Let's take a look at the #DeFi lending space.

1/ Unlike DEXs, it's so small so that its important participants can be counted on one hand.

1/ Unlike DEXs, it's so small so that its important participants can be counted on one hand.

2/ Yes, there is also #DYDX but it offers lending only for $DAI, $USDC & $ETH (v low rates). Plus it doesn't have its own token(yet) so I'll skip this one.

4/ then there is $CEL with a nice $1B+ TVL but it sparks lots of controversy about not being decentralized. They seem to be fixing that tho:

prnewswire.com/news-releases/…

prnewswire.com/news-releases/…

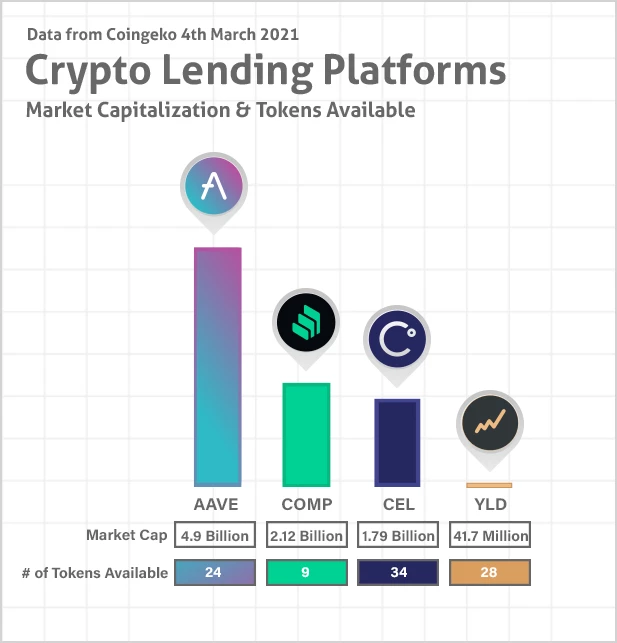

5/ Then, we have our beloved big boys $AAVE & $COMP which are superb (god bless flash loans) but their lenders can't predict the outcome on their deposits either as often rates trend towards 0% as well.

6/ On top of that, as stated by @MessariCrypto, their utilization rates are not so great as none of the big bois utilizes more than 50% of their user's deposits.

https://twitter.com/asiahodl/status/1362079761418252288

7/ Which means that a ton of idle capital is waiting on the sidelines.

This is where @YieldCredit enters the game with its P2P lending platform that offers fixed interest rates.

This is where @YieldCredit enters the game with its P2P lending platform that offers fixed interest rates.

8/ @YieldCredit hit mainnet just yesterday and people barely know about it.

Yup, it's far from being perfect but has the first-mover advantage in a huge P2P market (valued at $68B in $TradFi and that sector doesn't exist in #Defi at all!)

Yup, it's far from being perfect but has the first-mover advantage in a huge P2P market (valued at $68B in $TradFi and that sector doesn't exist in #Defi at all!)

9/

As of today, $YLD is valued at a mere $42M.

Will it combat big defi lending bois? Hell no.

Will it eat their piece of cake? Hell yes.

As of today, $YLD is valued at a mere $42M.

Will it combat big defi lending bois? Hell no.

Will it eat their piece of cake? Hell yes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh