I sold my first fourplex for a record setting $4.3M, turning $250K into $2M. Here's how I

• bought a money losing property

• made every mistake in the book

• hustled my way to becoming a RE millionaire

• bought a money losing property

• made every mistake in the book

• hustled my way to becoming a RE millionaire

Summary

• Purchased in 2013 for $2.53M

• Sold in 2017 for $4.3M

• Initial NOI $60k (2.4% cap)

• Final NOI $183k (4.25% cap buyer adjusted)

Read on for the story ...

• Purchased in 2013 for $2.53M

• Sold in 2017 for $4.3M

• Initial NOI $60k (2.4% cap)

• Final NOI $183k (4.25% cap buyer adjusted)

Read on for the story ...

In 2013, my wife and I were newlyweds living in Silicon Valley.

Rents and home prices were rising like crazy.

If I didn't win the tech lottery, we risked being priced out for good.

Rents and home prices were rising like crazy.

If I didn't win the tech lottery, we risked being priced out for good.

The idea was to house hack with a small apartment building.

Living in one unit and renting the others, we could own more real estate at a lower monthly cost than if we bought a house.

In theory, our rent would eventually be subsidized and we would build equity.

Living in one unit and renting the others, we could own more real estate at a lower monthly cost than if we bought a house.

In theory, our rent would eventually be subsidized and we would build equity.

The main goal was to preserve our ability to live in Silicon Valley.

At the time, I saw it more as an investment in our careers than in real estate.

The truth is: the numbers were pretty ugly!

At the time, I saw it more as an investment in our careers than in real estate.

The truth is: the numbers were pretty ugly!

There was nothing particularly special about the property that we found

• Original units from the 1950s

• Lots of deferred maintenance

• Shared a driveway with three identical neighbors

... except for the location. It was 1 mile from the top, local university.

• Original units from the 1950s

• Lots of deferred maintenance

• Shared a driveway with three identical neighbors

... except for the location. It was 1 mile from the top, local university.

Lesson: Location is the most important factor in real estate.

It's the only thing about a property that you absolutely cannot change.

A good location can enable opportunities and protect the ownership from other mistakes.

It's the only thing about a property that you absolutely cannot change.

A good location can enable opportunities and protect the ownership from other mistakes.

The pricing was aggressive. Listed at $2.2M, similar properties sold as low as $1.8M earlier that year.

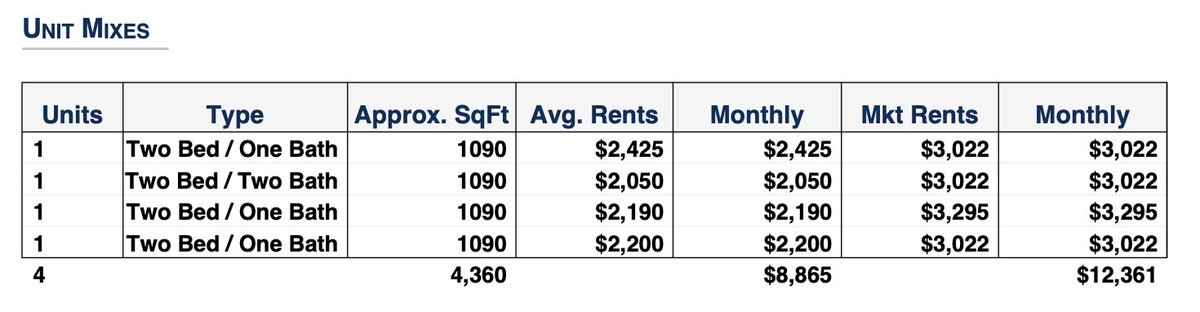

Average rents, $2200, were 40% under market, but how much work would the units need to get there?

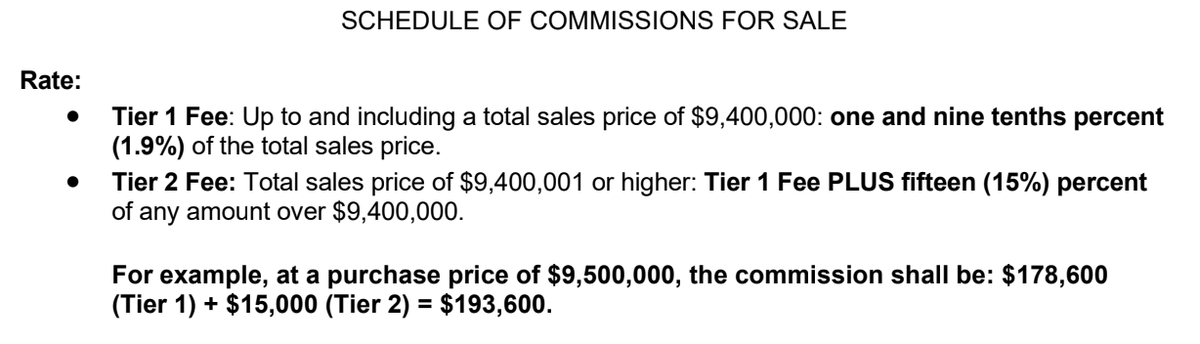

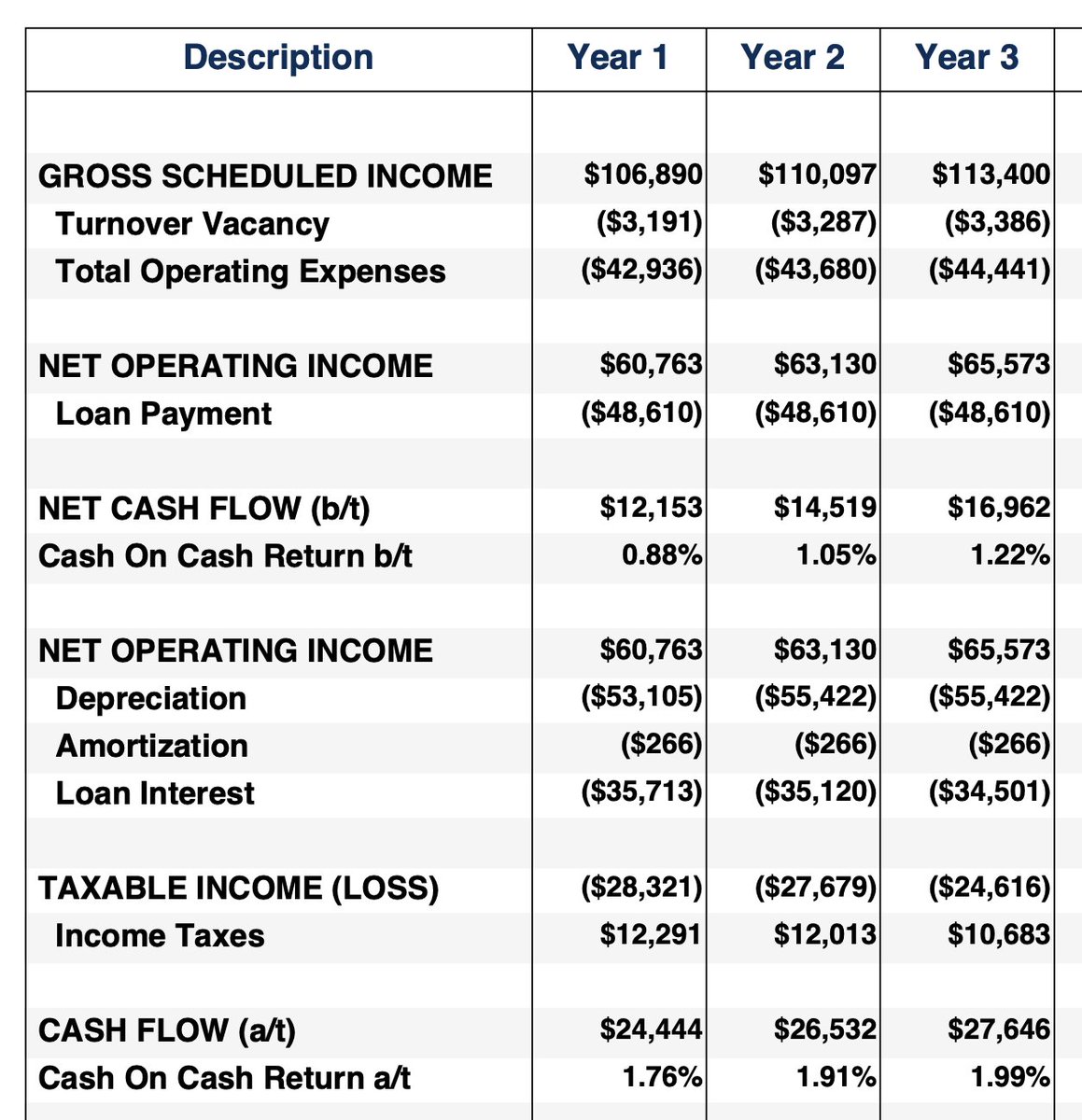

Here are the broker's projections. Note the juicy 0.88% cash return in Y1!

Average rents, $2200, were 40% under market, but how much work would the units need to get there?

Here are the broker's projections. Note the juicy 0.88% cash return in Y1!

Winning the deal was no easy feat.

Competing against early Facebook employees and one of the most respected real estate families in the area is especially tough as a first time buyer with no experience.

One of our mentors, an LA real estate veteran, guided us to victory.

Competing against early Facebook employees and one of the most respected real estate families in the area is especially tough as a first time buyer with no experience.

One of our mentors, an LA real estate veteran, guided us to victory.

Winning the deal despite our inexperience required us to

• Bid the highest

• Waive all contingencies

• Let the listing agent represent us, doubling his commission

This is not advice! It's risky, even if you know exactly what you're doing. We didn't.

• Bid the highest

• Waive all contingencies

• Let the listing agent represent us, doubling his commission

This is not advice! It's risky, even if you know exactly what you're doing. We didn't.

https://twitter.com/evanmr/status/1361521168713277442

Without any experience underwriting, or knowing what would make a deal "good", my model said

• if we got rents to $3000 in Y1

• and assumed 6% rent growth per year

• we'd be cashflow negative until Y6

Still, the overall monthly cost was favorable to owning a $2.5M home.

• if we got rents to $3000 in Y1

• and assumed 6% rent growth per year

• we'd be cashflow negative until Y6

Still, the overall monthly cost was favorable to owning a $2.5M home.

Luckily for us, a friend lived in an identical, neighboring building.

Her unit had been remodeled beautifully and she paid $3000 in rent.

Knowing her rent and seeing her unit firsthand gave us inspiration and the confidence to proceed.

Her unit had been remodeled beautifully and she paid $3000 in rent.

Knowing her rent and seeing her unit firsthand gave us inspiration and the confidence to proceed.

The purchase price was $2.53M. Breakeven required rents to be $3750 in Y5.

Since the property was fully occupied, we couldn't move in at closing.

The first vacancy came a month later. We decided to try renting it out to get experience as landlords.

Since the property was fully occupied, we couldn't move in at closing.

The first vacancy came a month later. We decided to try renting it out to get experience as landlords.

Amazingly, we were able to rent out the unit for $3195, without any remodeling.

The tenant wanted an in-unit washer and dryer. Bids for the work came in at $5000, so I told the tenant we would do it for an extra $100 in rent (25% ROI).

She accepted.

The tenant wanted an in-unit washer and dryer. Bids for the work came in at $5000, so I told the tenant we would do it for an extra $100 in rent (25% ROI).

She accepted.

Around then, my app business that was paying for the monthly shortfall was shut down unexpectedly.

Speeding up the timeline to pay for our money losing property was now a matter of survival.

Out of curiosity, I listed one of our apartments on Airbnb to see the analytics.

Speeding up the timeline to pay for our money losing property was now a matter of survival.

Out of curiosity, I listed one of our apartments on Airbnb to see the analytics.

Lesson: Don't buy a property unless it cashflows

When the cap rate is less than the interest rate on the mortgage, every dollar borrowed loses you more money. This is very dangerous!

If the property can't support itself and you don't have a plan to get there, leave it alone.

When the cap rate is less than the interest rate on the mortgage, every dollar borrowed loses you more money. This is very dangerous!

If the property can't support itself and you don't have a plan to get there, leave it alone.

Everything changed with Xe's message. She was to be a visiting professor and needed a place for 5 months.

After negotiation, we agreed to a rent of $4400 per month for a furnished, remodeled apartment.

This rent level wasn't expected until Y7!

After negotiation, we agreed to a rent of $4400 per month for a furnished, remodeled apartment.

This rent level wasn't expected until Y7!

Lesson: To reduce risk, sell before you build

Notice that Xe's email asks why the pictures showed an unfurnished unit. The unit wasn't furnished or remodeled.

I pre-sold the product to validate demand before committing to an expensive remodeling project.

Notice that Xe's email asks why the pictures showed an unfurnished unit. The unit wasn't furnished or remodeled.

I pre-sold the product to validate demand before committing to an expensive remodeling project.

The remodel cost $50k, plus $10k for furniture. My wife and I designed the home we would want to live in, figuring that we would move in when Xe left. We probably over-improved, adding

• granite countertops

• stainless steel appliances

• travertine tiled kitchen/bath

• granite countertops

• stainless steel appliances

• travertine tiled kitchen/bath

We had stumbled upon a way to get very attractive rents, but I had no idea what would happen after Xe left.

• Would we be able to find another long-term tenant at that rate on Airbnb?

• What were market rents post-remodel?

• What if we had to store the furniture?

• Would we be able to find another long-term tenant at that rate on Airbnb?

• What were market rents post-remodel?

• What if we had to store the furniture?

The next vacancy was remodeled and rented it to an executive for $4000/mo, but he bailed.

Unable to afford the vacancy, we put it on Airbnb, and within an hour, it was rented for move-in the next day.

We spent all night building furniture, not for the first or last time.

Unable to afford the vacancy, we put it on Airbnb, and within an hour, it was rented for move-in the next day.

We spent all night building furniture, not for the first or last time.

I leaned into the business model, giving the last two apartments the same treatment.

For the next year, I negotiated rates and dates on Airbnb to maximize collections on 1-12 month leases.

It was exhausting, but we surpassed our Y10 projections, collecting $243k in Y2.

For the next year, I negotiated rates and dates on Airbnb to maximize collections on 1-12 month leases.

It was exhausting, but we surpassed our Y10 projections, collecting $243k in Y2.

Lesson: To reach higher price points, sometimes you need a new market.

Upgrading the property allowed us to sell into a market with higher end clientele, at higher rents.

Changing the business model to offer furnished, corporate rentals amplified the impact even further.

Upgrading the property allowed us to sell into a market with higher end clientele, at higher rents.

Changing the business model to offer furnished, corporate rentals amplified the impact even further.

The extra rent was used to improve the building.

While my friends worked on startups, I watched a guy hit nails with a hammer, wondering what the heck I was doing with my life.

Realizing that at our budget, I had to be the general contractor, I oversaw 15 construction projects.

While my friends worked on startups, I watched a guy hit nails with a hammer, wondering what the heck I was doing with my life.

Realizing that at our budget, I had to be the general contractor, I oversaw 15 construction projects.

Managing construction comes with a huge learning curve.

Contractors fleeced us in every way possible: overcharging, bad work, extortion, etc.

I'll share these hilarious and terrifying stories another day.

Contractors fleeced us in every way possible: overcharging, bad work, extortion, etc.

I'll share these hilarious and terrifying stories another day.

https://twitter.com/evanmr/status/1350923190957051904?s=20

Finding several multi-month leases was stressful and not sustainable. I needed an exit plan.

For a year, I tried to sign major area employers to rent from us, without success.

One day, I saw a van marked "student housing" parking on my street. I flagged down the driver.

For a year, I tried to sign major area employers to rent from us, without success.

One day, I saw a van marked "student housing" parking on my street. I flagged down the driver.

The driver told me that the university rented a few apartments for students. I asked for his supervisor's card and called her.

My building was too small, but she would make an exception if she could rent the whole building.

We signed a year lease for $5000 per month per unit.

My building was too small, but she would make an exception if she could rent the whole building.

We signed a year lease for $5000 per month per unit.

The university was the greatest tenant. Each month I received one check for $20,000, the week before rent was due.

The next year, I told them that the new rate was $5200/mo, but if they signed a two year lease, the first year would remain $5000/mo.

They signed a two year lease.

The next year, I told them that the new rate was $5200/mo, but if they signed a two year lease, the first year would remain $5000/mo.

They signed a two year lease.

Realizing that we had maximized the potential of the building, with the best tenant and above market rents, we decided to sell. Other reasons

• the university was building more housing

• rent control had been proposed in the area

• I wanted a property I couldn't micromanage

• the university was building more housing

• rent control had been proposed in the area

• I wanted a property I couldn't micromanage

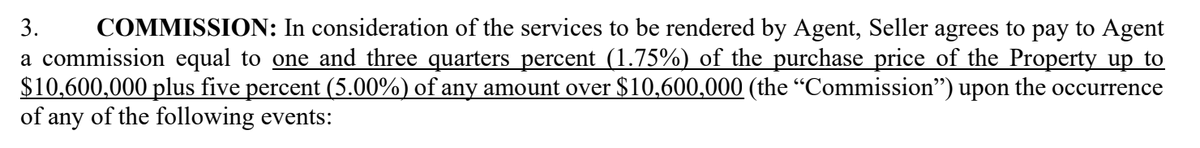

After a fascinating search process, we picked an agent and listed the property for $4.5M.

Like all transactions, it was not without drama, but it closed at $4.3M, a 4.25% cap rate on actuals.

At over $1M/unit, it was a record setting transaction in the area.

Like all transactions, it was not without drama, but it closed at $4.3M, a 4.25% cap rate on actuals.

At over $1M/unit, it was a record setting transaction in the area.

The sale was the end of one journey and the beginning of another to place our $2M proceeds.

We executed a difficult, tax-deferred 1031 exchange, and purchased a 100+ unit property in Dallas.

The initial capital has multiplied many times over and continues to return cash.

We executed a difficult, tax-deferred 1031 exchange, and purchased a 100+ unit property in Dallas.

The initial capital has multiplied many times over and continues to return cash.

Looking back, the time I spent leasing and overseeing construction wasn't wasted at all.

It was some of the best, hands-on experience I could have received and prepared me well to move on to 100+ unit buildings.

It was some of the best, hands-on experience I could have received and prepared me well to move on to 100+ unit buildings.

If you enjoyed this thread and want more

• Follow me

• Subscribe to my newsletter. I write deep dives on tech, real estate, and business.

bytestobricks.substack.com

• Follow me

• Subscribe to my newsletter. I write deep dives on tech, real estate, and business.

bytestobricks.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh