1/21 I have been asked by many people if there are any LBMA vault custodian or subcustodian concerns. Upon investigation this is what I found. Auditing responsibilities of LBMA vaults in London may surprise you.

2/21 Are audits required by the LBMA for vault custodians or are audits the responsibility of the customer storing the metal? The following information is supported by publicly available documents.

3/21 In a February 3, 2014 letter to the SEC, a law firm representing Brinks discusses custody and transportation services in both the USA and United Kingdom.

sec.gov/divisions/inve…

sec.gov/divisions/inve…

4/21 The letter mentions on page 8, “The LBMA does not have any specific membership requirements related to vaults.” The letter then references the LBMA publication, Best Practice Guidelines; Used by "Loco London" Vaults Opening a new vault for the storage of precious metals

5/21 (Sept. 2012) (the "LBMA Best Practices")

lbma.org.uk/assets/Best_pr…

lbma.org.uk/assets/Best_pr…

6/21 In these guidelines, is a very carefully crafted statement. Read slowly! “When your vault is operational you should expect your customers to ask to perform regular audits of your facility and the stock that you hold of on their behalf.”

7/21 Unlike the Comex where independent audits are required of the vault custodian of all holdings relating to metals reported in the registered category, LBMA reflects that responsibility back to the customer.

8/21 What does this mean? Neither the LBMA nor the vault is required or is responsible for providing independent audits of allocated or unallocated holdings. The customer is 100% responsible for auditing and verifying its holdings.

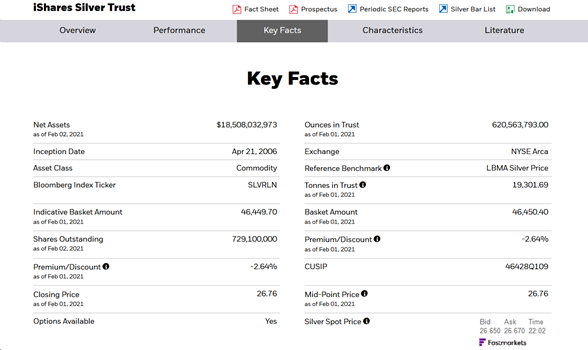

9/This is brought to light by ETFs who custody their metal in London. Interestingly, the obligations of the Custodian under the Custody Agreements are governed by English law. Page 28 of the SEC filing for GLD provides more transparency on what this means.

sec.gov/Archives/edgar…

sec.gov/Archives/edgar…

10/21 “Under English law, neither the Trustee nor the Custodian would have a supportable breach of contract claim against a subcustodian for losses relating to the safekeeping of gold.

11/21 If the Trust’s gold is lost or damaged while in the custody of a subcustodian, the Trust may not be able to recover damages from the Custodian or the subcustodian.”

12/ GLD“the obligations of any subcustodian of the Trust’s gold are not determined by contractual arrangements but by LBMA rules and London bullion market customs and practices,which may prevent the Trust’s recovery of damages for losses on its gold custodied with subcustodians”

13/21 On page 15 of the most recent 2020 10K filing by GLD, similar disclosures were expounded. “In accordance with LBMA practices and customs, the Custodian does not have written custody agreements with the subcustodians it selects.

14/21 The Custodian’s selected subcustodians may appoint further subcustodians. These further subcustodians are not expected to have written custody agreements with the Custodian’s subcustodians that selected them. The lack of such written contracts could affect the recourse

15/21 of the Trust and the Custodian against any subcustodian in the event a subcustodian does not use due care in the safekeeping of the Trust’s gold. See “Risk Factors—The ability of the Trustee and the Custodian to take legal action against subcustodians may be limited.”

16/21 And if that was not enough to concern you, take a look at page 16 of the same GLD 2020 10K filing. “The Custodian and the Trustee do not require any direct or indirect subcustodians to be insured or bonded with respect to their custodial activities.” spdrgoldshares.com/media/GLD/file…

17/21 Many ETFs have one Custodian which then hires sub-custodians to hold more of the trust’s assets. LBMA’s own rules may greatly limit recourse when subcustodians are involved. Counterparty risk and systemic risk could jeopardize one’s investment which they bought metals for.

18/21 If you are confused or concerned after reading this, wouldn’t simply buying physical metal held under your own possession or title make much more sense?

19/21 There is no question London provides a very deep and beneficial market for precious metals producers, users, and financial intermediaries.

20/21 I implore individuals and institutions investing in metal longer term to understand the risks inherent with structured programs or funds from a convenience or “qualified custodian” perspective.

21/21 “Directly held” metal can help avoid unnecessary systemic or counterparty risks and allow the investor greater control over their investment.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh