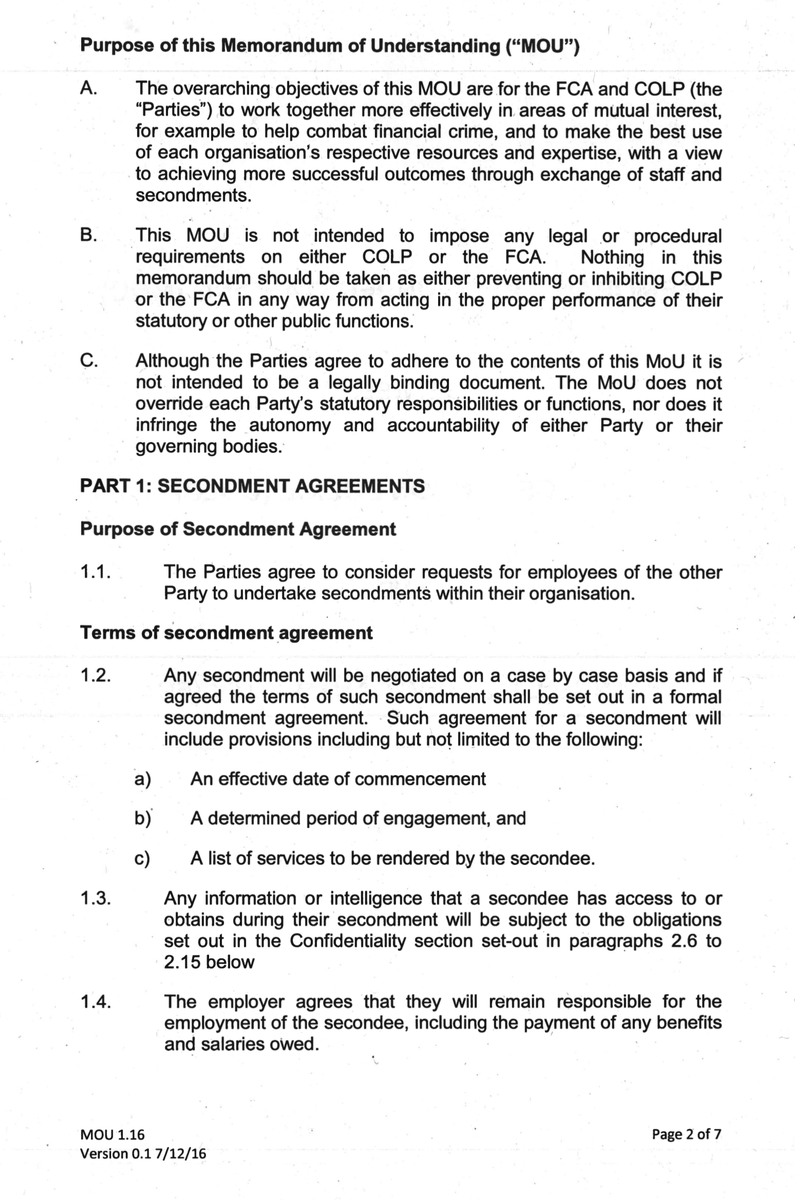

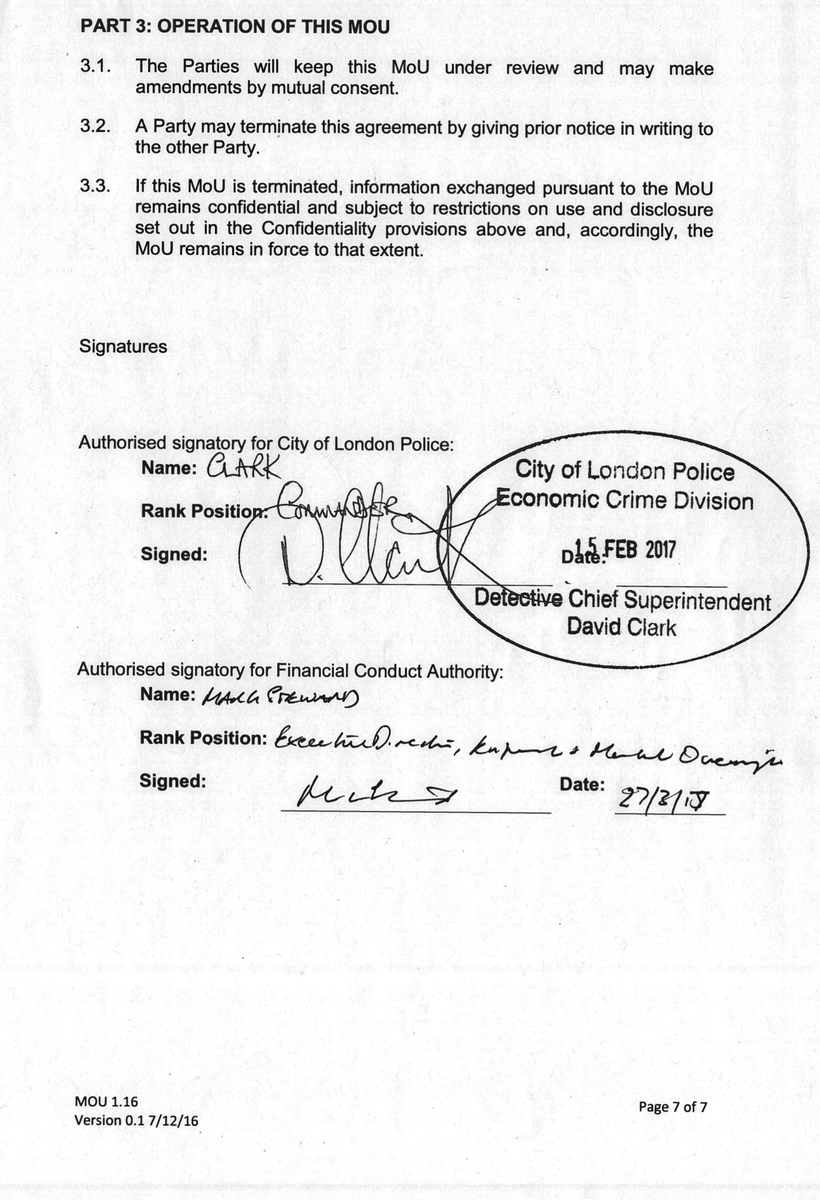

MOU between @CityPoliceFraud and @TheFCA dated 2017. Prior ones exist. Disturbing to say the least. I outline why below. Pages 1-4 here, pages 5-7 below... @TransparencyTF @True_and_FairUK @andyverity @TV_PCC @CarshaltonArt @markbishopuk @MarkTaber_FII @CommonsTreasury

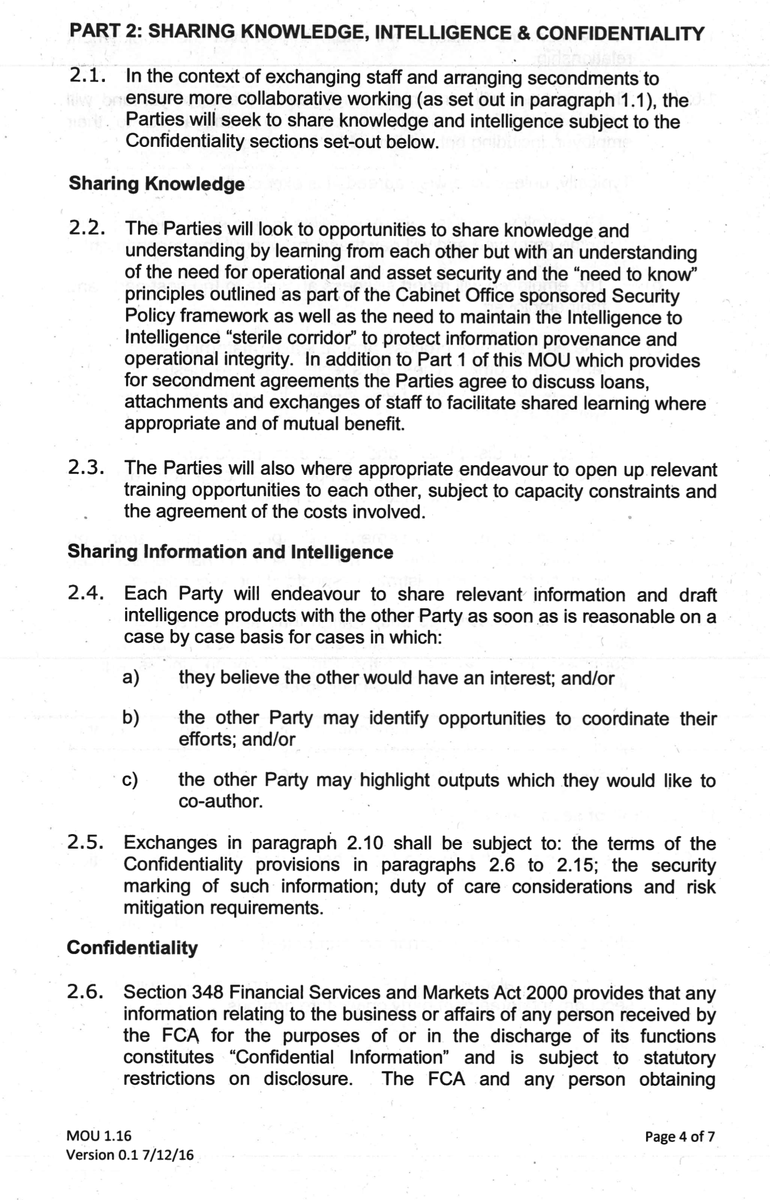

Of note: 1. FSMA, the legislation used repeatedly by the FCA to conceal & deny, is prominent. 2. Whole of section 2 of MOU is problematic. It seeks to limit information flow, particularly restrictions it establishes in respect to information flow from the FCA to COLP......

Para 2.6 - Enables FCA to withold info from COLP. States FCA must not disclose confidential info relating to business affairs of any person received by FCA for purposes of discharge of its functions, without consent of person it obtained it from or person to whom it relates.....

This would enable FCA to withold evidence of criminality, or not provide it to COLP without permission of the person that the evidence incriminates. What person in that position is going to give permission to share information that incriminates them?....

Para 2.7 b) "permits (but does not oblige) FCA to disclose information for purposes of any criminal investigation, criminal proceedings or for purposes of initiating or bringing to an end any such investigation or proceedings or facilitating a determination of .......

whether it or they should be initiated or brought to an end.” Herein lies the problem, it gives the FCA authority to bring a criminal investigation to an end, or even if they should be initiated. The FCA intervened to prevent criminal investigation into FX marks at LBG in 2016...

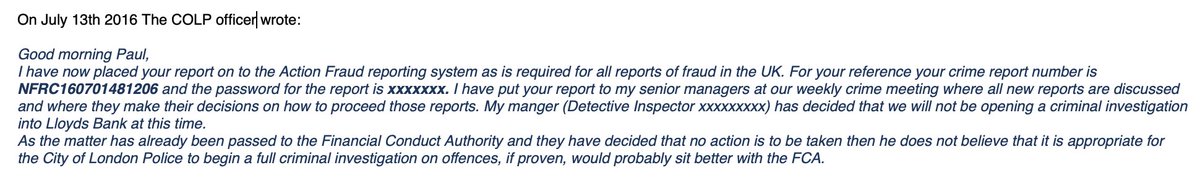

Here are extracts from my emails with COLP officer that I met with in 2016 and presented him with unequivocal evidence of FX fraud by Lloyds in respect to excessive and undisclosed mark ups. I reported to COLP after the FCA said they had no jurisdiction in respect to fraud.....

COLP officer confirms he opened crime report but then confirms that the reason for not proceeding to criminal investigation was because the FCA took no action. This was disturbing for numerous reasons and I replied to seek clarification.....

Ignore for a moment the statement by FCA in there; "there is no suitable individual at the FCA in a position to give an opinion”. This is the regulator & they told me that there's nobody at FCA suitable to determine if my protected disclosures did represent breach of FCA codes...

The FCA had refused to tell me anything in response to my disclosures regarding excessive and undisclosed mark ups claiming a) Spot FX was not within their scope because it was an unregulated product and b) the fraud represented by this was not within their scope.....

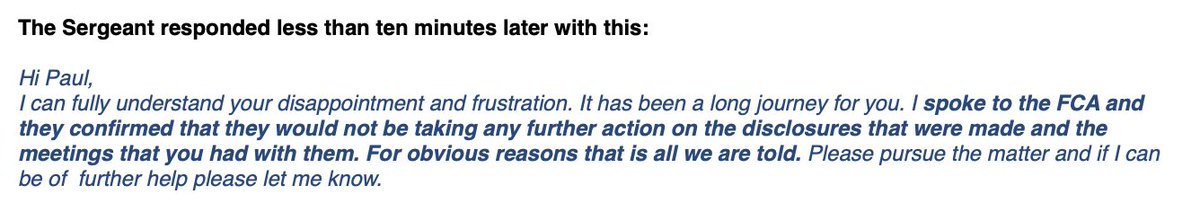

In response to my email and questions the COLP Officer replied with this. He confirms that he spoke to the FCA and that they told him that they would not be taking any action in respect to these matters, and thats reason for no criminal investigation.....

However, and most disturbingly he says "For obvious reasons that is all we are told.". Why is it obvious that the police would not be told all there was to know about this FCA position and what they had or had not done, and why?Police trump regulators don't they?

What FCA failed to tell the COLP was a) Spot FX was unregulated and therefore they had no scope to act in any event, and b) they had no jurisdiction in respect to fraud. This was fraud and the FCA knew it and here they were dishonestly & actively preventing fraud investigation...

To be clear, here is how Lloyds were advertising their FX services and charges to customers. 'No charge' for Spot FX transactions and 'No charge' for FX Forward exchange contracts. It is clear and unequivocal.....

WHEREAS, the official LBG Pricing Policy called the FM Pricing Framework had a price matrix (table) that determined the maximum amount of mark up (aka 'AV' (Added Value)) sales persons could take on a 'whatever you can get away with basis up to 3.3%....

Indeed, for basic Spot FX transactions of even more than £5mio sales persons were entitled to take up to 1.92%. That's a £96,000 charge for a basic £5mio Spot FX transaction that has zero counterparty or credit risk for bank and costs bank less than $20.....

The same pricing policy, incredibly, states "clients should receive pricing that provides value, is fair and transparent" and encourages "a client centric culture and appropriate behaviours". However, that is not the worst part of this policy that made protected disclosures about

It also says "In highly competitive markets where clients are sophisticated, highly price sensitive... AV may not be charged. Where AV is charged, for smaller less sophisticated customers, AV is limited to a set level..." No. It was an obscene level.....

And that passage confirms that the pricing to clients is specific to how 'price sensitive' the customer was. This actually means how aware the customer was of the true price. The more aware you were as a customer, the cheaper the price. The less aware, the higher the price....

Fraud. Yet FCA prevented criminal investigation by failing to disclose info to COLP who were content to let the FCA withold vital info. Para 2.8 says that confidential info received by COLP from FCA remains subject to statutory restrictions but also requires consent from FCA...

before it can be shared. Para 2.10 says that even in event that either COLP or FCA receives legally enforceable demand to disclose information, they will notify the other party PRIOR to disclosure & give the other party 5 business days notice prior to complying with the demand...

Worst of all is this passage;

"The party receiving the demand agrees to use its best efforts to assert such appropriate legal exemptions or privileges with respect to such information as may be available.” They actively agree to do all they can to prevent disclosure of info...

"The party receiving the demand agrees to use its best efforts to assert such appropriate legal exemptions or privileges with respect to such information as may be available.” They actively agree to do all they can to prevent disclosure of info...

There is no mention that the parties must do whatever it takes to disclose as much information as is possible, only mention of maximising efforts to withold or conceal as much information as is possible. And they do this to incredibly good effect as we are all well aware....

Para 2.11 states that certain information can be labelled ’sensitive’ & no forward disclosure is permitted without prior consent. I understand this should apply in respect to information provided by COLP to FCA, but this shouldn't apply to information provided by The FCA to COLP

It is an MOU that affords the ability to conceal and prevent investigation. And the FCA and COLP are abusing it to the detriment of the public and the wider economy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh