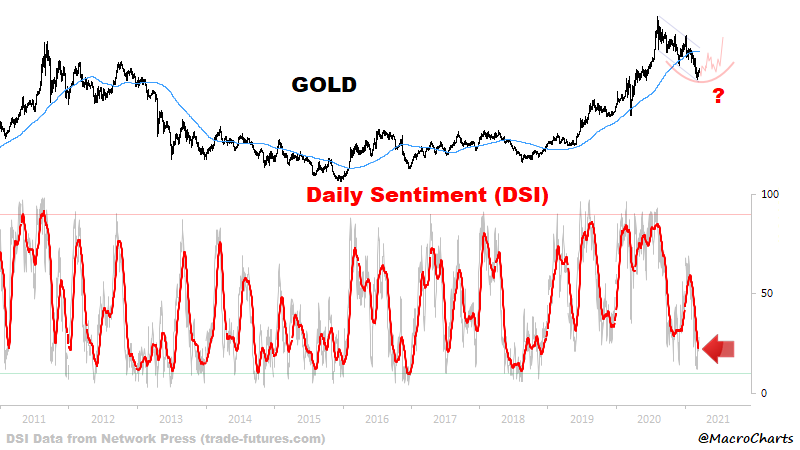

While #sentiment for gold is most definitely depressed and close to historic extremes...

chart via @MacroCharts

chart via @MacroCharts

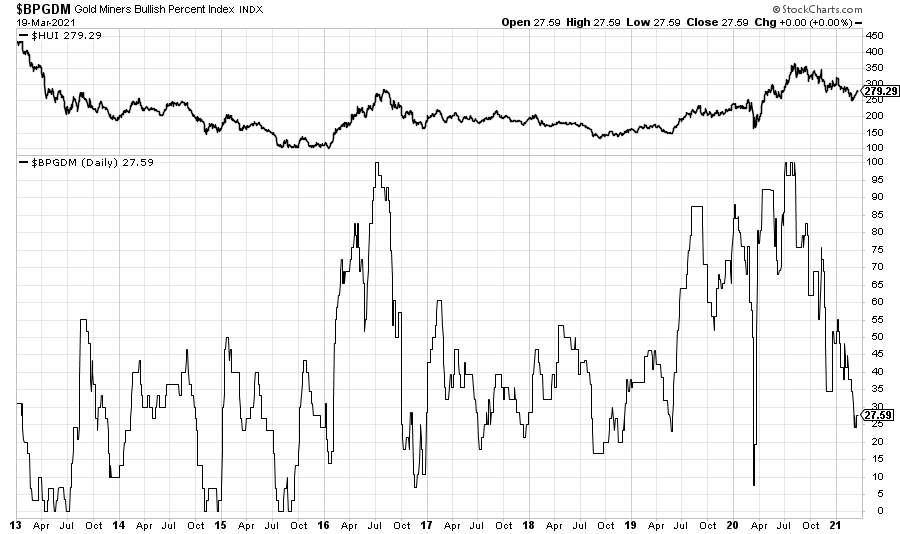

Here's another breadth metric, the percent above 200EMA. It fell to almost 10% on Mar 8th and since then it has bounced strongly:

The Hulbert Gold Newsletter #Sentiment Index tracking the long/short recommendation of stock newsletters focusing on precious metals fell to an extremely pessimistic level earlier this month:

thestreet.com/investing/gold…

thestreet.com/investing/gold…

FYI: Hulbert Gold Newsletter Sentiment Index has recovered from its recent extreme pessimistic depths (see above) but remains relatively low at ~22%.

IOW gold timing newsletters tracked are on average recommending -22% short exposure to #gold.

$GLD $HUI $XAU #contrarian

IOW gold timing newsletters tracked are on average recommending -22% short exposure to #gold.

$GLD $HUI $XAU #contrarian

• • •

Missing some Tweet in this thread? You can try to

force a refresh