My next 100X $ALT is: $AIOZ / @AIOZNetwork.

Here's why I'm so bullish on it and expect such a return:

Here's why I'm so bullish on it and expect such a return:

Team

The core team themselves have been working for AIOZ for over 5 years each; focusing not only on blockchain technology but AI products. They have won several hackathons and even have patents that they are not applying to support decentralisation.

The core team themselves have been working for AIOZ for over 5 years each; focusing not only on blockchain technology but AI products. They have won several hackathons and even have patents that they are not applying to support decentralisation.

Self-funded.

For the last 3 years 30+ developers have been working on the project. This shows huge commitment and vision; not a project that's appeared because it's a bull-run. They have created their own L1 blockchain based CDN.

For the last 3 years 30+ developers have been working on the project. This shows huge commitment and vision; not a project that's appeared because it's a bull-run. They have created their own L1 blockchain based CDN.

CDN? Content Delivery Network.

Geographically distributed group of servers that work together to provide fast delivery of Internet content. This is the infrastructure that supports YouTube, Netflix, etc.

Geographically distributed group of servers that work together to provide fast delivery of Internet content. This is the infrastructure that supports YouTube, Netflix, etc.

So why decentralise it?

Servers -> community of p2p edge nodes where computational power is distributed across nodes in transcoding, delivery and storage. This creates instant cost savings as costs are distributed across a decentralised network.

Servers -> community of p2p edge nodes where computational power is distributed across nodes in transcoding, delivery and storage. This creates instant cost savings as costs are distributed across a decentralised network.

"What sort of savings?" I hear you ask.

Did you know, Baby Shark cost YouTube c.$20M for the 7B views of the Baby Shark song? If they used AIOZ's nodes for CDN, it would have cost them around $800k - a saving of 96%. That's for ONE video on ONE platform.

Did you know, Baby Shark cost YouTube c.$20M for the 7B views of the Baby Shark song? If they used AIOZ's nodes for CDN, it would have cost them around $800k - a saving of 96%. That's for ONE video on ONE platform.

The beauty of AIOZ is it is scalable (more nodes, more scalability… i.e. infinite) and could act as any business's CDN (think Netflix, YouTube etc.). Total CDN addressable market size is expected to grow from $14.4B to $27.9B in 2025.

Existing products.

