0/ Teaching an old DEX new tricks ($BNT)

4 months ago, Bancor released their flagship single sided Impermanent Loss protection solution for LPs.

70x increase in TVL and 55x increase in volume later,

I present a deep dive on a forgotten DEX that may be the dark horse of 2021

👇

4 months ago, Bancor released their flagship single sided Impermanent Loss protection solution for LPs.

70x increase in TVL and 55x increase in volume later,

I present a deep dive on a forgotten DEX that may be the dark horse of 2021

👇

1/ Story so far

Bancor is a OG DEX launched in 2018 (to much fanfare) but suffered from an overcomplicated token model and lacked noticeable traction despite lofty promises.

venturebeat.com/2017/12/12/6-m…

Bancor is a OG DEX launched in 2018 (to much fanfare) but suffered from an overcomplicated token model and lacked noticeable traction despite lofty promises.

venturebeat.com/2017/12/12/6-m…

2/ After 2 years of behind the scenes product iteration and a leadership reshuffle, the original Bancor vision is being realised. Consequently, the Bancorian community is stronger than ever led by @yudilevi @NateHindman @MBRichardson87.

3/ The Bancor Thesis

The TLDR is simple. Create a highly desired product with insane tokenomics that goes unnoticed by the market.

1. Single sided IL Insured Liquidity Provision

2. Immense liquidity sinkhole tokenomics

3. Extremely underpriced relative to broader DEX peers

The TLDR is simple. Create a highly desired product with insane tokenomics that goes unnoticed by the market.

1. Single sided IL Insured Liquidity Provision

2. Immense liquidity sinkhole tokenomics

3. Extremely underpriced relative to broader DEX peers

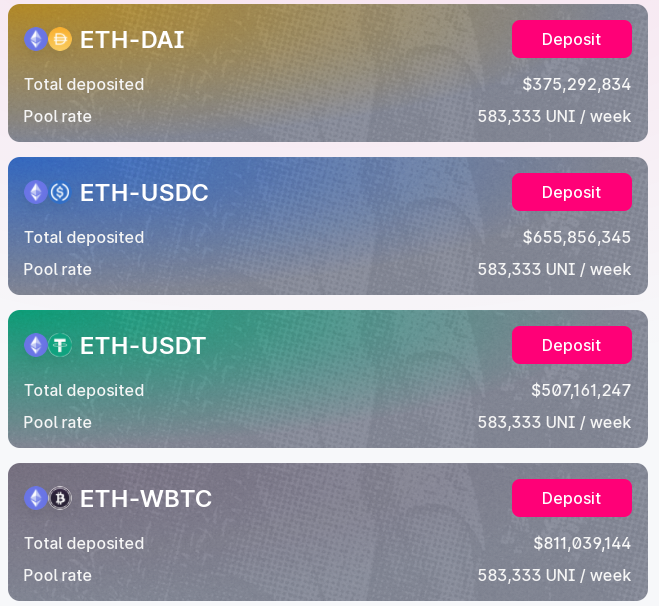

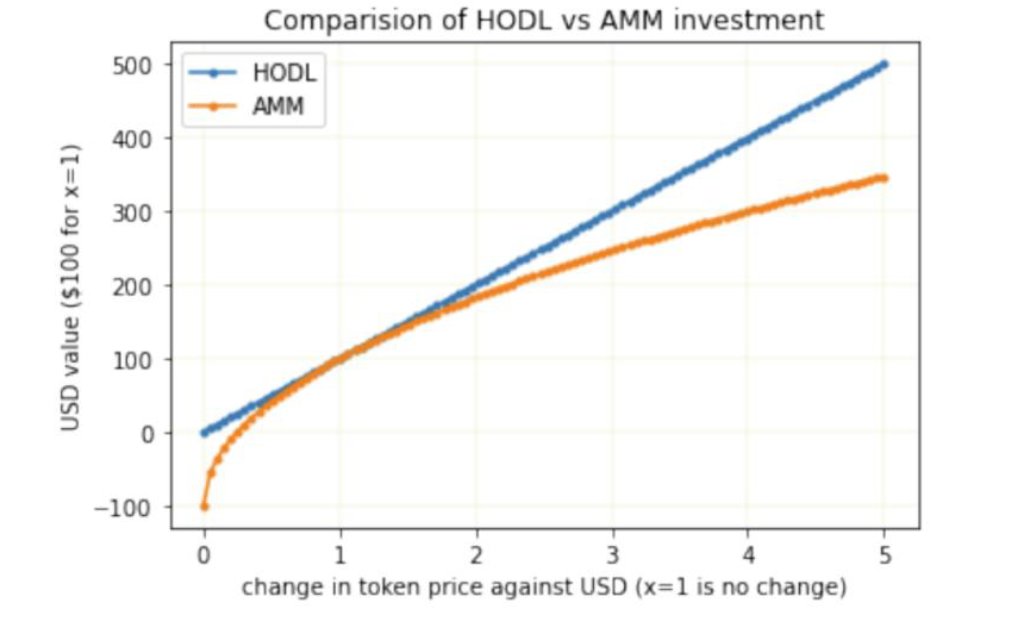

4/ IL Insurance

IL has been a major pain point for LPs since the inception of AMMs. With Bancor 2.1, LPs can now stake single sided assets to earn 60-100% yields and receive FULL IL protection.

This is material as it is the Pareto Optimal choice for all LPs

IL has been a major pain point for LPs since the inception of AMMs. With Bancor 2.1, LPs can now stake single sided assets to earn 60-100% yields and receive FULL IL protection.

This is material as it is the Pareto Optimal choice for all LPs

5/ IL Insurance

How does this work?

Bancor uses a portion of swap fees generated across all pools to pay for protocol wide realised IL.

For every $1 in earned swap fees, ~2.8c is used to cover realised IL. No $BNT is minted or issued to subsidize this.

How does this work?

Bancor uses a portion of swap fees generated across all pools to pay for protocol wide realised IL.

For every $1 in earned swap fees, ~2.8c is used to cover realised IL. No $BNT is minted or issued to subsidize this.

6/ IL Insurance

This means that Bancor has created a self-sustaining non subsidized solution for IL. The catch? You have to keep your tokens staked for 100 days.

This is crucial to unlock capital lower down the risk curve that can now obtain IL free single sided exposure

This means that Bancor has created a self-sustaining non subsidized solution for IL. The catch? You have to keep your tokens staked for 100 days.

This is crucial to unlock capital lower down the risk curve that can now obtain IL free single sided exposure

7/ BNT Sinkhole

Bancor's token model is by far the most elegant one to date (matched only by $SNX). By integrating $BNT as the base asset, liquidity providers and tokenholders are one and the same.

@shomakishi details below:

Bancor's token model is by far the most elegant one to date (matched only by $SNX). By integrating $BNT as the base asset, liquidity providers and tokenholders are one and the same.

@shomakishi details below:

https://twitter.com/shomakishi/status/1366415317321342978?s=20

8/ BNT Sinkhole

As a $BNT holder, there is an immense incentive to stake your BNT (thereby improving the liquidity of the protocol) to earn IL free 50-100% APYs. Since v2.1, BNT staked on the platform has shot up tremendously (currently 61%)

h/t @fiebsy

As a $BNT holder, there is an immense incentive to stake your BNT (thereby improving the liquidity of the protocol) to earn IL free 50-100% APYs. Since v2.1, BNT staked on the platform has shot up tremendously (currently 61%)

h/t @fiebsy

9/ Bancor Vortex

But this is just one part of the sinkhole puzzle...enter Vortex. An extension on BNT's capital efficiency by offering interest and liquidation free leverage capped at 1.0x

How does it work? See below.

But this is just one part of the sinkhole puzzle...enter Vortex. An extension on BNT's capital efficiency by offering interest and liquidation free leverage capped at 1.0x

How does it work? See below.

10/ Bancor Vortex 🌀

With this mechanism, by holding $BNT, you can:

1. Stake BNT to earn swap fees + LM rewards

2. Obtain vBNT to deposit into Vortex and borrow more BNT (whilst earning LM rewards)

3. Use borrowed BNT to buy any asset with NO interest or liquidation risk.

With this mechanism, by holding $BNT, you can:

1. Stake BNT to earn swap fees + LM rewards

2. Obtain vBNT to deposit into Vortex and borrow more BNT (whilst earning LM rewards)

3. Use borrowed BNT to buy any asset with NO interest or liquidation risk.

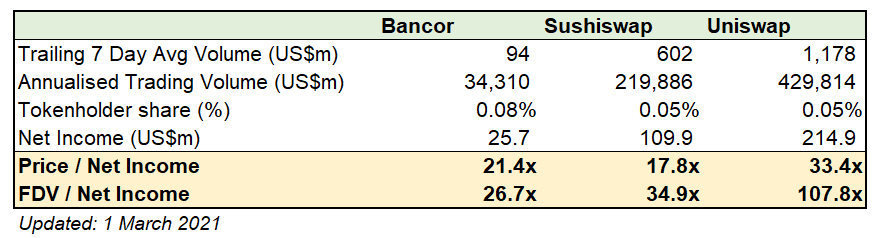

11/ Benefits of the TKN / BNT model

Due to the token model above, $BNT stakers also receive the highest swap fees across all DEXs.

Per transaction:

Bancor: 8bps

Sushiswap: 5bps

Uniswap: 5 bps (incl fee switch)

This effectively results in higher net margins for BNT holders

Due to the token model above, $BNT stakers also receive the highest swap fees across all DEXs.

Per transaction:

Bancor: 8bps

Sushiswap: 5bps

Uniswap: 5 bps (incl fee switch)

This effectively results in higher net margins for BNT holders

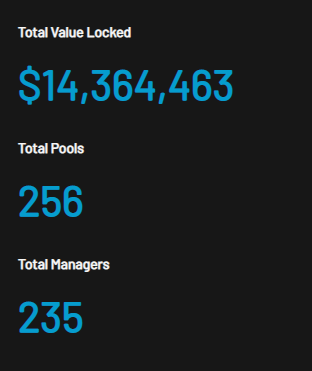

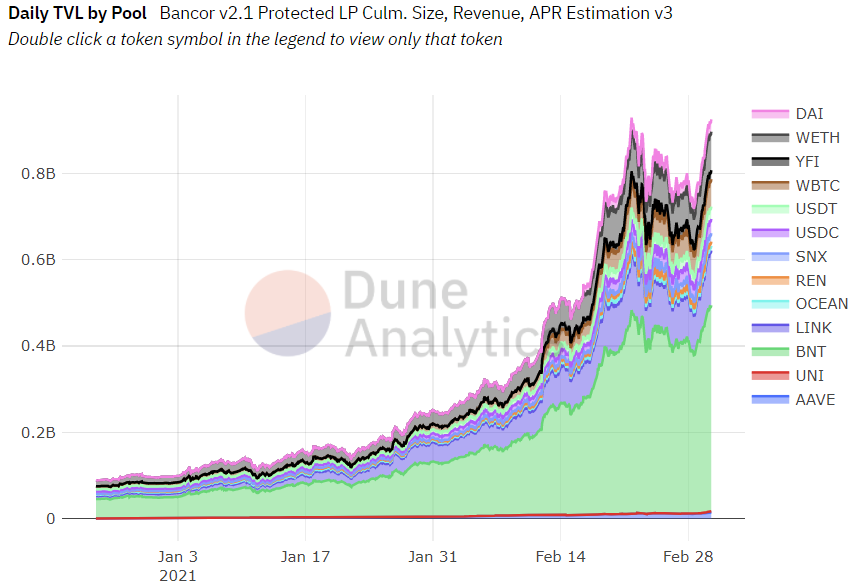

10/ Traction

As a result of these new innovations, Bancor has found its growing niche within the market. Comparing TVL and Volume from Oct 2020:

TVL: $15m ➡️ $1,050m (70x growth)

Daily Volume: $1.3m ➡️ $71.5m (55x growth)

As a result of these new innovations, Bancor has found its growing niche within the market. Comparing TVL and Volume from Oct 2020:

TVL: $15m ➡️ $1,050m (70x growth)

Daily Volume: $1.3m ➡️ $71.5m (55x growth)

13/ Valuation

Despite the parabolic growth, $BNT is still trading relatively cheaply vs other DEXs. Based on common metrics, $BNT and $SUSHI seem to be the most undervalued.

Despite the parabolic growth, $BNT is still trading relatively cheaply vs other DEXs. Based on common metrics, $BNT and $SUSHI seem to be the most undervalued.

14/ Valuation

This comparison is material because it severely underprices both Bancor's past & future growth opportunities. Seen below, Bancor and Dodo have most aggressively captured DEX market share in recent weeks.

I suspect it will not stop here for Bancor either.

This comparison is material because it severely underprices both Bancor's past & future growth opportunities. Seen below, Bancor and Dodo have most aggressively captured DEX market share in recent weeks.

I suspect it will not stop here for Bancor either.

15/ The Road Ahead

After 2 years, Bancor v2.1 has achieved superior PMF. With its flagship IL Insurance, Bancor is just beginning to unlock the synergies arising from their unique BNT model. Further improvements to Bancor Vortex will allow for greater capital efficiency as well

After 2 years, Bancor v2.1 has achieved superior PMF. With its flagship IL Insurance, Bancor is just beginning to unlock the synergies arising from their unique BNT model. Further improvements to Bancor Vortex will allow for greater capital efficiency as well

16/ Conclusion

The way Bancor is designed, $1bn TVL is just the beginning. Its possible we see billions of dollars of liquidity inflows seeking IL free yields in the near future.

2021 may just be the year for Bancor to become the dark horse DEX contender.

The way Bancor is designed, $1bn TVL is just the beginning. Its possible we see billions of dollars of liquidity inflows seeking IL free yields in the near future.

2021 may just be the year for Bancor to become the dark horse DEX contender.

17/ Disclaimer

Author currently holds positions in $BNT. Please DYOR. Feel free to DM to learn more about the $BNT token system!

Author currently holds positions in $BNT. Please DYOR. Feel free to DM to learn more about the $BNT token system!

• • •

Missing some Tweet in this thread? You can try to

force a refresh