Appreciate the dialog @ki_young_ju.

1) me: Whales dumping Gemini is bogus data

2) @glassnode: it's an internal transfer

3) @cryptoquant_com: it's an external transfer

4) @coinmetrics: it's BlockFi

Me: warning 28,300 traders of whales dumping needs fact-checking.

1) me: Whales dumping Gemini is bogus data

2) @glassnode: it's an internal transfer

3) @cryptoquant_com: it's an external transfer

4) @coinmetrics: it's BlockFi

Me: warning 28,300 traders of whales dumping needs fact-checking.

https://twitter.com/ki_young_ju/status/1371740443759706112

Full chrono breakdown of events as they came to me.

TLDR; Ultimately we have a responsibility to fact-check and take all due care before releasing data.

TLDR; Ultimately we have a responsibility to fact-check and take all due care before releasing data.

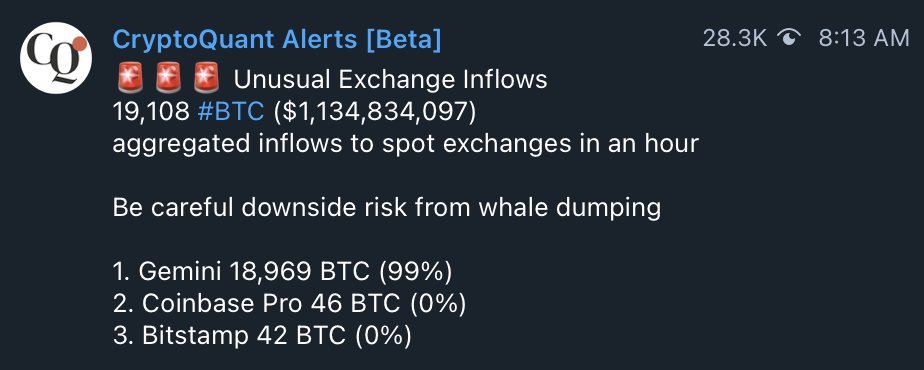

Markets dumped immediately after @cryptoquant_com issued a warning of Whales dumping into Gemini.

It's actually the second time in a month that this occurrence has happened.

It's actually the second time in a month that this occurrence has happened.

CyptoQuant: "it's external".

But I noticed in the QC analysis the "whale dumping" alert that was sent out got downplayed, 2 new scenarios were introduced:

1) whale dumping

2) inter-exchange transfer

3) OTC deal

The (2) (3) are not bearish.

But I noticed in the QC analysis the "whale dumping" alert that was sent out got downplayed, 2 new scenarios were introduced:

1) whale dumping

2) inter-exchange transfer

3) OTC deal

The (2) (3) are not bearish.

