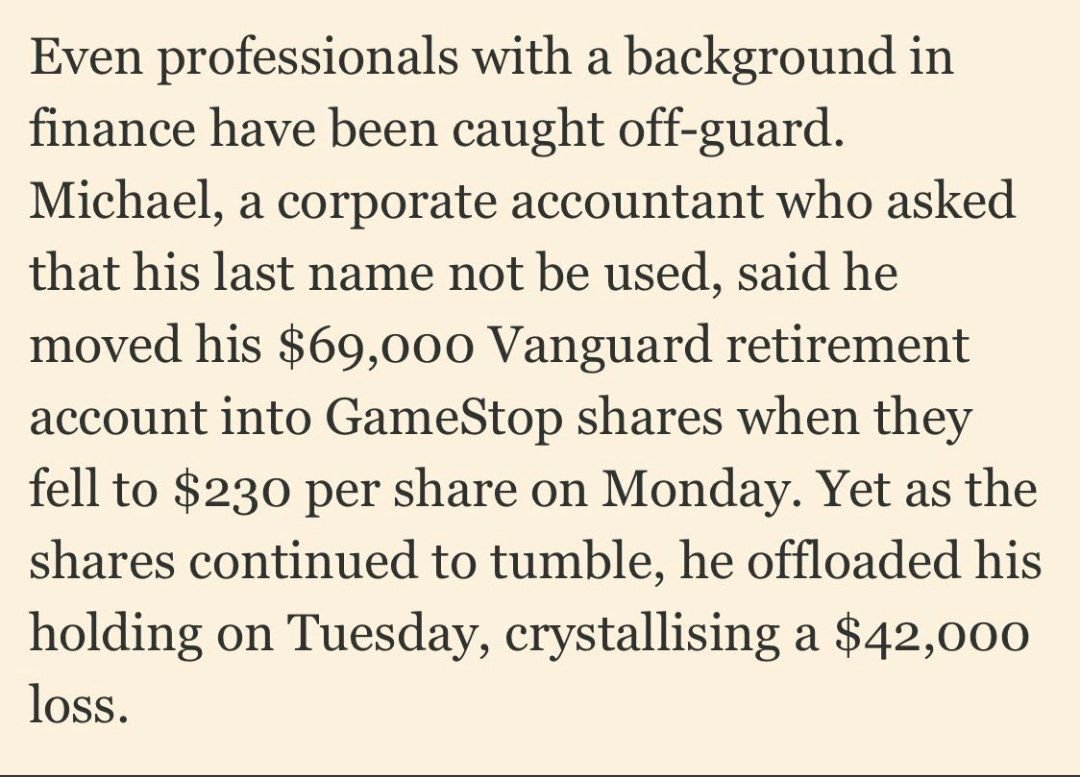

2. Moment of weakness’: Amateur investors left counting GameStop losses

ft.com/content/04e6c5…

3. Wallstreetbets

reddit.com/r/wallstreetbe…

1. Robinhood Has Lured Young Traders, Sometimes With Devastating Results

nytimes.com/2020/07/08/tec…

2. Moment of weakness’: Amateur investors left counting GameStop losses

ft.com/content/04e6c5…

3. Wallstreetbets

reddit.com/r/wallstreetbe…

• • •

Missing some Tweet in this thread? You can try to

force a refresh