1/ Excess Volatility and Closed-End Funds (Pontiff)

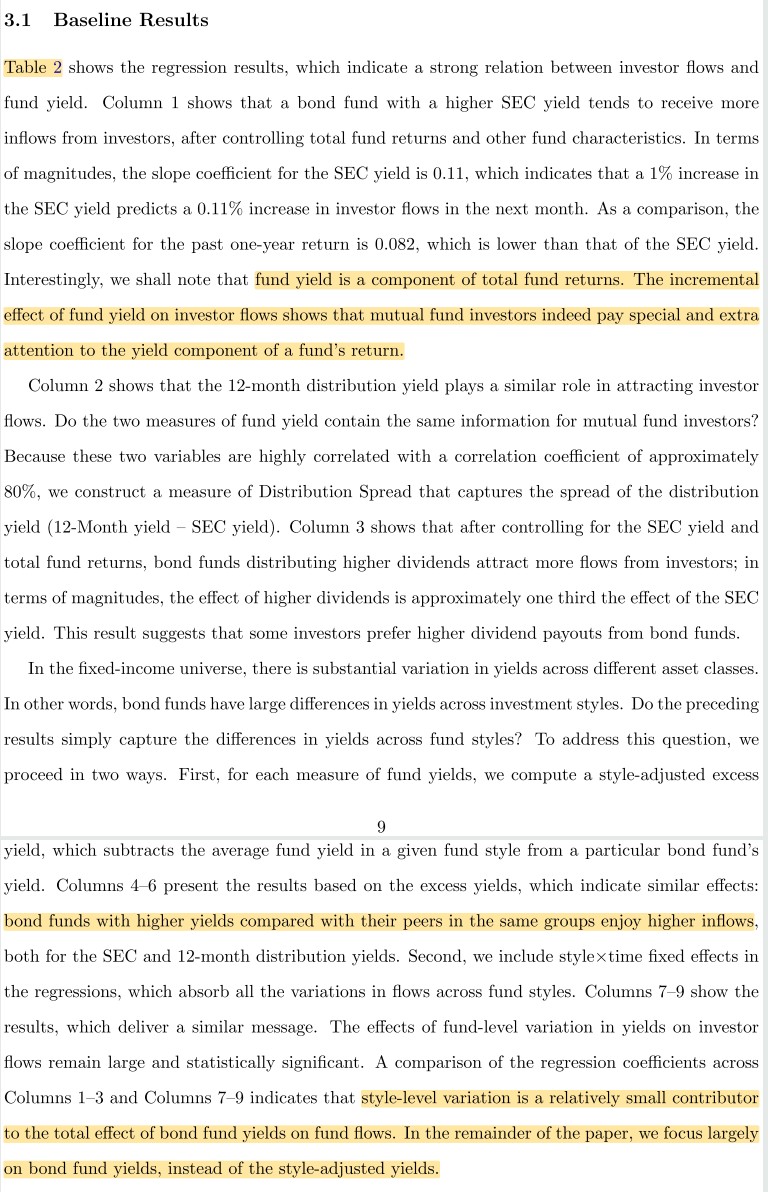

"The avg CEF's monthly return is 64% more volatile than its assets'. Although largely idiosyncratic, 15% of excess risk is explained by market risk, small-firm risk, and risk that affects other CEFs."

jstor.org/stable/2950859…

"The avg CEF's monthly return is 64% more volatile than its assets'. Although largely idiosyncratic, 15% of excess risk is explained by market risk, small-firm risk, and risk that affects other CEFs."

jstor.org/stable/2950859…

2/ Sample of 52 publicly-traded CEFs with more than six months of discount data (1965-85)

"If NAV (stock) returns have a larger effect on changes in premiums than stock (NAV) returns, then NAV returns are more (less) volatile than stock returns."

"If NAV (stock) returns have a larger effect on changes in premiums than stock (NAV) returns, then NAV returns are more (less) volatile than stock returns."

3/ "The average monthly CEF return variance is greater than the average NAV return variance.

"CEF prices also underreact to NAV returns. If the NAV is the fundamental value, this implies that CEF prices are excessively volatile, despite underreacting to fundamentals."

"CEF prices also underreact to NAV returns. If the NAV is the fundamental value, this implies that CEF prices are excessively volatile, despite underreacting to fundamentals."

4/ "Adjusted R²s estimate of how closely a CEF's NAV can be replicated with open-end funds.

"A median adjusted R² of 70% implies that the assets and management styles used by CEFs are not unique to the industry.

"The average CEF NAV is redundant, given the ten open-end funds."

"A median adjusted R² of 70% implies that the assets and management styles used by CEFs are not unique to the industry.

"The average CEF NAV is redundant, given the ten open-end funds."

5/ "Most excess CEF volatility is unrelated to market factors.

"This is interesting, since virtually all excess volatility studies use market indexes. If typical stocks are similar to CEFs, 98% of their excess volatility would be not be captured by tests using a market index."

"This is interesting, since virtually all excess volatility studies use market indexes. If typical stocks are similar to CEFs, 98% of their excess volatility would be not be captured by tests using a market index."

6/ "Most funds have a positive exposure to investor sentiment risk, as proxied by the cap-weighted return of *other* CEFs in excess of their portfolios.

"Market and size betas are small (0.13 and 0.20) but statistically significant. B/M is not significantly different from zero."

"Market and size betas are small (0.13 and 0.20) but statistically significant. B/M is not significantly different from zero."

7/ "On average, the high (low) premium sells at a discount of 1.4% (17.1%) with σ = 9.8% (7.6%).

"The low-premium portfolio has strong exposure to book-to-market risk; the high-premium portfolio does not.

"Both have market risk, small-firm risk, and investor sentiment risk."

"The low-premium portfolio has strong exposure to book-to-market risk; the high-premium portfolio does not.

"Both have market risk, small-firm risk, and investor sentiment risk."

8/ "Prices are more volatile than fundamentals, even though there is a tendency for prices to underreact to fundamentals.

"Since the excess volatility is largely idiosyncratic, tests that examine diversified portfolios will overlook this large component of volatility."

"Since the excess volatility is largely idiosyncratic, tests that examine diversified portfolios will overlook this large component of volatility."

9/ Related research:

What Drives CEF Discounts? Evidence from COVID-19

Strategic Timing in CEF Portfolio Holdings Disclosure

Exploiting Closed-End Fund Discounts: A Systematic Examination of Alphas

What Drives CEF Discounts? Evidence from COVID-19

https://twitter.com/ReformedTrader/status/1371139740557185028

Strategic Timing in CEF Portfolio Holdings Disclosure

https://twitter.com/ReformedTrader/status/1370801944827027458

Exploiting Closed-End Fund Discounts: A Systematic Examination of Alphas

https://twitter.com/ReformedTrader/status/1354923117898960896

10/ Dividend policy, signaling, and discounts on closed-end funds

https://twitter.com/ReformedTrader/status/1373800895599681539

• • •

Missing some Tweet in this thread? You can try to

force a refresh