1/ How to think about a stock that is recently up BIG

A 🧵 about my personal history with Anchoring Bias

With $DMTK, $FVRR, $NVCR, $ZM ⬇️

A 🧵 about my personal history with Anchoring Bias

With $DMTK, $FVRR, $NVCR, $ZM ⬇️

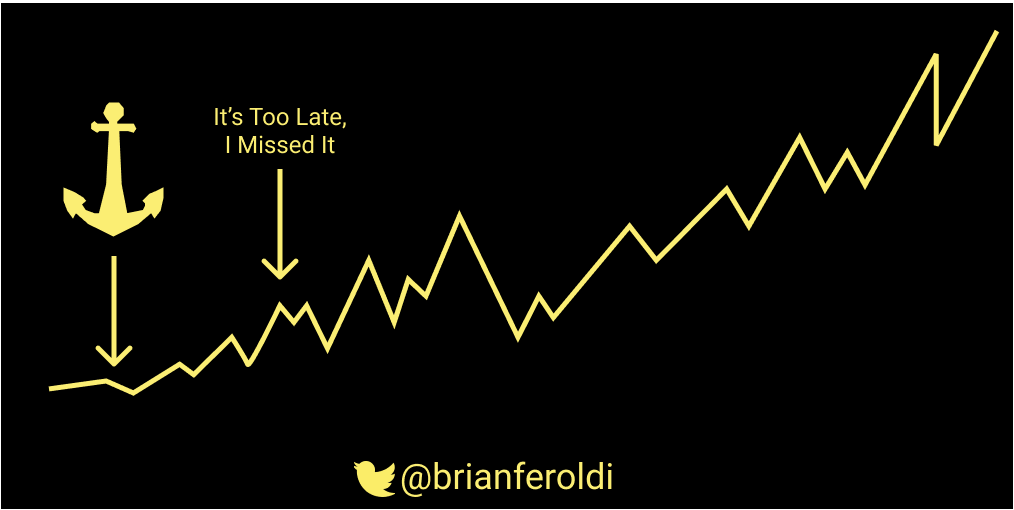

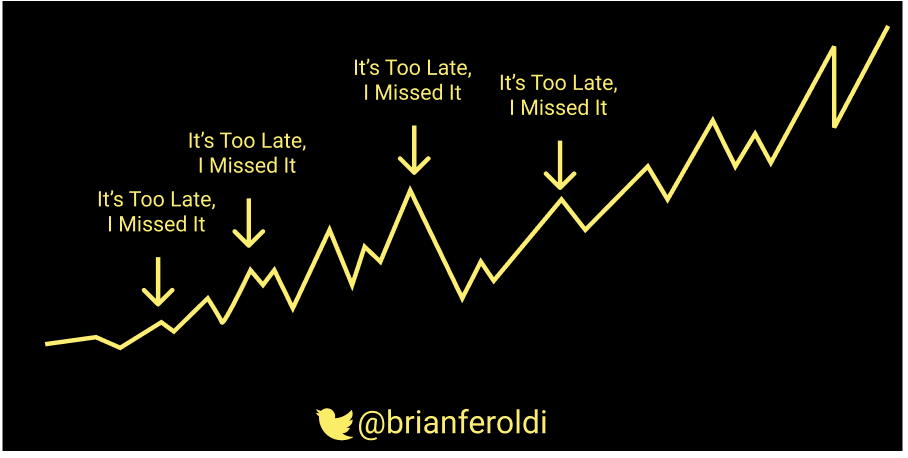

2/ What is anchoring bias?

When the first price that you see influences your future opinion

Ex: I offer you a piece of gum for $0.10. You decline

You change your mind, but the price is now $0.50

Do you buy?

Probably not -- you are 'anchoring' to the original $0.10 price

When the first price that you see influences your future opinion

Ex: I offer you a piece of gum for $0.10. You decline

You change your mind, but the price is now $0.50

Do you buy?

Probably not -- you are 'anchoring' to the original $0.10 price

3/ This comes up ALL THE TIME with investing

$ZM came public at $65 in 2019

Current price: $426

Is it a buy today?

Should you wait for a pullback?

It's really, really hard to convince yourself to pay 8x the price for a stock!

$ZM came public at $65 in 2019

Current price: $426

Is it a buy today?

Should you wait for a pullback?

It's really, really hard to convince yourself to pay 8x the price for a stock!

4/ Anchoring bias is a big problem for me

I didn't buy

$ABMD at $80

$CRM at $40

$SHOP at $50

$ZM at $100

because "they were already up so much"

I was anchoring to previous prices, NOT looking at them with "fresh eyes"

ALL have multi-bagged since I initially passed

I didn't buy

$ABMD at $80

$CRM at $40

$SHOP at $50

$ZM at $100

because "they were already up so much"

I was anchoring to previous prices, NOT looking at them with "fresh eyes"

ALL have multi-bagged since I initially passed

5/ @DavidGFool is a MASTER at overcoming anchoring bias

It's like a superpower!

He has recommended buying numerous stocks that DOUBLED in the weeks BEFORE his recommendation!

Like $AMZN in 1997. That worked out OK.

@RBIPodcast is fantastic!

fool.com/podcasts/rule-…

It's like a superpower!

He has recommended buying numerous stocks that DOUBLED in the weeks BEFORE his recommendation!

Like $AMZN in 1997. That worked out OK.

@RBIPodcast is fantastic!

fool.com/podcasts/rule-…

6/ I still struggle with anchoring bias, but I'm getting better

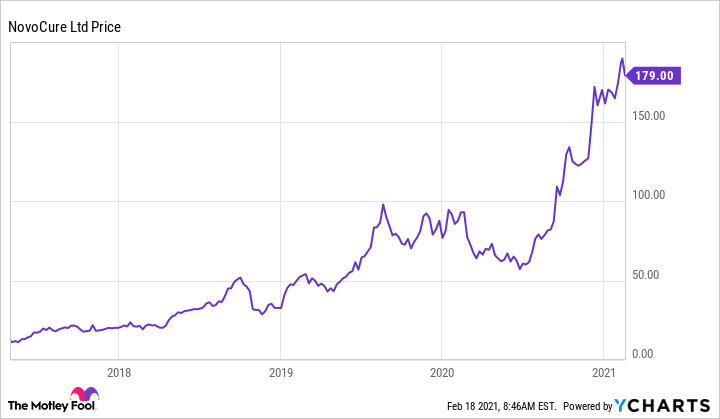

My personal history with $NVCR is a success story at overcoming my problem

My personal history with $NVCR is a success story at overcoming my problem

7/ I first learned about $NVCR in 2016

The tech seemed interesting but VERY high-risk

I didn't buy - I watched

By Oct 2016, bad news sent the stock down to ~$5

I remember thinking "there's still potential, might be worth a shot at these levels"

The tech seemed interesting but VERY high-risk

I didn't buy - I watched

By Oct 2016, bad news sent the stock down to ~$5

I remember thinking "there's still potential, might be worth a shot at these levels"

8/ I didn't buy at $5

a few months later GREAT clinical news came out

Shares rose 57% in a single day!

Quickly, the stock was up to $14

(Here's the news, in case you are interested)

fool.com/investing/2017…

a few months later GREAT clinical news came out

Shares rose 57% in a single day!

Quickly, the stock was up to $14

(Here's the news, in case you are interested)

fool.com/investing/2017…

9/ The old me: "I'll wait for a pullback"

Thankfully, I bought it at ~$14 anyway

Hard to do when I could have bought at $5 just a few months earlier!

My logic: At $14, the market cap was ~$1 billion. If this works, it could be $10+ BB someday

Thankfully, I bought it at ~$14 anyway

Hard to do when I could have bought at $5 just a few months earlier!

