We are actively working to launch on @binance Smart Chain #BSC .

To make this transition easy & understandable for everyone, we are answering most frequently asked questions here.

Ready? Go! 🔥

1/24

#DeFi #YieldFarming

To make this transition easy & understandable for everyone, we are answering most frequently asked questions here.

Ready? Go! 🔥

1/24

#DeFi #YieldFarming

@binance Q1 - What are the benefits of holding the $VALUE token on the Ethereum Mainnet network? Give me reasons not to sell. Some are assuming that the VALUE token will be abandoned now that vBSWAP is being created. Can you clarify the use case for VALUE?

@binance 👉 $VALUE will always be a governance & profit receiving token of the whole ecosystem if staked in #vGov. With the new farming token on #BSC , gvVALUE holders will get extra rewards at BSC if they choose to bridge their gvVALUE to BSC & stake in gvVALUE-B/BUSD 98/2 pool.

@binance Q2 - What do I need to do with my VALUE tokens that are staked in vGov? Is it OK to leave them in the vGov?

👉If you have VALUE but aren't staking in the vGov & you would like to participate in the BSC expansion, you will need to stake your VALUE in the vGov to receive gvVALUE.

👉If you have VALUE but aren't staking in the vGov & you would like to participate in the BSC expansion, you will need to stake your VALUE in the vGov to receive gvVALUE.

@binance If you are staking in vGov but don't see the correct gvVALUE amount in your wallet, go to vGov (valuedefi.io/governance) to unlock your gvVALUE from the old contract. There will be a bridge from ETH to BSC to move gvVALUE and vUSD over.

@binance Q3 - What is the purpose of the “Unlock” button on the #vGov page? What does it do? How often do I need to execute it? How do I know whether or not I need to click it?

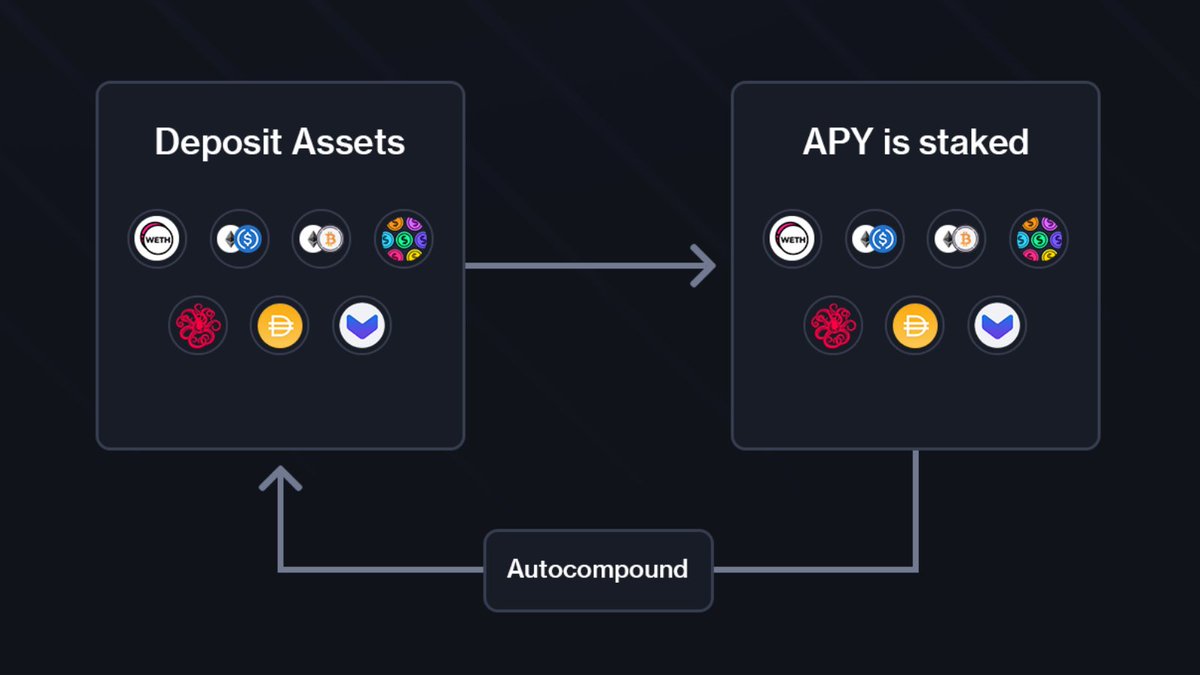

👉 Prior to auto compound upgrade of vGov in November 2020, all gvVALUE was locked in vGov contract, ...

👉 Prior to auto compound upgrade of vGov in November 2020, all gvVALUE was locked in vGov contract, ...

@binance ... post upgrade it returned back to wallet. All users who deposited prior to it now have the option to transfer gvVALUE to their wallet at relatively cheap gas cost (depending on $ETH network congestion).

@binance It is one time action that is available only to users who have their gvVALUE locked in contract.

Q4 - Will we be able to stake value-B on the #BSC chain?

👉 Value-b is bearn.fi pegged Value token, as such it is not part of our Value ecosystem.

Q4 - Will we be able to stake value-B on the #BSC chain?

👉 Value-b is bearn.fi pegged Value token, as such it is not part of our Value ecosystem.

@binance Q5 - Will I lose any of the gvVALUE benefits (compounded etc…) if I peg them to gvVALUE-B?

👉 All benefits stay and you get additional rewards from #BSC.

👉 All benefits stay and you get additional rewards from #BSC.

@binance Q6 - Will I be able to bridge my gVALUE coins to #BSC 1:1 (at a"relative cheap cost")? and have gvVALUE-B ? And vBSWAP is a completely new token not directly related to my VALUE/gvVALUE-B ? If yes, what will be the initial price for vBSWAP and max supply?

@binance 👉 gvVALUE will be bridged at 1:1 peg to gvVALUE-B before we roll out our #BSC ecosystem. It’s cheap because it’s just a transfer tx.

vBSWAP is a profit share token of ValueDeFi at BSC. Farmers get vBSWAP as incentive, vBSWAP holders get farmers' profit as buyback and burn.

vBSWAP is a profit share token of ValueDeFi at BSC. Farmers get vBSWAP as incentive, vBSWAP holders get farmers' profit as buyback and burn.

@binance vBSWAP holders can control the profit sharing rate and decide on the % of swap fee from vSwap that goes to buy back vBSWAP. Max supply of vBSWAP will be 100000 that will be distributed over 104 weeks with reduction in emission by 10% every 4 weeks (e.g. in first 4 weeks...

@binance ... total of 10600 vBSWAP tokens will be distributed, for next 4 weeks 9540 vBSWAP etc..)

@binance Q7 - Only thing I’m confused about is the addition of vBSWAP. So swap on #BSC will not profit share with value holders but with holders of a new token instead? I don’t understand why we’re getting another profit sharing token for the platform.

@binance 👉 vBSWAP token will be distributed to 98/2 gvVALUE-B/BUSD pool stakers as well. gvVALUE holders are able to receive benefits from both chains if they choose to do so. In order to compete on the #BSC landscape, incentives have to be given to future users, and since there will...

@binance ... be no more VALUE emissions and vUSD has its own purpose now, the optimal solution is to create a new token that is backed by BSC profits.

@binance Q8 - So am I getting this right that I will be able to pull out my gvVALUE use it on the #BSC to farm another token/reward yet still receive my rewards/buybacks etc in Gov vault? Surely my money/value can't be used in 2 places at once can it?

@binance 👉 gvVALUE is a token that represents your share in vGov, as long as you hold gvVALUE (or gvVALUE-b) you are receiving profit from Value ETH Ecosystem and by bridging over to BSC you will be able to receive additional rewards (vBSWAP tokens) from BSC if ...

@binance ... you choose to stake it in 98/2 gvVALUE-b/BUSD pool.

Q9 - What are the advantages of #BSC long-term for the project?

👉 Cheaper gas costs on BSC will allow us to demonstrate our unique multistrat + auto-rebalance tech for #vSafe, as well as vPegSwap. There are also plans...

Q9 - What are the advantages of #BSC long-term for the project?

👉 Cheaper gas costs on BSC will allow us to demonstrate our unique multistrat + auto-rebalance tech for #vSafe, as well as vPegSwap. There are also plans...

@binance ... to upgrade #FaaS to create projects from scratch - vLaunch and to start vLend on #BSC. We will also be one of first projects with complete infrastructure on BSC which should give us first mover advantage.

@binance Q10 - Will it be Cross #Heco?

👉 #BSC is just the first of chains that we will expand to, and depending on ease of integration several more are under consideration, including Heco.

👉 #BSC is just the first of chains that we will expand to, and depending on ease of integration several more are under consideration, including Heco.

@binance Q11 - Do I need $ETH in my wallet to pay for the gas on #BSC?

👉No, #BNB is native currency of BSC, just like ETH is of @Ethereum. In order to initiate any transaction on BSC you need to hold BNB in your wallet. You can get BNB by buying it from @binance , @FTX_Official or @BKEX

👉No, #BNB is native currency of BSC, just like ETH is of @Ethereum. In order to initiate any transaction on BSC you need to hold BNB in your wallet. You can get BNB by buying it from @binance , @FTX_Official or @BKEX

@binance @ethereum @FTX_Official @bkex Q12 - Where can I learn more about #BSC?

👉 For those of you who are new to BSC, we recommend the following online resources:

academy.binance.com/en/articles/an…

👉 For those of you who are new to BSC, we recommend the following online resources:

academy.binance.com/en/articles/an…

@binance @ethereum @FTX_Official @bkex If you have any further questions, do not hesitate to ask them in the comments! 📝

We invite you to retweet this thread if you liked it. The more people who know about it, the better!

24/24

We invite you to retweet this thread if you liked it. The more people who know about it, the better!

24/24

We are really excited to be joining @BinanceChain!

@news_of_bsc & @bsc_daily we are also ready to answer all your questions ! Hope you will like this :)

@news_of_bsc & @bsc_daily we are also ready to answer all your questions ! Hope you will like this :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh