#Nifty on making a low of 14626 displays +ve divergence & has completed downside normal targets of Pivot & Camarilla tables.

#Nifty does a double +ve divergences.

As per pre-market plan, only a breach of 14595 would be bearish.

Low done 14603 & trading @ 14641... more to come holding 14610.

As per pre-market plan, only a breach of 14595 would be bearish.

Low done 14603 & trading @ 14641... more to come holding 14610.

#Nifty divergences failed; 14610 broken.

Higher t/f - week's weak technical taking it's toll.

Heading towards lower end of BB/ Channel break...

Higher t/f - week's weak technical taking it's toll.

Heading towards lower end of BB/ Channel break...

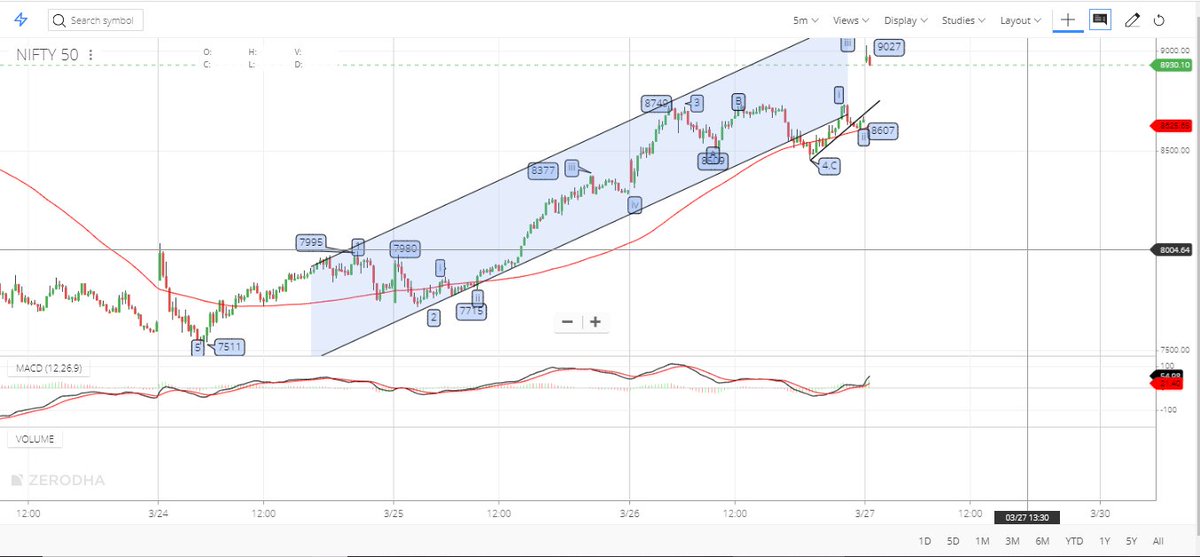

How #Nifty 14595 was arrived @

Now look at the retarce of this fall from 14879 to 14579

= 38% = 14693

= 50% = 14729

= 62% = 14764

Only above 14800(73.6%) strength returns.

Now look at the retarce of this fall from 14879 to 14579

= 38% = 14693

= 50% = 14729

= 62% = 14764

Only above 14800(73.6%) strength returns.

• • •

Missing some Tweet in this thread? You can try to

force a refresh