https://twitter.com/cryptoquant_com/status/1371460828101189636?s=20

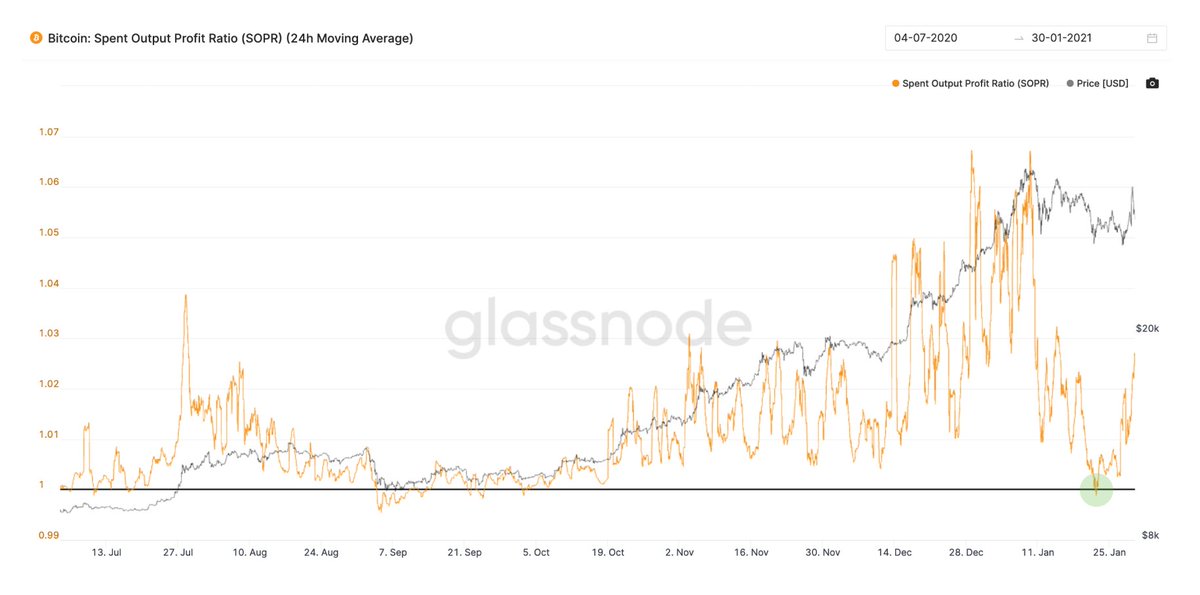

I published my sanity check which ruled out:

(1) Whales dumping

(3) OTC inflows.

(1) Whales dumping

(3) OTC inflows.

https://twitter.com/woonomic/status/1371672872557572099?s=20

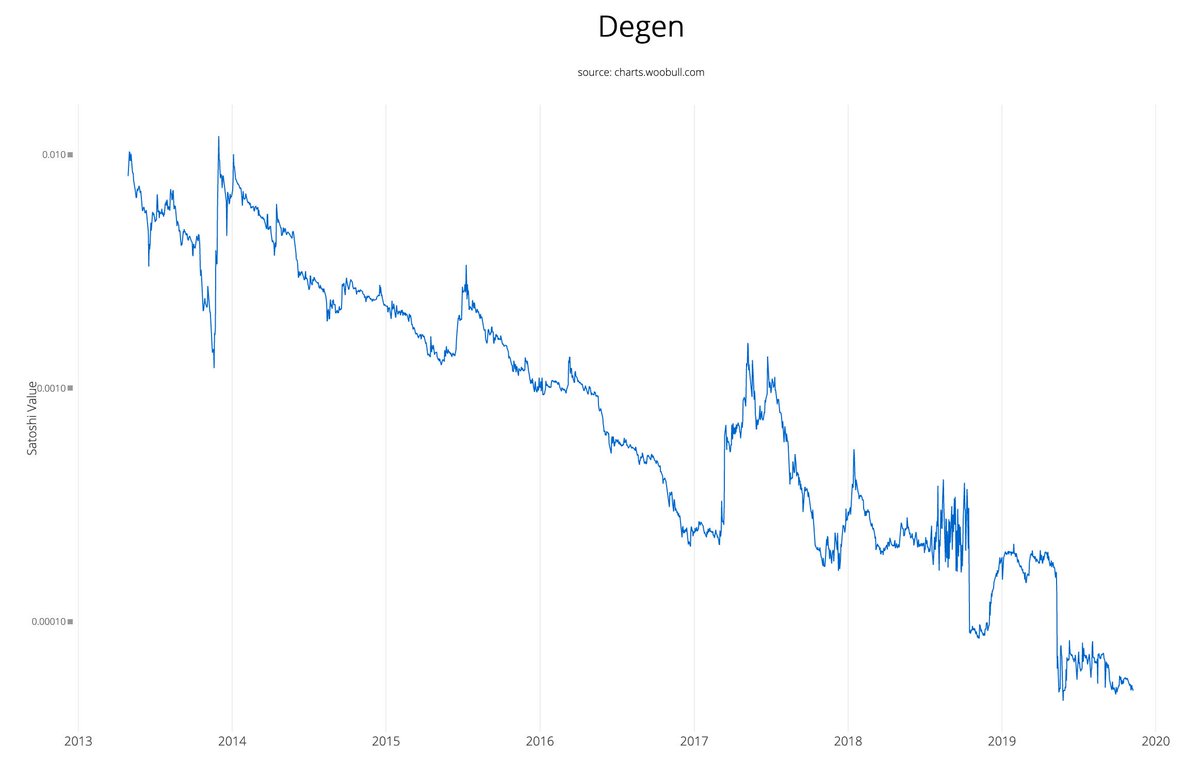

I'll add I did a rudimentary check on QC's tweet which disclosed the transaction and the dumping party looked like an infrastructure entity like an exchange.

