After writing on Banking & Paints, this thread focuses on the 'Logistic Sector'. Idea is to give a small start to the retail investors looking at investing in this space from where they can build on.

This thread covers,

- Macro

- Business Model

- 3PL & 4PL

- Valuation (1/n)

This thread covers,

- Macro

- Business Model

- 3PL & 4PL

- Valuation (1/n)

Logistics business macro

-14% of India’s GDP is spent on Logistic

-Organized market is 42%

-Growing at 10-15%

-Employs 2.2 cr

-Achieved Infrastructure status

-FY 14-18 attracted 1,00,000 cr FDI (2/n)

-14% of India’s GDP is spent on Logistic

-Organized market is 42%

-Growing at 10-15%

-Employs 2.2 cr

-Achieved Infrastructure status

-FY 14-18 attracted 1,00,000 cr FDI (2/n)

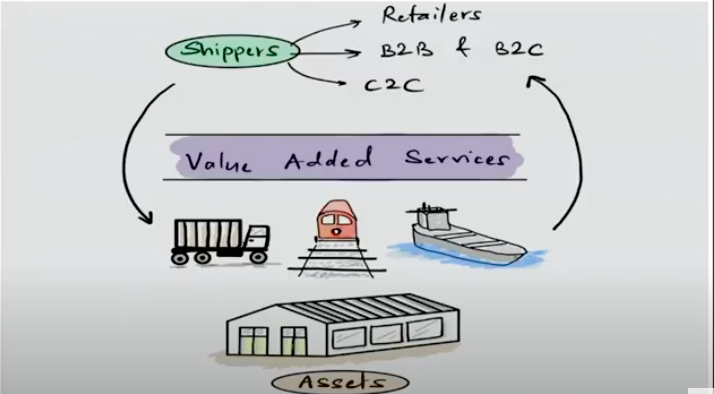

What’s the business?

Logistic is traditionally seen as a warehousing & transportation business where goods, needs 2b transported 4m point A to B using Road, Rail, Ship or Air & can be stored at multiple warehouses before the consumer receives the product (3/n)

Logistic is traditionally seen as a warehousing & transportation business where goods, needs 2b transported 4m point A to B using Road, Rail, Ship or Air & can be stored at multiple warehouses before the consumer receives the product (3/n)

The business landscape is changing fast with newer competition and technology is challenging the older business models. 3PL (3rd party logistics) & 4PL is one such change in the business of logistics, will discuss about the same ahead. (4/n)

Listed companies involved in the business may or largely may not own the Trucks, Rails, Aircraft, Ships, Warehouses etc., but uses outsourced services of other vendors and the listed companies manage the logistics from point A to point B (5/n)

Which are the top 5 companies in this space?

Container Corporation – 28,000 cr

Blue Dart – 10,000 cr

Mahindra Logistic – 3,500 cr

Allcargo Logistic – 3,000 cr

Gateway – 2,000 cr (6/n)

Container Corporation – 28,000 cr

Blue Dart – 10,000 cr

Mahindra Logistic – 3,500 cr

Allcargo Logistic – 3,000 cr

Gateway – 2,000 cr (6/n)

What business are they in?

(A) Container Corporation

-Transportation of the shipping container from point A to B using the rail network

-Has monopoly in this business

-Globally more than 500 km of logistics is done through rail but in India it is still done through road (7/n)

(A) Container Corporation

-Transportation of the shipping container from point A to B using the rail network

-Has monopoly in this business

-Globally more than 500 km of logistics is done through rail but in India it is still done through road (7/n)

- In India only 25% of the logistics happen through rail

(B) Blue Dart – Is in the traditional business of courier within India using Air & Road network (8/n)

(B) Blue Dart – Is in the traditional business of courier within India using Air & Road network (8/n)

(C) Allcargo

(i) Multi-Modal - The multi-modal process usually begins with a container being moved by a truck to a rail, then back to a truck to complete the process (9/n)

(i) Multi-Modal - The multi-modal process usually begins with a container being moved by a truck to a rail, then back to a truck to complete the process (9/n)

(ii) Container freight station operation - A container freight station is a location, usually a warehouse, where products and other goods are collected, stored, and where they wait to be shipped to the next location. (10/n)

iii) Inland container depot–Ports equipped 4 handling & temporary storage of containerized cargo

iv) Contract logistic operations–Managing end 2 end 4m designing facility, warehousing, transportation, order processing & distribution, inventory management & customer service (11/n)

iv) Contract logistic operations–Managing end 2 end 4m designing facility, warehousing, transportation, order processing & distribution, inventory management & customer service (11/n)

(D) Gateway – It is also into Multi-Modal & Container Freight Station management

(E) Mahindra logistic - Mahindra Logistics is a 3PL (3rd party logistic) & 4PL player (12/n)

(E) Mahindra logistic - Mahindra Logistics is a 3PL (3rd party logistic) & 4PL player (12/n)

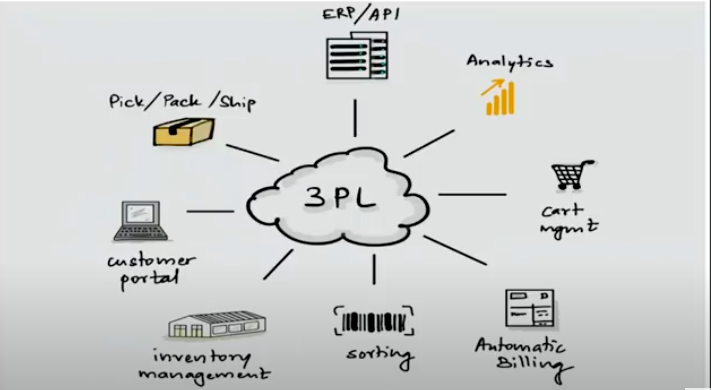

What & how of 3PL industry operation

Imagine it to be like Uber. There is a traveler and a driver, Uber connects them and manages the entire logistics. (13/n)

Imagine it to be like Uber. There is a traveler and a driver, Uber connects them and manages the entire logistics. (13/n)

3PL is outsourcing the entire operations of your logistic supply chain management, Transportation (Asset), Warehousing (Asset) & other value added services to a 3rd party logistic company (3PL) (14/n)

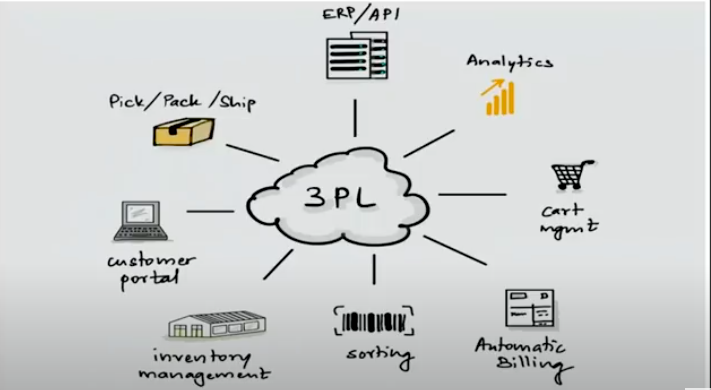

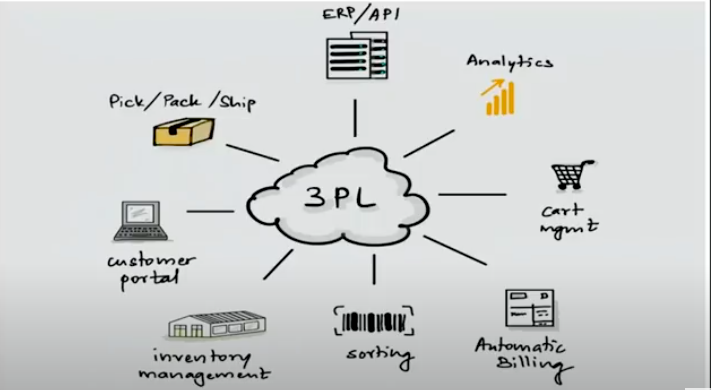

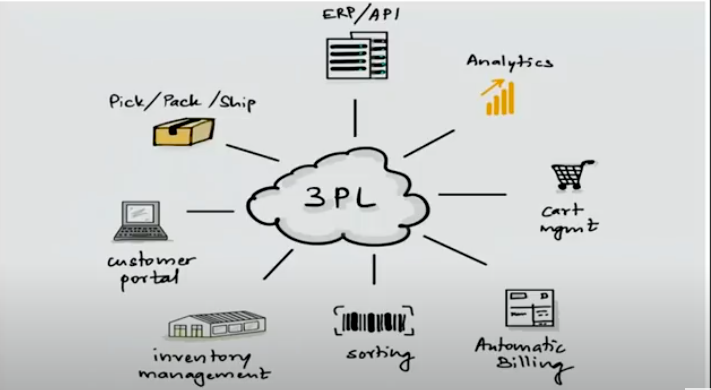

What are the value added services?

ERP/API – Procurement planning, raw material, billing, working capital management, leasing out trucks & warehouse etc., now can be managed by the 3rd party logistics company (15/n)

ERP/API – Procurement planning, raw material, billing, working capital management, leasing out trucks & warehouse etc., now can be managed by the 3rd party logistics company (15/n)

Analytics – Transport efficiency (reducing cost), warehouse management (reducing cost), Inventory management (optimum capital utilization) leading to improved ROI using AI (16/n)

Cart Management & Customer Portal – Retailer who wants to go online, 3PLs take care of everything from website making, inventory management, billing, to delivery & reverse logistics (17/n)

Similarly, Automatic Billing, Sorting, Inventory Management, Pick, Pack, Ship, everything can be managed by the 3PL company (18/n)

Infact some companies provide 4PL, where u allow the logistic player 2 become a part of ur own supply management & they redesign things internally within ur own organization like changing the manufacturing layout, to make it more effective over & above all the 3PL services (19/n)

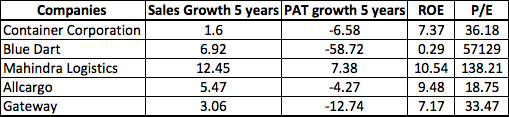

If you look at the last 5 years, companies have not been able to grow sales. Valuations still look rich. May be market participants are expecting this sector to do well. (This is not an advice ☺) (20/n)

Took some data from the very interesting FOF presentation done by @oraunak of @PPFAS the last year (21/n)

Hope the thread added value :) Hit the 're-tweet' & help us reach more investors. We have written multiple similar educative threads on personal finance. You can find them as a pinned tweet on my profile or click the link below (**END**)

https://twitter.com/KirtanShahCFP/status/1337953717274832896?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh