This week, let's deepen the concept of our 98/2 pools. ⭐️

What are the advantages of these pools compared to conventional ones? 🧐

Let's check this.

1/4

What are the advantages of these pools compared to conventional ones? 🧐

Let's check this.

1/4

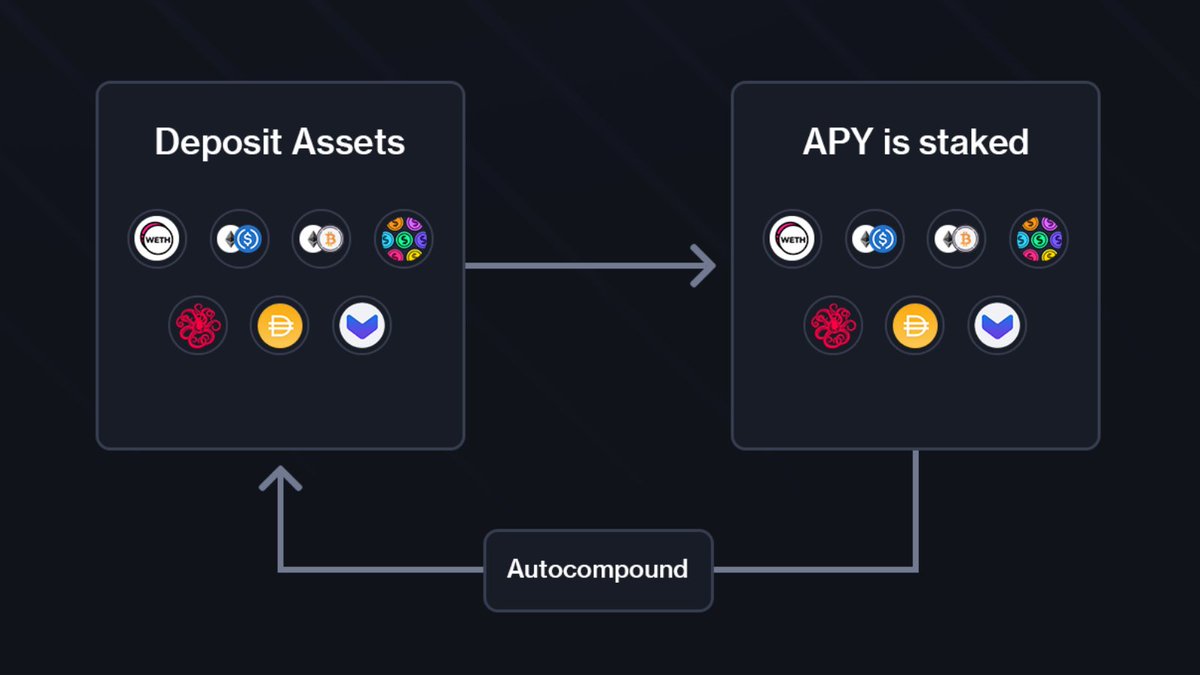

Conventional Staking Pools

✅ No impermanent loss

✅ Lower fees through autocompound

❌ Dead capital - the fund is just sitting in the pool

2/4

✅ No impermanent loss

✅ Lower fees through autocompound

❌ Dead capital - the fund is just sitting in the pool

2/4

👑 98/2 FaaS Pools

✅ Almost 0 impermanent loss when using a stable pair (f.e. TOKEN/DAI)

✅ Capital can act as liquidity for trading

✅ Liquidity providers incentivized from swap fee

✅ Lower fees through autocompound

❌ Slightly higher GAS fee when providing Liquidity

3/4

✅ Almost 0 impermanent loss when using a stable pair (f.e. TOKEN/DAI)

✅ Capital can act as liquidity for trading

✅ Liquidity providers incentivized from swap fee

✅ Lower fees through autocompound

❌ Slightly higher GAS fee when providing Liquidity

3/4

@Sentivate was the first project to use the potential of this innovation. 🐙

Since then, many other projects have joined them.

If you want to leverage your capital using these 98/2 pools, go now to valuedefi.io & make your choice! ✨

4/4

Since then, many other projects have joined them.

If you want to leverage your capital using these 98/2 pools, go now to valuedefi.io & make your choice! ✨

4/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh