Shiva🙏 🚩📚:biography/health&nutrition/biz&mkts/brain science/history/💙Surf🏄. Nature. Reduce. Reuse. LCHF. IBD. BITS Pilani. IIM I. IG: tapak7777

How to get URL link on X (Twitter) App

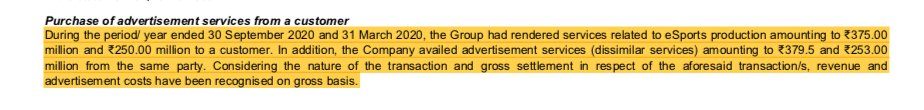

https://twitter.com/VedikaBhaia/status/1481622731695493121How did the debt come down :