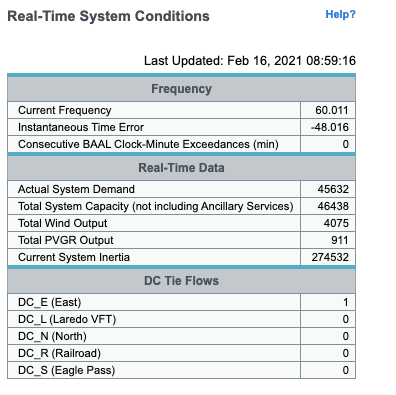

Update: it looks like the Texas Commission ordered ERCOT to be prepared to further increase electricity price cap from $9,000/MWh to up to 50x the spot price for natural gas, if necessary to keep incentive for gas generators to run.

https://twitter.com/PaulSaladino7/status/1362084121305096192

https://twitter.com/JesseJenkins/status/1361832670062387200

That means is spot gas prices are above $180/MMBtu, the market price for electricity could rise above the $9,000/MWh cap that normally occurs during power supply scarcity. @EIAGov is reporting $350/MMBtu spot price in Houston today, so that may be in effect now!

Maybe they will do this retroactively? The current prices reported by ERCOT are still $9,000/MWh including adder to reflect demand shutoffs ongoing. ercot.com/content/cdr/ht…

The clusterfuzzle continues...

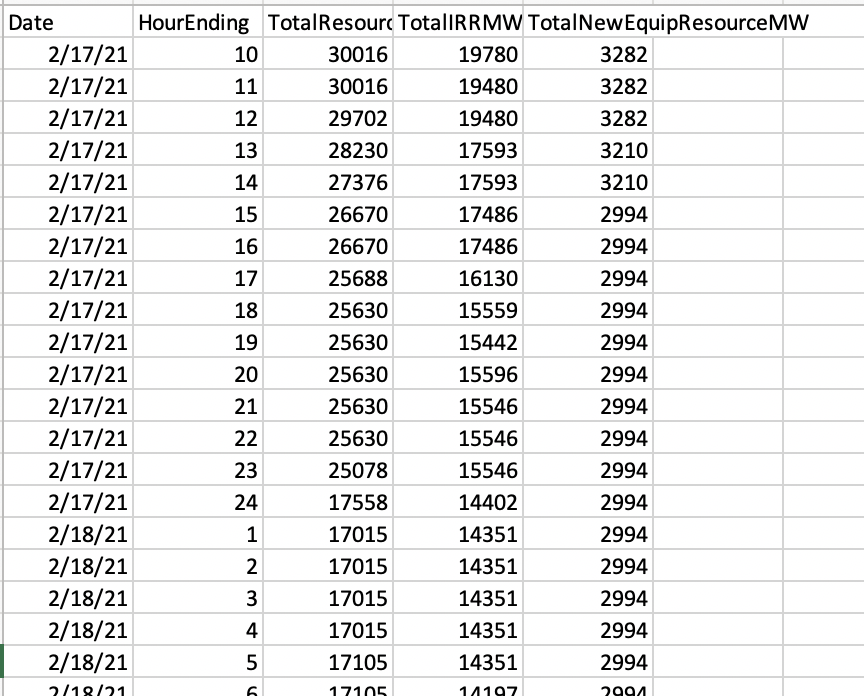

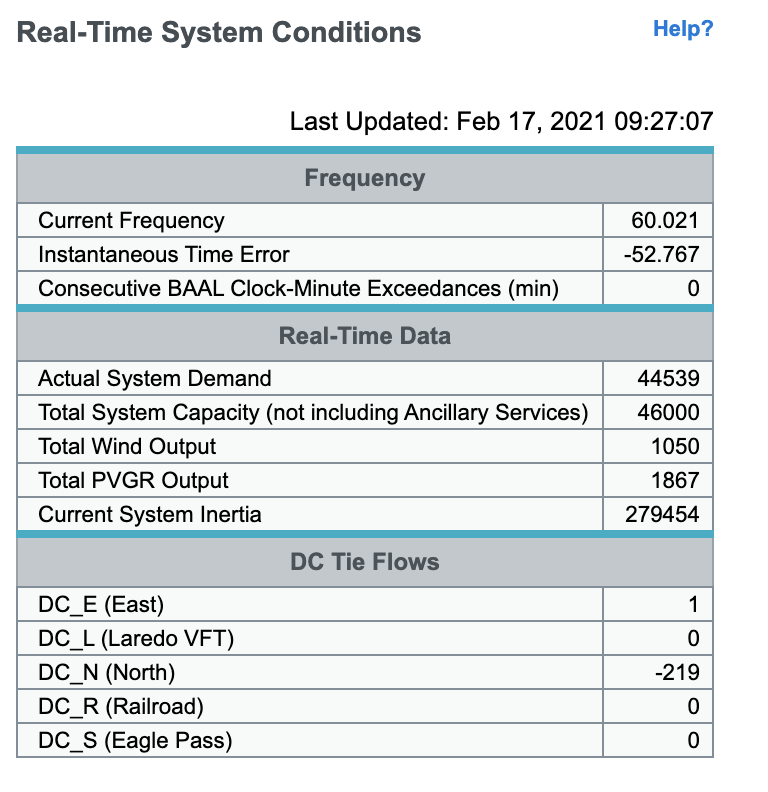

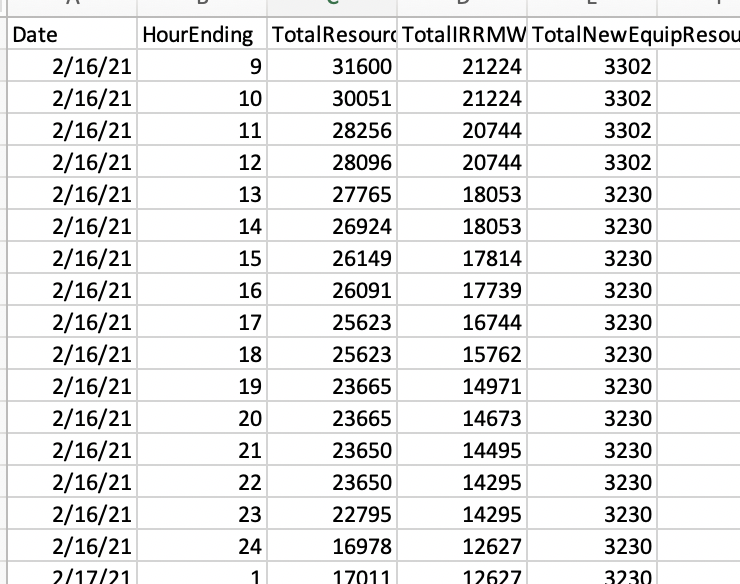

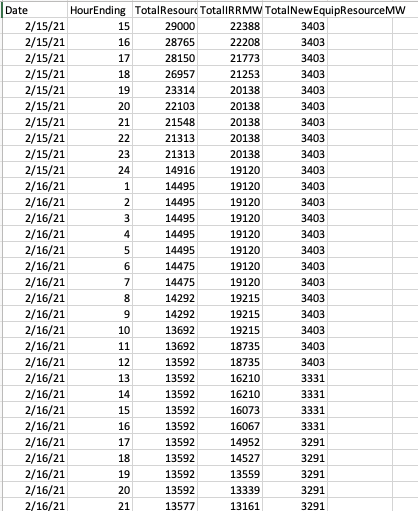

Here's recent market prices, which have now gone above $9000/MWh for the first time ever, as the maximum electricity price increases to reflect sky high natural gas costs, ensuring any generator who can get fuel has $ incentive to run.

https://twitter.com/PaulSaladino7/status/1362088633184919553?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh