This was fun to write w/ @tragicbios (and w/ much-appreciated help from @hassankhan). More to come...

"Supplying Demand: The Chip Shortage in Macro Context"

tl;dr Supply & demand are highly intertwined; econ policy should not the treat two as independent

employamerica.medium.com/supplying-dema…

"Supplying Demand: The Chip Shortage in Macro Context"

tl;dr Supply & demand are highly intertwined; econ policy should not the treat two as independent

employamerica.medium.com/supplying-dema…

The semiconductor chip shortage has made headlines and been a rare source of bipartisan concern. But the shortage reflects something intellectually impt: supply and demand are deeply cointegrated. This often gets lost in the intro econ textbook portrayal (both micro & macro)

Current shortage is not because of a supply disruption, but because supply is now having to play catch-up to surprising demand. After 20yrs of underwhelming business demand for tech equipment along with other trends, not a surprise that existing capacity was not well-prepared.

Through the 2010s, there was a lot of handwringing about why productivity growth & investment were weak (particularly so for high-tech equipment). Commentators pointed to technology, globalization, demographics, inequality, and yet...

...in a pandemic-induced recession, we've broken out of a stagnant investment regime. How did businesses break away from rational propensity to hoard in such instances? Some of this is transitory work-from-home demand, but spending has increased for successive quarters now

Yes this recession is different, but a big part of the shift from hoarding to spending can be explained by the historic scale, speed and scope of the fiscal & monetary policy response. For spending to happen, private sector must have both willingness & balance sheet capacity

Cyclical, interest-rate sensitive sectors that struggled to recover after the global financial crisis saw a surging recovery as a result. Automakers, caught offsides amidst this chip shortage, saw demand fully recover much faster than was expected 12 months ago.

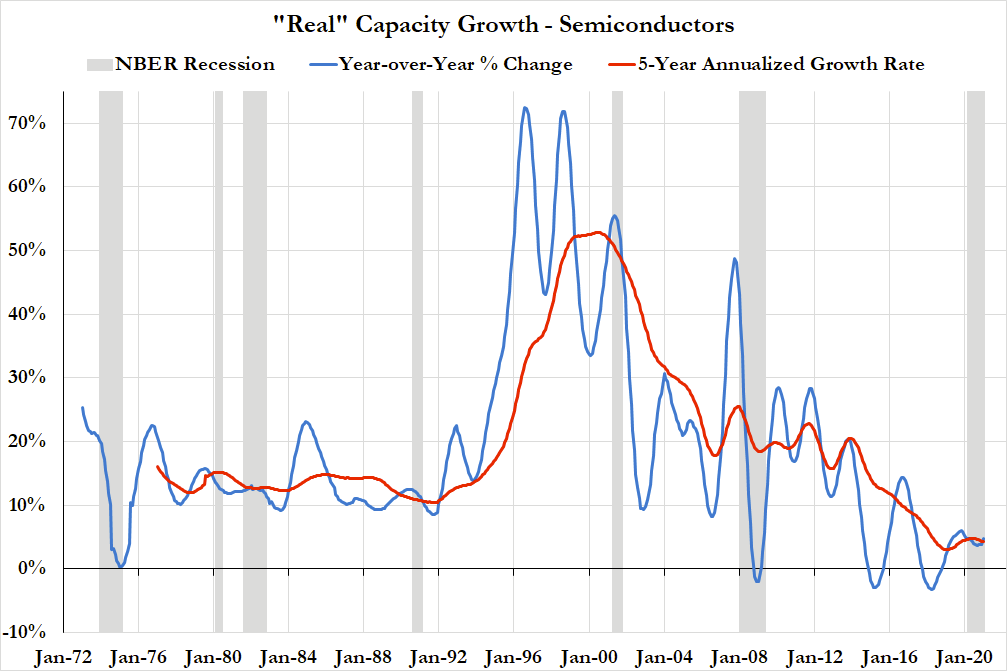

Which gets us to the challenges within semiconductor manufacturing. Current capacity is a function of realized demand and expected demand. In the 1990s, demand ran very close to current capacity, and that motivated capacity expansion. Since the 2001 recession, demand has lagged

In manufacturing, and especially so for semiconductors, it takes time to get yields up and for investments to fully pay off. The financial viability of new investment is highly contingent on the demand outlook

https://twitter.com/anjani_trivedi/status/1364392830450294785?s=20

If demand underwhelms, capacity underutilization will disincentivize investment and employment in the sector. Employment in semiconductor mfg and adjacent mfg sectors also peaked prior to the 2001 recession and it too never really recovered.

This reality is not isolated to semiconductor mfg. Manufacturing endured not just a jobless recovery from the 2001 recession, but a jobless expansion. The jobs also weren't merely replaced in other sectors tied to capital formation (construction, intellectual property production)

Also important to note that while it's easy to write off certain segments of manufacturing as "uncompetitive" and low value-add (and thus rational to offshore), it's hard to make the same case for semis. Technical and institutional knowledge is not easily replaceable

If you listened to Odd Lots' recent episodes with @tculpan or @WillyShih_atHBS or read @anjani_trivedi's most recent column, it should be clear that the know-how required here can amount to a substantial strategic advantage bloomberg.com/opinion/articl…

Under-investment is not self-correcting.

Under-employment is not self-correcting.

Recessions are not self-correcting.

These challenges warrant ambitious policy responses and skillful coordination across the public and private sector.

Under-employment is not self-correcting.

Recessions are not self-correcting.

These challenges warrant ambitious policy responses and skillful coordination across the public and private sector.

The right answer here is not solely "throw money" at the problem, but it does require a richer view of what public support can amount to. The govt's uniquely flexible balance sheet is powerful for reducing uncertainty, improving optionality, and solving collective action problems

If you get stuck in the false separation of "supply policy" from "demand policy," you'll end up fear-mongering about how a pandemic will lead to 1970s inflation and dilute the potential policy response (see Rogoff's columns from last year).

If you take the "non-excludable" "nonrivalrous" def'n of public goods, you might miss how mfg capacity, w/ its front-loaded costs + uncertain/backloaded payoffs, can amount to critical supply chain infrastructure. Govts can transform uncertainty into private sector optionality

There is also the challenge of developing solutions for the technological frontier. It is best to think beyond what @hassankhan narrowly calls "science policy" (NSF grants, public R&D fixation). Policy must be calibrated to fostering a robust ecosystem of firms and supply chains

These efforts will require public-private coordination, flexible use of the govt's balance sheet, and collective political will. If they materialize, labor mkt opportunities can persistently expand both in quantity and quality, while also benefitting society's productive capacity

• • •

Missing some Tweet in this thread? You can try to

force a refresh