The administration is reviewing U.S. economic resilience - this is much needed

Why is it necessary? And how should one do it?

Why is it necessary? And how should one do it?

https://twitter.com/BrianDeeseNEC/status/1364601061995122690

Resilience => ability to absorb "shocks" such as disruptions in microchips or bursting of a bubble without major layoffs

An inability to do so is very costly. This study by @ojblanchard1 @LHSummers & Cerutti shows that short-run losses often become more permanent

An inability to do so is very costly. This study by @ojblanchard1 @LHSummers & Cerutti shows that short-run losses often become more permanent

So how can we make the U.S. economy more resilient?

There are two sides to it (as always)

The supply-side and the demand-side

The administration is currently focusing on the supply-side

There are two sides to it (as always)

The supply-side and the demand-side

The administration is currently focusing on the supply-side

The resilience of supply-side depends on the *production network* - i.e. which products are used as inputs to other products and so on.

This can get complicated

But it turns out there is a very intuitive answer to this problem:

This can get complicated

But it turns out there is a very intuitive answer to this problem:

Focus on the core "upstream" sectors that serve as inputs to highest share of output

@ErnestLiuEcon & Tsyvinski have a nice new paper on this question

scholar.princeton.edu/sites/default/…

This is what the administration is currently looking into .. a lot to do, to do it right.

@ErnestLiuEcon & Tsyvinski have a nice new paper on this question

scholar.princeton.edu/sites/default/…

This is what the administration is currently looking into .. a lot to do, to do it right.

Resilience is equally important on the demand side. Here the key intuition is "risk sharing"

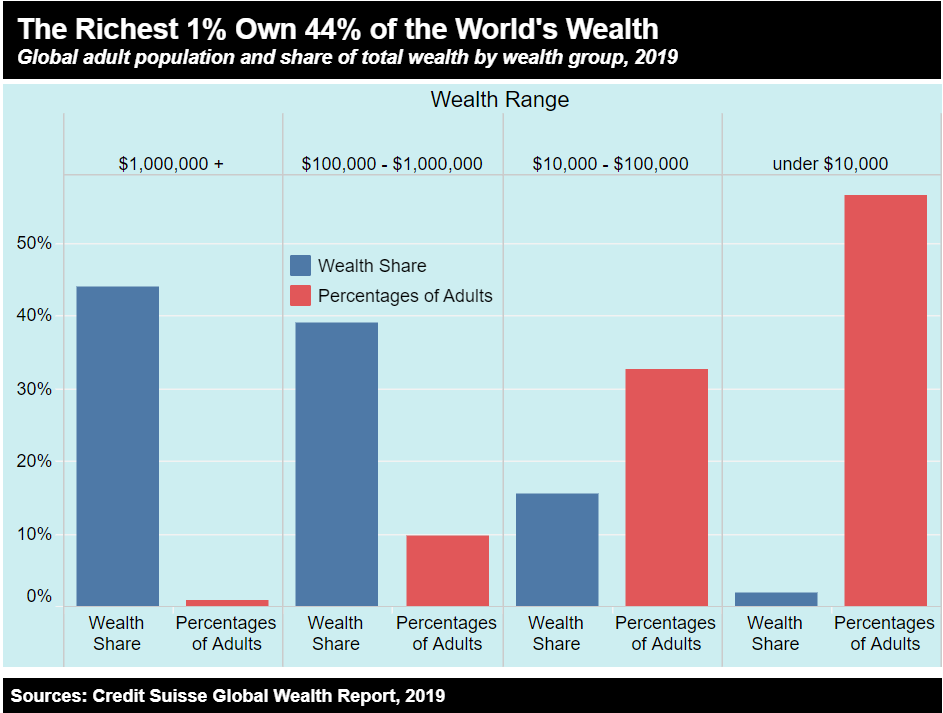

The Achilles' heel of U.S. economy is that the cost of economic downturn falls disproportionately on those who are least able to absorb the negative shock

We all lose out as a result

The Achilles' heel of U.S. economy is that the cost of economic downturn falls disproportionately on those who are least able to absorb the negative shock

We all lose out as a result

This is what our book, house of debt, was focused on.

Unfortunately not much has happened to address this lack of demand-side resilience

I hope this changes too.

Unfortunately not much has happened to address this lack of demand-side resilience

I hope this changes too.

• • •

Missing some Tweet in this thread? You can try to

force a refresh