A thread on some observations from #Nazaratechnologies DRHP - largely to do with revenue analysis. The IPO notes of i-bankers aren't delving on these points. Since I noticed them, I am putting them out here.

(not an opinion or recco wrt to IPO)

(not an opinion or recco wrt to IPO)

Reported consolidated revenues:

Sep 2020 (6m) = 200 cr (~annualised 400 cr)

Mar 2020 (12m) = 248 cr

Mar 2019 (12m) = 170 cr

Mar 2018 (12 m) = 172 cr

Sep 2020 (6m) = 200 cr (~annualised 400 cr)

Mar 2020 (12m) = 248 cr

Mar 2019 (12m) = 170 cr

Mar 2018 (12 m) = 172 cr

Interesting insight into the 200 cr rev for 6 months ended Sep '20:

1) 79/200 cr is from segment 'gamified early learning'. This entire 79 cr is attributable to subsidiary, paper boat apps: makers of Kiddopia. Nazara owns 51% - acquired in '20. Entire 79 cr rev is from N America

1) 79/200 cr is from segment 'gamified early learning'. This entire 79 cr is attributable to subsidiary, paper boat apps: makers of Kiddopia. Nazara owns 51% - acquired in '20. Entire 79 cr rev is from N America

2) 64/200 cr is from esports. of the 64 cr, 54 cr is from Nodwin Gaming, a subsidiary. Nazara has ~ 55% stake in Nodwin. Acqred in '18. Entire 54 cr rev of Nodwin is from India. Recently Korean gaming co Krafton (PUBG fame) invested 110 cr in Nodwin for 10%. & totally owns 16.3%

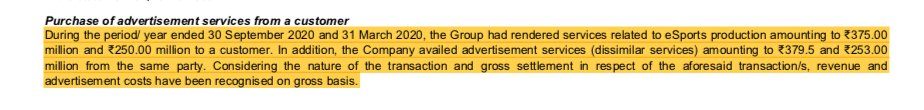

3) Lastly, of the 200 cr rev in Sep '20 ending P/L, about 37 cr of rev (and 37 cr of cost) is from following (see image). So essentially this 37 cr, is not true operating revenue

So for 6 months ending 2020, the true operating revenue attributable to Nazara shareholders is:

200 - 0.49*79 - 0.45*54 - 37 = 100 cr

So summary of 6m ended Sep 2020 rev:

Reported consolidated: 200 cr

Adjusted attributable to shareholders of Nazara: 100 cr

200 - 0.49*79 - 0.45*54 - 37 = 100 cr

So summary of 6m ended Sep 2020 rev:

Reported consolidated: 200 cr

Adjusted attributable to shareholders of Nazara: 100 cr

It's amazing that of the 100 cr half yrly rev attributable to shareholders of Nazara, ~ 70 cr is FROM non wholly owned subsidiaries acquired as recently as 2018 & 2020!

79*0.51 + 54*0.55 = 70

(other recent acquisitions also giving small contribution to revenue)

79*0.51 + 54*0.55 = 70

(other recent acquisitions also giving small contribution to revenue)

Basically, Nazara's traditional heavyweight segment for revenues was Telco subscriptions but is in decline:

Consol telco sub rev share:

153 cr of 172 cr total rev - 2018

96 cr of 170 cr total rev - 2019

81 cr of 248 cr total rev - 2020

43 cr of 200 cr half yr rev - Sep 2020

Consol telco sub rev share:

153 cr of 172 cr total rev - 2018

96 cr of 170 cr total rev - 2019

81 cr of 248 cr total rev - 2020

43 cr of 200 cr half yr rev - Sep 2020

So Nazara of today is largely what it has acquired in last 3 years + the distribution reach it created over the years.

Future of Nazara is hence the future of these & new acquisitions

Future of Nazara is hence the future of these & new acquisitions

NODWIN was a gr8 investment. the 55% stake has grown tremendously in value as have revenues over 3 years.

PAPER Boat (Kiddopia app): Also seen growth over the one year, but tough to put a finger on longevity of growth or sustainability of biz. Covid was definitely a tailwind

PAPER Boat (Kiddopia app): Also seen growth over the one year, but tough to put a finger on longevity of growth or sustainability of biz. Covid was definitely a tailwind

To me:

A ) Nazara has to b viewed more as an investment co - not operating co. If we don't consider the investments in NODWIN and PAPER BOAT, rev attributable to Nazara shareholders is barely 30 cr for 6 months ended Sep 2020! it's been around 15-20 years!

A ) Nazara has to b viewed more as an investment co - not operating co. If we don't consider the investments in NODWIN and PAPER BOAT, rev attributable to Nazara shareholders is barely 30 cr for 6 months ended Sep 2020! it's been around 15-20 years!

B) if u r still going to view it as an operating co from PoV of valuation & thinking of applying the Price to Sales ratio to value it then pls note right revenue to apply the multiple to is 100 cr (annualised 200 cr). (u will annualise b4 applying the P/S multiple of ur choice)

Hope there was some info of interest to you in this thread

• • •

Missing some Tweet in this thread? You can try to

force a refresh