1/ The subject of Tesla's market share is always a topic of great debate and controversy. This is because there is no accepted consensus on what the "market" actually is.

How we define the market determines how we view & interpret the performance of players within the market.

How we define the market determines how we view & interpret the performance of players within the market.

2/ At its highest level, the global auto market is the TL # of cars sold/yr. We can drill down & segment the market many ways:

- price

- form factor (sedan/SUV/pickup)

- size (ex: small sedan/mid-size sedan/large-sedan)

- brand (premium/mass)

- powertrain (petrol/EV/PHEV)

Etc.

- price

- form factor (sedan/SUV/pickup)

- size (ex: small sedan/mid-size sedan/large-sedan)

- brand (premium/mass)

- powertrain (petrol/EV/PHEV)

Etc.

3/ $TSLA bears point to 🔽 EU EV market share as proof that Tesla is losing in the EU + will lose elsewhere.

Tesla EV market share is defined as:

TL Teslas Sold/ TL EVs Sold

There are several problems with EV market shr:

A) The market is tiny, and growing. Unless Tesla...

Tesla EV market share is defined as:

TL Teslas Sold/ TL EVs Sold

There are several problems with EV market shr:

A) The market is tiny, and growing. Unless Tesla...

4/....grows volume faster than all EV competitors COMBINED, it will lose EV market share. Does this mean Tesla is "losing" or that any car/brand is "winning"? Nope. It means that its a young market, and it's growing.

B) More importantly, EV shr is misleading bc it includes all..

B) More importantly, EV shr is misleading bc it includes all..

5/...brands, all price points, all form factors (small car, big car, SUV, crossover, compact, etc.) blended together.

Problem = consumers don't shop on the basis of powertrain. Consumers shop on the basis of brand, price and form factor (see thread).

Problem = consumers don't shop on the basis of powertrain. Consumers shop on the basis of brand, price and form factor (see thread).

https://twitter.com/TSLAFanMtl/status/1360350577096556546?s=19

6/ It doesn't matter how many ID3s VW sold [to their dealership network] - because the ID3 is a mass market, compact sedan that does 0-60 in 7.5s, and costs a minimum of $10k less than a Model 3. Model 3 does not compete with ID3.

It matters far more how many consumers chose...

It matters far more how many consumers chose...

7/...Model 3 over BMW 3 series , Audi A4-6, MB C class, etc.

For both reasons A & B, EV market share and YoY changes in EV market share are very limited in utility as it pertains to determining "who's winning".

That said, there are FOUR very clear reasons for Tesla's...

For both reasons A & B, EV market share and YoY changes in EV market share are very limited in utility as it pertains to determining "who's winning".

That said, there are FOUR very clear reasons for Tesla's...

8/..decline in overall unit sales and EV share in EU in 2020:

1. Fremont production allocation to Model Y. Tesla simply built fewer cars for EU in 2020 bc it decided to convert one of its only two GA lines in Fremont to build Model Y for 🇺🇸 🇨🇦. GA4 used to build 350 M3s/day.

1. Fremont production allocation to Model Y. Tesla simply built fewer cars for EU in 2020 bc it decided to convert one of its only two GA lines in Fremont to build Model Y for 🇺🇸 🇨🇦. GA4 used to build 350 M3s/day.

9/ When Model Y was introduced, those 350/day Model 3s disappeared - and EU was hit the hardest. Full thread on this here.

2. Fremont 50-day shutdown. Tesla only sent 9 RoRos to EU in Q1+Q2 2020 vs. 13 RoRos in Q1 + Q2 19. Tesla also carries far less..

2. Fremont 50-day shutdown. Tesla only sent 9 RoRos to EU in Q1+Q2 2020 vs. 13 RoRos in Q1 + Q2 19. Tesla also carries far less..

https://twitter.com/TSLAFanMtl/status/1316170800060301313?s=19

10/...inventory than OEMs, and it entered Q2 with only 25 days of sales in inventory (GLOBALLY). Do the math.

3. 2019 was the first year Model 3 was sold in EU. This is important bc pent up demand from 2017 and 2018 was filled in 2019 - particularly in NO & NL, sullying...

3. 2019 was the first year Model 3 was sold in EU. This is important bc pent up demand from 2017 and 2018 was filled in 2019 - particularly in NO & NL, sullying...

11/...the YoY comparison with 2020.

People underestimate the impact of this on 2019 numbers; let me add some context. In 2019, Tesla sold 18.8k cars in Norway. Norway - the whole country - sold 142k cars. TOTAL. All powertrains. Tesla sold 13% of all cars.

Normal? Organic? No.

People underestimate the impact of this on 2019 numbers; let me add some context. In 2019, Tesla sold 18.8k cars in Norway. Norway - the whole country - sold 142k cars. TOTAL. All powertrains. Tesla sold 13% of all cars.

Normal? Organic? No.

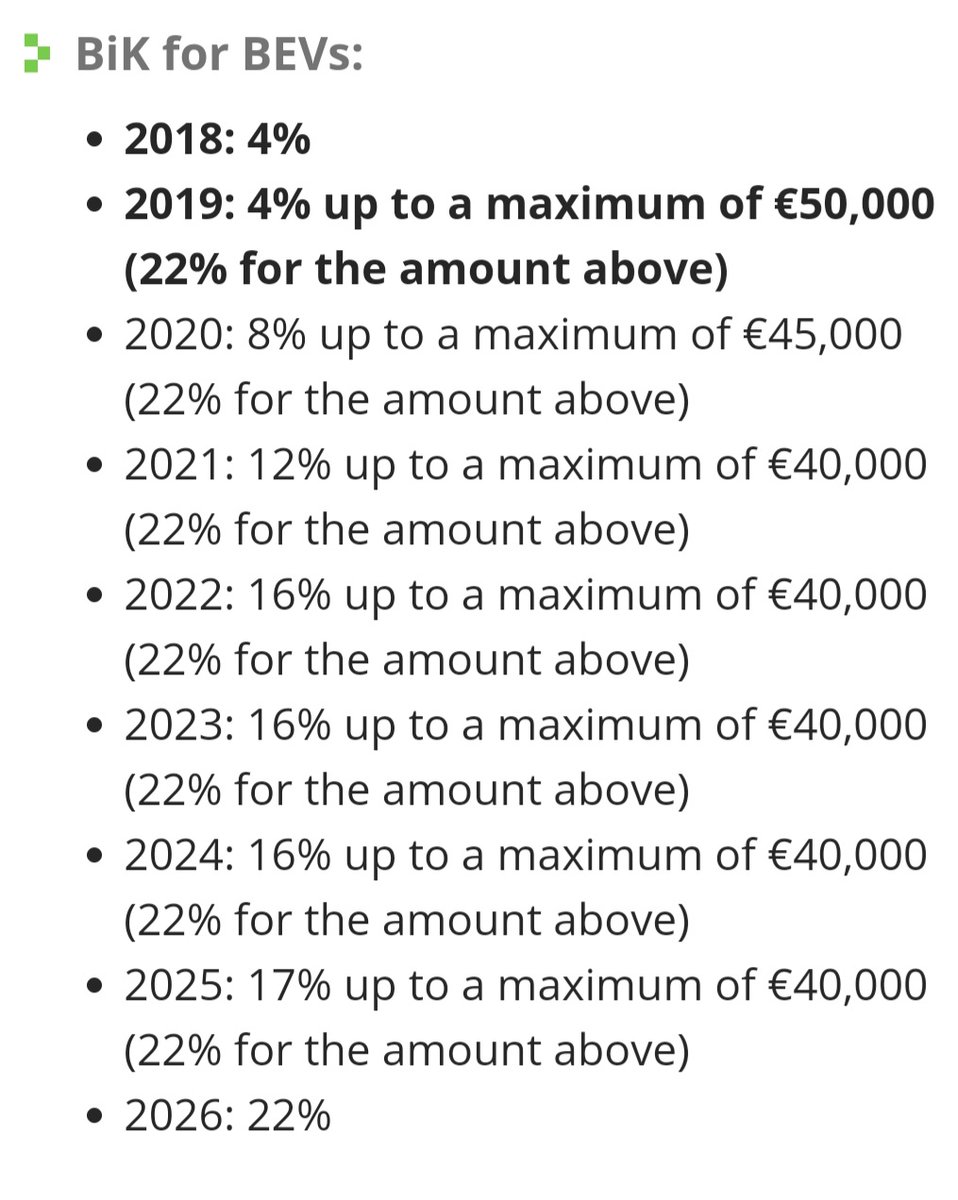

12/ The same thing impacted the Netherlands. Tesla sold ~30k Model 3s in 2019 (vs. 8.2k in 2020) or 13.9% of the new car market

Why?

A tax policy that 🔽 BiK tax from 22% to 4% for EVs <€50k was to change in 2020 (M-3 started at €48.5k) = M-3 demand was pulled into 2019.

Why?

A tax policy that 🔽 BiK tax from 22% to 4% for EVs <€50k was to change in 2020 (M-3 started at €48.5k) = M-3 demand was pulled into 2019.

13/And finally:

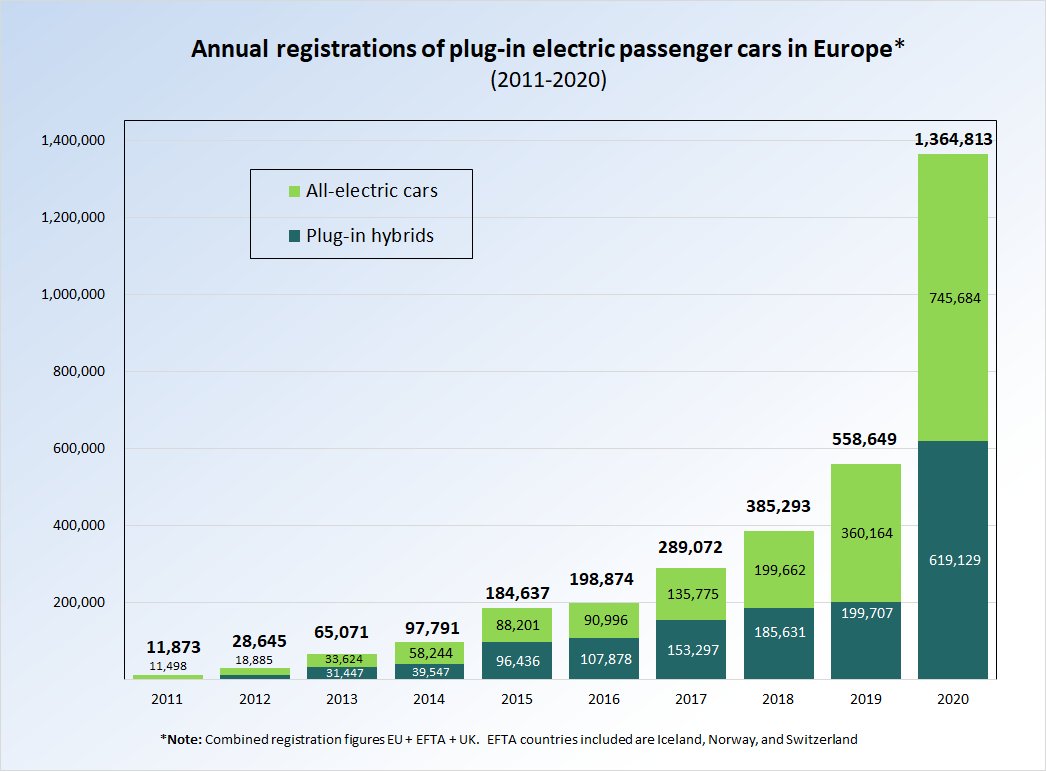

4. Legacy OEMs held back EV shipments from 2019 & dumped everything into 2020 to avoid paying regulatory fines. This push forward of 2019 demand into 2020 artificially inflated legacy's shr of the EV market - and the EV market itself - taking Tesla's EV shr 🔽.

4. Legacy OEMs held back EV shipments from 2019 & dumped everything into 2020 to avoid paying regulatory fines. This push forward of 2019 demand into 2020 artificially inflated legacy's shr of the EV market - and the EV market itself - taking Tesla's EV shr 🔽.

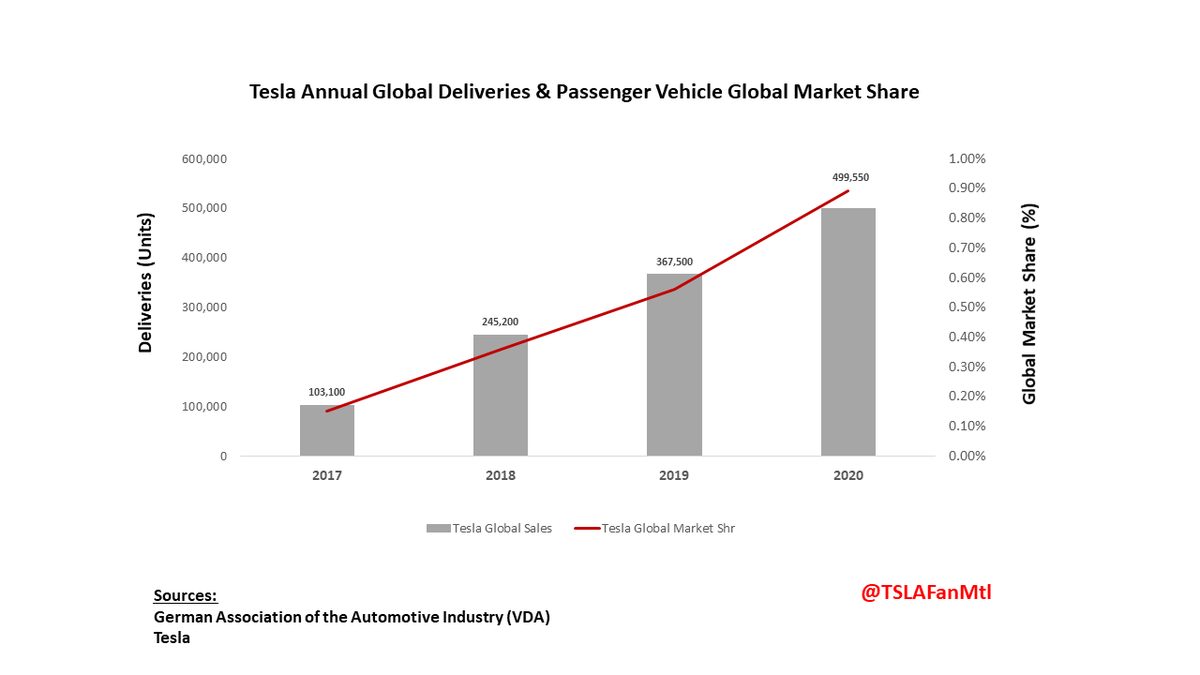

14/ So how is Tesla really performing?

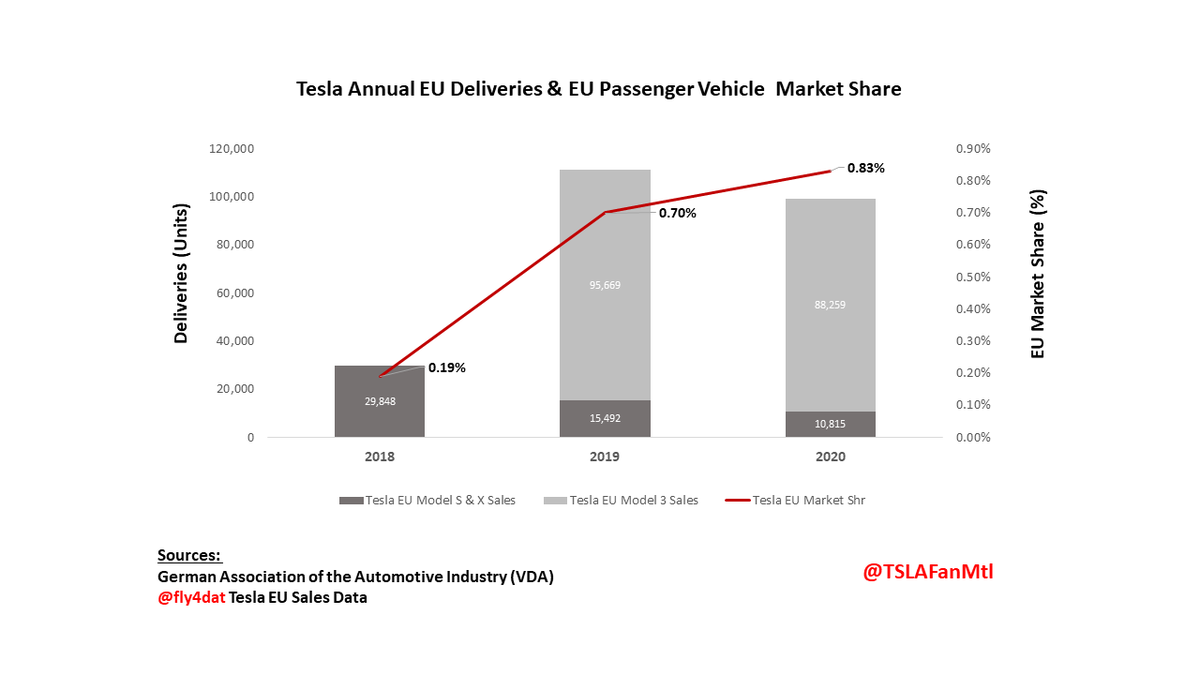

Despite the challenges that I have described, 2020 was a good year for Tesla - both globally and in the EU. If we look globally, Tesla's sales and market share both grew (see pic). In the EU, while units fell for the reasons I explained...

Despite the challenges that I have described, 2020 was a good year for Tesla - both globally and in the EU. If we look globally, Tesla's sales and market share both grew (see pic). In the EU, while units fell for the reasons I explained...

15/...market share STILL grew. I am expecting this trend to accelerate in 2021 as Tesla is now sending RoRos to EU from China, and with the start of Giga Berlin.

One final note on market share. With Tesla expected to grow volume on average 50% for many years to come, Tesla...

One final note on market share. With Tesla expected to grow volume on average 50% for many years to come, Tesla...

16/ will keep growing its global market share ~10x market rate yearly. It's foolish, imo, to think that Tesla's growth is limited by EV competition. Sales that Tesla will lose to other EV competitor(s) will not be felt bc Tesla will be capturing ICE market shr at a faster rate.

17/

Conclusion: I have shown Tesla EU softness in 2020 vs. 2019/EV market is due to:

1. Supply allocation (Model Y)

2. Supply disruption (Fremont shutdown)

3. Artificially high 2019 Tesla sales

4. Artificially high 2020 competitive EV sales (check out VW's Q121...🥱🥴)

Conclusion: I have shown Tesla EU softness in 2020 vs. 2019/EV market is due to:

1. Supply allocation (Model Y)

2. Supply disruption (Fremont shutdown)

3. Artificially high 2019 Tesla sales

4. Artificially high 2020 competitive EV sales (check out VW's Q121...🥱🥴)

18/ I have also shown that Tesla has grown market share in EU DESPITE all of these headwinds.

I expect continued strong growth in 2021 as Tesla expands production of existing models in Berlin, Shanghai and Austin - and launches new models in 2022.

$TSLA

I expect continued strong growth in 2021 as Tesla expands production of existing models in Berlin, Shanghai and Austin - and launches new models in 2022.

$TSLA

19/

Special thanks to my friend @fly4dat for his great work on EU $TSLA sales data and contribution to my EU graph.

@CuervoBorracho

Special thanks to my friend @fly4dat for his great work on EU $TSLA sales data and contribution to my EU graph.

@CuervoBorracho

• • •

Missing some Tweet in this thread? You can try to

force a refresh