This is not correct. The PUCT statement says NOTHING here about gas generators disconnecting. It says that the Commission directed ERCOT to raise electricity prices to $9000/MWh during demand disconnects to reflect the scarcity conditions underway. #TexasFreeze #TexasBlackout

https://twitter.com/jmontforttx/status/1361703554789031937

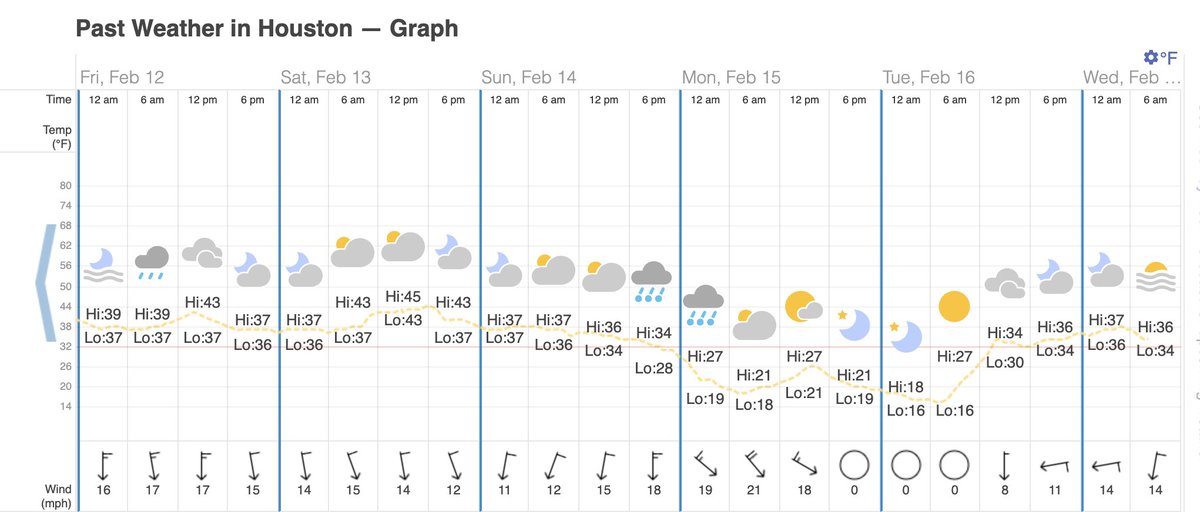

ERCOT runs the state electricity market and operates the generation & distribution system. Early Sunday morning, as generators went offline due to various reasons, ERCOT initiated an emergency and directed distribution utilities to start demand shutoffs (shutting off substations)

The way ERCOT's electricity market is supposed to work, if there is involuntary demand shutoffs like this, the price should be at the maximum allowed price or price cap, which is $9,000/MWh (typical prices are $30-40/MWh for context).

What the PUCT statement is saying is that in this case, when ERCOT started demand shutoffs, the market prices was at 'only' $1200/MWh. So the Commission ordered ERCOT to immediately increase the market price to the cap to reflect the very real scarcity conditions underway.

So this is the PUCT telling ERCOT to *raise* electricity market prices, and says nothing AT ALL about natural gas power plants deciding to disconnect to avoid high price fuels as the quoted tweet by @jmontforttx above claims. That's just wrong.

WHY were market prices not at the cap? That's a very good question and one we will learn more about in the aftermath of all of this. But given what I know about electricity systems and market operations, allow me to speculate (remember: speculation from here on... caveat emptor)

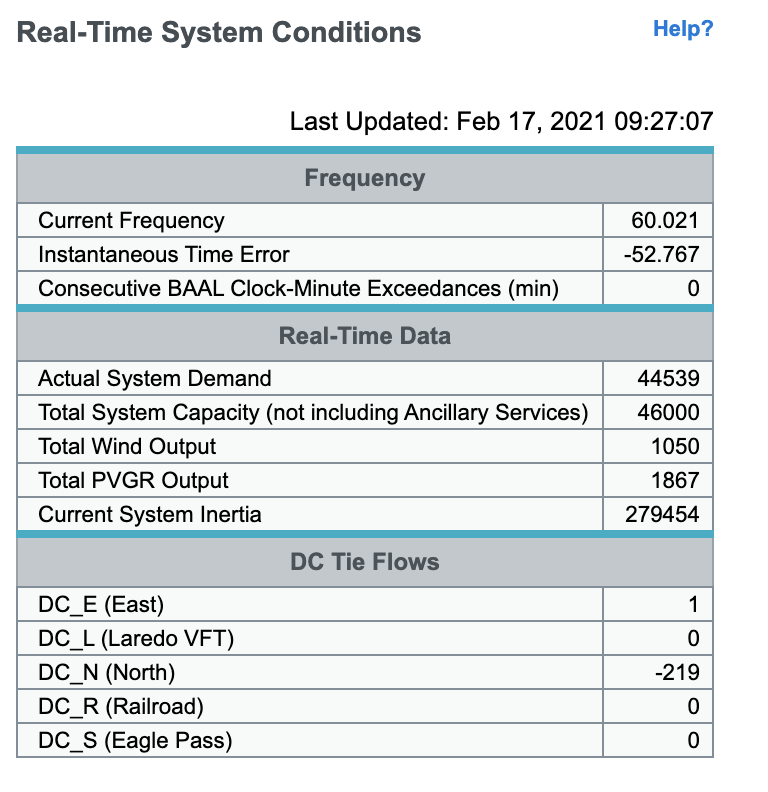

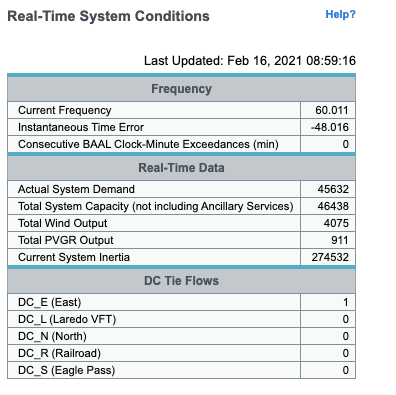

Electricity systems MUST maintain supply & demand balance at ALL times. If demand > supply, AC frequency drops, and if it falls below a very narrow tolerance, generators & protection switches all over the system will trip off to prevent damage to synchronized generators & motors.

In other words, if demand is allowed to greatly exceed supply for more than a moment, a cascading set of failures will lead to a system-wide blackout! The whole role of electricity system operators is to PREVENT this from occuring.

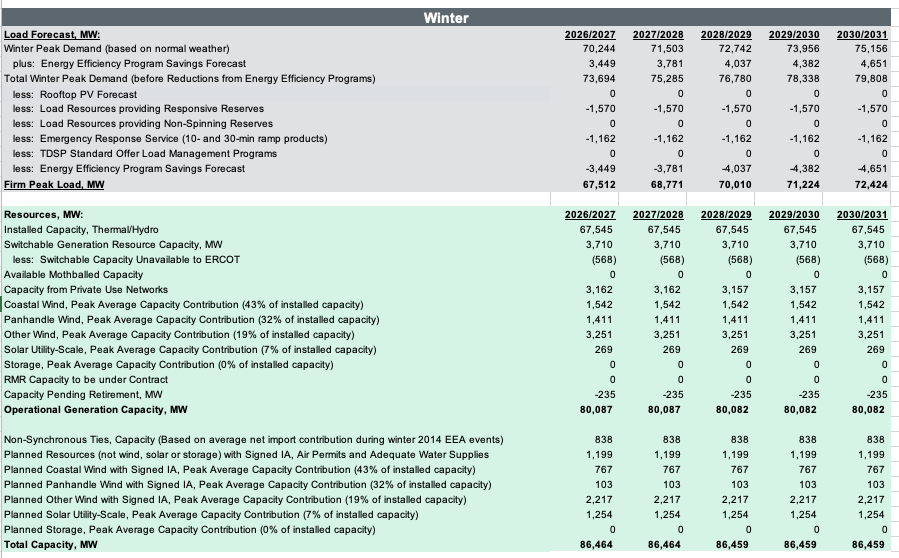

To do that, system operators maintain some standby spare capacity or "reserves," power plants (or batteries) that are not operating at their full output, but are online and ready to ramp up if a generator or transmission line suddenly fails, in order to quickly restore balance.

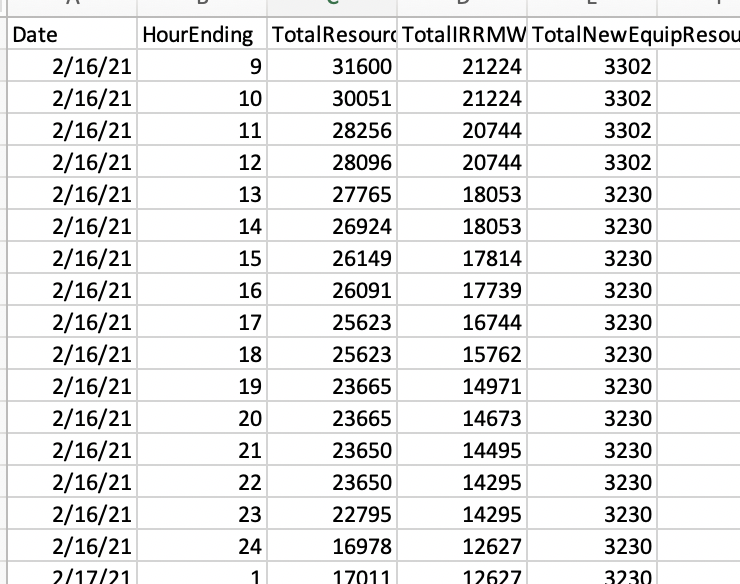

In Texas, as supply gets scarce, ERCOT starts running w/ less reserves, as plants on standby are called into operation to meet demand. As the available reserves deplete, the electricity price is supposed to rise towards $9000 to reflect increased risk of emergency demand shutoff.

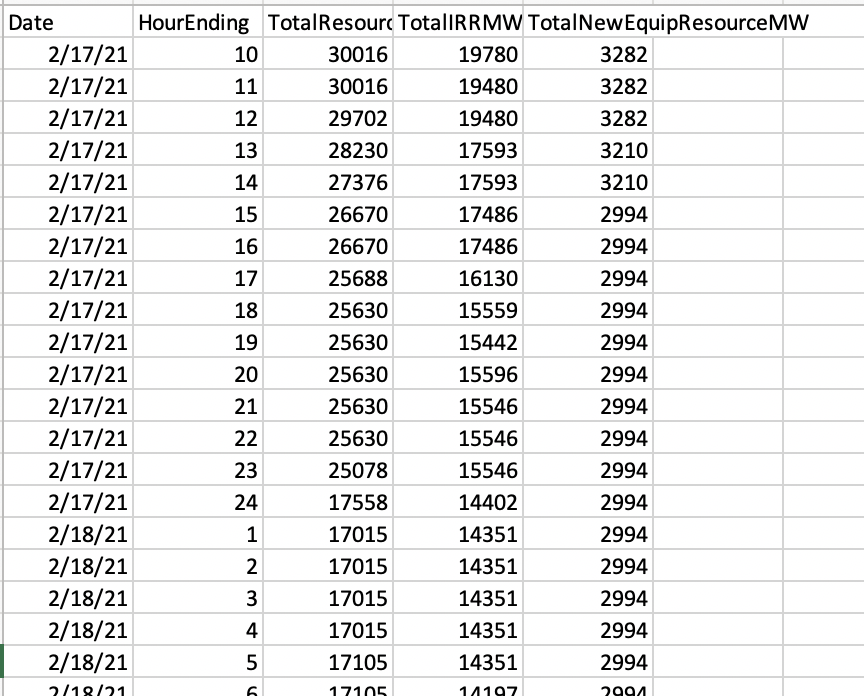

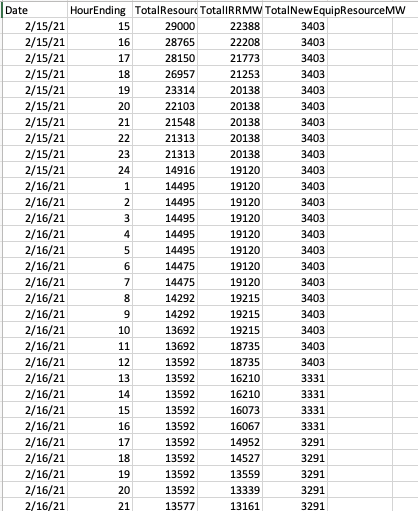

By time system operator (ERCOT) is in a true emergency and shutting off demand to balance supply, they should already be at $9000/MWh with very limited operating reserves on standby. For some reason, in this case, that did NOT occur. Price was $1200/MWh as shutoffs began on 2/14.

The reason is most likely because in these extreme conditions, with generators dropping like flies, ERCOT did not want to run with depleted reserves at all, because running with less reserves raised risk that more generator outages could cause statewide blackout.

To avoid that situation, they probably proactively started demand shutoffs w/ more reserves on hand than they normally would have -- and that the design of the 'operating reserve demand curve' meant to price reserve scarcity into markets anticipated. That would have been my move

So to wrap this up, the PUCT statement says that since there WERE demand shutoffs on 2/15 (sorry, I should have said 2/15 above; cutoffs started at 1:25 am 2/15 ercot.com/news/releases/…), the market price should be at the cap and ordered ERCOT to adjust it.

In short, NO evidence of market manipulation by generators here. Price didnt jump to cap b.c. generators purposefully went off. Price went to cap because PUCT ordered ERCOT to raise it during demand shutoffs. ERCOT probably started those early to avoid risk of total blackout /End

• • •

Missing some Tweet in this thread? You can try to

force a refresh