1/8 This is a thread about whether Fed policy is really as easy and dovish as it seems and as the Fed intends it to be.

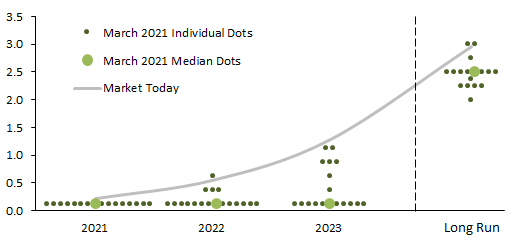

I would argue it is not, and not because the Fed doesn't want it to be, but because markets are skeptical of the new Fed's framework, as the chart shows.

I would argue it is not, and not because the Fed doesn't want it to be, but because markets are skeptical of the new Fed's framework, as the chart shows.

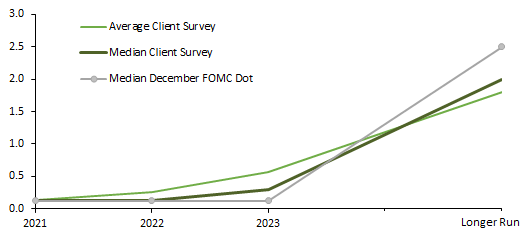

2/8 Monetary policy works via financial markets, and financial markets price interest rates in part based on expectations of what the Fed will do in the future.

This year, markets have pushed up the expected path for the fed funds rate a lot, despite the Fed's reassurances.

This year, markets have pushed up the expected path for the fed funds rate a lot, despite the Fed's reassurances.

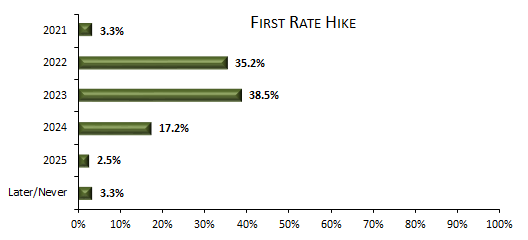

3/8 That investors are not in sync with the Fed is also evident from surveys — see this thread for our @csmresearch recent survey of investors expectations and for how it is not consistent with the Fed’s intentions.

https://twitter.com/R_Perli/status/1371894305510526983?s=20

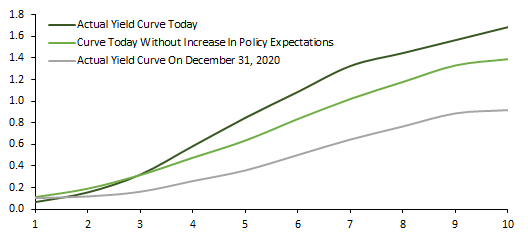

4/8 The increase in policy expectations has accounted for about 1/3 of the increase in rates across the medium- and long-end of the yield curve.

E.g., had policy expectations not increased this year, the 10 yr rate (and mortgage rates, etc) would be ~35 bps lower, or 1.38%.

E.g., had policy expectations not increased this year, the 10 yr rate (and mortgage rates, etc) would be ~35 bps lower, or 1.38%.

5/8 Historically, it takes about three 25 bps FFR hikes to produce a 33 bps increase in the 10yr rate. Effectively, #Fed policy has tightened by that much.

So, nothing has changed: Fed policy has tightened at the first whiff of inflation, regardless of the new framework.

So, nothing has changed: Fed policy has tightened at the first whiff of inflation, regardless of the new framework.

6/8 Powell and the #FOMC have been very clear on their intentions, but to no avail.

The problem the Fed has is not clarity - it's the credibility of its commitment to the new framework. The mkt is used to the old Fed and wants proof (beyond words) that the thinking has changed.

The problem the Fed has is not clarity - it's the credibility of its commitment to the new framework. The mkt is used to the old Fed and wants proof (beyond words) that the thinking has changed.

7/8 So, what should the Fed do? For sure, continue explaining its new framework. But the natural solution to the problem is yield curve control, which the Fed intended precisely as a tool to reinforce forward guidance and counter runaway market expectations.

8/8 I am not holding my breath that this will happen any time soon. But if the #Fed does not convince markets, Fed policy - de facto - has not changed. It’s as if the new framework never happened and the Fed is only paying lip service to it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh