Few things worth keeping an eye on in the next few weeks:

1. Increasing US Treasury yields & 10-2 spreads

2. $TSLA as an indicator for sentiment

3. Retail investor volatility

4. Discounts on IPO issuances

5. M&A premia ++ volumes

6. Crypto adopting by institutions

1. Increasing US Treasury yields & 10-2 spreads

2. $TSLA as an indicator for sentiment

3. Retail investor volatility

4. Discounts on IPO issuances

5. M&A premia ++ volumes

6. Crypto adopting by institutions

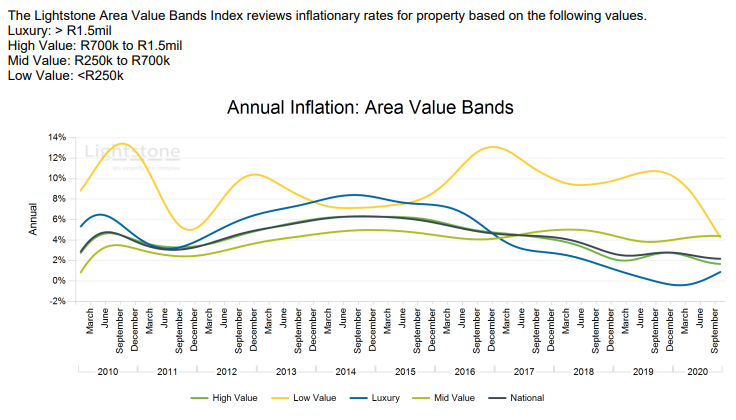

1. Surging yields

COVID delayed inevitable reflation trade. Inflation expectations are ticking up. Will rising yields trigger an equity market sell-off? Probably not- such a deep disconnect between valuations & fundamentals

BUT it will suffocate the MANY overleveraged companies

COVID delayed inevitable reflation trade. Inflation expectations are ticking up. Will rising yields trigger an equity market sell-off? Probably not- such a deep disconnect between valuations & fundamentals

BUT it will suffocate the MANY overleveraged companies

2. Bets on $TSLA

Some WILD writing on OTM put options - folks banking premiums that could smoke them if it goes badly. Nobody thinks gravity will kick-in.... until it does. It's also a retail favourite which makes it a great indicator. $800bn is an eye watering valuation.

Some WILD writing on OTM put options - folks banking premiums that could smoke them if it goes badly. Nobody thinks gravity will kick-in.... until it does. It's also a retail favourite which makes it a great indicator. $800bn is an eye watering valuation.

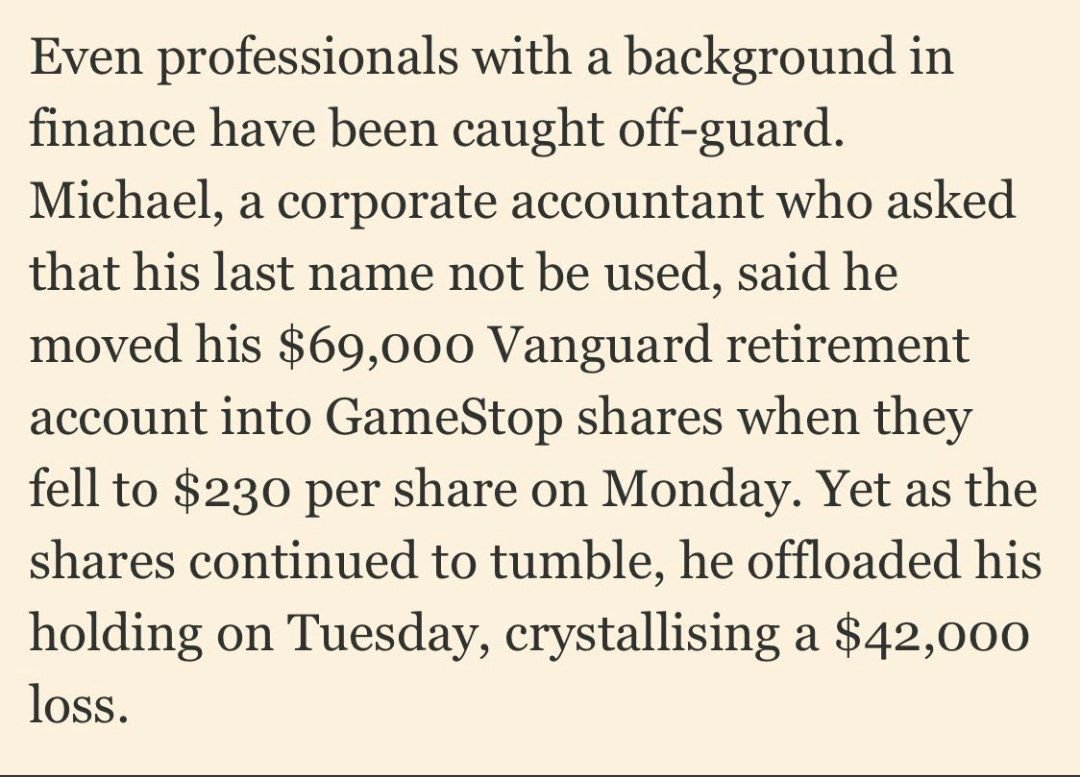

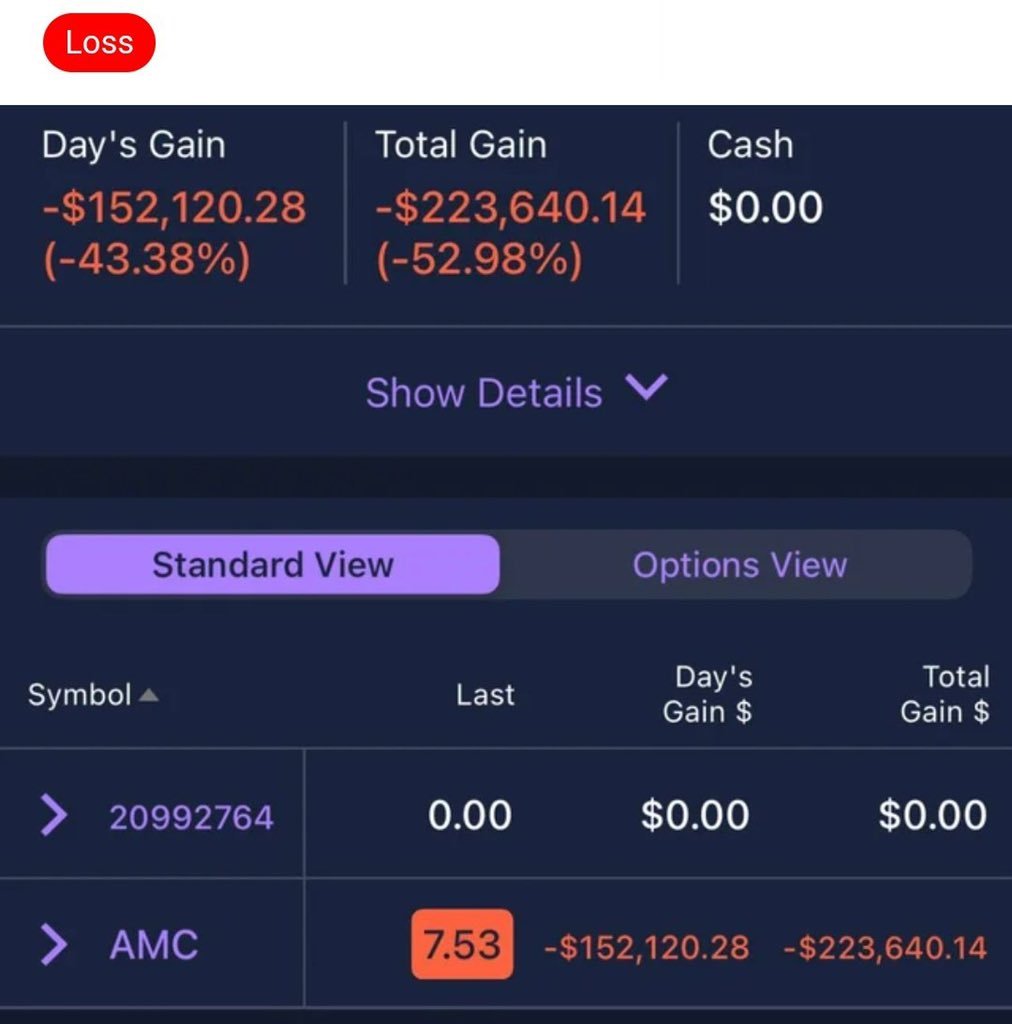

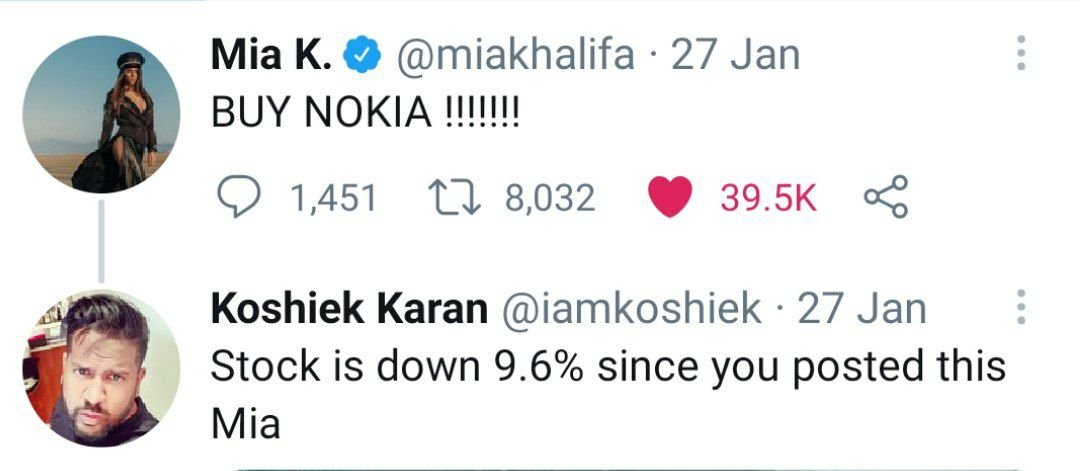

3. Retail creating vol

Between archaic game stores & cannabis companies, anything goes. So far the moves have been largely company specific. The contagion has been controlled but with so much options volume driven out of retail, it could trigger a series of unfortunate events.

Between archaic game stores & cannabis companies, anything goes. So far the moves have been largely company specific. The contagion has been controlled but with so much options volume driven out of retail, it could trigger a series of unfortunate events.

4. IPO discounts

Airbnb, Doordash, Bumble... when did underwriters & ECM bankers become this bad?! (Am biased, I was one...)

Oversubscription and first day pops are great... not when listing valuations are already frothy. Clear case of bag holders in the distance on some IPOs

Airbnb, Doordash, Bumble... when did underwriters & ECM bankers become this bad?! (Am biased, I was one...)

Oversubscription and first day pops are great... not when listing valuations are already frothy. Clear case of bag holders in the distance on some IPOs

5. M&A premia

Probably less to do with overall premia & more to do with capital structure underpinning acquisitions. Peaks in M&A have preceded a sell-off by 12-18 months multiple times in the past. It's the impending goodwill hits and worse - cash burn by growing inorganically

Probably less to do with overall premia & more to do with capital structure underpinning acquisitions. Peaks in M&A have preceded a sell-off by 12-18 months multiple times in the past. It's the impending goodwill hits and worse - cash burn by growing inorganically

6. Crypto take up

Tesla news last week resulted in a short pop of BTC (almost $50 weekend trade). More listCos putting their confidence in crypto will provide price support. The flipside is a possible dollar strengthening medium term trade.

Tesla news last week resulted in a short pop of BTC (almost $50 weekend trade). More listCos putting their confidence in crypto will provide price support. The flipside is a possible dollar strengthening medium term trade.

Relentless Fed stimulus has created a bit of complacency. It's a bad erection advert - everything goes up. Fed balance sheet is bloated, valuations are suffocatingly high- does an economic rebound support the mania? Probably not.

Sure, party hard... but party near the exit

Sure, party hard... but party near the exit

• • •

Missing some Tweet in this thread? You can try to

force a refresh