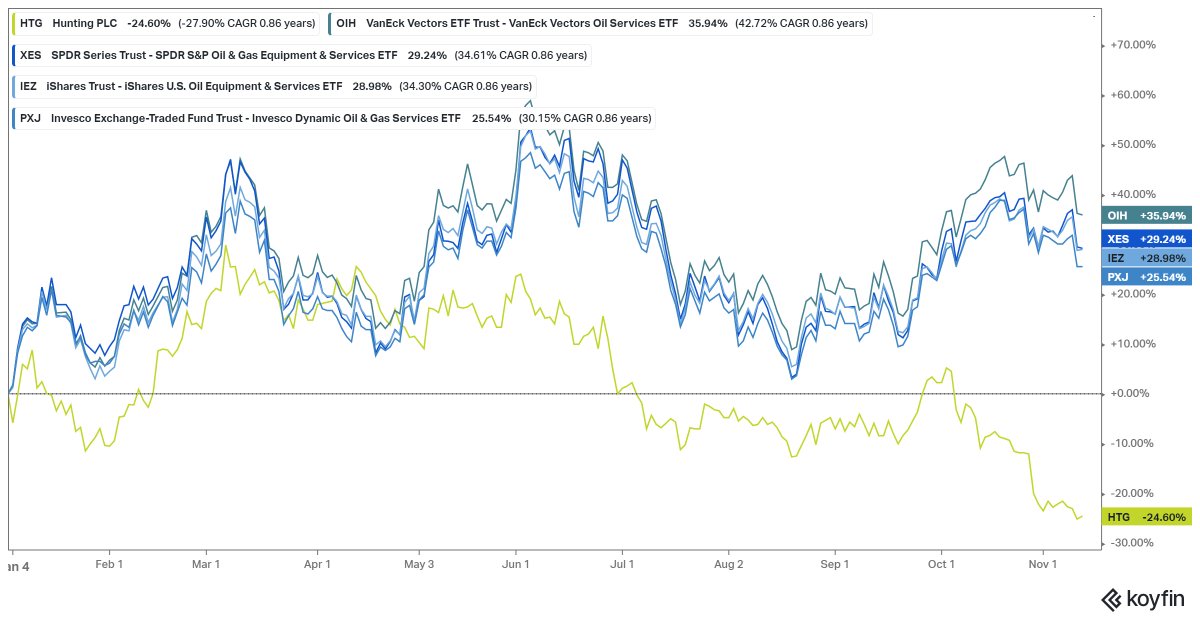

More of an observation than anything but here's Accesso Technology #ACSO - a popped bubble and long before covid.

The idea was virtual queuing; you wander around consuming other things whilst waiting for your spot to come up for a ride or attraction somewhere.

The idea was virtual queuing; you wander around consuming other things whilst waiting for your spot to come up for a ride or attraction somewhere.

Revenues explain the chart well enough. Growth stalls, the starch comes out of the shares and then suddenly everyone notices a lack of profitability and cost capitalisation all along. Results released today, the last column, pretty much what you'd expect.

There are a couple of things that caught my eye here in the results.

The first is that essentially they're a play on volume; heavy footfall means transactional revenue, either as by clipping a commission on a ticket or a revenue share

The first is that essentially they're a play on volume; heavy footfall means transactional revenue, either as by clipping a commission on a ticket or a revenue share

I've edited out the other revenue lines for simplicity. In a normalised 2019 environment this was ¾ of total revenues.

Second is where they make those revenues: 90% are UK / US - as far as any summer reopening goes, those aren't bad places to be.

The valuation doesn't look terrible for a normalised environment and it's not badly positioned as reopening play. If social distancing remains, it's not impossible this could even find itself a covid beneficiary on the other side of the curve.

bbc.co.uk/news/uk-564758…

bbc.co.uk/news/uk-564758…

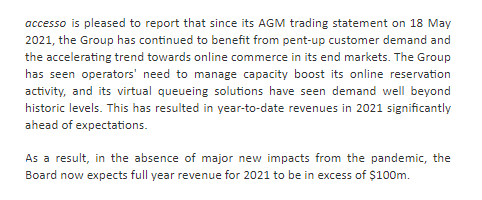

Had been a distinct uptick in traffic on #ACSO's showare domain since the previous update - where for example you have [theatrename].showare.com. Quite a few contract wins / trials reported on the website but not via RNS. Trading update today: "demand well beyond historic levels"

#ACSO again revises upwards expectations for full year 2021 revenues to "not less than $117m. This represents full recovery to 2019 trading levels... will result in Cash EBITDA being significantly ahead of current market expectations for both the half and the full year"

$83M -> $100M -> $117M -> $124M and considering that's with a decent portion of the year in lockdown you'd think #ASCO in FY22 makes light work of FY17's record $133M. Trailing P/S here of 3.2x against the glory days' fwd multiples 3-4 turns higher, suggest it may have more to go

On #ACSO it seems the real point here is less my original thinking, covid itself - but rather the effect of covid: labour and that screw only turns one way. Off a lockdown impacted UK/EU 21, now 80% US by revenues. This one might not be long for the UK market.

• • •

Missing some Tweet in this thread? You can try to

force a refresh