Thread on APL Apollo Tubes 🧵

Market cap: 16,588 crores.

Revenues: 7.723 crores.

P/E: 55.71

P/B: 10.49

ROCE: 20.12%

ROE: 22.23%

Here we go👇

APL Apollo is India’s leading steel tubes manufacturer with 2,600 KTPA capacity;

It has positioned itself as India’s leading

1/25

Market cap: 16,588 crores.

Revenues: 7.723 crores.

P/E: 55.71

P/B: 10.49

ROCE: 20.12%

ROE: 22.23%

Here we go👇

APL Apollo is India’s leading steel tubes manufacturer with 2,600 KTPA capacity;

It has positioned itself as India’s leading

1/25

branded steel tubes manufacturer, following sustained branding and awareness initiatives over the past few years;

APL Apollo Tubes commenced operations in 1986 as a private limited company promoted by the late Mr. Sudesh Gupta;

2/25

APL Apollo Tubes commenced operations in 1986 as a private limited company promoted by the late Mr. Sudesh Gupta;

2/25

It has emerged as one of India’s leading Electric Resistance Welded (ERW) steel tubes manufacturers; At least 70% of the company’s products are niche categories that have limited competition;

Products cover a range of industrial applications such as urban infrastructure,

3/25

Products cover a range of industrial applications such as urban infrastructure,

3/25

construction, housing, energy, irrigation, and solar plants; Over the years, the company has established a strong distribution network across India, with access to more than 800 distributors, 50k retailers, and 200k fabricators.

4/25

4/25

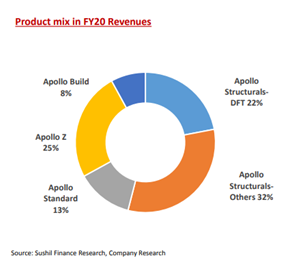

The share of value-added products has now risen to 60% (40% in FY16) & is driving overall margin expansion;

The acquisition of Apollo Tricoat in FY18 played a significant role in improving the company’s product profile and margins;

Outlook for the structural steel-tubes

5/25

The acquisition of Apollo Tricoat in FY18 played a significant role in improving the company’s product profile and margins;

Outlook for the structural steel-tubes

5/25

industry in India remains strong, driven by a government push for infrastructure, revival in real estate, & increased acceptance of steel over traditional materials;

More than 90% of the company’s overall revenue is primarily from 2 sectors i.e. Housing and Infrastructure;

6/25

More than 90% of the company’s overall revenue is primarily from 2 sectors i.e. Housing and Infrastructure;

6/25

Increased need for housing in metro cities due to the large influx of the immigrant population has resulted in the government increasing the FSI of various areas & promote G+20 floors type of building which can provide huge growth potential for the Structural Steel Products (SSP)

The company had incurred a Capex of ~Rs. 5.5 Bn over FY17 to FY19 to expand its production capacity and add more SKUs to its product portfolio;

The company has plans for organic expansion where the total manufacturing capacity will be increased to 3 MTPA by end of FY22-

8/25

The company has plans for organic expansion where the total manufacturing capacity will be increased to 3 MTPA by end of FY22-

8/25

and inorganic expansion by way of acquiring Shankara’s Hyderabad unit and APL Tricoat.

Key Risk:

👉Subdued steel demand growth, Softening steel demand, especially in the building & construction segment, could impact the company’s volume growth and margins in the near term

9/25

Key Risk:

👉Subdued steel demand growth, Softening steel demand, especially in the building & construction segment, could impact the company’s volume growth and margins in the near term

9/25

👉Sustained weakness in steel prices or continuous decline in steel prices could hurt margins, as the company could suffer inventory losses, especially when new capacity is commissioned and utilization levels are low.

10/25

10/25

In line with capacity expansions, The company has delivered a strong ~25% volume CAGR over the past decade;

The company has been the pioneer in bringing high-speed mills from Europe and introducing pre-galvanized tubes and DFT technology in India;

11/25

The company has been the pioneer in bringing high-speed mills from Europe and introducing pre-galvanized tubes and DFT technology in India;

11/25

This allows cost-effective customization to meet client requirements; Access to DFT technology and in-line galvanizing (ILG) allows the manufacturing of niche eco-friendly products;

Its strategy to develop products that replace wood, steel angles, aluminum profiles,

12/25

Its strategy to develop products that replace wood, steel angles, aluminum profiles,

12/25

and RCC has been yielding good results;

It also undertook a mass branding exercise with TV and Print media, to improve brand visibility across India.

The structural steel-tubes market accounts for only 4% of the overall steel market in India, significantly lower

13/25

It also undertook a mass branding exercise with TV and Print media, to improve brand visibility across India.

The structural steel-tubes market accounts for only 4% of the overall steel market in India, significantly lower

13/25

than the global average of ~9%;

The company with its widest range of products, 800+ dealers, geographic diversity in terms of placement of manufacturing facilities, & investment in brand building has achieved a market share of ~50% (both organized and unorganized Sector);

14/25

The company with its widest range of products, 800+ dealers, geographic diversity in terms of placement of manufacturing facilities, & investment in brand building has achieved a market share of ~50% (both organized and unorganized Sector);

14/25

Sectors like Real estate and Infrastructure to be the core catalyst of growth:

Trends for affordable housing, with low cost and faster completion, are picking up in India; Modular buildings, where steel modules are stacked and connected together, are gaining traction.

15/25

Trends for affordable housing, with low cost and faster completion, are picking up in India; Modular buildings, where steel modules are stacked and connected together, are gaining traction.

15/25

The company from the start of this CAPEX cycle has focused on high margin products which can increase the profitability of the company;

The 400 KTPA capacity expansion at Raipur is underway, with expected commissioning by FY22, This should increase overall capacity to 3000 KTPA

The 400 KTPA capacity expansion at Raipur is underway, with expected commissioning by FY22, This should increase overall capacity to 3000 KTPA

Acquisition of APL Tricoat provides access to the in-line galvanizing technology, which seamlessly coats steel tubes with 3-layer protection in a continuous process;

This multi-layered coated tube (3-layer coating on the outside and one layer inside) enjoys double the

17/25

This multi-layered coated tube (3-layer coating on the outside and one layer inside) enjoys double the

17/25

the life of any other galvanized product. There are only about 10 such production lines globally, across 4-5 countries;

Apollo Tricoat reported healthy volume growth over FY20-21, as the popularity of its new products steadily improved, on the back of the company's

18/25

Apollo Tricoat reported healthy volume growth over FY20-21, as the popularity of its new products steadily improved, on the back of the company's

18/25

marketing & distribution efforts;

Utilization rates improved to more than 80% in 3QFY21, with some further improvement expected in the coming quarters

EBITDA/Tonne also gradually improved, to Rs7,800 in 3QFY21;

The management is targeting Rs9,000-10,000 of EBITDA/Tonne

19/25

Utilization rates improved to more than 80% in 3QFY21, with some further improvement expected in the coming quarters

EBITDA/Tonne also gradually improved, to Rs7,800 in 3QFY21;

The management is targeting Rs9,000-10,000 of EBITDA/Tonne

19/25

Over the medium term, driven by improved cost efficiencies (operational and distribution) and higher premium on solutions being offered (door frame solutions for an entire property);

The merger with APL Apollo would also drive ~5% improvement in overall EBITDA/Tonne;

20/25

The merger with APL Apollo would also drive ~5% improvement in overall EBITDA/Tonne;

20/25

Management has identified multiple synergies by executing this type of transaction like simplification of the group structure and create a single entity with 2.6 MTPA capacity, a stronger platform for future growth, with the greater financial flexibility to deploy capital,

21/25

21/25

operational synergies where the combined entity would have 4 plants in the NCR region and 3 plants around Bengaluru; An opportunity to consolidate plants and convert one plant in NCR for warehousing operations could be a possibility; Savings in distribution and marketing costs.

Currently, the company has a presence in 300 towns and cities across India, with 29 warehouses, more than 800 distributors, and 50,000 retailers with a dedicated retailer binding program;

Distribution reach and warehouses have rapidly expanded over the past few years,

23/25

Distribution reach and warehouses have rapidly expanded over the past few years,

23/25

in-line with growing volumes;

The company has introduced innovative incentive schemes for dealers, to push volumes;

And also connected with more than 200,000 fabricators through their Apollo connect bonding programs where fabricator meets to promote the APL Apollo Brand.

24/25

The company has introduced innovative incentive schemes for dealers, to push volumes;

And also connected with more than 200,000 fabricators through their Apollo connect bonding programs where fabricator meets to promote the APL Apollo Brand.

24/25

BRANDING- To drive the next leg of growth:

In November 2019, the company roped in Amitabh Bachchan as the brand ambassador for all the brands housed under APL Apollo, for 2 years;

Large-scale print and TV commercials were launched to improve visibility.

End of thread 🧵

25/25

In November 2019, the company roped in Amitabh Bachchan as the brand ambassador for all the brands housed under APL Apollo, for 2 years;

Large-scale print and TV commercials were launched to improve visibility.

End of thread 🧵

25/25

• • •

Missing some Tweet in this thread? You can try to

force a refresh