Although the $1.9 trillion COVID relief bill under consideration addresses some key needs, some pieces could be better targeted. A redesigned plan could still provide the support necessary to fight the virus and support a strong economic recovery.

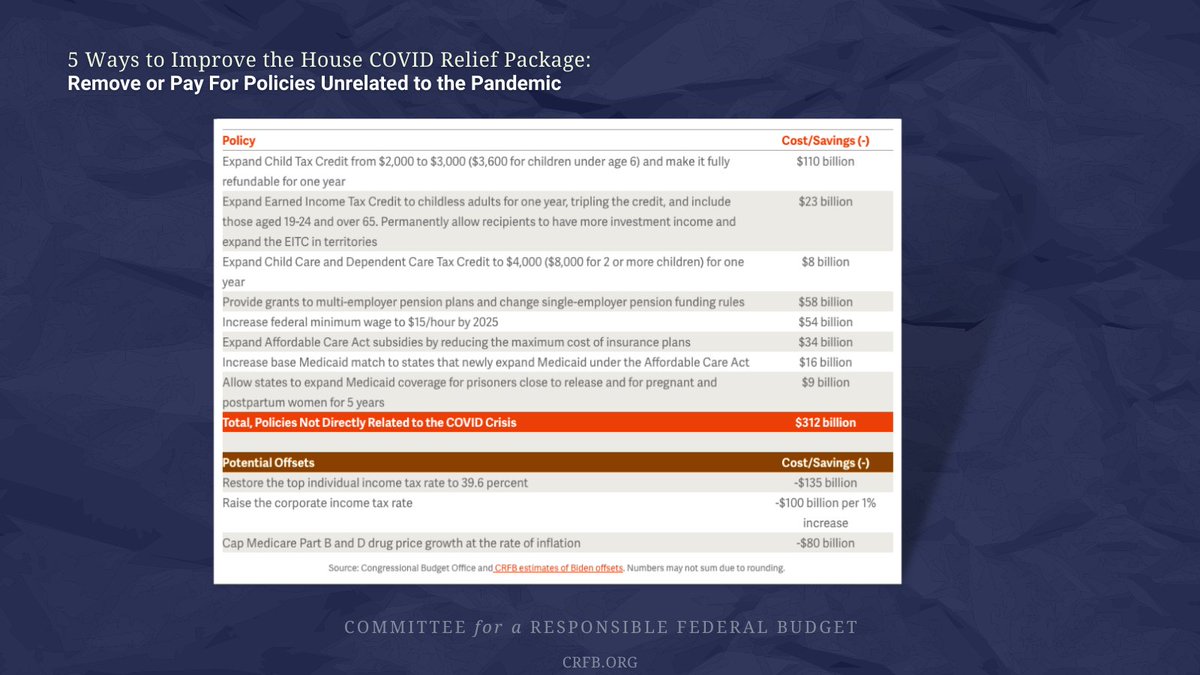

The House #COVIDrelief package includes about $312B of policies developed long before the #COVID crisis, not in response to it. Many of these policies are worthwhile but should be paid for and made permanent parts of the tax code or budget.

Policymakers could offset these policies by raising the top individual income tax rate for high earners back to 39.6% or increasing the corporate income tax rate.

The House bill includes over $500 billion of aid to state and local governments, but many states are now seeing budget surpluses, strong revenue gains, and fewer losses than expected.

Expanded unemployment benefits, including the $300/week federal supplement, expire in mid-March. The House bill would boost this supplement to $400/week, but benefits would expire at the end of August.

A $400/week supplement would mean two-thirds of recipients would collect more in benefits than they would collect in paychecks (most income support programs are capped at 80% of wages). And it is widely expected that high levels of joblessness will continue...

...beyond August. Rather than create another unemployment benefits cliff, policymakers should consider extending the current $300 supplement and then gradually taper it down as the pandemic ends and the economy recovers.

This could allow expanded benefits to continue through the end of 2021 at a net cost of $50 to $75 billion.

Senate lawmakers are currently reviewing the bill and have proposed tighter restrictions for the $1,400 per person rebate checks. The House had proposed phasing out payments between $75,000 and $100,000 of individual income ($150,000 and $200,000 of family income).

Under the House version, a family of five that made $130,000 in 2019 and saw its income rise to $150,000 in 2020 would receive $7,000 of additional money, on top of the $3,000 received in January and $3,900 received last spring.

Adjusting the phase outs could lower the cost of the bill and still get relief to households in need

As negotiations continue, you can check out our suggestions for improving the $1.9 trillion package here: crfb.org/blogs/five-way…

• • •

Missing some Tweet in this thread? You can try to

force a refresh