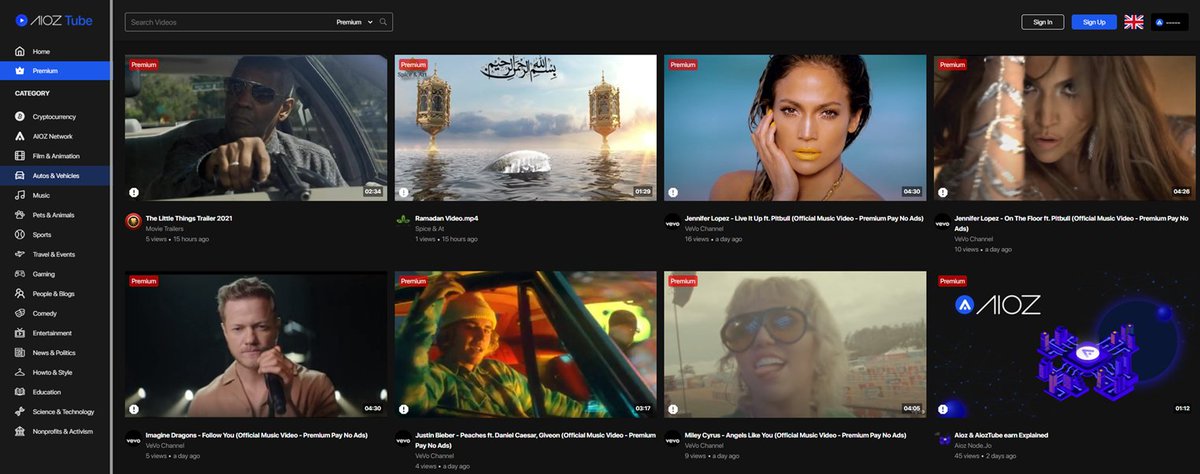

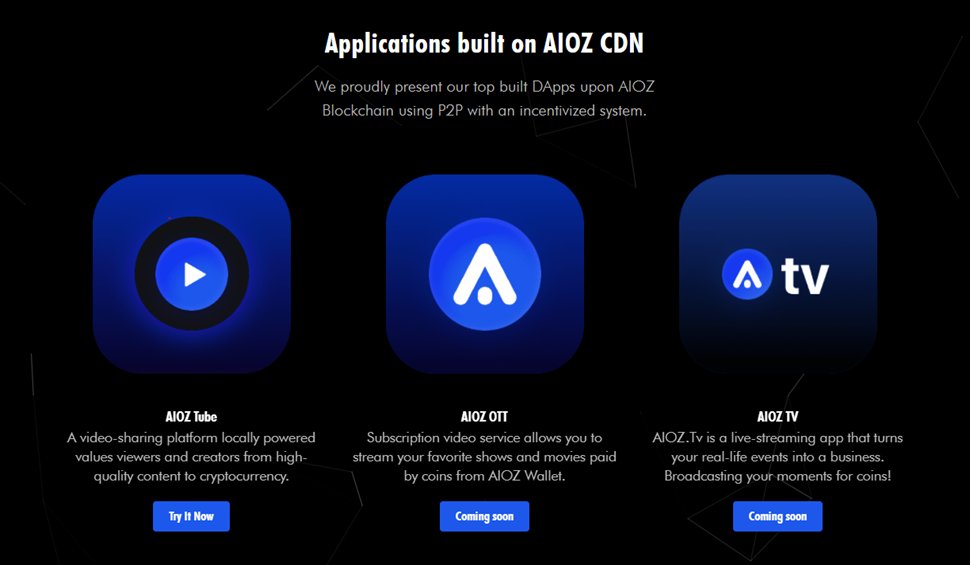

The team have essentially created a decentralised YouTube (AIOZ Tube) to showcase what can be done on their network. Any team that can effectively replicate YouTube to demonstrate their product has huge credibility my book!

The team have essentially created a decentralised YouTube (AIOZ Tube) to showcase what can be done on their network. Any team that can effectively replicate YouTube to demonstrate their product has huge credibility my book!

The team are working on AIOZ OTT - a subscription service Dapp (think Netflix / Amazon prime) and AIOZ.tv - a livestreaming app (think twitch or YouTube live). This is one of the huge benefits of AIOZ - all kinds of Dapps can be built on top of it.

Decentralised Media dApps that cover Audio (decentralised Spotify), Image (decentralised Instagram), Video (decentralised YouTube/Netflix) and Live streaming (decentralised eSports) are all possible on the $AIOZ network.

Services will be paid for with AIOZ tokens; but through a fiat converter; so businesses or consumers can use FIAT and the AIOZ purchase is behind the scenes. This reduces market friction as participants will not need any crypto knowledge to participate.

Growth

AIOZ already has over 7,000 nodes up from 1,000 just two weeks ago. People want $AIOZ and want to support the network. This is hugely bullish and shows community support.

AIOZ already has over 7,000 nodes up from 1,000 just two weeks ago. People want $AIOZ and want to support the network. This is hugely bullish and shows community support.

Roadmap

The team are building constantly and even have #NFT 's and a DEX in the Q4 2021 pipeline. Live Streaming support in Q3 as well. DApps could compete with things like twitch, or twitch themselves could switch to AIOZ for CDN.

The team are building constantly and even have #NFT 's and a DEX in the Q4 2021 pipeline. Live Streaming support in Q3 as well. DApps could compete with things like twitch, or twitch themselves could switch to AIOZ for CDN.

Competition

$THETA is the only competitor valued at $13.6bn.

$AIOZ will launch at $0.0006bn / $600k market cap; 22,650th of the price.

However there is a big difference…

$THETA is the only competitor valued at $13.6bn.

$AIOZ will launch at $0.0006bn / $600k market cap; 22,650th of the price.

However there is a big difference…

$THETA only have their own DApp deployed on their network. $AIOZ is focused on developing developers portal resources for dApp deployment; expanding their potential market dramatically; i.e. an ecosystem of products that require $AIOZ to function.

This could lead to an entire new era of decentralised apps that are supported on the $AIOZ network; creating huge demand for the token itself. Many of the below could either use the CDN to save money, or be replicated entirely using the AIOZ blockchain:

In these projects, I always ask, "What would make me sell my token?" if I was a node operator. The answer really is nothing until it gets to $1BN+ market cap at a minimum. That's nearly 1,700X initial listing price…

In summary why it's my next 100X $ALT:

- Team

- History & proven ability

- Tech

- Roadmap

- Potential to disrupt an entire industry in MULTIPLE ways.

$600K market cap at launch vs. $THETA 's $13bn

Launches 2nd of April on $PAID IGNITION and #BSCPad.

- Team

- History & proven ability

- Tech

- Roadmap

- Potential to disrupt an entire industry in MULTIPLE ways.

$600K market cap at launch vs. $THETA 's $13bn

Launches 2nd of April on $PAID IGNITION and #BSCPad.

p.s. this took me a while to compile so if you enjoyed/appreciated it please show me some love and like/RT and it'll encourage me to do more.

• • •

Missing some Tweet in this thread? You can try to

force a refresh