Gonna write a bit more about $SWTH TradeHub since I'm bullish on it.

Mini Thread 👇

Mini Thread 👇

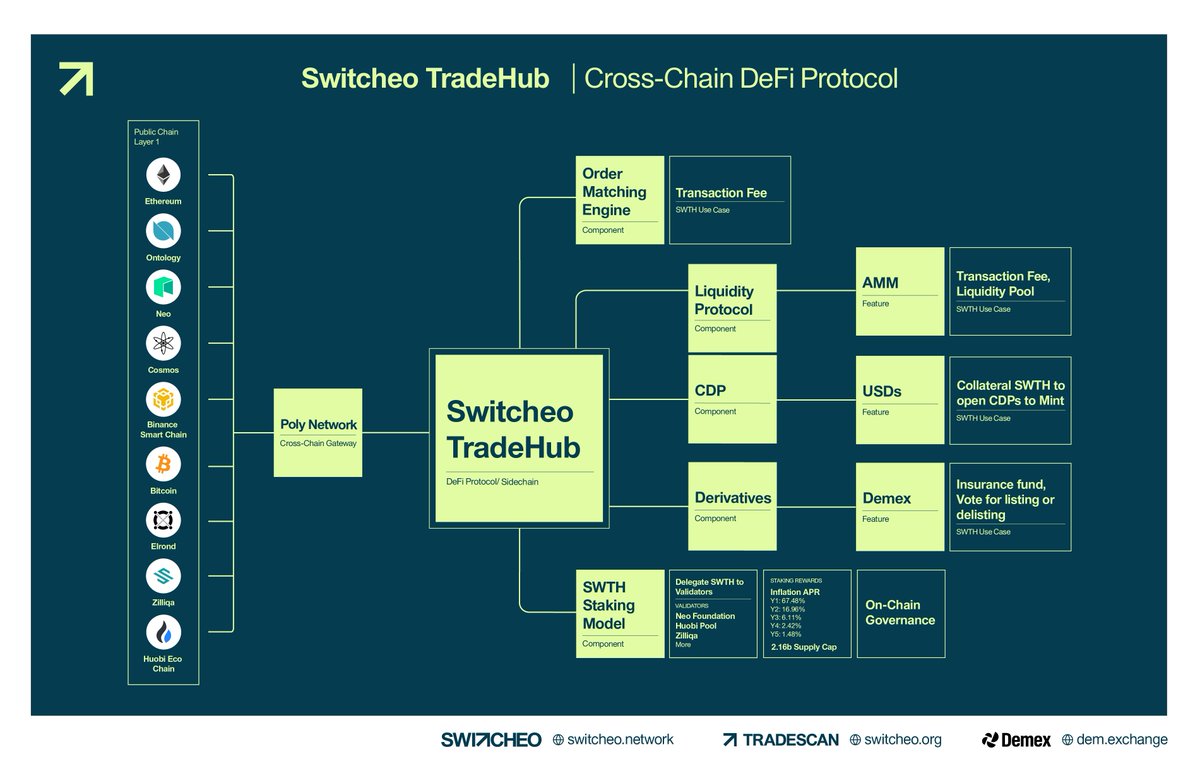

What is it? @SwitcheoNetwork TradeHub is a cross-chain DeFi protocol that serves as a decentralised bridge + exchange for assets living on other chains. Essentially, you can bridge tokens like ( $ETH, $BTC, ERC20, BEP20, ZRC2 ) over to this Layer 2 and trade at lightning speed.

Why should it exists? Currently, trades execute atomically on smart contract L1s (Ethereum, NEO, BSC, Zilliqa), but L1s latency is an issue that can never be solved. This makes it a problem to support CLOB-based markets for spot and futures (physical and perp). Hence, TradeHub...

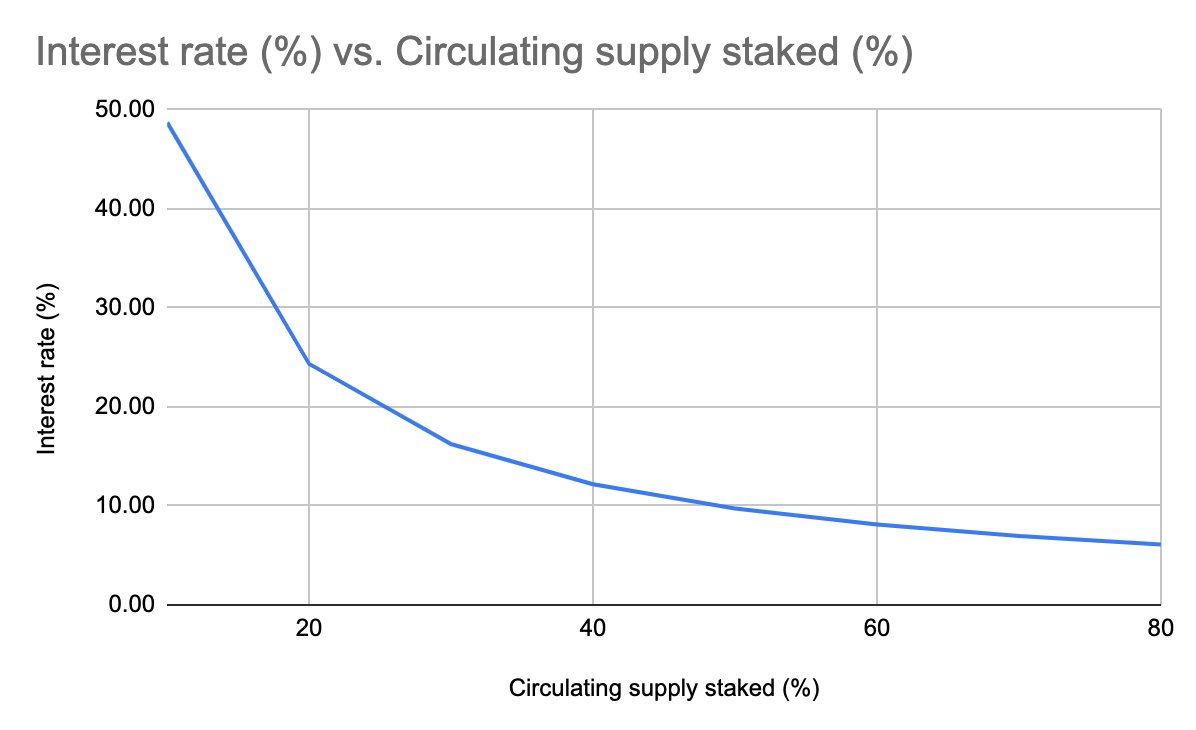

Built using Tendermint SDK, it is a performant L2 sidechain that is secured by its own $SWTH stakers. The current staking stats is impressive:

1⃣ ~70% of circulating supply staked

2⃣ Staking APR is at ~50%

3⃣ 21 active validators, 27 total. Top 6 holds < 47% of cumulative stake.

1⃣ ~70% of circulating supply staked

2⃣ Staking APR is at ~50%

3⃣ 21 active validators, 27 total. Top 6 holds < 47% of cumulative stake.

$SWTH stakers are eligible to earn:

- 100% of trading fees earned by the platform in the form of the traded tokens

- $SWTH inflationary rewards every block

- 🔜 Debt liquidation rewards

- 100% of trading fees earned by the platform in the form of the traded tokens

- $SWTH inflationary rewards every block

- 🔜 Debt liquidation rewards

On TradeHub, there are currently a few modules that are deployed for traders:

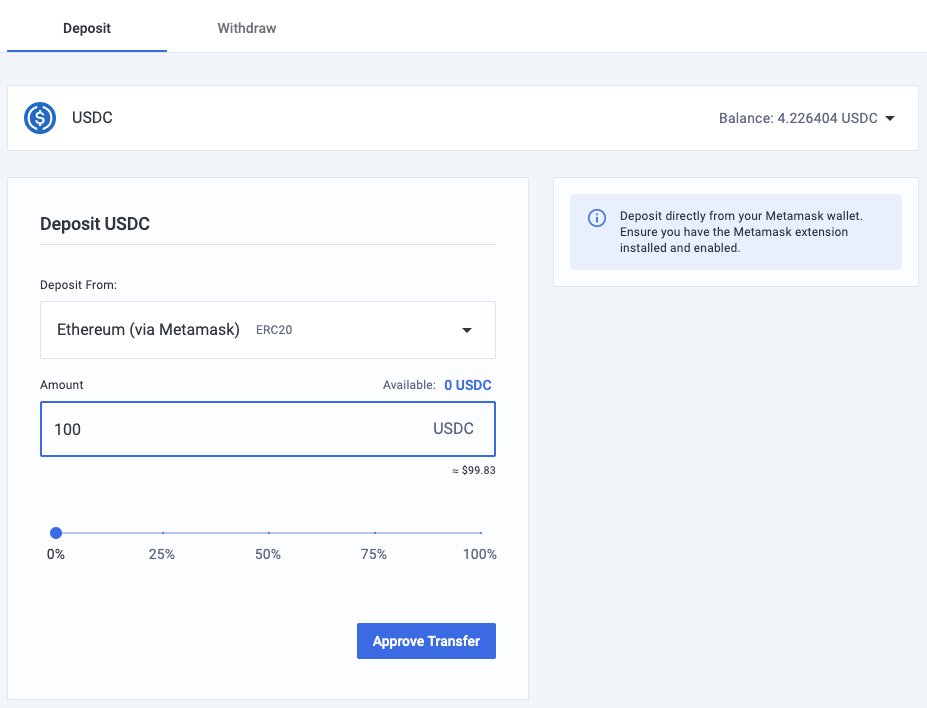

🌉 Bridge wallet module -

One-click bridge from L1s (MetaMask and Ledger supported)

⚖️ AMM spot market module -

~$12mil TVL. ~$300k daily volume

🔮 Futures module -

ETH and BTC markets. Others TBD.

🌉 Bridge wallet module -

One-click bridge from L1s (MetaMask and Ledger supported)

⚖️ AMM spot market module -

~$12mil TVL. ~$300k daily volume

🔮 Futures module -

ETH and BTC markets. Others TBD.

I mean just look at the UI for Bridging assets, do you see any complicated logics involved? This is probably the most intuitive cross-chain bridge I've ever seen...

🛣️ Future roadmap includes:

- Perpetual swap markets

- Options markets

- Synthetic stablecoin (USDs)

- Physically settled cross-chain DeFi Index Fund

- Perpetual swap markets

- Options markets

- Synthetic stablecoin (USDs)

- Physically settled cross-chain DeFi Index Fund

I think the future for Switcheo TradeHub is bright. With a strong partnership with @PolyNetwork2, it is starting to support more and more chains. Next in line is #BSC and then #Zilliqa. If you are staking since inception, you would have more than doubled your holdings by now.

Furthermore, Cosmos Gravity bridge is slated to go live this year, allowing Cosmos-based (chains built on Tendermint) assets to bridged to Switcheo Tradehub too. Significant Cosmos-based chains includes Terra ( $LUNA ), Thorchain ( $RUNE ) and Band Protocol ( $BAND ).

That's all folks... Will make a prediction here too. $SWTH should be re-rated to at least top 200 on CoinGecko by June 2021.

P.S Never bet against @Arthur_0x too.

He invested in this too. 🧐

P.S Never bet against @Arthur_0x too.

He invested in this too. 🧐

• • •

Missing some Tweet in this thread? You can try to

force a refresh