Saw a one-line tweet the other day mentioning McColls #MCLS as one of 2 highest conviction names.

I think I see why: there's a metamorphosis happening underneath and reasonable path to PE and FCF multiples between 2-3 plus a growth narrative, all under that lovely grim exterior

I think I see why: there's a metamorphosis happening underneath and reasonable path to PE and FCF multiples between 2-3 plus a growth narrative, all under that lovely grim exterior

Story is that they're shrinking. 1500+ stores 2 years back, to 1050 by the end of FY21

Also changing: culling small newsagent shops to focus towards larger, more profitable grocery-heavy stores. So far, so worthy - but the real interest is the transformation into Morrisons Daily

Also changing: culling small newsagent shops to focus towards larger, more profitable grocery-heavy stores. So far, so worthy - but the real interest is the transformation into Morrisons Daily

Company raised recently to accelerate a programme converting 350 stores into these Mini Morrisons. They're at 56 today, will be 350 by end FY22

Cost is £90K per shop, what they call "cash payback" is 2-3 years and so far they're providing pretty immediate LFL sales growth of 25%

Cost is £90K per shop, what they call "cash payback" is 2-3 years and so far they're providing pretty immediate LFL sales growth of 25%

TLDR: model out the stores with and without Morrisons, give it a couple of years for the payback time to bed in and it's an annual Δ of ~£180m-£200m in revs. Low 20s GMs, into a (*very*) roughly breakeven cost base gives +£40M, ¼ off for tax and voilà: £30m on a £55m cap, PE <2

FCFs something like this, 6 monthly. Idea being somewhere north of £20M yearly before long. We're currently in between the two marked points. I stopped modelling conversions at 350 but the co has another 400 odd that they reckon are suitable and the mood music suggests it happens

That's pretty much it, the rest here is just a few bits around assumptions I've made.

Offending tweet that sent me down the rabbit hole is below and a bit of back and forth in the DMs with @here_there (whose idea it is) helped me out. Worth a follow.

Offending tweet that sent me down the rabbit hole is below and a bit of back and forth in the DMs with @here_there (whose idea it is) helped me out. Worth a follow.

https://twitter.com/here_there/status/1442895194513240067?s=20

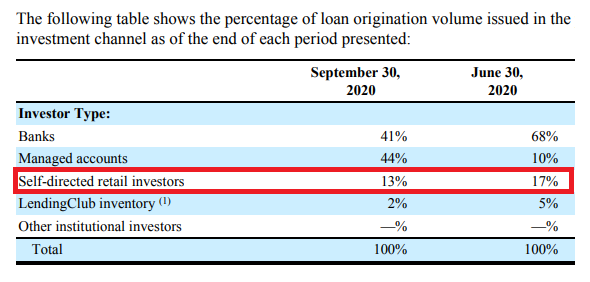

So, for the details. This horrific wall of numbers is to get one thing: revenues. Company says the top 500 stores do 50% of revenues. I split that out and assume they convert those first. My only real input is rev per store.

I take the high end of recent perf in top 500, put an immediate +25% of those going into Morrisons and matured them both at +1.5% per half (a guess, I don't know how these things mature) For the rump McColls, +1% to reflect getting rid of the worst stores.

The last 3x 6M of MCLS' results. I remove all their one time adjust's (invariably recurring, esp given the turnover in the store base), add but mainly subtract a few genuine one-timers, for a stab at a normalised cost base.

And as God intended add back leases where they belong,

And as God intended add back leases where they belong,

Stick the whole unholy lot together and it ends up like this. Not a single number in here will be right, it's full of false precision, off timings because I average stores, assumptions aren't wildly blue sky but towards the favourable side. It's just to see what may be there.

From this lot, just want to highlight 2 things. First is the EBITDA line. I came at this from top down - interestingly to me is that if taking what I assume the co would want you to look at: favourable recent annualised EBITDAs (£40M per year), a ~£30M payback naturally drops out

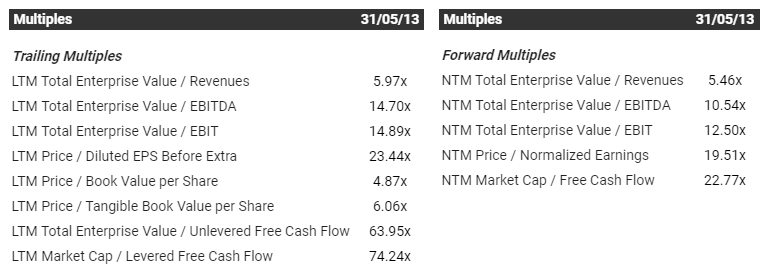

Second, last, those multiples. Of course the assumptions are just my stab at torturing the numbers but all told, RR doesn't seem too bad. Worst case, waste of time perhaps and could think of worse places to start from you wanted a takeout or an outside shot at multibagger

• • •

Missing some Tweet in this thread? You can try to

force a refresh