Thread on ITC 🧵

(CLSA report + MJK Investment presentation)

Market cap: 259,593 crores

Revenues: 51,393 crores

P/E: 19.57

P/B: 4.39

Dividend yield: 4.81%

ROCE: 32.32%

ROE: 25.89%

Detailed presentation:

bit.ly/3fsE7b8

Here we go👇

1/25

@dmuthuk

(CLSA report + MJK Investment presentation)

Market cap: 259,593 crores

Revenues: 51,393 crores

P/E: 19.57

P/B: 4.39

Dividend yield: 4.81%

ROCE: 32.32%

ROE: 25.89%

Detailed presentation:

bit.ly/3fsE7b8

Here we go👇

1/25

@dmuthuk

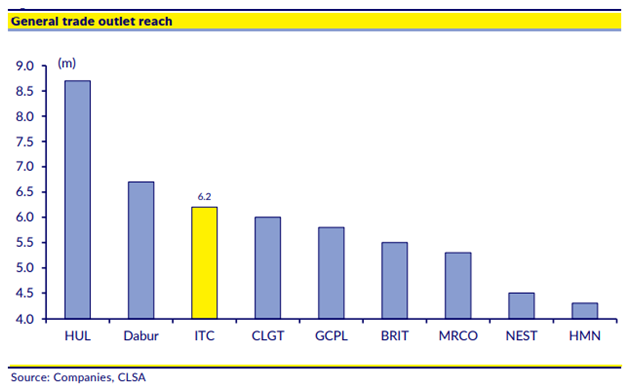

The second-largest FMCG player in India in terms of revenue;

Company has incubated a larger category basket compared to peers, has an improving sales mix, falling incubation costs, operating leverage benefits, & ability to move into new categories with limited incremental

2/25

Company has incubated a larger category basket compared to peers, has an improving sales mix, falling incubation costs, operating leverage benefits, & ability to move into new categories with limited incremental

2/25

costs.

Cigarettes account for 80% of tobacco industry tax and 9% of overall tobacco consumption;

ITC’s derating in the past year was a factor of ESG related concerns, regulatory tightening, Capital allocation and Covid-created uncertainty;

3/25

Cigarettes account for 80% of tobacco industry tax and 9% of overall tobacco consumption;

ITC’s derating in the past year was a factor of ESG related concerns, regulatory tightening, Capital allocation and Covid-created uncertainty;

3/25

Most of these concerns are set to be addressed as the FMCG business is at an inflection point & capital allocation issues are being addressed;

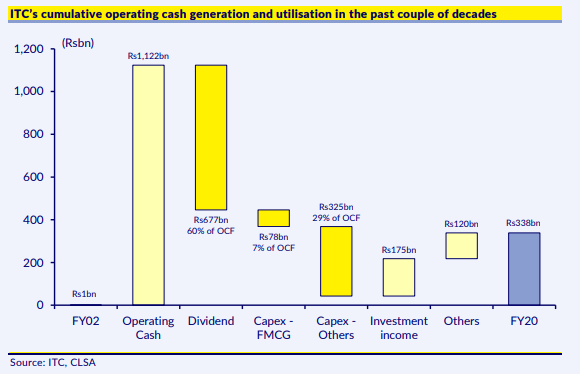

Over past two decades, ITC used a small portion of its core business operating cashflow to incubate & scale-up its FMCG business;

4/25

Over past two decades, ITC used a small portion of its core business operating cashflow to incubate & scale-up its FMCG business;

4/25

The FMCG business has built a strong brand portfolio, largely organically, and is at an inflection point in terms of both scale and margins.

ITC is looking to quickly grow its FMCG business, which currently makes US$2bn of revenue (or about 28% of total ITC revenue);

5/25

ITC is looking to quickly grow its FMCG business, which currently makes US$2bn of revenue (or about 28% of total ITC revenue);

5/25

It is mainly focused on foods, which made up 81% of its business in FY20;

In less than two decades, ITC has become the second-largest FMCG firm in India in terms of revenue, with most of its portfolio built organically (barring a few small-ticket brand acquisitions);

6/25

In less than two decades, ITC has become the second-largest FMCG firm in India in terms of revenue, with most of its portfolio built organically (barring a few small-ticket brand acquisitions);

6/25

In the last decade, revenue contribution from FMCG expanded from 20% in FY10 to 28% in FY20; Similarly, EBITDA contribution expanded from (-6%) in FY10 to +7% in FY20;

Between FY08 - FY20, revenue from the FMCG segment saw a CAGR of 15%, new categories developed included

7/25

Between FY08 - FY20, revenue from the FMCG segment saw a CAGR of 15%, new categories developed included

7/25

noodles, juices, and personal care.

ITC is one of the most diversified FMCG businesses in India;

With strategic CAPEX now in place, no need for any expansionary CAPEX for the organic business over the next five years;

8/25

ITC is one of the most diversified FMCG businesses in India;

With strategic CAPEX now in place, no need for any expansionary CAPEX for the organic business over the next five years;

8/25

The Savlon brand, acquired in FY15, has seen a CAGR of 50%, Nimyle, acquired a couple of years ago, saw 100% CAGR.

Agri-business- a strategic fit & competitive advantage:

ITC has a broad agri-business with a non-leaf tobacco share of 86% compared to 62% a decade ago

9/25

Agri-business- a strategic fit & competitive advantage:

ITC has a broad agri-business with a non-leaf tobacco share of 86% compared to 62% a decade ago

9/25

The agri-business provides strong back-end support (42% of internal sales for FY20);

Its “e-choupal” initiative (a digital endeavor for direct procurement from farmers) has widened its coverage, linking 35,000 villages through about 6,100 e-Choupal, servicing about

10/25

Its “e-choupal” initiative (a digital endeavor for direct procurement from farmers) has widened its coverage, linking 35,000 villages through about 6,100 e-Choupal, servicing about

10/25

4million farmers;

ITC sources about two-thirds of its procurement through e-Choupal;

ITC’s agri-business capabilities play an important role in securing supplies for its packaged food business, too;

11/25

ITC sources about two-thirds of its procurement through e-Choupal;

ITC’s agri-business capabilities play an important role in securing supplies for its packaged food business, too;

11/25

Foods & Beverages categories offer an opportunity to create scale but have relatively low margin profiles (10-20%, versus around 25-30% for home & personal care).

ITC has made significant front-end investments in capacity:

Seeing the potential opportunity from Organized

12/25

ITC has made significant front-end investments in capacity:

Seeing the potential opportunity from Organized

12/25

foods and beverages, ITC has been aggressive over the last couple of decades in setting up capacity across this vertical;

Since FY02, ITC’s FMCG business has invested Rs78bn in CAPEX with cumulative EBITDA losses of Rs10bn;

The business turned profit positive from FY13;

13/25

Since FY02, ITC’s FMCG business has invested Rs78bn in CAPEX with cumulative EBITDA losses of Rs10bn;

The business turned profit positive from FY13;

13/25

ITC has added 9 integrated consumer goods manufacturing and logistics (ICML) facilities and is in process of setting up two more;

To provide structural advantages including ensuring product freshness, Improving market responsiveness, and providing a heightened focus on

14/25

To provide structural advantages including ensuring product freshness, Improving market responsiveness, and providing a heightened focus on

14/25

product hygiene, safety, and quality. In 2018, ITC commissioned its largest integrated food manufacturing and logistics facility with ‘Wheat-mandi’, with an investment of Rs15bn in Kapurthala, Punjab; This ICML is still in the ramp-up phase, with direct buying from farmers

15/25

15/25

reducing transaction, handling, and transportation costs; ITC currently sources two-thirds of its agri-requirements directly from Farmers and the rest from the open market.

Key reasons for ITC pursuing acquisitions could be to address gaps in its portfolio & distribution;

16/25

Key reasons for ITC pursuing acquisitions could be to address gaps in its portfolio & distribution;

16/25

Interestingly, Atta is perceived by some to be a low margin business, it is now a high-single-digit margin business (with 9% Ebit margin);

Improving scale, rising premium compared to peers, less need for promotions, and increasing captive production should help drive

17/25

Improving scale, rising premium compared to peers, less need for promotions, and increasing captive production should help drive

17/25

strong margin expansion in the Atta business;

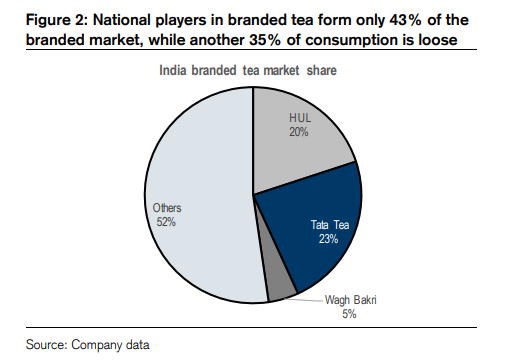

The decision to focus on foods was strategically sound, given the wide penetration of categories with a large unorganized share, limited competition in the organized space, and Consumers trading up as the economy grew.

