I first experienced financial markets as a young boy, going to the stockbroking firm my mother worked at in the evenings and on Saturday morning (Mom often worked late, and we didn’t have a helper until my sister was born, so this was early-80s-style childcare). (1/n)

My first few temporary jobs were also in the back offices of different financial firms. That’s what got me interested in international finance to begin with, a field I would write several theses about and go on to get a PhD. It is my (intelectual) first love. (2/n)

Although I now ply my trade at a university, most of my career has actually been outside of academia; in a think tank, an international financial institution, and a sovereign wealth fund. Each offered a different perspective on financial markets, which I value deeply. (3/n)

When we look at financial markets—especially in foreign exchange, the largest market in the world—it is tempting to think of them as wild and mysterious. Currency crises, stock market crashes, and bubble events like GameStop or Tulipomania tend to reinforce that view. (4/n)

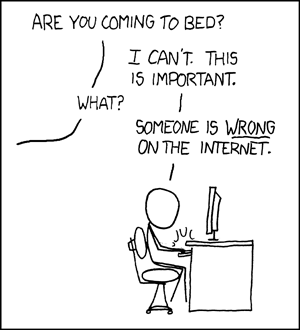

But most long-time observers of markets—academic or practitioner—will concede that markets tend toward efficiency. While few take the most extreme view that market prices are always and everywhere correct, many shirts have been lost thinking one is smarter than the market. (5/n)

In fact, if “incorrect” pricing were so easy to detect, someone would have made money off that trade already (this is the “weak” form of the efficient markets hypothesis). That reasoning, in and of itself, is why prices cannot deviate too far from what fundamentals dictate. (6/n)

It is persistent deviations that tend to give rise to violent corrections. That’s why it makes sense to allow the market to do the work for you. If we eschew the sort of market manipulation that would throw us off fundamentals, speculation can actually be stabilizing. (7/n)

This isn’t some abstract theoretical concept. Our financial markets hire tens of thousands of professionals dedicated to trading that keeps markets efficient. The fact that sharp market movements are so infrequent speaks to the inherent reality of stabilizing speculation. (8/n)

One could make money (lots of it) on destabilizing speculation, of course (these are mostly momentum or trend-following traders). But those that are most celebrated—think the Soros ‘92 pound bet, or the Paulson CDS trade—were just early, not wrong. (9/n)

To prove this point, just put one’s money where one’s mouth is: if one thinks that speculation is usually destabilizing, go ahead and take the other end of that trade. More than 90% of market professionals will tell you, it’s harder to beat the market than it looks. (10/n)

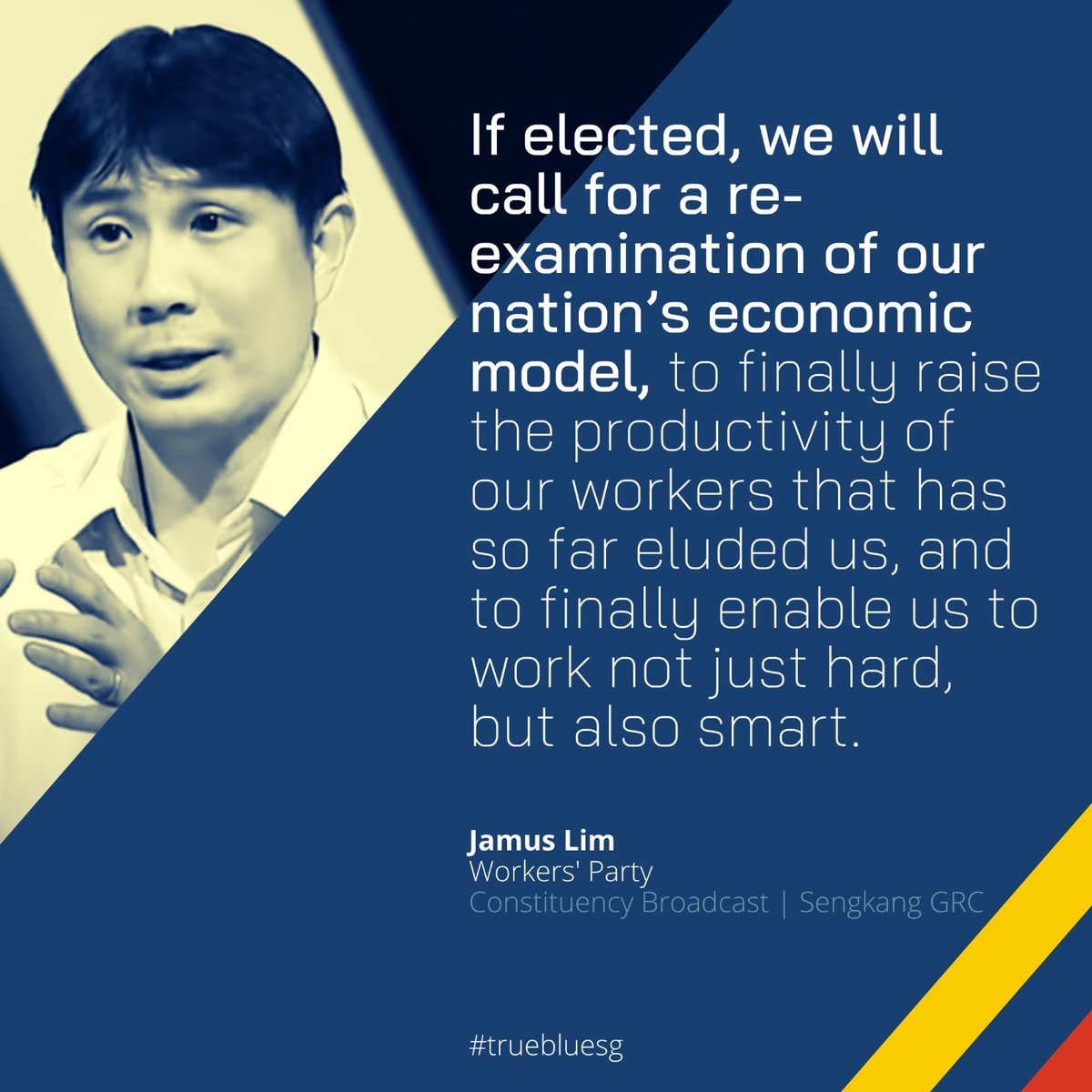

This is why I actually favor transparency in our reserve holdings. As long as we aren’t tying our exchange rate to a level inconsistent with fundamentals, we need not fear the power of information. (n/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh