1/ The Long Run Is Lying to You (Asness)

"Valuation changes unnecessarily reduce the precision of our estimates of true long-term expected market and factor returns. The usual examination of long-run average returns is not all it’s cracked up to be."

aqr.com/Insights/Persp…

"Valuation changes unnecessarily reduce the precision of our estimates of true long-term expected market and factor returns. The usual examination of long-run average returns is not all it’s cracked up to be."

aqr.com/Insights/Persp…

2/ S&P 500

"While 6.5% a year is what you actually earned in the S&P 500, 5.2% a year is what you might long-term forecast going forward assuming neither mean reversion in CAPE (i.e., falling from its high ending value in our sample) or continued permanent expansion."

"While 6.5% a year is what you actually earned in the S&P 500, 5.2% a year is what you might long-term forecast going forward assuming neither mean reversion in CAPE (i.e., falling from its high ending value in our sample) or continued permanent expansion."

3/ Fixed Income

"A whole lot of the giant (for bonds) 4.4% a year over cash from 1984–2020 comes from the massive long-term fall in bond yields over this period. Again, I don’t think anyone should build that into their long-term estimate of bond expected return going forward."

"A whole lot of the giant (for bonds) 4.4% a year over cash from 1984–2020 comes from the massive long-term fall in bond yields over this period. Again, I don’t think anyone should build that into their long-term estimate of bond expected return going forward."

4/ USA vs. EAFE

"The USA has won over the last 30 years mostly on a revaluation from the late 1980s Japanese bubble, ending at the richest USA-vs.-world valuations we’ve seen. Building in an expectation that it will repeat (and shunning international stocks) seems ill-advised."

"The USA has won over the last 30 years mostly on a revaluation from the late 1980s Japanese bubble, ending at the richest USA-vs.-world valuations we’ve seen. Building in an expectation that it will repeat (and shunning international stocks) seems ill-advised."

5/ "Contemporaneous valuation changes can explain a lot of realized return variance... we can get more precision in our estimate of the intercept.

"Even if the Sharpe is the same, we are more certain (more precise in our estimate) of the numerator and thus of the Sharpe itself.

"Even if the Sharpe is the same, we are more certain (more precise in our estimate) of the numerator and thus of the Sharpe itself.

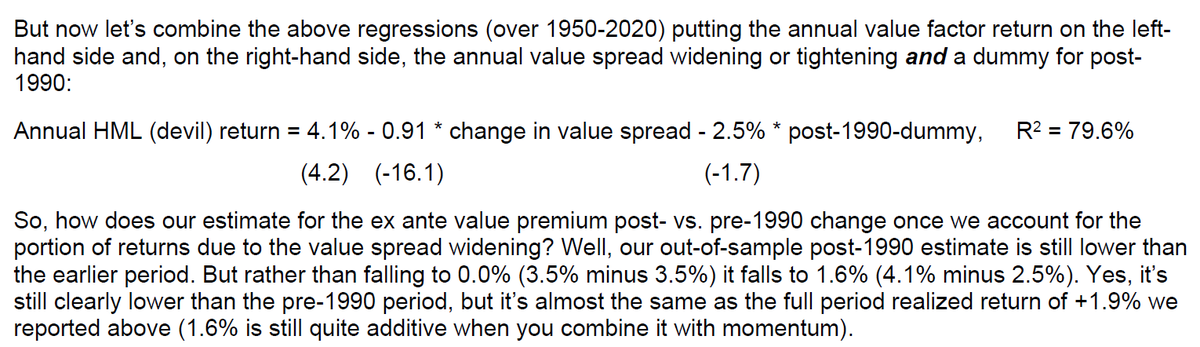

6/ "The post-1990 value failure is largely a result of changes

in the value spread. If you think this spread doesn’t

permanently widen going forward, you aren’t nearly as negative on the true expected return of value as those

looking just at realized returns."

in the value spread. If you think this spread doesn’t

permanently widen going forward, you aren’t nearly as negative on the true expected return of value as those

looking just at realized returns."

7/ "This echoes results we've discussed elsewhere showing that the last three years’ value debacle has been mainly (actually, in this case more than entirely) spread widening, not fundamental destruction."

More on this (thread):

More on this (thread):

https://twitter.com/ReformedTrader/status/1259165422412128259

8/ "The estimate of the Sales/EV factor return is better adjusting for valuation changes (the precision goes up substantially, with the t-statistic almost doubling from 1.9 to 3.4). We’re far more certain it is positive."

9/ "Lest you think valuation can change all the simple results we hold so dear, I tried it for the superiority of value investing in Japan versus the USA, and it didn’t explain anything at all. Value investing just kicks *** in Japan."

10/ "It would not be going too far to say that avoiding

these value-spread-driven misestimations (in both directions) and the portfolio misallocations they bring is a large part of the job of a long-term investor. If we aren’t doing this, we’re simply not doing our jobs."

these value-spread-driven misestimations (in both directions) and the portfolio misallocations they bring is a large part of the job of a long-term investor. If we aren’t doing this, we’re simply not doing our jobs."

• • •

Missing some Tweet in this thread? You can try to

force a refresh