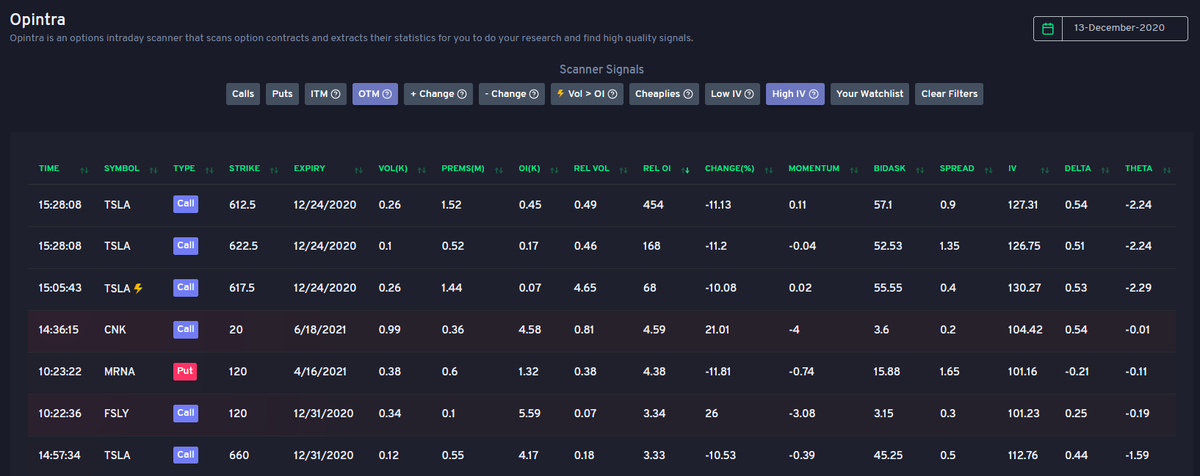

Options flow tip.

How to find bottoms? When you see puts being sold for large premiums and short-term out-of-the-money calls, that is a strong indication that people think we have bottomed. Here's an example of $TSLA. See how there are tons of sold puts and bought calls >= 650.

How to find bottoms? When you see puts being sold for large premiums and short-term out-of-the-money calls, that is a strong indication that people think we have bottomed. Here's an example of $TSLA. See how there are tons of sold puts and bought calls >= 650.

How do we know whether puts and calls were bought or sold, that's what the side column tells you. Green means puts were sold and calls were bought and red means puts were bought and calls were sold.

Now you do see some 600 puts bought which might actually pan out eventually but their expiration is slightly farther away from the 650 puts sold and 700 calls bought.

When someone is selling a put right below the stock price, that means they are quite certain that price won't dip below the price.

Same goes for when someone sells calls with high premiums. That can show us tops sometimes. Happened with $PLTR last week with 30 calls sold!

Same goes for when someone sells calls with high premiums. That can show us tops sometimes. Happened with $PLTR last week with 30 calls sold!

It's obviously not a 100% guarantee but nothing is in trading so we want to do as much as we can to make sure our plays are good. Options flow provides us a way to do that.

• • •

Missing some Tweet in this thread? You can try to

force a refresh