Get Rich Slowly and Surely.

Breathing the market since 1992.

5 subscribers

How to get URL link on X (Twitter) App

#Priceaction Step:2

#Priceaction Step:2

#banknifty

#banknifty

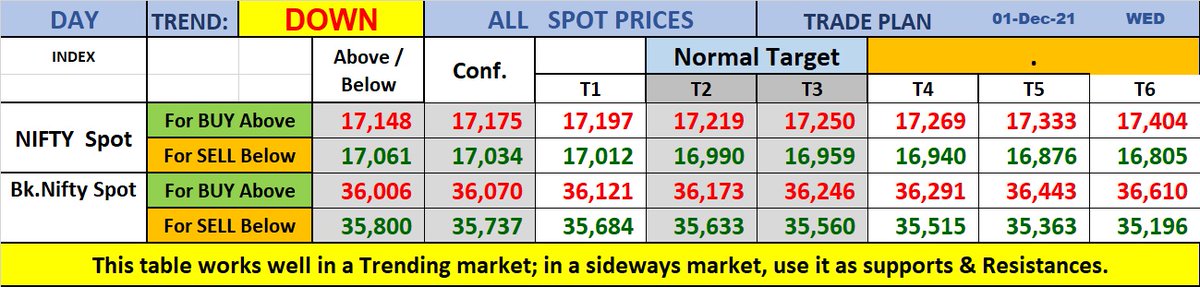

Based on significant gap down, the "revised trade levels" for the "day" & "Week".

Based on significant gap down, the "revised trade levels" for the "day" & "Week".

#Nifty Trade plan:

#Nifty Trade plan:

Using shorter Moving Average (5 & 10) will produce a quicker, more responsive indicator (fast macd), while using longer MA (12 & 26) will produce a slower indicator (Slow macd), less prone to whipsaws.

Using shorter Moving Average (5 & 10) will produce a quicker, more responsive indicator (fast macd), while using longer MA (12 & 26) will produce a slower indicator (Slow macd), less prone to whipsaws.

#Nifty

#Nifty

How the grind to unfold... #Banknifty

How the grind to unfold... #Banknifty

#Nifty held "17140" with a low of "17149"

#Nifty held "17140" with a low of "17149"

Based on significant gap up, the "revised trade levels" for the day.

Based on significant gap up, the "revised trade levels" for the day.

How do you follow "Trend" ?

How do you follow "Trend" ?

https://twitter.com/JustNifty/status/1458697307033989122

#Bhartiartl

#Bhartiartl

#Hdfclife

#Hdfclife

#Nifty

#Nifty

#Nifty

#Nifty

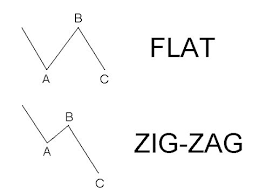

#Waves advance, then retrace and with each advance & retraces, they gather strength & thus the subsequent advances grow in strength & intensity until they blow themselves up. Then, they go into a quiet mode.

#Waves advance, then retrace and with each advance & retraces, they gather strength & thus the subsequent advances grow in strength & intensity until they blow themselves up. Then, they go into a quiet mode.

#Elliottwave

#Elliottwave

When prices move:

When prices move:

#Reliance has done exactly 61.8% retrace of 2494 to 2556 @ 2518

#Reliance has done exactly 61.8% retrace of 2494 to 2556 @ 2518