How to get URL link on X (Twitter) App

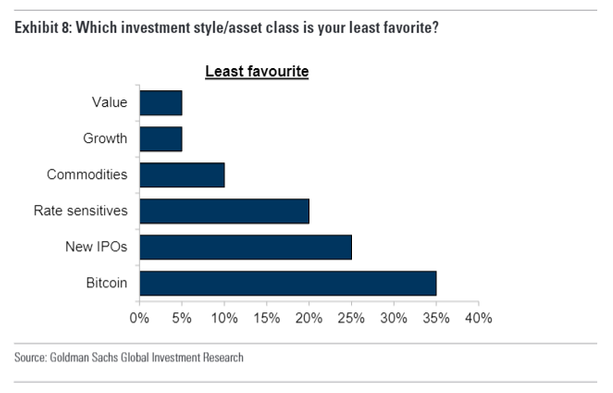

With growth and value leading the most favorite:

With growth and value leading the most favorite:

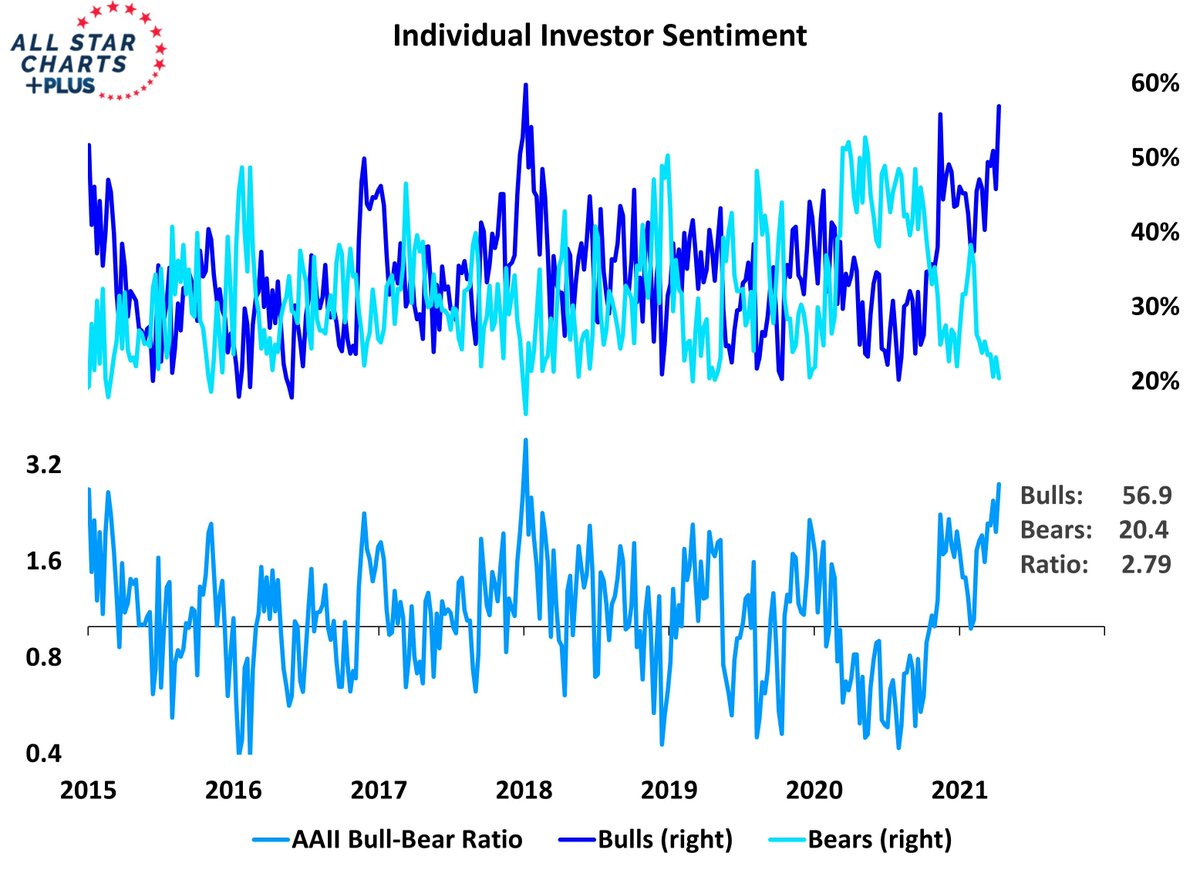

Retail investor #sentiment much more optimistic with those expecting the stock market to continue to rally at the highest levels since January 3rd 2018:

Retail investor #sentiment much more optimistic with those expecting the stock market to continue to rally at the highest levels since January 3rd 2018:

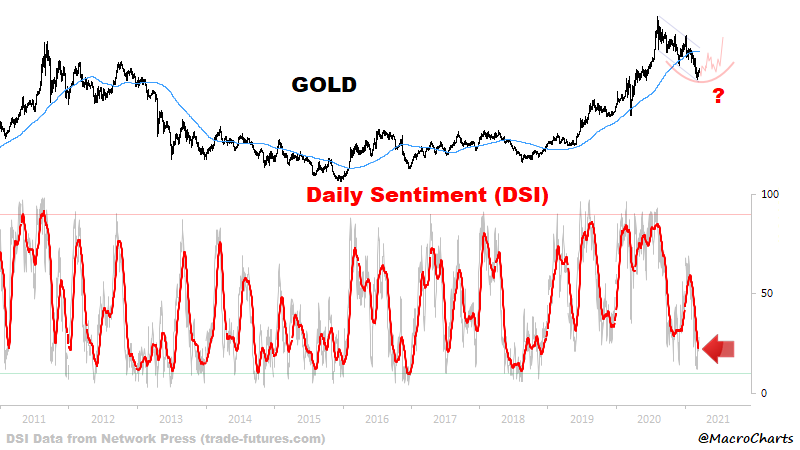

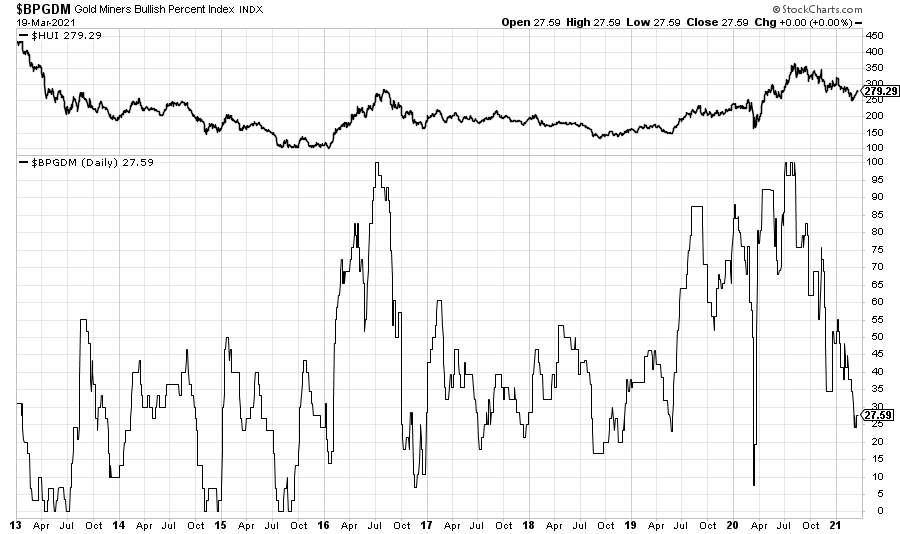

The Bullish Percent index for the gold miners/equity sector is not as extreme:

The Bullish Percent index for the gold miners/equity sector is not as extreme:

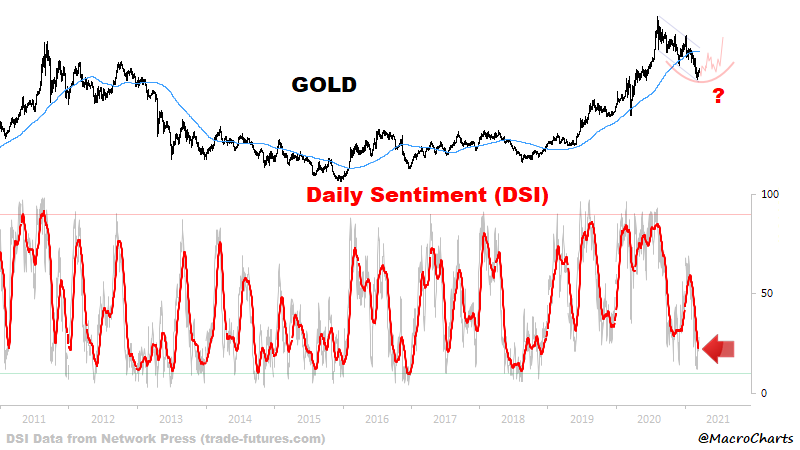

Similar, but slightly different #valuation gauge from Bridgewater:

Similar, but slightly different #valuation gauge from Bridgewater: