0/ Tokenomics Tips - Token Float

Launching with a tiny token float has a high potential for short term euphoria at the cost of long term pain

Launching with a tiny token float has a high potential for short term euphoria at the cost of long term pain

1/ Why do so many projects launch w/ low float?

(a) Early venture investors & team have lockups & vesting to ensure long term alignment

2017/2018 era saw little lockups/vesting and funds would be quick to flip & dump projects on TGE so this is a good change

(a) Early venture investors & team have lockups & vesting to ensure long term alignment

2017/2018 era saw little lockups/vesting and funds would be quick to flip & dump projects on TGE so this is a good change

2/ (b) $YFI fair launch meme worked out alright

But this is more so the exception than the rule - all of the inflation hit within first week of launch which is materially different from inflation over multiple years

But this is more so the exception than the rule - all of the inflation hit within first week of launch which is materially different from inflation over multiple years

3/ Why is it so bad to have a low token float?

Because crypto markets are inefficient and the lack of supply (vs demand) results in an overly inflated FDV

People that receive inflation recognize the out of whack FDV creating heavy dumping pressure and declining token price

Because crypto markets are inefficient and the lack of supply (vs demand) results in an overly inflated FDV

People that receive inflation recognize the out of whack FDV creating heavy dumping pressure and declining token price

4/ Early token buyers and holders i.e. community members all get cucked

Community morale declines, people capitulate and stop paying attention to the project

You lose your biggest evangelists, talent pool, and contributors

Community morale declines, people capitulate and stop paying attention to the project

You lose your biggest evangelists, talent pool, and contributors

https://twitter.com/Rewkang/status/1283543960468652033

5/ Project team members lose productivity having to constantly deal with negativity and price trolling in the community chats

It takes away from research, development, building product, etc

It takes away from research, development, building product, etc

6/ That's not all. Your liquidity mining programs are denominated in the token. The incentives become less and less attractive. Accordingly, protocol liquidity growth slows.

If liquidity decreases, you're in for some real reflexive pain with token price & liquidity spiraling

If liquidity decreases, you're in for some real reflexive pain with token price & liquidity spiraling

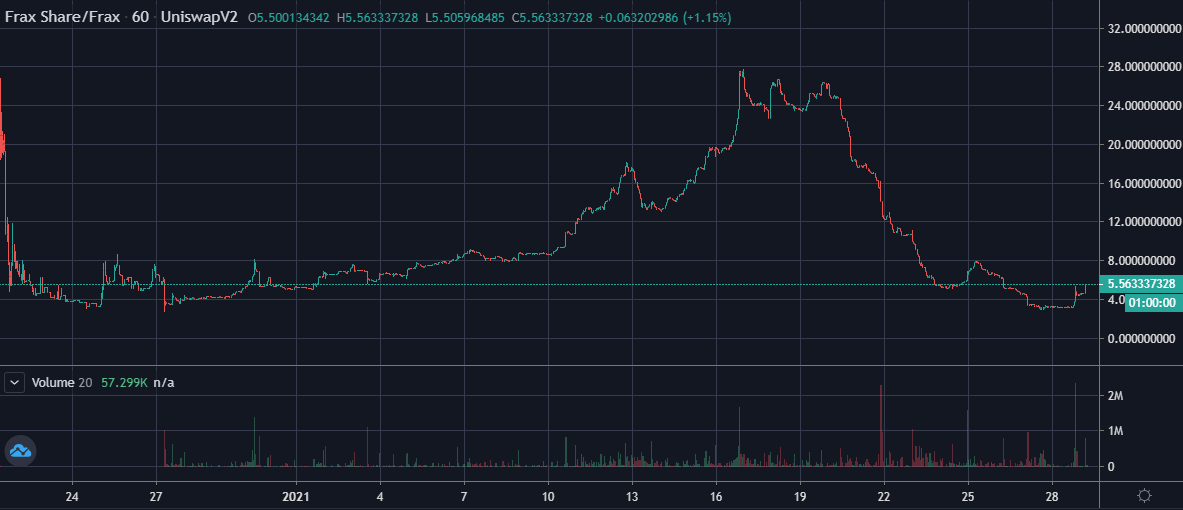

7/ There are many projects that recently launched at risk of these circumstances. A few that have been around longer and through the process already include Mstable ($MTA), Curve ($CRV), and Hakka ($HAKKA)

8/ These projects had great teams which helped them weather the storm, but these storms can be avoided by launching w/ a larger circulating supply and softer inflation

9/ How to increase initial token float?

- Retroactive airdrop to previous product users proportional to usage/utility created

- Larger public sale (this also allows for better initial price discovery and token distribution to project enthusiasts)

- Retroactive airdrop to previous product users proportional to usage/utility created

- Larger public sale (this also allows for better initial price discovery and token distribution to project enthusiasts)

10/

- Rewarding other contributors (educators, community admins, ecosystem devs, idea contributors, etc.)

- seeding large amount of AMM liquidity/market making

- small unlock for early investors that supported team for a significant time before TGE

- Rewarding other contributors (educators, community admins, ecosystem devs, idea contributors, etc.)

- seeding large amount of AMM liquidity/market making

- small unlock for early investors that supported team for a significant time before TGE

11/ >20% initial circulating supply and <150% inflation are metrics to aim for with some wiggle room for initial float if inflation is lower

>200% annual inflation is generally very tough for markets to sustain

>200% annual inflation is generally very tough for markets to sustain

12/ Some builders prefer to ignore prices, but price trajectory is intertwined with protocol growth. Giving your early supporters a good entry and the opportunity to grow with you can make a huge impact

https://twitter.com/statelayer/status/1366519486661226505

• • •

Missing some Tweet in this thread? You can try to

force a refresh