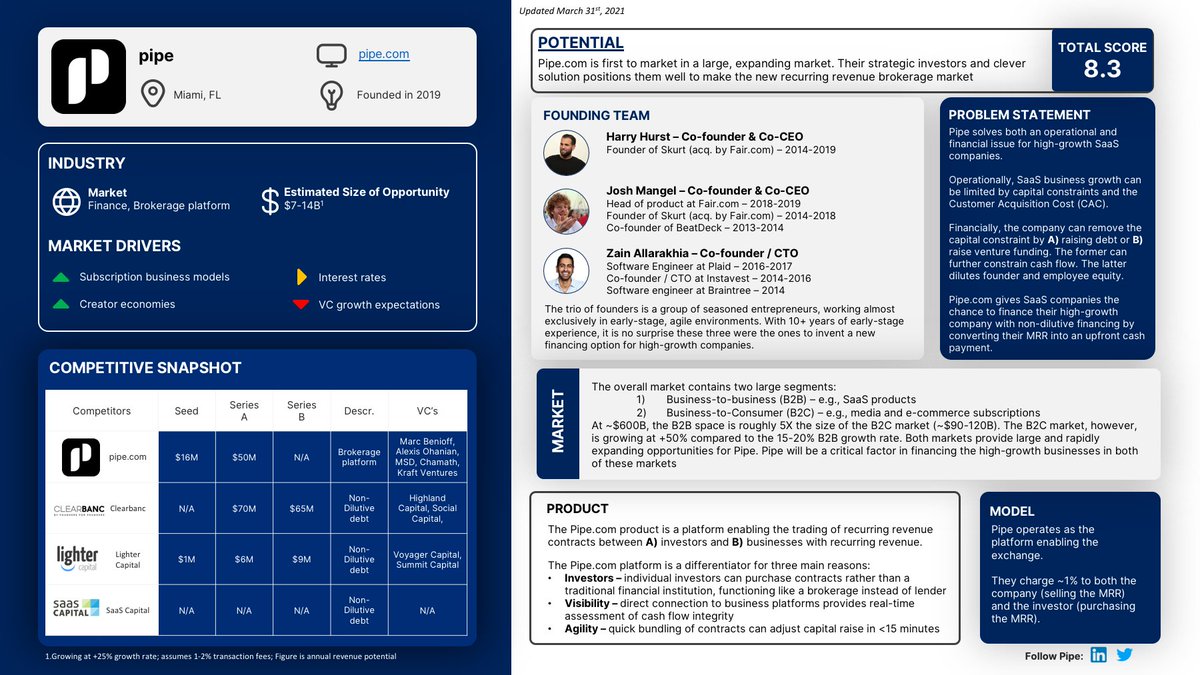

1/@pipe: The traditional venture capital disruptor

One month ago, @pipe raised a $50M series A from some of the biggest names in tech.

Here is my full breakdown of @pipe:

One month ago, @pipe raised a $50M series A from some of the biggest names in tech.

Here is my full breakdown of @pipe:

2/ The problem

High-growth companies need capital to scale rapidly.

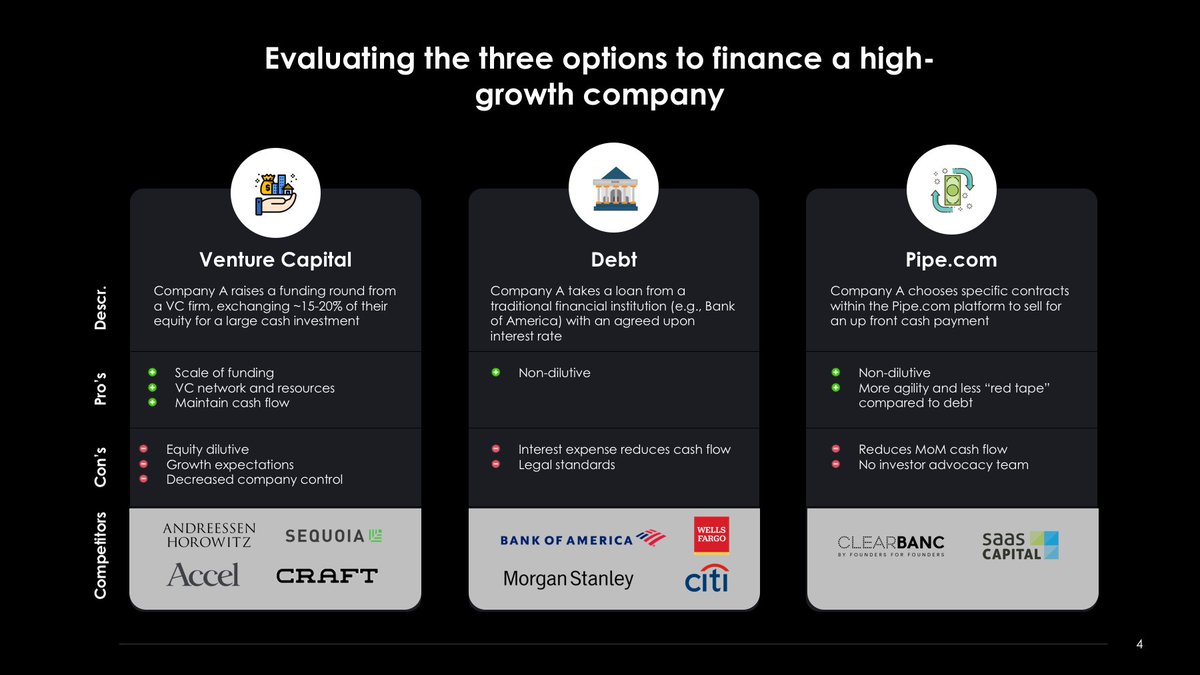

Their options include:

A) Debt

B) Venture capital

Debt is not ideal. The structure is rigid, and interest expense compromises long-term cash

Most companies choose VC

High-growth companies need capital to scale rapidly.

Their options include:

A) Debt

B) Venture capital

Debt is not ideal. The structure is rigid, and interest expense compromises long-term cash

Most companies choose VC

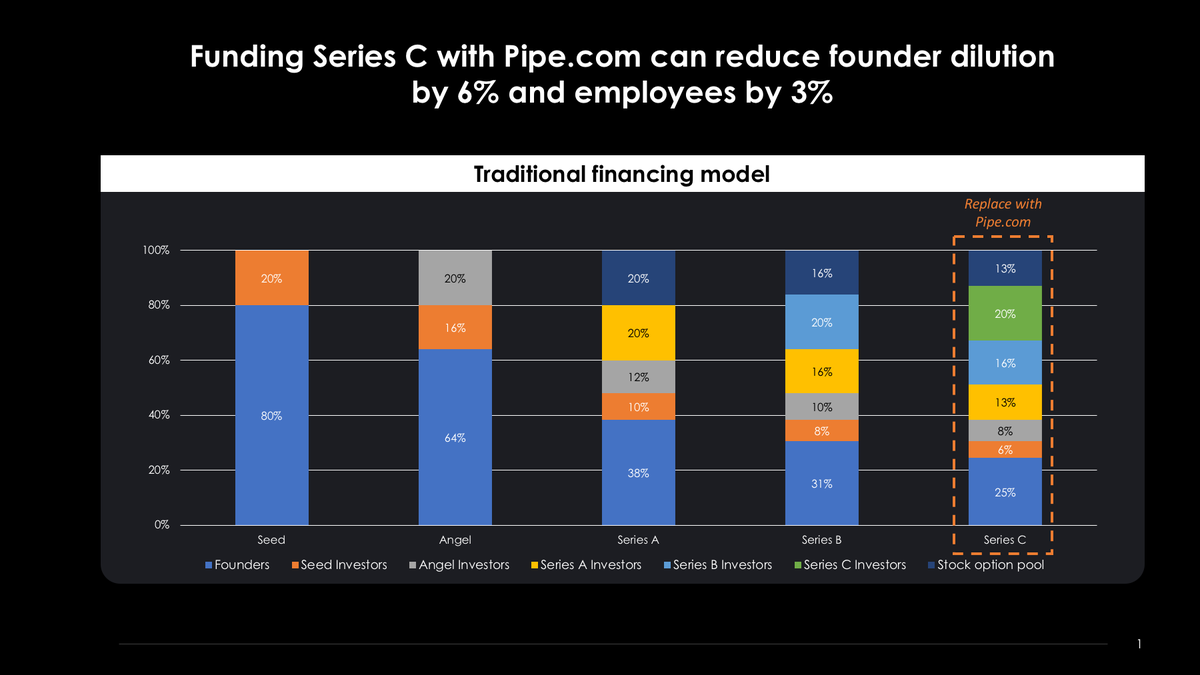

3/ In the traditional VC model, founders raise capital in exchange for equity.

The model has been quite effective and is a contributor to the pace of innovation we see today.

But is that the only way?

The model has been quite effective and is a contributor to the pace of innovation we see today.

But is that the only way?

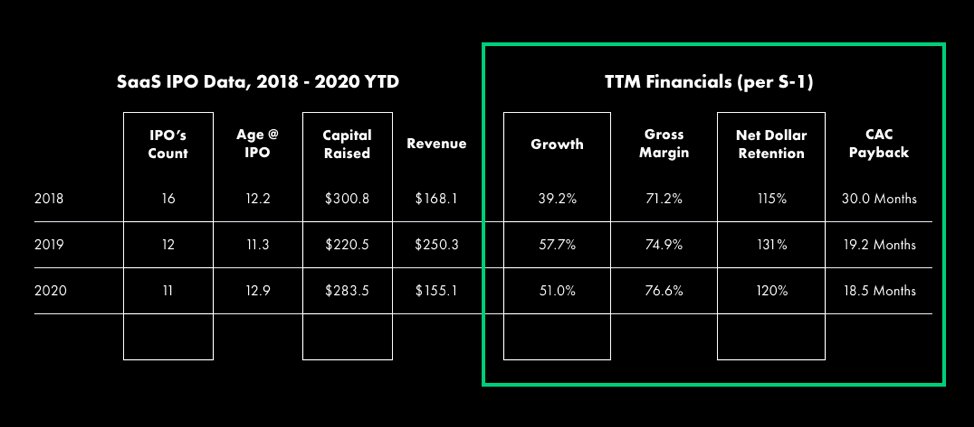

4/ High-growth subscription models have two coveted attributes:

1) Predictable future revenue

2) High margins

Basically, these companies are steady, and they make a lot of money

Awesome

1) Predictable future revenue

2) High margins

Basically, these companies are steady, and they make a lot of money

Awesome

5/ Their main challenge: High Customer Acquisition Cost

It takes a significant amount of go-to-market / OpEx to get people to purchase.

Summary: It is expensive & challenging to get subscribers / customers, but once you do, it is very lucrative

It takes a significant amount of go-to-market / OpEx to get people to purchase.

Summary: It is expensive & challenging to get subscribers / customers, but once you do, it is very lucrative

6/ These companies need additional funding to acquire new customers (and scale).

Many investors are seeking opportunities to get a predictable return

@Pipe is building the online platform to connect these two groups

Many investors are seeking opportunities to get a predictable return

@Pipe is building the online platform to connect these two groups

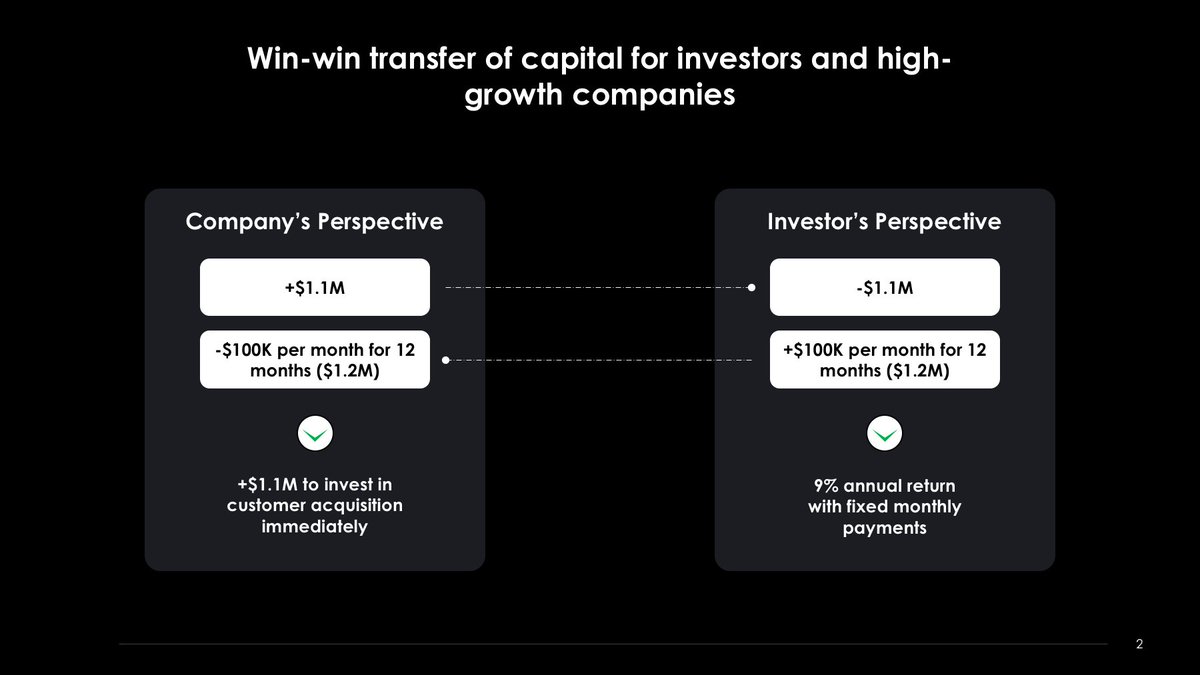

7/ Companies sell their future cash flow (to investors) in return for capital to scale.

Investors buy the recurring revenue (from companies) in exchange for a cash payment

No equity dilution for the founders

Investors buy the recurring revenue (from companies) in exchange for a cash payment

No equity dilution for the founders

8/ Let’s use an example. Imagine Company PMF (Product-Market Fit) is growing rapidly. Their product is amazing, but they do not have the money to spend on the sales & marketing needed to scale.

So they go to a VC to raise a Series C, and the VC demands 20% of the company

So they go to a VC to raise a Series C, and the VC demands 20% of the company

9/ The founder and employees have already been diluted multiple times, so they say no. Not today. I am going to Pipe it!

10/ So they connect to Pipe.com and within 15 minutes, they identify a contract that is worth $100K per month.

They want to sell 12 months of this recurring revenue, and Pipe.com prices it at $1.1M (~$0.90-0.95 of par value)

All is good

They want to sell 12 months of this recurring revenue, and Pipe.com prices it at $1.1M (~$0.90-0.95 of par value)

All is good

11/ Except now, PMF realizes how quick and easy @pipe is. @pipe connects to their systems, so in real-time, they can value and assess their revenue.

They now have an agile and effective financing platform at their fingertips

They now have an agile and effective financing platform at their fingertips

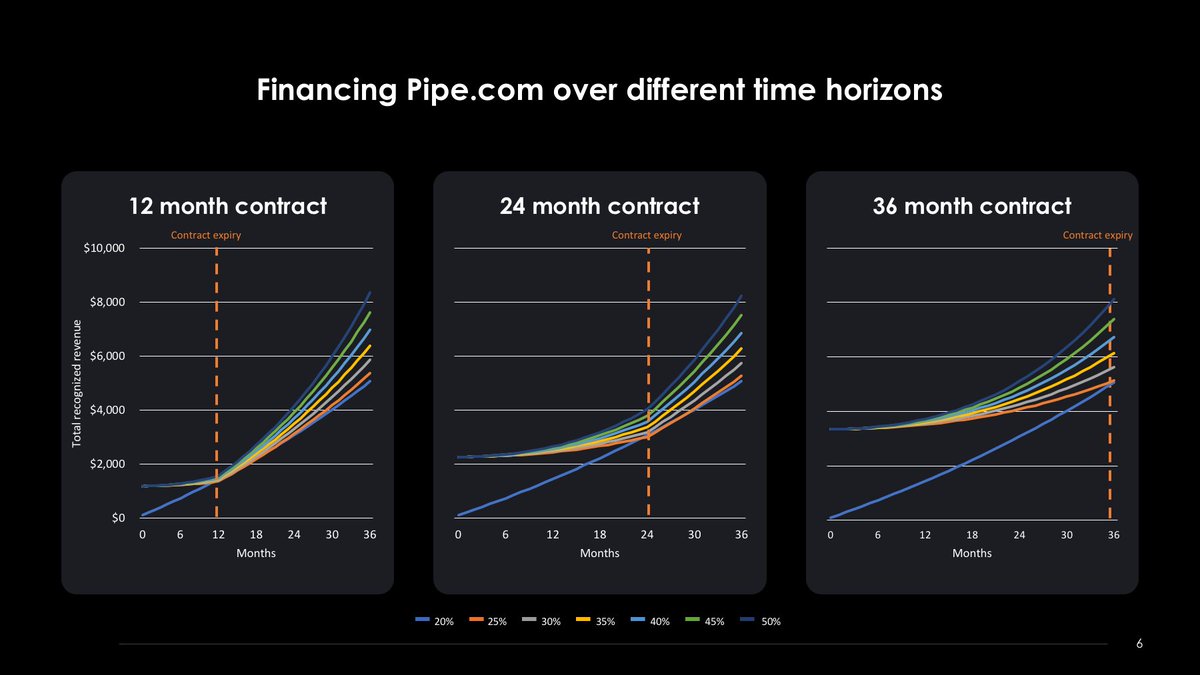

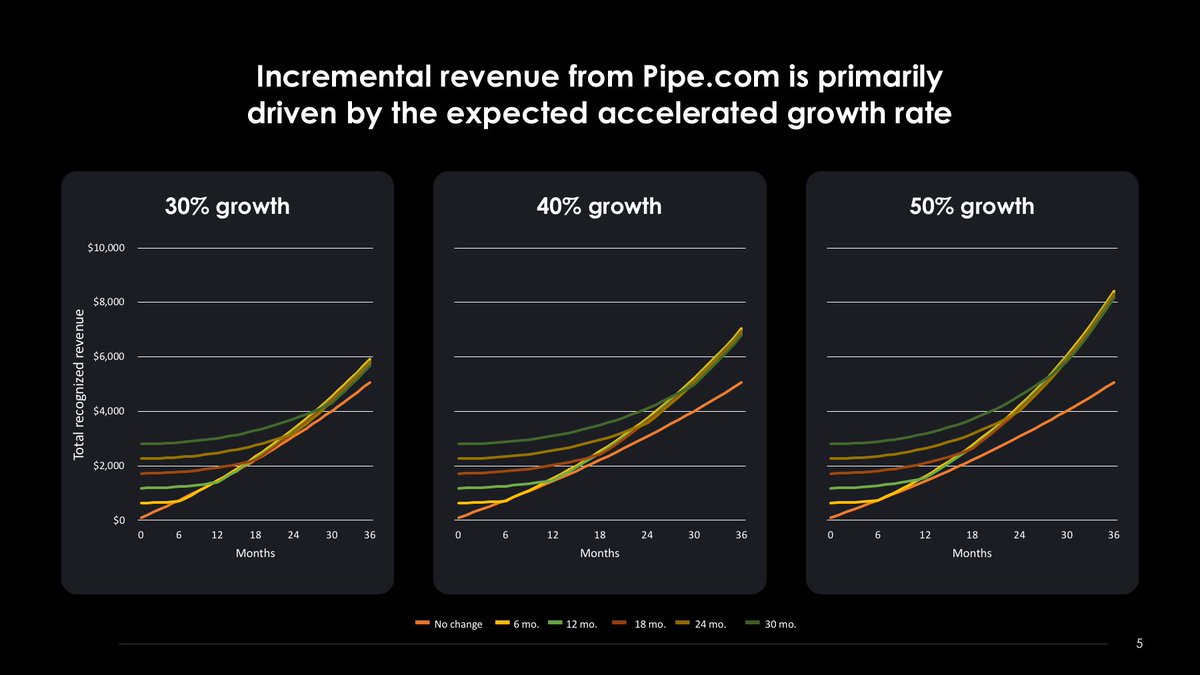

12/ A quick (and simplified) look at timelines and incremental growth can show payoff periods for PMF

13/ As long as the investment can be used to drive incremental growth, then PMF should continue to sell future contracts.

If PMF is growing at 20%, it is easy to see how much value can be created if the OpEx investments can drive growth to 30%, 40%, or 50%

If PMF is growing at 20%, it is easy to see how much value can be created if the OpEx investments can drive growth to 30%, 40%, or 50%

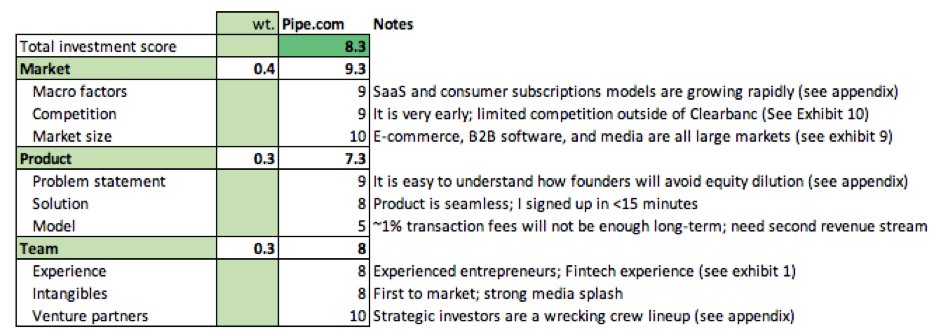

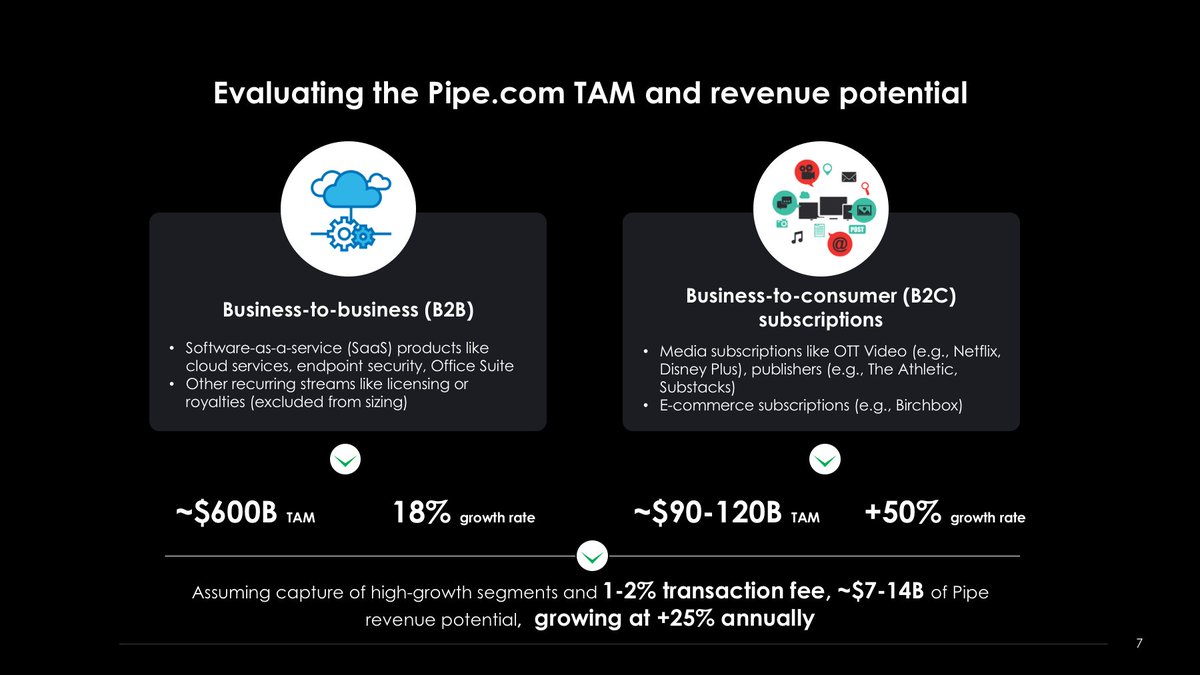

14/ So how big could this be?

Subscription models have exploded. If we think about both B2B (e.g., SaaS) and B2C (e.g., Birchbox) opportunity, then there is over $700B of TAM… and growing rapidly

Based of Pipe’s basic 1-2% transaction fee, this is $7-14B in revenue potential

Subscription models have exploded. If we think about both B2B (e.g., SaaS) and B2C (e.g., Birchbox) opportunity, then there is over $700B of TAM… and growing rapidly

Based of Pipe’s basic 1-2% transaction fee, this is $7-14B in revenue potential

5/ The team

The founding team consists of three experienced entrepreneurs: @harryhurst @joshmangel @zallarak

@harryhurst and @joshmangel previously founded Skurt together

The founding team consists of three experienced entrepreneurs: @harryhurst @joshmangel @zallarak

@harryhurst and @joshmangel previously founded Skurt together

6/ The investors

Seed: @craft_ventures , @DavidSacks (King of SaaS)

Series A: @jimpallotta13 , @alexisohanian , @chamath , @Benioff , @Shopify , @SlackHQ , @MichaelDell , @HubSpot

Notable @theallinpod exclusions: Dry-beak @Jason and @friedberg

Seed: @craft_ventures , @DavidSacks (King of SaaS)

Series A: @jimpallotta13 , @alexisohanian , @chamath , @Benioff , @Shopify , @SlackHQ , @MichaelDell , @HubSpot

Notable @theallinpod exclusions: Dry-beak @Jason and @friedberg

Short list for next write ups:

@ClementDelangue building an NLP at @huggingface

@Austen disrupting education at @LambdaSchool

@akashrnigam at @genies and their NFT oppty

@WillBruey @zebulgar space manufacturing at @vardaspace

Taking any suggestions and / or founder input!

@ClementDelangue building an NLP at @huggingface

@Austen disrupting education at @LambdaSchool

@akashrnigam at @genies and their NFT oppty

@WillBruey @zebulgar space manufacturing at @vardaspace

Taking any suggestions and / or founder input!

• • •

Missing some Tweet in this thread? You can try to

force a refresh