1/ Tesla Effect and the Mispricing of Special Purpose Acquisition Companies (Saengchote)

"Many mispriced SPACs in 2020 were linked to electric vehicle-related businesses (“Tesla effect”), raising concern whether investors understand what they are buying."

papers.ssrn.com/sol3/papers.cf…

"Many mispriced SPACs in 2020 were linked to electric vehicle-related businesses (“Tesla effect”), raising concern whether investors understand what they are buying."

papers.ssrn.com/sol3/papers.cf…

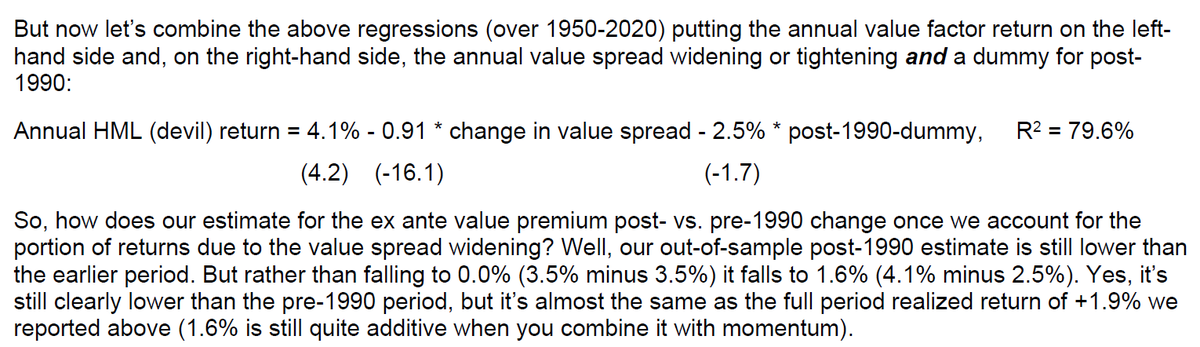

2/ "Historically, most SPACs have traded at $10 per unit all the way until merger completion. However, many SPACs in 2020 traded at prices far above $10 despite being combined into the new business at approximately $10 per share."

3/ "In 2019, SPACs traded close to $10, on average. For 2020 announcements, the jump in SPAC prices was greater and was more pronounced for EV SPACs.

"The parallel trend provides comfort for the use of the difference-in-differences method for our regression analysis."

"The parallel trend provides comfort for the use of the difference-in-differences method for our regression analysis."

4/ "On average, SPAC unit prices are higher after announcements of business combination, and more so for electric-vehicle SPACs.

"The coefficient on Thematic (cannabis and space) is indistinguishable from zero, suggesting that much of the mispricing may be limited to EV SPACs."

"The coefficient on Thematic (cannabis and space) is indistinguishable from zero, suggesting that much of the mispricing may be limited to EV SPACs."

• • •

Missing some Tweet in this thread? You can try to

force a refresh