CoinMetrics: "It's BlockFi"

No validating proof was given, but the wallet above did look like an infrastructure entity.

No validating proof was given, but the wallet above did look like an infrastructure entity.

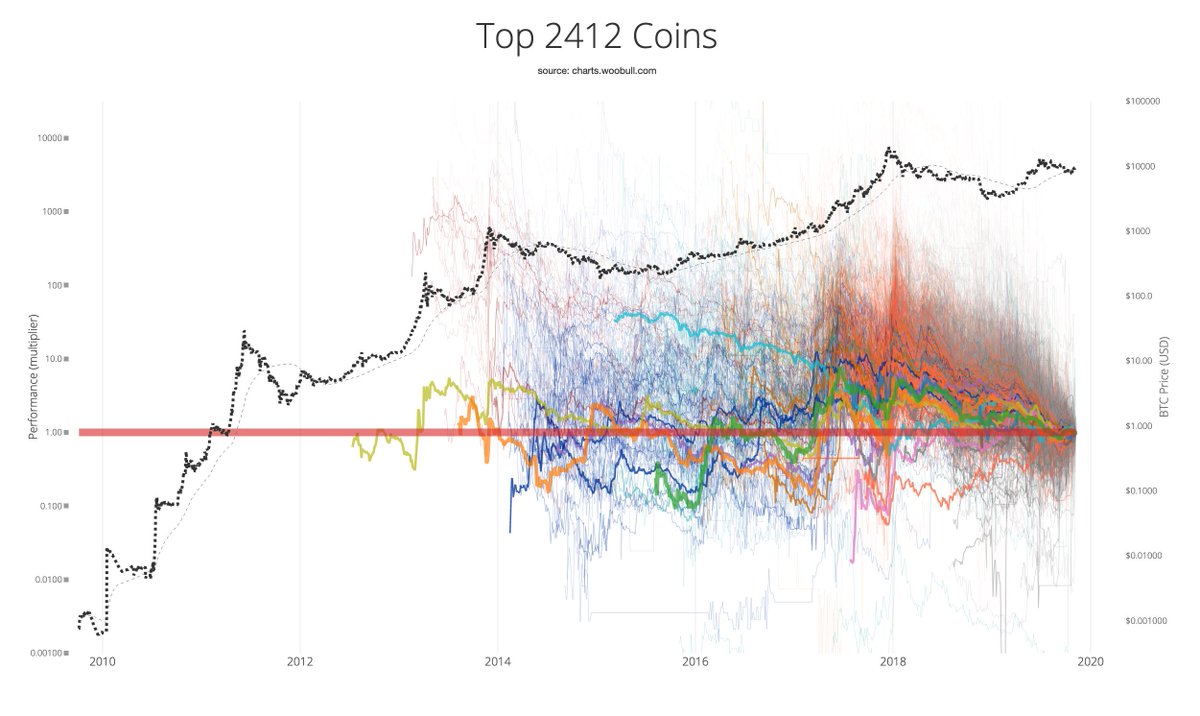

@ki_young_ju, I love that you're passionate about this, it's not a game of right or wrong over an internal or external transfer.

This is about validation and responsible fact-checking before alerting large number of traders of directly tradeable market information.

This is about validation and responsible fact-checking before alerting large number of traders of directly tradeable market information.

It's the second time QC broadcasted "whales dumping Gemini" to traders in the last 30 days. Leverage markets have a huge impact on price.

I note @glassnode also showed the first spike, but they fixed their labelling issues nor did they broadcast to tens of thousands of traders.

I'm appreciative of this entire on-chain industry including your work.

I'm asking you, and all data providers to take more care.

I'm appreciative of this entire on-chain industry including your work.

I'm asking you, and all data providers to take more care.

• • •

Missing some Tweet in this thread? You can try to

force a refresh