18/25

The decision to focus on foods was strategically sound, given the wide penetration of categories with a large unorganized share, limited competition in the organized space, and Consumers trading up as the economy grew.

18/25

A focus on value-accretive segments:

ITC’s food business is concentrated in categories with limited added value;

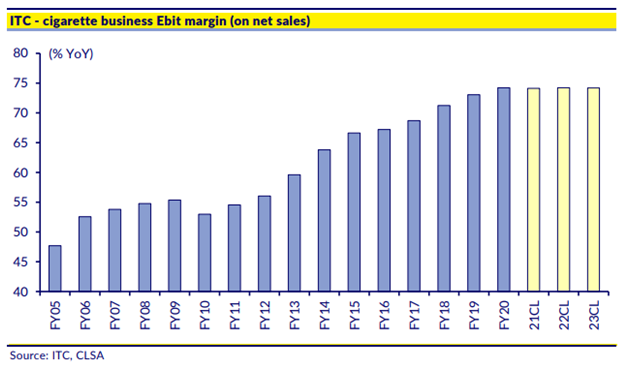

Cigarettes- A cash cow:

Despite multiple headwinds, ITC’s cigarette business has maintained profit growth momentum which in turn has helped

19/25

ITC’s food business is concentrated in categories with limited added value;

Cigarettes- A cash cow:

Despite multiple headwinds, ITC’s cigarette business has maintained profit growth momentum which in turn has helped

19/25

create steady free cash flow;

ITC has said that while legal industry volume declined 20% over FY11-FY20, illegal volume grew 36%. EBIT margin looks like it may have reached its limit:

The management approach of completely passing on the effect of any tax increase has

20/25

ITC has said that while legal industry volume declined 20% over FY11-FY20, illegal volume grew 36%. EBIT margin looks like it may have reached its limit:

The management approach of completely passing on the effect of any tax increase has

20/25

been rewarded with improvements in margin profile.

Hefty contribution to exchequer:

Payout in terms of taxes has been high given the high taxation structure for cigarettes

With steady increases in indirect tax, the company’s indirect payout expanded to c.41% of gross revenue.

Hefty contribution to exchequer:

Payout in terms of taxes has been high given the high taxation structure for cigarettes

With steady increases in indirect tax, the company’s indirect payout expanded to c.41% of gross revenue.

According to the Global Adult Tobacco Survey India 2016-17, while 42% of adult Indian males consume tobacco only 7% of them smoke cigarettes (compared to 14% who smoke bidis and 30% who use smokeless tobacco);

22/25

22/25

Dividend yield looks attractive:

The large pile of cash and liquid investments at ITC’s disposal (US$4.6bn as of March 2020, c.16% of market cap) means the dividend payout can be ramped up further.

Strategic changes to capital allocation address some concerns:

23/25

The large pile of cash and liquid investments at ITC’s disposal (US$4.6bn as of March 2020, c.16% of market cap) means the dividend payout can be ramped up further.

Strategic changes to capital allocation address some concerns:

23/25

Management has noted that it will go asset-light for hotels, where the focus would now be on managed properties

Increased focus on improving the ESG scorecard:

In past 2 decades it has put in place a series of sustainability initiatives around carbon emissions, renewable

24/25

Increased focus on improving the ESG scorecard:

In past 2 decades it has put in place a series of sustainability initiatives around carbon emissions, renewable

24/25

energy, water conservation, animal husbandry, & empowerment of women;

ITC ranked 1st globally amongst peers (comprising companies with a market cap between US$38bn and US$51bn), & overall 3rd globally on ESG performance in the Food Products industry.

End of Thread🧵

25/25

ITC ranked 1st globally amongst peers (comprising companies with a market cap between US$38bn and US$51bn), & overall 3rd globally on ESG performance in the Food Products industry.

End of Thread🧵

25/25

• • •

Missing some Tweet in this thread? You can try to

force a refresh