My logic: At $14, the market cap was ~$1 billion. If this works, it could be $10+ BB someday

https://twitter.com/BrianFeroldi/status/885971918393933825?s=20

10/ $14 turned out to be the LOWEST PRICE since then

Even though it was at the 52-week HIGH at the time

$NVCR is now $179, a 10+ bagger since I bought "at the high"

Even though it was at the 52-week HIGH at the time

$NVCR is now $179, a 10+ bagger since I bought "at the high"

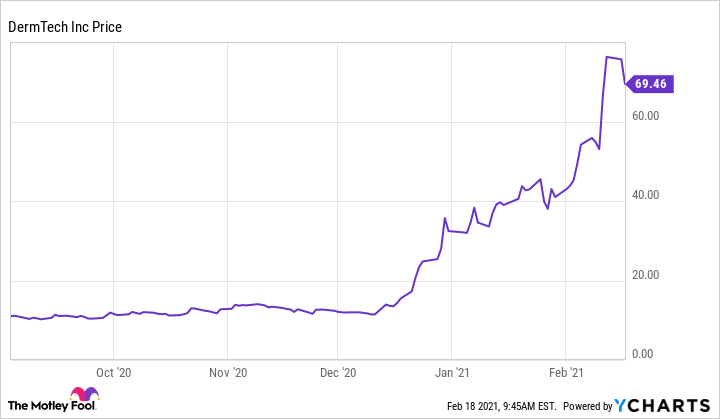

11/ More recently, I did a deep dive on $DMTK on Sept 30, 2020

Price at the time: $12

I said "wow, if this works, it could be huge"

I haven't bought it yet. Here's what happened since:

Price at the time: $12

I said "wow, if this works, it could be huge"

I haven't bought it yet. Here's what happened since:

12/ I could have bought $DMTK at $12

$12!!!!!

The price is now $67

$67!!!!!!

Hard to buy now, isn't it?

I may still buy -- I haven't decided yet!

The market cap is <$2 billion. 10x returns from here still possible!

I'm going to fight my desire to anchor like crazy!

$12!!!!!

The price is now $67

$67!!!!!!

Hard to buy now, isn't it?

I may still buy -- I haven't decided yet!

The market cap is <$2 billion. 10x returns from here still possible!

I'm going to fight my desire to anchor like crazy!

13/ Another ex: $FVRR

The stock was $22 in March 2020

@TomGardnerFool recommended it in Sept 2020 at $116 -- up 5x in 6 months!

I didn't buy. Took a harder look in Oct 2020 -- but the price was now $159 -- an all-time high

I bought anyway

Current price: $294!!!!

The stock was $22 in March 2020

@TomGardnerFool recommended it in Sept 2020 at $116 -- up 5x in 6 months!

I didn't buy. Took a harder look in Oct 2020 -- but the price was now $159 -- an all-time high

I bought anyway

Current price: $294!!!!

14/ Why did I buy $FVRR even though the stock was up already up huge?

Market cap was only $5 billion at the time

I thought 10x returns were possible

Market cap was only $5 billion at the time

I thought 10x returns were possible

https://twitter.com/BrianFeroldi/status/1337778933748600838?s=20

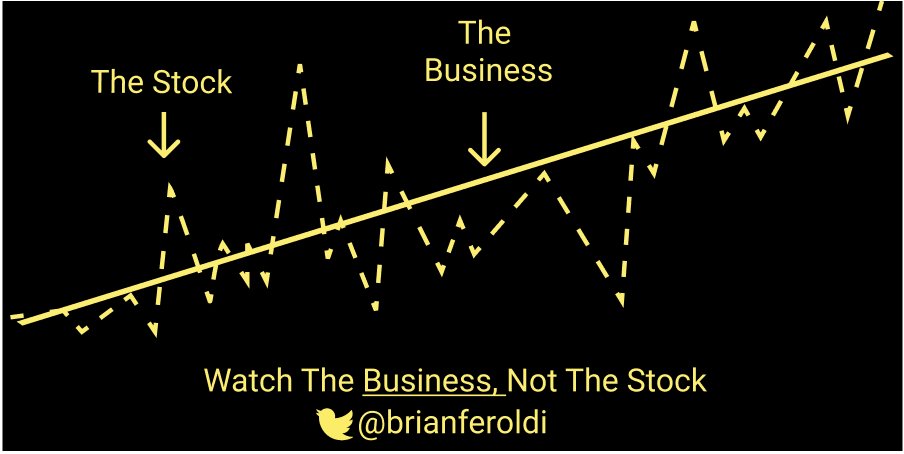

15/ Anchoring bias is HARD to overcome

It's counter-intuitive to pay so much for something that's up big recently

Now, to be clear, YOU SHOULDN'T JUST BUY A STOCK BECAUSE IT IS RECENTLY UP BIG

You need to due research & measure the opportunity from the CURRENT price

It's counter-intuitive to pay so much for something that's up big recently

Now, to be clear, YOU SHOULDN'T JUST BUY A STOCK BECAUSE IT IS RECENTLY UP BIG

You need to due research & measure the opportunity from the CURRENT price

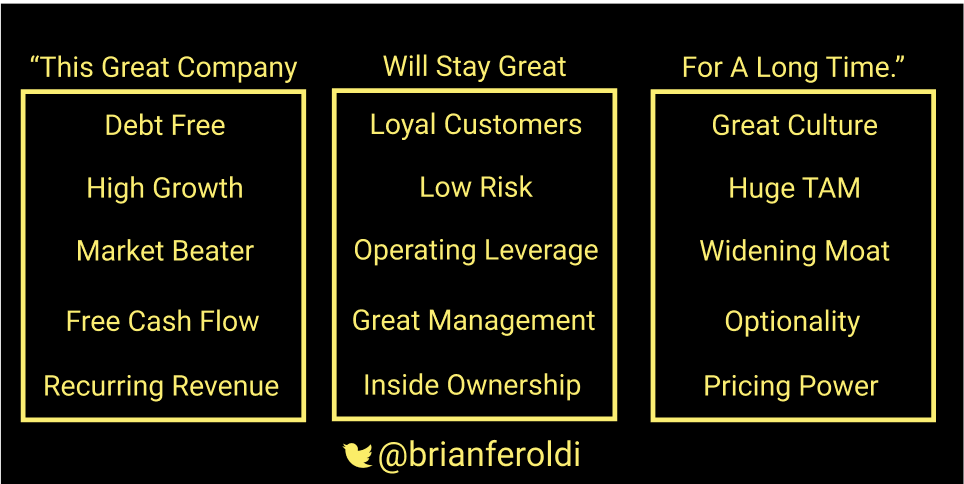

16/ But, if you find a GREAT company and you still think it can grow

Don't let the recent price movement keep you from buying!

Here's what I mean by "a GREAT company"

Don't let the recent price movement keep you from buying!

Here's what I mean by "a GREAT company"

https://twitter.com/BrianFeroldi/status/1324359239469588485?s=20

17/ My thinking on investing has hugely evolved over time

My favorite investing thesis today boils down to:

"This great company will stay great for a long time."

My favorite investing thesis today boils down to:

"This great company will stay great for a long time."

17/ You don't have to go "all-in" right away, either

If you like it and its up big

1⃣But some right away

2⃣Try to make future buys at "better value points"

What does buy at "better value points" mean?

If you like it and its up big

1⃣But some right away

2⃣Try to make future buys at "better value points"

What does buy at "better value points" mean?

https://twitter.com/BrianFeroldi/status/1275752033325330433?s=20

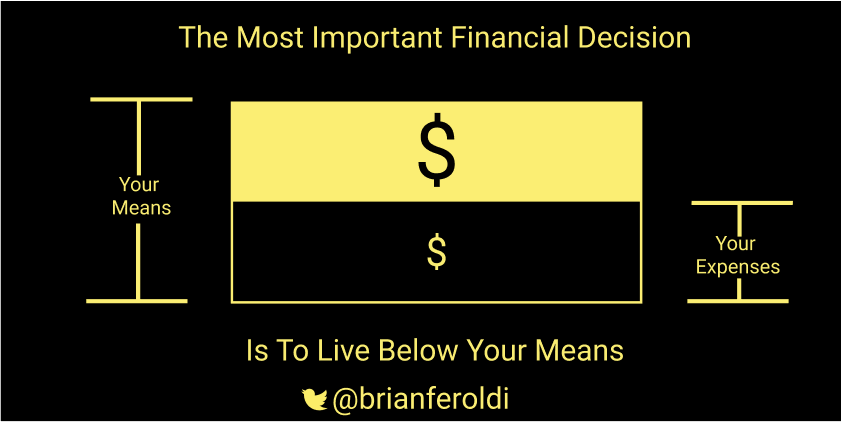

18/ Remember investing is a never-ending battle in your brain

Don't let your emotions & baises get in the way

Don't let your emotions & baises get in the way

• • •

Missing some Tweet in this thread? You can try to

force a refresh