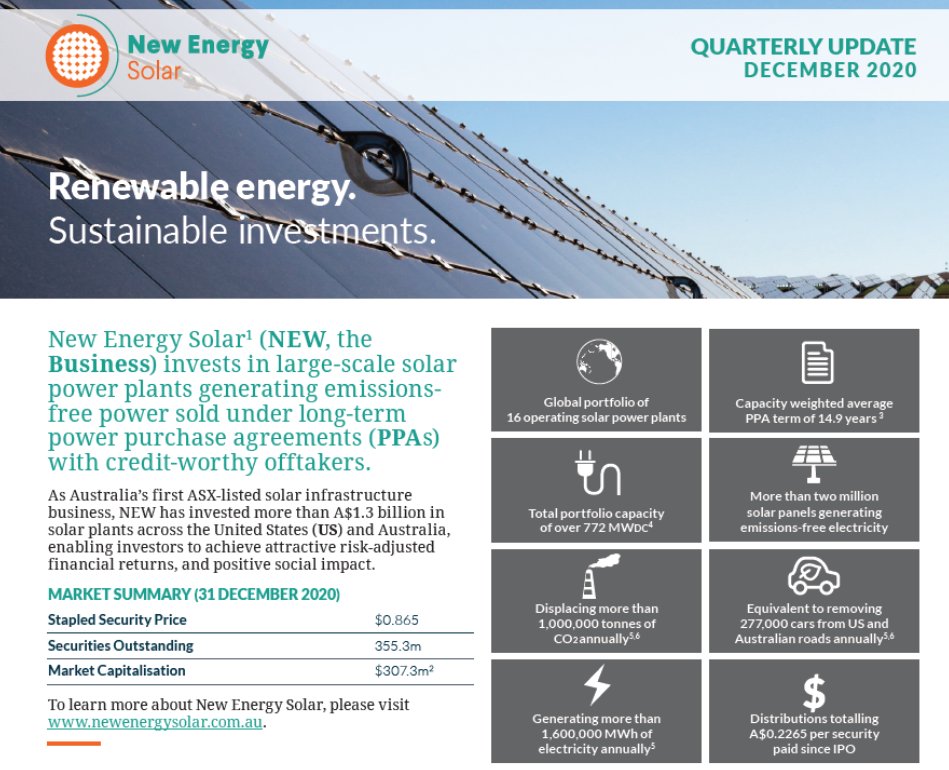

New Energy Solar $NEW $NEW.AX is an Australian/US renewable energy developer and operator.

A renewable energy company Trading at 37% discount to NAV undergoing a restructure following a strategic review?

Let’s take a deep dive.👇

A renewable energy company Trading at 37% discount to NAV undergoing a restructure following a strategic review?

Let’s take a deep dive.👇

1. Investment thesis: A special situation/asset play. Undervalued due to management issues and recent poor solar performances; seeking to gain from a narrowing of the discount to NAV through divesting non-core / Australian assets; could be a turnaround with improved management.

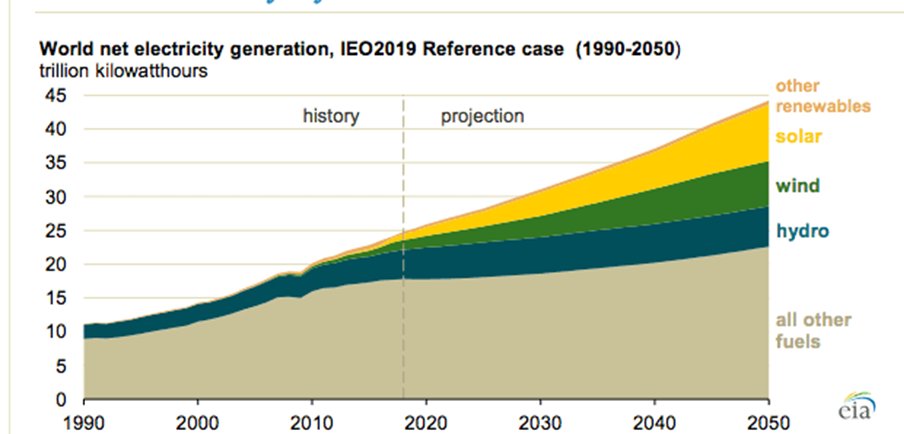

2. Macro. Renewable energy is an undoubted megatrend as we transition our energy mix. Solar is well passed its inflection point, and represents 10% of current generation, growing the most at 25% yoy or $130bn pa.

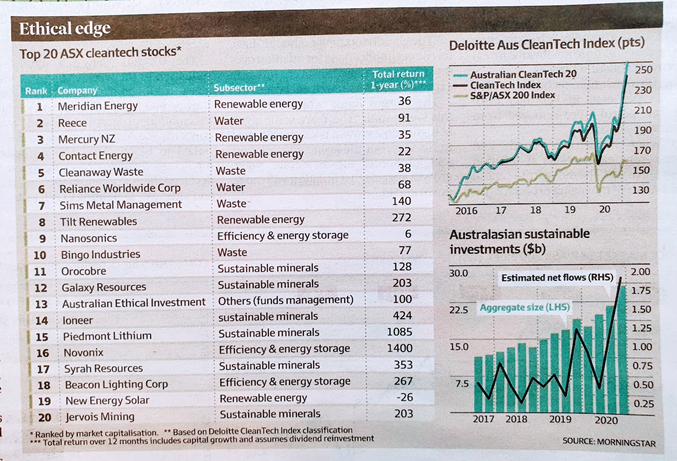

3. Macro. Ethical investing is also on the rise, just look at the @FinancialReview article on the weekend. Unfortunately, not many good opportunities on #ASX or in Aus (I’m long $BEP and $D for instance). So good vehicles should trade at a premium as they do elsewhere.

4. Business model. Simple infrastructure play. Shitco finds infrastructure need; takes out big loan; builds infrastructure; long term PPA lease; revenue pays interest on debt & dividends; at the end you own the asset which can be recycled. Rinse and repeat.

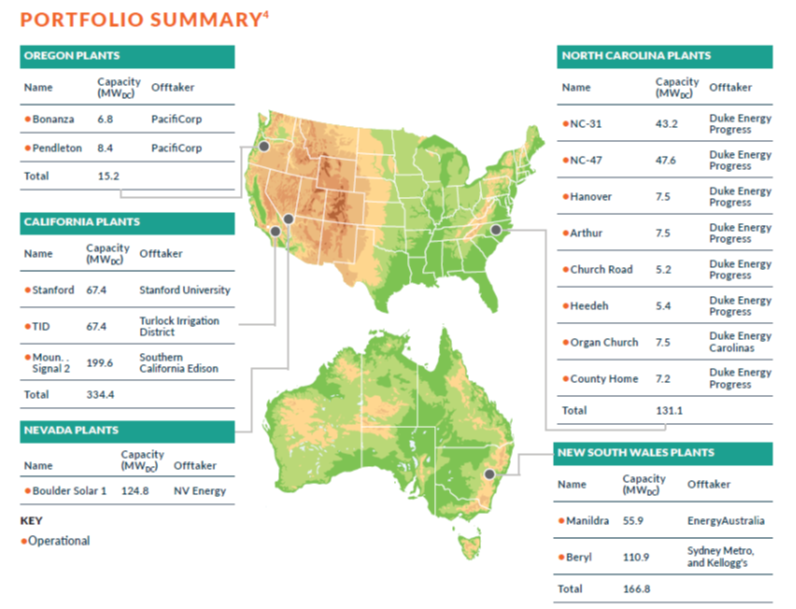

5. Assets. NEW has 16 solar farms across Australia and US with a reported 772MW capacity. Mostly wholly owned. And mostly with 10yr PPAs with reputable partners.

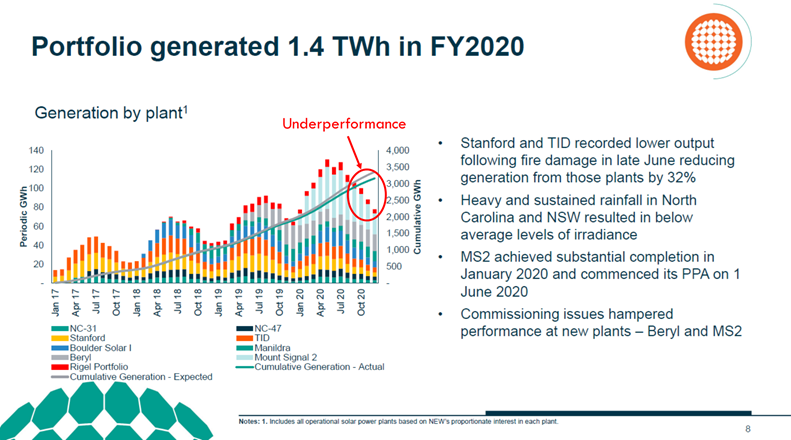

6. Compounding generation. Since 2016 there has been increasing generation at an increasing rate. This is a first good sign for the business model. However, two things over past year: no new developments in pipeline, and operational issues.

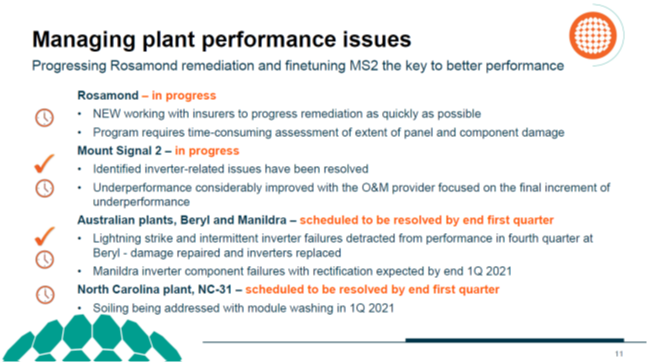

7. Operational issues. a range of problems, with production down 14% in 1H21 with no announcements to market until 25 Feb. Covid is blamed, but not sure how a fire or inverter problem is Covid’s fault. Expect years of underperformance in Stanford & Tid (30% of MW capacity)

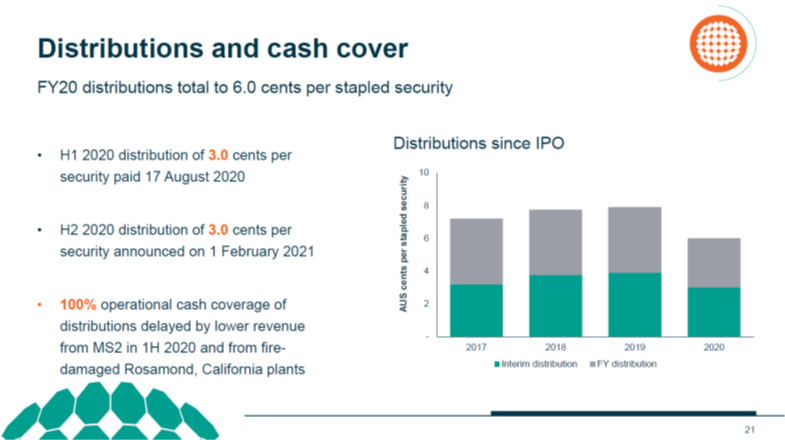

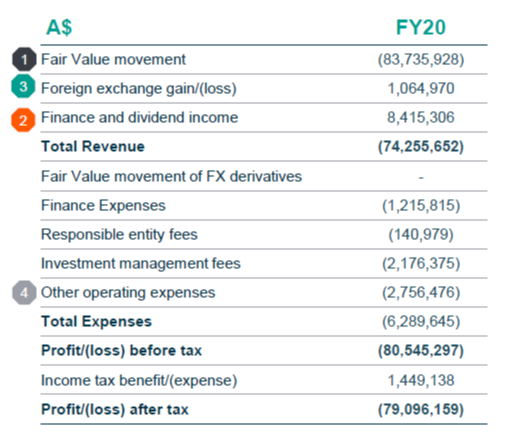

8. Distributions. NEW is paying a whopping 8% yield, despite dividends falling. $27m of dividends paid in 2020 vs. EBITDA of $36m. BUT, due to heavy financing costs, dividends are actually greater than funds from operations. Thus we see increasing debt and >100% payout.

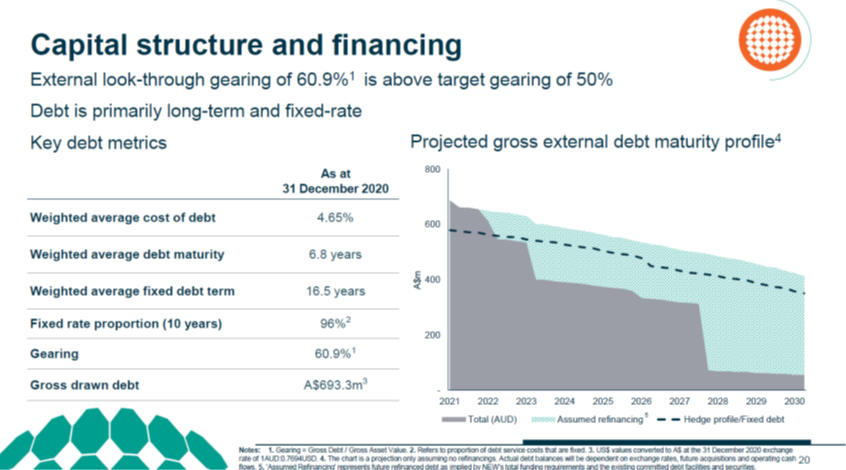

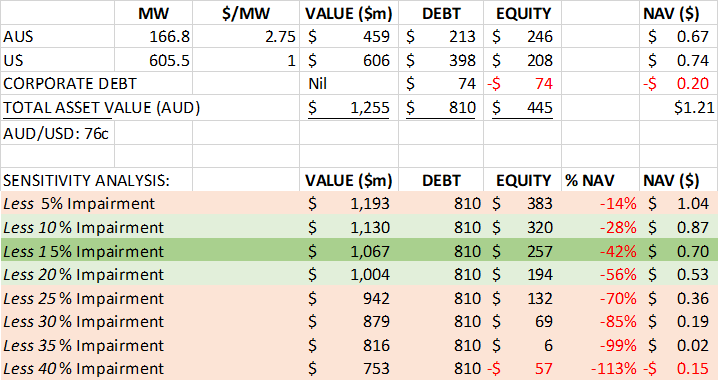

9. Capital Structure. Debt is financed at a relatively high rate of 4.65% with long term payment (10+yrs). Gearing is reported at 60.9%, though using fair value of debt ($810m) it is 71%, significantly above the target of 50%.

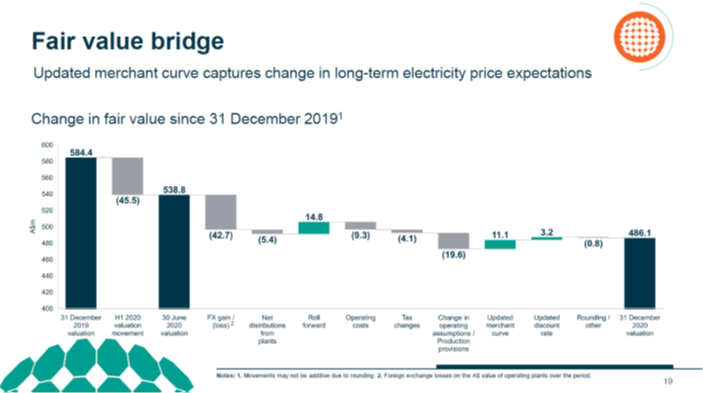

10. Asset valuation. Enterprise value (read: total asset values) is $1.25bn, and equity of $445m. This has decreased in 20-21 due to operational issues, lower long-term electricity prices, and the exchange rate. NAV currently is $1.25 per share, peaking in Dec 2018 at $1.60.

11. Asset value triangulation. Looking at recent solar farm sales, the valuation is right if you assume they are fully functional and good quality. Sensitivity analysis however shows that minor impairments would lead to major devaluations in NAV (3:1) due to high debt levels.

12. Impairment assumptions. A 15% impairment is not just a margin of safety. One could assume 10% for operational issues at least over the coming years (why pay full price for something not fully functional?); and the exchange rate could easily see 5% or 80 AUD/USD.

13. Exchange Rate. I am agnostic to AUD range of 60-90c. However, if a small movement can make a substantial impact to the viability of a business, I’ll be more risk averse. For that reason, I factored in 80c, but could even have gone to 90c to be more conservative.

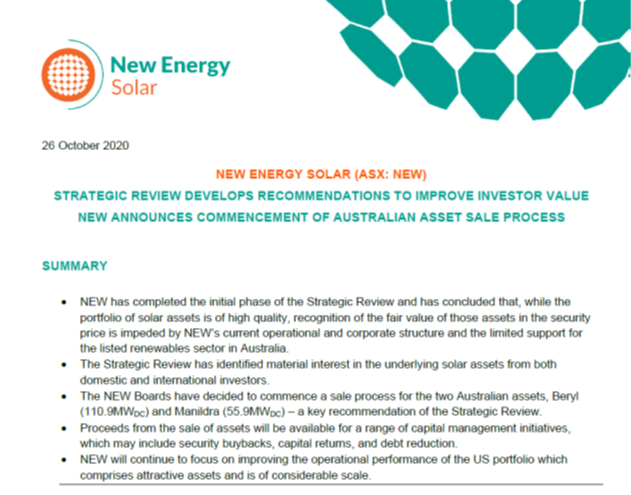

14. Restructure. A strategic review by @rbccm recommended the sale of non-core and Australian assets to reduce the NAV discount. Peter Lynch writes about how this could be an asset arbitrage opportunity.

15. Divesting. Sold MS2 for US$44m offmarket to… themselves? $USF is another fund of E&P Financial Group $EP1.AX This wouldn’t be an issue if the price was above fair value, and if this was a non-core or Australian asset. Unclear how this fits within the strategic review.

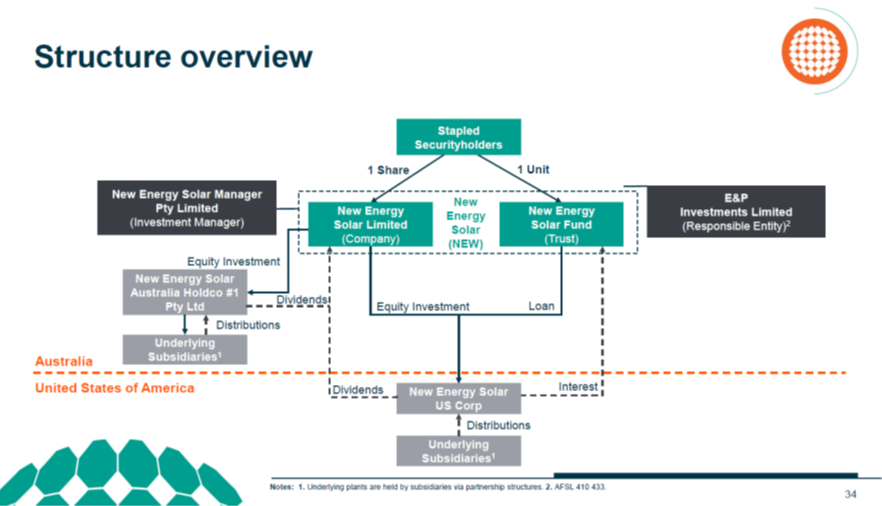

16. Complex structure. As an investor in $BEP Brookfield, I am not averse to complex structures and good capital allocators. But this may just take the cake - it's like a shell game of debt refinancing across their own funds with no real tax benefit.

17. Management. @asicmedia ASIC commenced civil proceedings against Dixon Advisory in 2020 for failing to act in their client's interest. They renamed themselves to E&P Financial Group $EP1.AX - That seems to have fixed things.

18. Management fees. $2.2m per annum on top of financial costs, operating costs, etc. At 0.5% of equity, it may not seem high – if the history had not been of buying high, selling low.

19. Risks. Management incentives not aligned with shareholders return. Asset impairments. Ongoing operational issues. Lack of development pipeline for growth. Exchange rates. Interest rates.

20. Overall, while stable mate $USF.L is trading at 5% premium to NAV, there's a world with ~30% reevaluation for NEW. However, it's probably close to fair value. With management's history, the left side tail may be bigger than the right. Removed from watchlist.

If you enjoyed this, bash the like / retweet / follow buttons.

h/t @neke86_ and @abroninvestor

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR.

Disclaimer, I’m not holding any position on NEW or EP1.

h/t @neke86_ and @abroninvestor

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR.

Disclaimer, I’m not holding any position on NEW or EP1.

• • •

Missing some Tweet in this thread? You can try to

force a refresh