1/ The Closed-End Funds Puzzle: A Survey Review (Charrón)

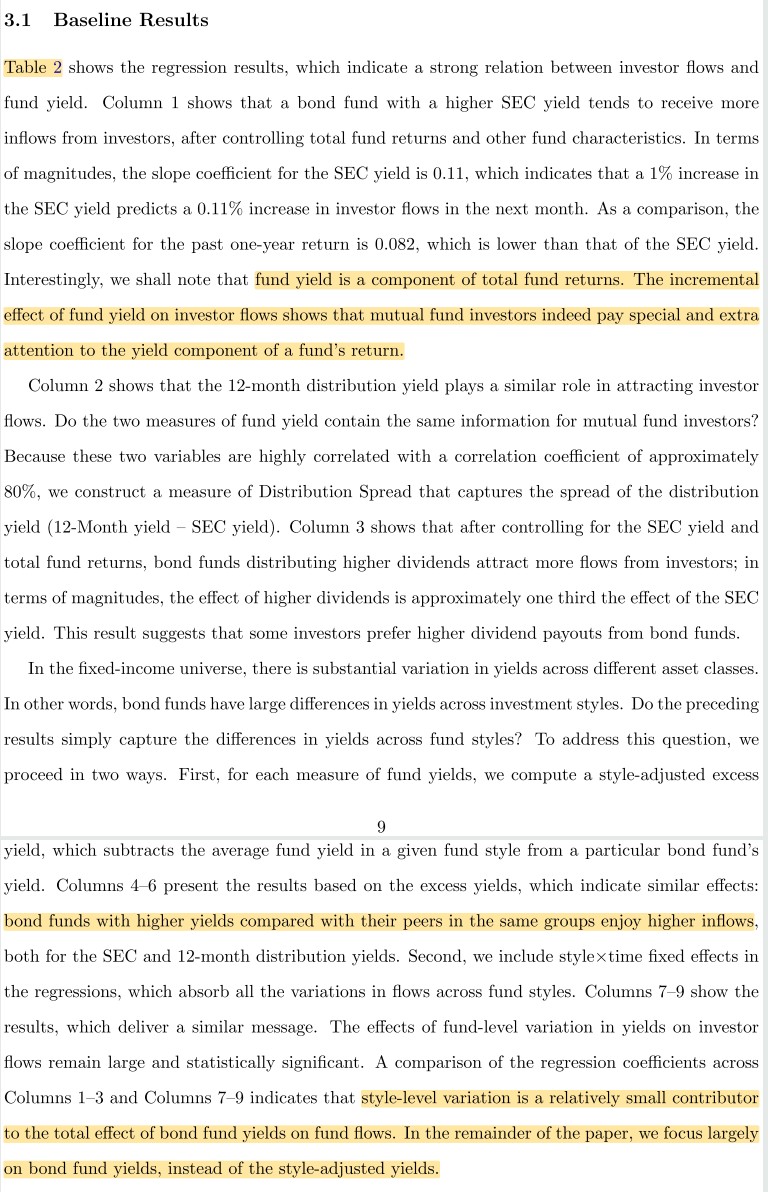

"So far, none of the possible explanations from either traditional finance or behavioral finance has been able to fully account for the occurrence of the CEF puzzle."

dialnet.unirioja.es/descarga/artic…

"So far, none of the possible explanations from either traditional finance or behavioral finance has been able to fully account for the occurrence of the CEF puzzle."

dialnet.unirioja.es/descarga/artic…

2/ "Discounts are subject to wide variations over time and across funds. The fluctuations appear to be mean-reverting and highly correlated. When merger, liquidation, or conversion to open-end fund terminates a closed-end fund, prices tend to converge to reported NAVs."

3/ "Malkiel finds a positive relationship between discounts and unrealized appreciation and restricted stocks. Funds with higher liquidity, have higher premiums or lower discounts.

"On the other hand, Lee et al. showed that restricted holdings could not explain the discount."

"On the other hand, Lee et al. showed that restricted holdings could not explain the discount."

4/ "Malkiel finds that restricted stock, turnover ratio and unrealized appreciation could explain the discounts, but not insider ownership, payout, or expenses.

"The greater the managerial stock ownership in the closed-end fund, the larger the discounts to NAV."

"The greater the managerial stock ownership in the closed-end fund, the larger the discounts to NAV."

5/ "There is a positive relationship between discounts and unrealized capital appreciation.

"Discounts are pos. correlated with the variance of the assets.

"But British funds behave like U.S. funds, suggesting that the discount cannot be explained by country-specific taxes."

"Discounts are pos. correlated with the variance of the assets.

"But British funds behave like U.S. funds, suggesting that the discount cannot be explained by country-specific taxes."

6/ "Lee and Moore hypothesize that a high dividend yield is the primary factor that drives the demand for closed-end bond funds. Their results show a very strong negative relationship between dividend yield and discounts even in the presence of the other explanatory variables."

7/ "The discount/premium can arise for funds with portfolios difficult to replicate, pay smaller dividends, with lower market values, and when the interest rates are high. Premia have an economically strong ability to predict returns, which is related to premium mean reversion."

8/ "Although Russel and Malhotra find prices of CEFs are affected by the expense ratio of the fund, size of fund, and fund family membership, they conclude that none of the theories individually or collectively can explain the CEF discount."

9/ "Lee et al., construct a value-weighted index of discounts. They find a strong correlation between the discounts of individual CEFs. They also find evidence that discounts narrow when small stocks do well, the correlation being stronger the smaller the stock."

10/ "Despite the fact that bond funds hold assets whose values are far less subject to waves of optimism or pessimism than stock funds, discounts on bond funds exhibit systematic risk which is essentially as large as that of stock funds."

11/ Related research:

What Drives CEF Discounts? Evidence from COVID-19

Strategic Timing in CEF Portfolio Holdings Disclosure

Exploiting Closed-End Fund Discounts: A Systematic Examination of Alphas

What Drives CEF Discounts? Evidence from COVID-19

https://twitter.com/ReformedTrader/status/1371139740557185028

Strategic Timing in CEF Portfolio Holdings Disclosure

https://twitter.com/ReformedTrader/status/1370801944827027458

Exploiting Closed-End Fund Discounts: A Systematic Examination of Alphas

https://twitter.com/ReformedTrader/status/1354923117898960896

12/ Dividend policy, signaling, and discounts on closed-end funds

Excess Volatility and Closed-End Funds

https://twitter.com/ReformedTrader/status/1373800895599681539

Excess Volatility and Closed-End Funds

https://twitter.com/ReformedTrader/status/1373702041206353920

• • •

Missing some Tweet in this thread? You can try to

force a refresh