Thread on Biocon 🧵

Market cap: 49,056 crores.

Revenues: 6,367 crores.

P/E: 80.33

P/B 6.95

ROCE: 14.25%

ROE: 14.26%

Here we go 👇

1/25

Market cap: 49,056 crores.

Revenues: 6,367 crores.

P/E: 80.33

P/B 6.95

ROCE: 14.25%

ROE: 14.26%

Here we go 👇

1/25

Biologics are agents derived from living organisms rather than chemicals;

Unlike small-molecule generics, biosimilars are not exact copies of their reference products (biologic);

The fact that biologics are derived from Living organisms also adds some slight-but not

2/25

Unlike small-molecule generics, biosimilars are not exact copies of their reference products (biologic);

The fact that biologics are derived from Living organisms also adds some slight-but not

2/25

necessarily meaningful-variability;

Biocon has 2 biosimilars launched in the US, 1 approved by USFDA (to be launched in FY21), while 2 under review;

In the EU, Biocon has 3 biosimilars launched, 2 approved, while 2 under-review;

3/25

Biocon has 2 biosimilars launched in the US, 1 approved by USFDA (to be launched in FY21), while 2 under review;

In the EU, Biocon has 3 biosimilars launched, 2 approved, while 2 under-review;

3/25

Biocon has launched and approved biosimilars throughout the world and has a combined pipeline of 28 molecules;

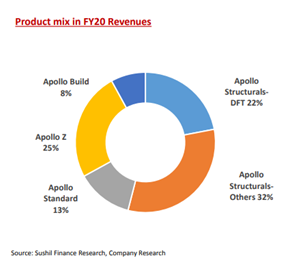

In FY20 Biosimilar, Generics and Research Services division, each account for 30-31% of the consolidated revenue of the company,

4/25

In FY20 Biosimilar, Generics and Research Services division, each account for 30-31% of the consolidated revenue of the company,

4/25

while the remaining 8% revenue comes from the Branded Formulations division of the company;

In 2018, Sandoz, the Novartis Biologics division announced its partnership with Biocon for 2026 Biosimilars Second wave wherein Biocon is a partner in Profit sharing as well;

5/25

In 2018, Sandoz, the Novartis Biologics division announced its partnership with Biocon for 2026 Biosimilars Second wave wherein Biocon is a partner in Profit sharing as well;

5/25

74% of physicians who responded reported ‘physician confidence’ as one of the biggest barriers to widespread adoption of biosimilars;

What makes Biosimilars cost-effective is the cost saved in the very many clinical and human trials that a biologic need to go through;

6/25

What makes Biosimilars cost-effective is the cost saved in the very many clinical and human trials that a biologic need to go through;

6/25

Indian pharma companies including Biocon, Glenmark Pharmaceuticals, and Zydus Wellness are actively focusing on the biosimilars market. Biocon, for instance, earned Rs 2,000 crore or nearly 30% of its revenue from biosimilars in FY20.

7/25

7/25

Strong Future pipeline:

Biocon’s target to have at least 8 biosimilars available in developed markets through the partner Mylan, by the end of FY22 viz. Trastuzumab, Pegfilgrastim, Adalimumab, Bevacizumab, Etanercept,Insulin Glargine, Insulin Aspart and rh-Insulin,-

8/25

Biocon’s target to have at least 8 biosimilars available in developed markets through the partner Mylan, by the end of FY22 viz. Trastuzumab, Pegfilgrastim, Adalimumab, Bevacizumab, Etanercept,Insulin Glargine, Insulin Aspart and rh-Insulin,-

8/25

Addressing an estimated market opportunity of up to

USD $33 billion;

Their pipeline is expected to deliver 3 additional molecules between FY23 and FY25 which are undisclosed now;

Biocon remains committed to impacting 5 million patient lives and-

9/25

USD $33 billion;

Their pipeline is expected to deliver 3 additional molecules between FY23 and FY25 which are undisclosed now;

Biocon remains committed to impacting 5 million patient lives and-

9/25

Attain a revenue milestone of USD 1 billion in the Biosimilars Division which translates into 70% CAGR for the next two years.

Biocon has 4 business divisions namely Generics, Biosimilar, Novel Biologic, and Research Services.

10/25

Biocon has 4 business divisions namely Generics, Biosimilar, Novel Biologic, and Research Services.

10/25

Generics Business:

Biocon’s Small Molecules (Generics Business) manufactures APIs and crossed an annual revenue milestone of Rs. 2,000 crore in FY20 generating revenue growth of 18% YoY;

To secure anticipated growth in fermentation-derived APIs,-

11/25

Biocon’s Small Molecules (Generics Business) manufactures APIs and crossed an annual revenue milestone of Rs. 2,000 crore in FY20 generating revenue growth of 18% YoY;

To secure anticipated growth in fermentation-derived APIs,-

11/25

the company commenced construction work on a greenfield, a fermentation-based manufacturing facility in Visakhapatnam, Andhra Pradesh in FY20 with an estimated CAPEX of Rs. 600 crore, which will enable a company to deliver a vertically integrated strategy of developing-

12/25

12/25

and commercializing our own Generic Formulations and service the needs of our global API customers;

The company expects this facility to be operational over the next three years followed by commercialization based on regulatory approvals in major markets.

13/25

The company expects this facility to be operational over the next three years followed by commercialization based on regulatory approvals in major markets.

13/25

Biosimilar Business:

The Biologics business ended FY20 on a strong note, reporting a 29% growth in revenue at Rs. 1,951 crore;

The company has also commercialized many biosimilars in Europe and Most of the World (MoW) Markets becoming the only company in the world-

14/25

The Biologics business ended FY20 on a strong note, reporting a 29% growth in revenue at Rs. 1,951 crore;

The company has also commercialized many biosimilars in Europe and Most of the World (MoW) Markets becoming the only company in the world-

14/25

With such a strong pipeline of biosimilars;

Biocon Biologics has set a target of impacting 5 million patient lives and attaining a revenue milestone of USD 1 billion in FY22.

Branded Formulations Business:

Segmental revenue stood at Rs. 536 crore, which contributed

15/25

Biocon Biologics has set a target of impacting 5 million patient lives and attaining a revenue milestone of USD 1 billion in FY22.

Branded Formulations Business:

Segmental revenue stood at Rs. 536 crore, which contributed

15/25

8% to FY20 consolidated revenue, declined 18% primarily due to significant downward pricing pressures in leading assets, and increased competition for some of the key brands in India;

Branded Formulations business, starting FY21 will be merged-

16/25

Branded Formulations business, starting FY21 will be merged-

16/25

And reported under Biosimilars Segment.

Research Services Business (Syngene International):

During FY20, Syngene’s revenue grew 10% to Rs. 2,012 crore, It contributes 30% to Biocon’s consolidated revenues;

In Mangaluru, the construction of-

17/25

Research Services Business (Syngene International):

During FY20, Syngene’s revenue grew 10% to Rs. 2,012 crore, It contributes 30% to Biocon’s consolidated revenues;

In Mangaluru, the construction of-

17/25

Active Pharmaceutical Ingredient (API) manufacturing facility in Mangaluru is complete and is going through the process of qualification and validation;

It is currently in preparation to commence full-scale commercial operations towards the end of FY21.

18/25

It is currently in preparation to commence full-scale commercial operations towards the end of FY21.

18/25

Strong Financials:

Biocon’s revenue has grown significantly from Rs. 3,460 Crore in FY16 to Rs. 6,529 Crore in FY20 at a CAGR of 17.2%;

Biocon has invested over Rs. 2,200 crore in CAPEX in last 5 years alone;

Gross R&D spend has remained in the range of 8-12%-

19/25

Biocon’s revenue has grown significantly from Rs. 3,460 Crore in FY16 to Rs. 6,529 Crore in FY20 at a CAGR of 17.2%;

Biocon has invested over Rs. 2,200 crore in CAPEX in last 5 years alone;

Gross R&D spend has remained in the range of 8-12%-

19/25

Of the total expenses for the last 5 years which validate the fact that the company aspires to become an innovation-driven company;

Biocon has generated strong ROEs at an average rate of 12.8% and ROCE at an average rate of 14.4% over the last 5 years.

20/25

Biocon has generated strong ROEs at an average rate of 12.8% and ROCE at an average rate of 14.4% over the last 5 years.

20/25

Dedicated Management for Each Vertical:

The biggest benefit of having business spread across different verticals is the mitigation of risk;

When due to unavoidable external forces, one side of the business is down, the company has different business-

21/25

The biggest benefit of having business spread across different verticals is the mitigation of risk;

When due to unavoidable external forces, one side of the business is down, the company has different business-

21/25

To come to the rescue and sail the company forward in the toughest of the situations.

Aggressive Capex Plans:

Management expects CAPEX spend to be USD 200 million ~Rs. 1500 crore each in FY21 & FY22, split equally between Small Molecules and the Biosimilars businesses.

22/25

Aggressive Capex Plans:

Management expects CAPEX spend to be USD 200 million ~Rs. 1500 crore each in FY21 & FY22, split equally between Small Molecules and the Biosimilars businesses.

22/25

Management Transparency and Accountability are key to Biocon’s success:

Biocon’s Management scores full marks for transparency and accountability;

Company’s management is always committed to high standards of Corporate Governance and has in place appropriate structures-

23/25

Biocon’s Management scores full marks for transparency and accountability;

Company’s management is always committed to high standards of Corporate Governance and has in place appropriate structures-

23/25

And reporting systems.

Biocon’s research services Syngene has long-standing partnerships with Bristol Myers Squibb, Amgen, Abbott Nutrition, Baxter, Glaxo Smith Kline, Herbal life nutrition, & many more pharma giants, that shows Biocon’s representation at a global level.

24/25

Biocon’s research services Syngene has long-standing partnerships with Bristol Myers Squibb, Amgen, Abbott Nutrition, Baxter, Glaxo Smith Kline, Herbal life nutrition, & many more pharma giants, that shows Biocon’s representation at a global level.

24/25

RISKS:

R&D does not always capitalize- replicating the biosimilar drug with the innovator drug is very difficult and has a lot of costs involved;

So, it may happen that spending billions on a molecule’s R&D may not clear trials at later stages or-

25/25

R&D does not always capitalize- replicating the biosimilar drug with the innovator drug is very difficult and has a lot of costs involved;

So, it may happen that spending billions on a molecule’s R&D may not clear trials at later stages or-

25/25

(Additional Tweets to complete the thread)

Not able to prove Bioequivalence, Hence, it can dent the company drastically;

USFDA is a big trigger- Litigation barriers can also allow other biosimilar manufacturers, that would have otherwise been 3rd or 4th to market,

Not able to prove Bioequivalence, Hence, it can dent the company drastically;

USFDA is a big trigger- Litigation barriers can also allow other biosimilar manufacturers, that would have otherwise been 3rd or 4th to market,

to get ahead of the presumptive biosimilar market leader and launch their products first, which again impacts a company’s strategy;

Originator Company’s Strategies to Slow Market Growth of Biosimilars- Biologics originators have been deploying a host of defensive strategies

Originator Company’s Strategies to Slow Market Growth of Biosimilars- Biologics originators have been deploying a host of defensive strategies

In their fight against biosimilars;

One is to get the patent on a biological drug extended (in one instance, by as many as 15 years); another is to insist that the drug’s manufacturing requirements & clinical data qualify as trade secrets.

End of thread 🧵

One is to get the patent on a biological drug extended (in one instance, by as many as 15 years); another is to insist that the drug’s manufacturing requirements & clinical data qualify as trade secrets.

End of thread 🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh