What does Sneller see to get such sudden FOMO for the old zombie that is Iofina #IOF? If you recall the name, it should produce revulsion but a few things have changed and there's a chance it may be about to make some money.

IOF produces Iodine in the US via O&G brine. Iodine is a beneficiary of industrial recovery generally and covid specifically - the largest use is used as x-ray contrast which may benefit demand from catch up on delayed hospital treatment.

And because it's 2021, inevitably:

And because it's 2021, inevitably:

Production is trapped on the wrong side of the Pacific: the two major production centres are Japan and Chile - so you have the obvious logistics issues for both and potentially politics for the latter.

IOF's production capacity is apparently limited not by plant capacity but by brine availability, therefore it should benefit as a derivative of a US onshore O&G recovery.

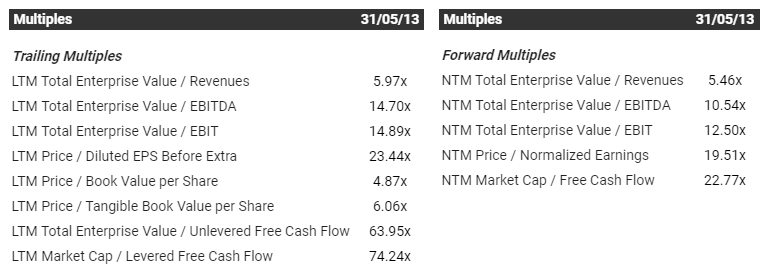

Late last year the company refi'd debt which roughly cut the cost in half and it's now levered 2-3x.

Late last year the company refi'd debt which roughly cut the cost in half and it's now levered 2-3x.

Q1 update reported "sales demand at pre-pandemic levels" and "record sales of iodine and specialty chemicals, as a result of a significant recovery in demand in the iodine market combined with the availability of crystalline iodine inventory that had been stockpiled in H2 2020."

H1 update described it as a "strong sales period with demand" and reports prices in the $35-37 range.

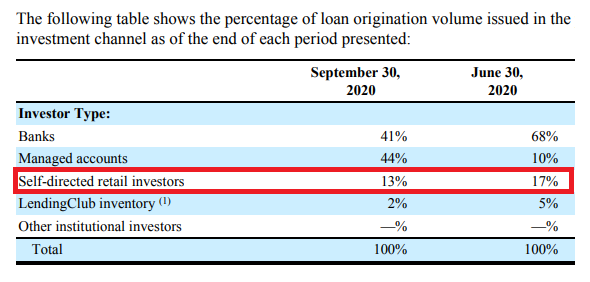

And that's about what about I've got on IOF. Here's what those who remember this one will probably recall, red everywhere. Valued at £300M+ on $18M revenues in the good old days

And that's about what about I've got on IOF. Here's what those who remember this one will probably recall, red everywhere. Valued at £300M+ on $18M revenues in the good old days

But underneath it seems to have been plugging on as they've kept building out capacity. The story of the covid period overall seems to be that sales volumes fell but into a higher price, keeping revenues stable.

If the idea is that volumes are at / above records combined with high (and increasing?) pricing, along with the refi - a beyond rough fag packet toy model can be made to come up with a PBT quite far in excess of anything previously.

PBT perhaps isn't a totally crazy proxy for FCF here. WC probably comes as a benefit given they're selling down covid stockpile, you could net that off against an increase in capex if you liked. £29M cap comes to an EV of about $50m vs about 7x EBITDA in the blue sky set of figs

Forgot to include - idea to check this out came from a suggestion from @Naan_Deal, who previously thought #SCE might be worth looking at last Spring..

Looks like the answer re: Sneller was that results were today - and they're excellent. Have boxed next to my optimisic FY case

Est run-rate shipments would exceed '16. Revs $20M, GM down 100bps, costs stable, CARES recognised - and debt dropped $3M. Annualised clean PBT ~$5M..🚀

Est run-rate shipments would exceed '16. Revs $20M, GM down 100bps, costs stable, CARES recognised - and debt dropped $3M. Annualised clean PBT ~$5M..🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh